In this article, we will discuss the top 10 free expense trackers in 2025. Follow me.

Have you ever tried to fetch water into a leaking bucket? I have. It was an utter waste of time and water. Earning without tracking your expenses is like fetching water into a leaking bucket. The water eventually wastes away! Similarly, your income eventually wastes if you don’t track your expenses. The first sign that you are ready to manage your income effectively is expense tracking.

Expense tracking is the meticulous practice of studying and recording how you spend your money, so as to inform your future expenses and savings. It is the next financial step to take after making a budget.

Just like budgeting, expense tracking in 2025 has become easier due to applications called expense trackers. These apps provide ingenious methods of computing, monitoring, and curtailing expenses. Although some expense trackers are specifically designed for expense tracking, some personal finance apps or budgeting apps double as expense trackers, too.

Now, since these apps provide much financial value, many of them are not free to use. However, after extensive research and comparison of many expense trackers, this article reveals the top 10 free expense trackers in 2025. All 10 apps have paid versions; however, they offer premium expense tracking even in their free versions. Let us dive in!

The 10 Free Expense Trackers

PocketGuard

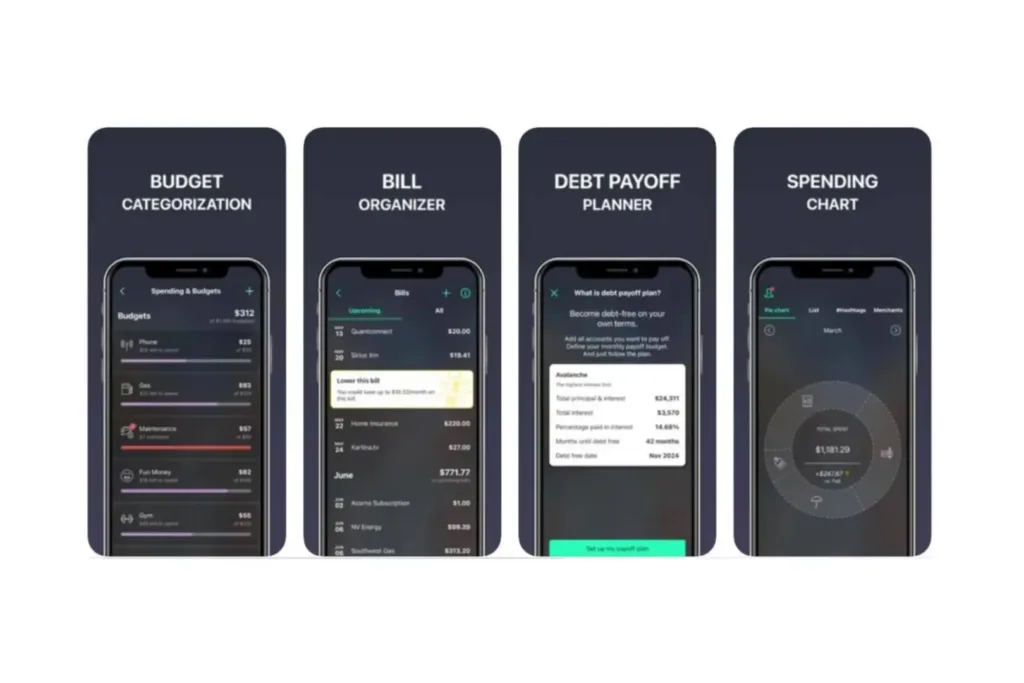

PocketGuard is an all-in-one finance management tool that offers expense tracking, budgeting, bill monitoring, savings goals, and personalized financial insights.

You can access most of its features without purchasing a premium subscription or making in-app purchases. However, if you require additional functionality, such as automated bill tracking, custom categories, priority assistance, and an ad-free experience, you may need to pay a monthly subscription.

PocketGuard automates the process of tracking expenses by securely syncing with your bank accounts, credit cards, and other financial institutions. This eliminates the need for you to manually document your transactions, so you can always have an accurate and up-to-date view of your financial transactions.

