After I completed my first degree in Microbiology, I was posted to Edo State, Nigeria, for National Youth Service. Honestly, I was excited to travel to another part of Nigeria. I was also excited because, for the first time, I would be earning as a graduate. My monthly remuneration would be 19,800 Nigerian Naira or $14. I was expected to live, give, and save from this stipend.

Oh, I recall having to trek to my place of primary assignment a few times because I had to reserve money for my other running expenses. I could barely save, but I had to try. Soon after, adulting began to hit hard. I began to understand that financial success is beyond academic prowess. I had to learn how to earn enough and save regardless!

Anyone who wants to have something to fall back on or build with when opportunities arise must save consistently. Adulthood in this economy is not for the weak!

In this article, we will discuss the 15 best ways to save in 2024. We will learn simple and creative ways to ensure that our financial futures are not compromised by the state of the economy. Follow me.

The Top 15 Saving Strategies in 2024

Budgeting

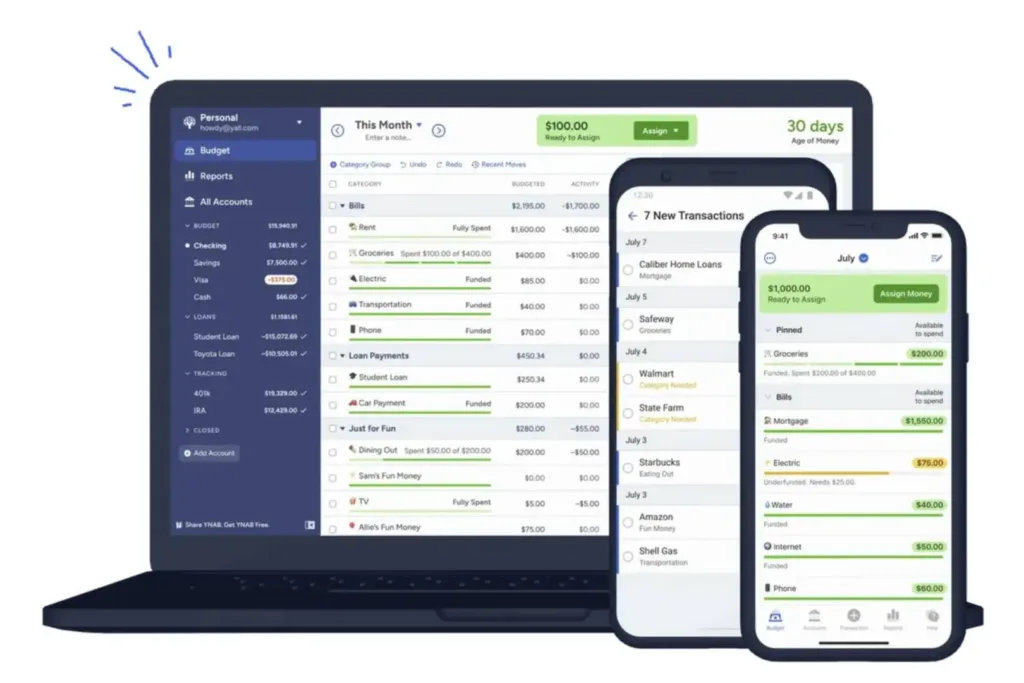

Undoubtedly, the habit of saving starts with creating a budget. By creating a budget, whether using a spreadsheet or a budgeting app, you can gain a clear understanding of your income, which will then inform your expenses and savings.

Budgeting helps you identify areas where you can reduce your spending and allocate more towards your savings goals, whether it be paying off debt or saving for a major purchase.

Additionally, budgeting promotes accountability and discipline, which helps you stay on track with your financial goals. If you want to save in 2024 regardless, start by creating a budget. Check out different types of budgeting here.

Automate Your Savings

This is undeniably one of the best ways to save in 2024, and here’s why: life can get hectic, and sometimes, our best intentions to save can get lost in the shuffle of daily expenses and distractions.

By setting up automatic transfers from your checking account to your savings account, you’re essentially removing the temptation to spend that money elsewhere. It’s like paying yourself first before your other expenses have a chance to chip away at your savings goals.

Also, automating your savings ensures consistency, as you will save the same amount regularly without having to remember to do it manually each time. It is a simple yet powerful strategy that can significantly improve your financial well-being.

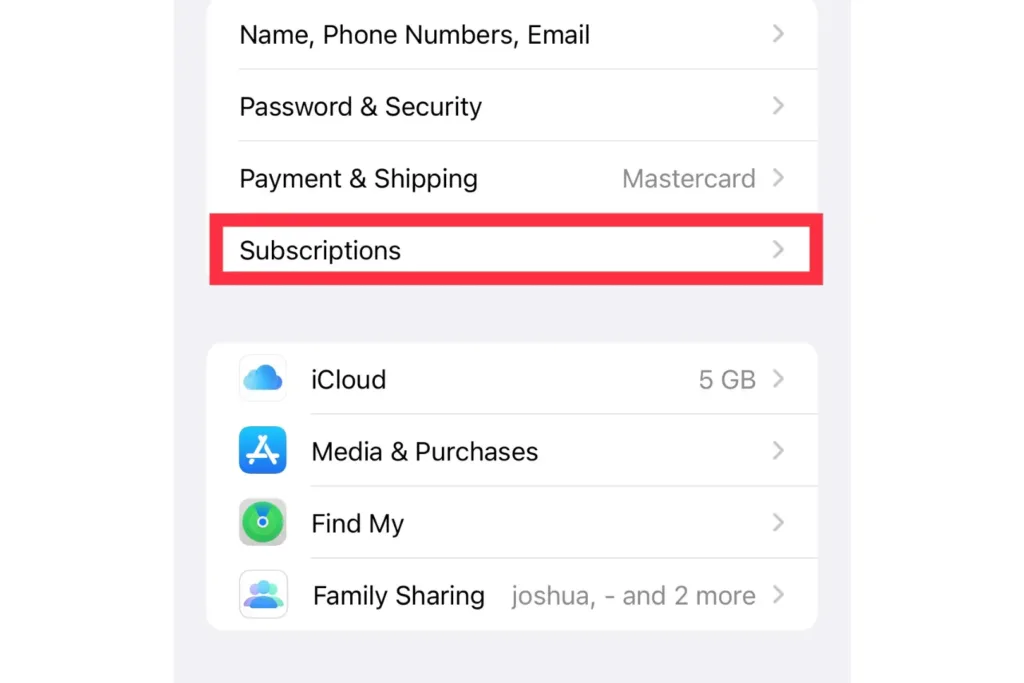

Cancel Subscriptions

Subscriptions have a sneaky way of accumulating, and those seemingly small monthly fees can add up to a substantial chunk of your budget. Canceling subscriptions is really about reassessing your priorities and redirecting funds to areas that align more closely with your financial goals.

For example, think about the multiple streaming services you might be subscribed to. Sure, each service may only cost a few dollars a month. But when you’re juggling multiple platforms, it quickly becomes a significant expense.

For instance, canceling one streaming service that costs $10 per month can save you $120 annually. Multiply that by a couple of services, and you’ve got a noteworthy sum that could be better allocated elsewhere. There are also those gym memberships we tend to forget about.

If you’re paying for a gym you rarely visit, consider redirecting that money to home workout equipment or outdoor activities. You’ll be surprised at how much you can save while still staying fit and healthy.

In summary, cancelling subscriptions is a simple yet impactful step towards achieving financial freedom in the ever-evolving landscape of personal finance.

Prepare your meals

If you want to save some money, cooking at home is an excellent option. Eating out can quickly lead to an empty wallet while preparing meals at home tends to be more cost-effective.

Besides, home-cooked meals are often healthier since you have more control over the ingredients and cooking methods. To save more in 2024, try planning out your meals in advance, buying groceries in bulk, and batch cooking.

Practice Delayed Gratification

In today’s fast-paced world, where everything is available at the click of a button, developing the habit of delaying gratification can have a profound impact on your financial well-being.

It is essential to differentiate between your needs and wants before making a purchase. You could take 24 hours to reflect before making an unplanned purchase. This pause can help you evaluate whether the purchase is necessary or something that can be put off. Often, the desire to buy subsides over time, and you may find that you can save a considerable amount of money by avoiding impulsive purchases.

Smart Shopping

When you’re planning to make a significant purchase, take some time to research and compare market prices. Don’t settle on the first offer you come across. The first price is usually a false price!

Look for discounts and promotions to ensure that you get the best possible value for your money. Additionally, consider purchasing thrift items instead of brand-new ones, as they can often be significantly cheaper and still in great condition. Making these few adjustments can help you save a lot of money in the long run.