However, in comparison to other expense-tracking applications, PocketGuard offers fewer customization options. Also, some customers say the premium features are a bit pricey.

PocketGuard is available for download on both iOS and Android devices at no charge. It has a 3.7 Google Play rating and a 4.6 App Store rating.

Goodbudget

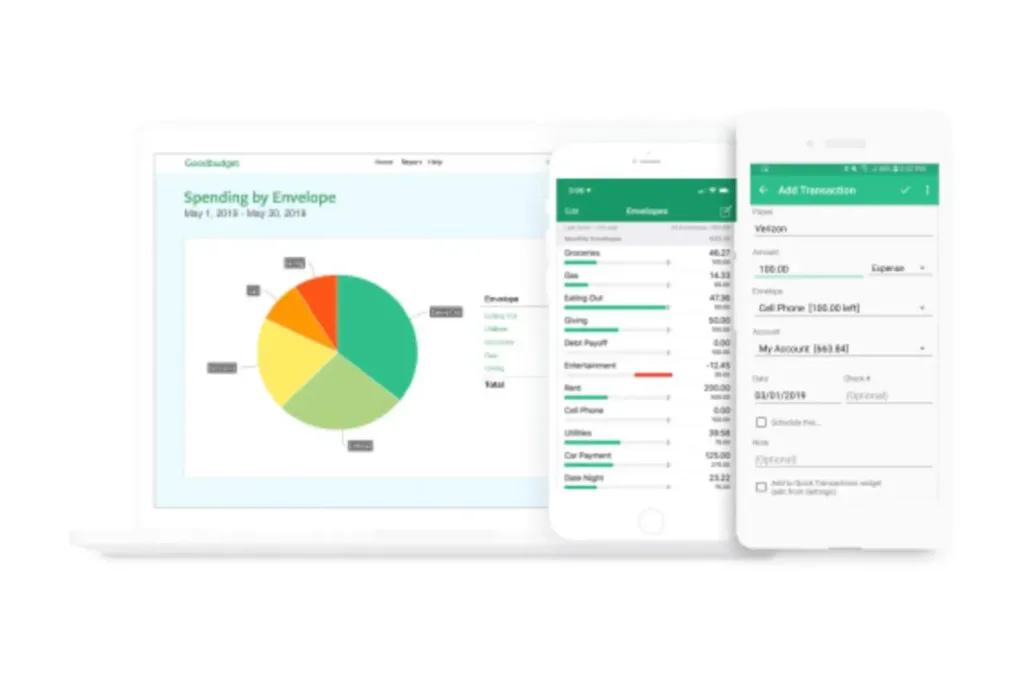

Goodbudget is a simple yet powerful budgeting app that digitizes the “old-but-gold” concept of envelope budgeting. With Goodbudget, you create virtual envelopes for various spending categories, allocate funds accordingly, and only spend money from each envelope as needed.

You can track your expenses, make budgets, envelope balances, set savings goals, sync across devices and even share your envelopes with family members.

Goodbudget has a paid version known as Goodbudget Plus, which offers additional benefits, such as an unlimited number of virtual envelopes, automatic syncing with financial accounts, an ad-free experience, priority support and more detailed financial reports. However, its free version is very capable of routine expense tracking and budgeting.

One of Goodbudget’s drawbacks is that the free version does not allow you to connect your bank accounts, so you would have to manually enter your transactions on-the-go. Also, if you compare the app’s user interface to other expense-tracking applications, it is a bit outdated.

Goodbudget is available for download on both iOS and Android devices at no charge. The app has a 4.4 rating on Google Play and a 4.6 rating on App Store.

Wally Expense Tracker

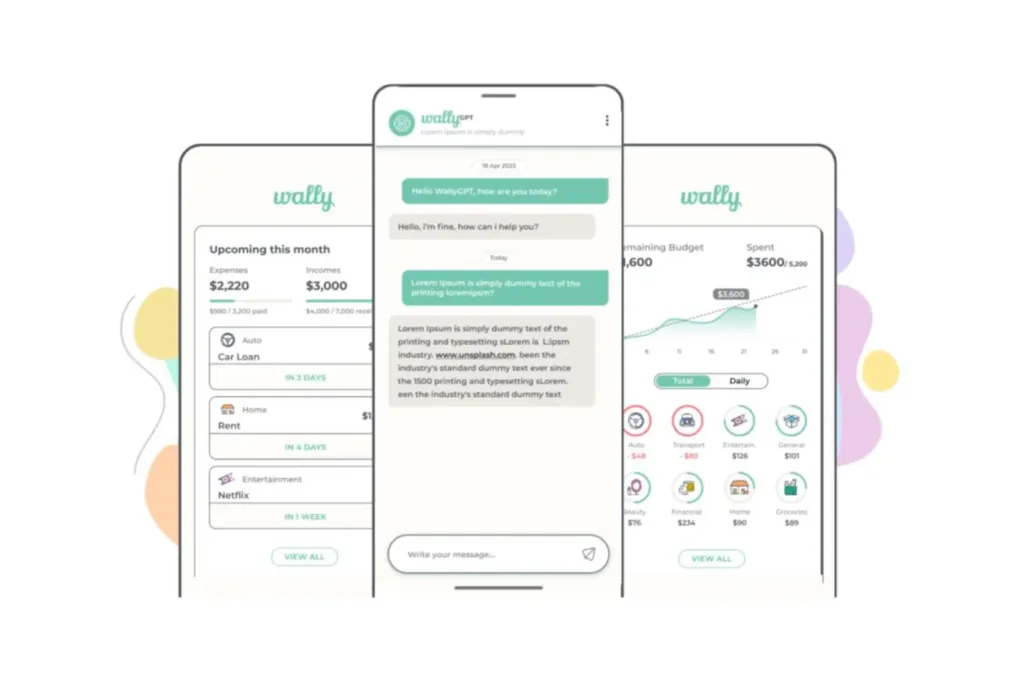

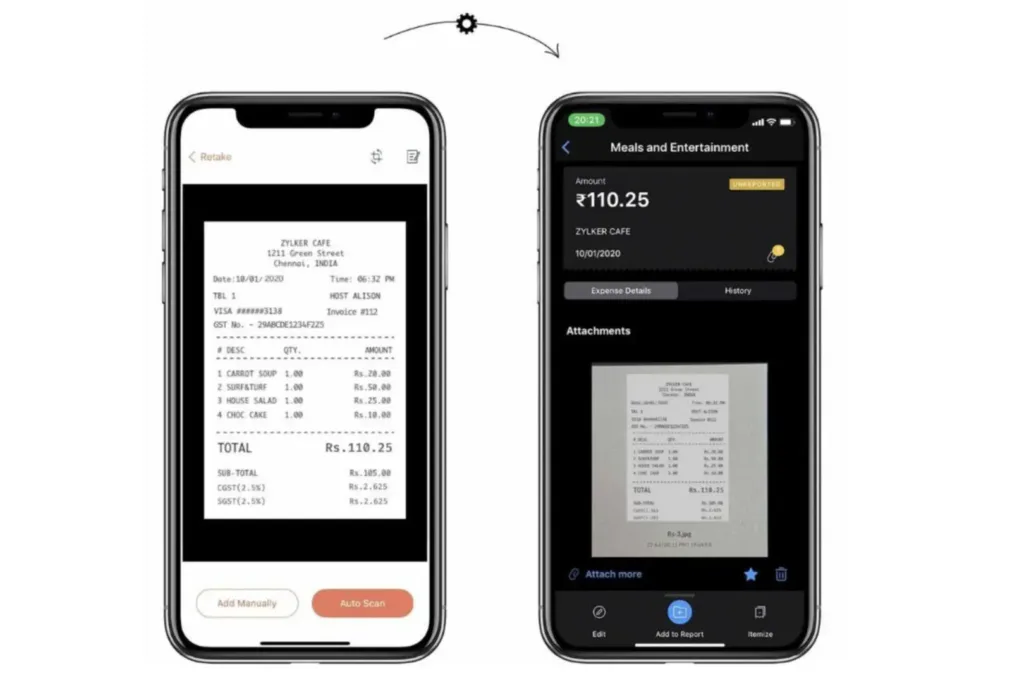

Wally is an intuitive and highly secure personal finance app that offers features for expense tracking, budgeting, goal setting, and financial insights.

At its core, Wally simplifies expense tracking by allowing you to manually input transactions or scan your receipts using your phone. Then, it automatically categorizes your expenses and provides basic visual financial reports, which help you know where your money is going and identify expenses to cut back.

In addition to expense tracking, Wally offers sophisticated budgeting tools that can help you set and track your spending limits for different expense categories.

Wally also allows you to set savings goals for major purchases or specific goals. You can even track your progress towards these goals and receive insights on how to achieve them much faster.

It has a premium version, Wally Gold, which automatically syncs bank accounts, allows for custom expense categories, and provides advanced reports, priority support, and an ad-free experience. However, while you cannot enjoy automatic syncing and whatnot on its free version, your expenses are still properly tracked.

Wally is available for download on both iOS and Android devices. The app has a 4.2 rating on the App Store and a 2.2 rating on the Google Play Store.

Buxfer Expense Tracker

Buxfer is a personal finance management app that offers a range of features to help you track expenses, budget, manage debt, and plan for the future. The app has an intuitive interface, tight security, and customizable options.

Buxfer simplifies expense tracking by allowing you to manually enter your transactions or automatically sync your financial accounts, including bank accounts, credit cards, and investment accounts, such that you can view all your financial transactions at a glance and understand your spending habits.

It offers robust budgeting tools that allow you to set spending limits for different categories, track your progress, and receive alerts when you approach your budget limits. Buxfer even provides you with tools for managing debt and setting up repayment plans.

You would also receive basic reports on income, expenses, assets, liabilities, and net worth to help you make informed decisions about your finances and plan for your bright future.

While the free version of Buxfer offers expense tracking, budgeting, and debt management tools, Buxfer Plus, its paid version, provides additional features like automatic bank syncing to unlimited accounts, advanced budgeting tools, enhanced reporting, and priority support.

Buxfer is available for download on both iOS and Android devices. It has a 3.5 Google Play Store rating and a 4.2 rating on the App Store.

Honeydue Expense Tracker

Couples looking to manage their finances jointly may opt for Honeydue, an intuitive finance app that helps partners track their expenses, make budgets together, set savings goals, repay their debts and stay informed about each other’s financial activities.

Honeydue allows couples to connect their bank, credit card, and other financial accounts to it for free. This allows both couples to view their joint financial activities in one place, giving them a clear picture of their combined spending habits and financial responsibilities.

Honeydue also has features for managing shared expenses, tracking their debts, splitting costs and settling payments seamlessly. It categorizes expenses and flags any disparities or odd expenses by either partner. Financially irresponsible partners are exposed! Lol.

While the free version of Honeydue includes essential features like expense tracking, bill reminders, shared lists, and communication, the paid version, Honeydue Plus, provides additional benefits such as custom categories, advanced bill reminders, transaction search, enhanced security, and priority support.

Honeydue is available for download on both iOS and Android devices. It has a 3.5 Google PlayStore rating and a 4.5 rating on the Apple Store.

Expense IQ

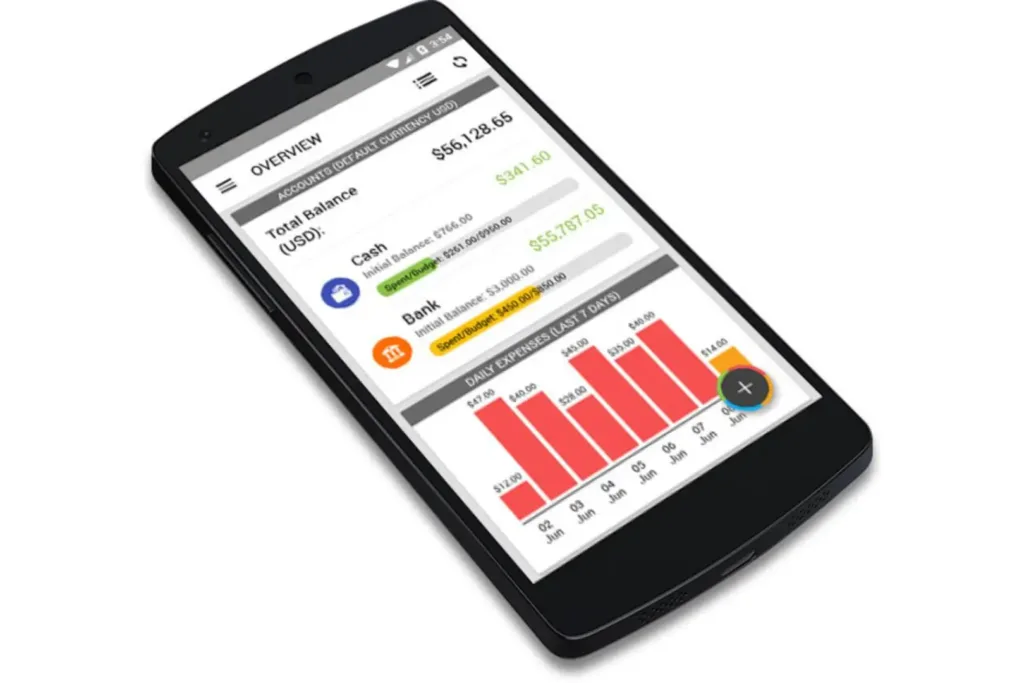

Expense IQ is a user-friendly and all-in-one financial solution for expense tracking, budgeting, debt management, and financial analysis. It allows you to manually input your transactions, categorize your expenses, and monitor your spending habits over time.

Its standout feature is its robust budgeting feature. With Expense IQ, you can make personalized budgets for your different expense categories. The app would send you notifications when you are approaching or exceeding your budget limits, thereby promoting wise spending.

Expense IQ also offers comprehensive debt management features, so you can input and track your debts, such as loans and credit card balances, and set up efficient repayment plans.

It also has a paid version known as Expense IQ Premium. While the free version of Expense IQ offers essential features for expense tracking, budgeting, and debt management, Expense IQ Premium provides additional benefits such as automatic transaction importing, advanced budgeting tools, enhanced debt management features, detailed reports and analytics, and priority support.

Expense IQ has a 4.2 Google Play rating. For some reason, it is not available on the App Store.

Spendee

Spendee is a user-friendly personal finance app that helps people manage their money efficiently. It has various tools for expense tracking, budgeting, and financial analysis, making it easier for users to take control of their finances.

With the free version of Spendee, you can input your transactions manually and see all your expenses in one place. You can also use the app’s budgeting and savings goals tools to plan your finances effectively.

Spendee ensures that all your sensitive information is protected with encryption and security measures, so you can trust the app.

If you want more advanced features, Spendee Premium offers automatic bank syncing to unlimited accounts, advanced budgeting tools, enhanced financial reports and analytics, and priority support.

Spendee is available for download on both iOS and Android devices. Spendee has a 4.1 rating on the Google Play Store and a 4.7 rating on the App Store.

Toshl Finance

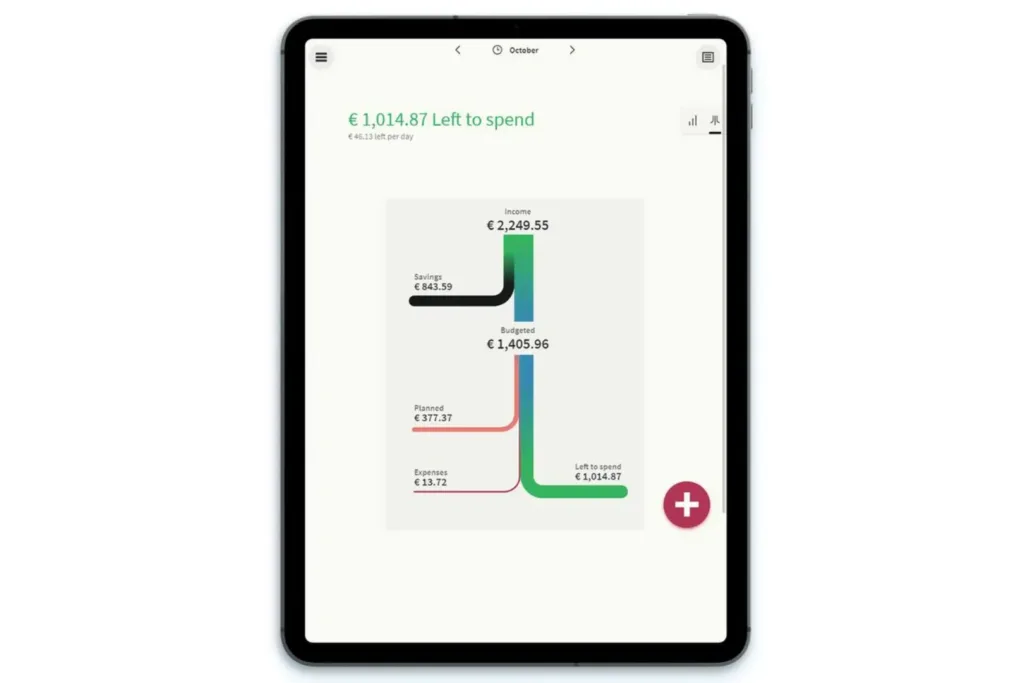

Toshl Finance is a personal finance app that helps you track your expenses, set budgets, and analyze your finances. It is user-friendly and offers both manual input of transactions and automatic syncing of bank accounts and credit cards to help you curb your spending and save money.

Additionally, Toshl Finance provides features like bill reminders, currency conversion, financial insights, goal-setting tools, analytics, and visualizations to motivate you to achieve your financial goals.

While the free version offers essential features for tracking expenses and basic budgeting, the paid version, Toshl Pro, provides additional benefits like unlimited budgets and categories, advanced budgeting tools, enhanced reporting and insights, and priority support. However, this version is relatively expensive.

Toshl Finance is available for download on both iOS and Android devices. Toshl Finance has really good ratings on both the Google Play Store (4.4) and the Apple Store (4.7).

Expensify

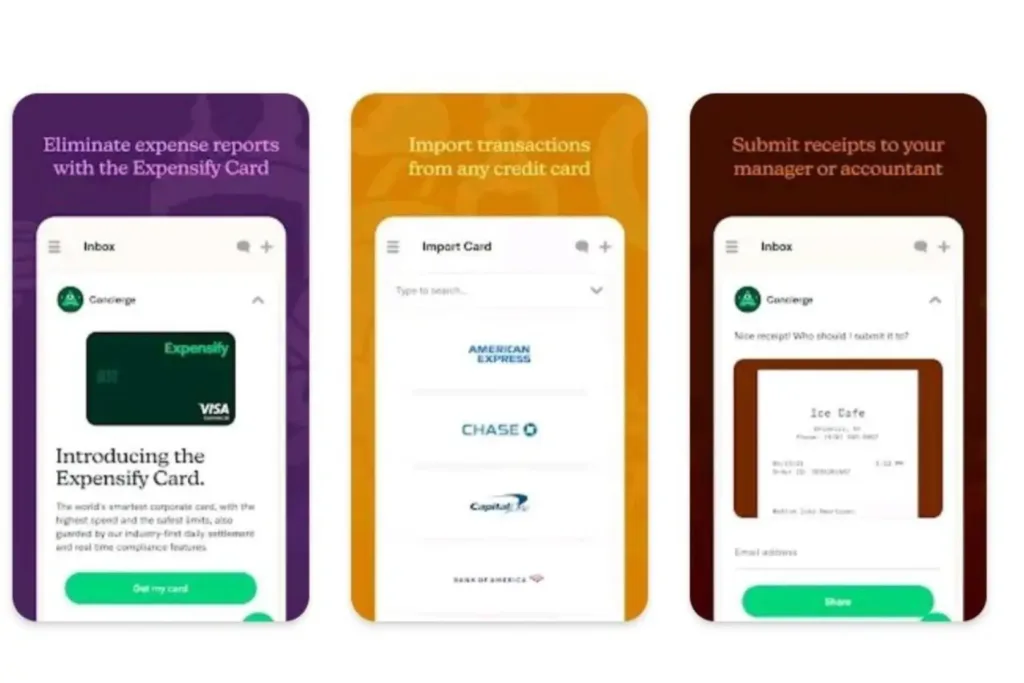

Expensify is a comprehensive expense management tool that simplifies the hassle of managing expenses, particularly for businesses and individuals who need to track their spending, organize receipts and streamline expense reporting.

At its core, Expensify is all about tracking expenses efficiently. Whether it’s a takeout, business trip or office supplies, you can effortlessly record their expenses by snapping photos of receipts or manually entering your transaction details.

But Expensify goes beyond expense tracking. It has a slew of features that simplify expense management, such as categorizing expenses, tagging them with relevant information, and assigning them to specific projects or clients.

Expensify also has features designed specifically for businesses and organizations, such as corporate credit card reconciliation and integration with popular accounting software like QuickBooks and Xero. It also simplifies the reimbursement process for employees by offering direct deposit reimbursement.

While the free version of Expensify offers expense tracking and premium reporting features, Expensify Premium provides additional benefits such as automatic receipt scanning, advanced reporting, unlimited integrations, policy enforcement, and priority support.

Notable drawbacks of Expensify include its complex interface and multiple limitations in the free version.

Expensify is available for download on both iOS and Android devices. It has high ratings on both Google Play (4.2) and Apple Store (4.7).

Zoho Expense

Zoho Expense is a user-friendly expense tracking and management software designed to simplify the process of managing business expenses. It has a comprehensive suite of tools that streamline expense reporting, automate reimbursement workflows and provide valuable insights into company spending.

One of the key features of Zoho Expense is its seamless integration with other Zoho applications, such as Zoho Books and Zoho CRM. This integration allows you to sync expense data with other business processes, such as accounting and customer relationship management, creating a cohesive and efficient workflow across the organization.

In addition to expense tracking, Zoho Expense provides powerful analytics and reporting tools that you can use to identify cost-saving opportunities, optimize budgets, and make informed financial decisions in your business.

The free version of Zoho Expense offers basic expense tracking and reporting features. However, Zoho Expense Premium provides additional benefits such as automatic expense capture, advanced reporting, enhanced integration options, policy enforcement features, and priority user support.

Zoho Expense is available for download on both iOS and Android devices. It has high ratings on both Google Play (4.6) and Apple Store (4.8).

Are You Ready to Take Control?

It may seem tough to choose the most appropriate expense tracker for you. However, you can start by carefully considering your financial needs and inclinations to determine if you need a simple and intuitive expense tracker or a comprehensive finance app. This article reveals the simple and complex expense trackers. Then, from among your preferred categories, try one app first. If it does not suit you, try another. Rest assured, regardless of your preference, your answer is likely among these ten.

Frequently Asked Questions

What is the best software for tracking expenses?

What you consider to be the best software for tracking expenses depends on your financial needs and inclinations. While some lean towards simple, intuitive expense apps, others prefer comprehensive finance apps. The best apps for tracking expenses include YNAB, PocketGuard, Goodbudget, Wally, Buxfer, Honeydue, Expense IQ, Toshl Finance, Expensify, and Zoho Expense.

Is there a completely free budget app?

Perhaps, there are completely free budget apps. However, their user ratings may not have positioned them among the top 20 budget apps. The following budget apps offer decent budgeting in their free versions: PocketGuard, Goodbudget, Wally, Buxfer, Honeydue, Spendee, Expense IQ, Toshl Finance, Expensify, and Zoho Expense.

Is there a free budget app that I can use without syncing my bank accounts?

Yes, there is. Goodbudget, Wally, Buxfer, and Spendee are examples of free budget apps that you can use without syncing your bank accounts.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist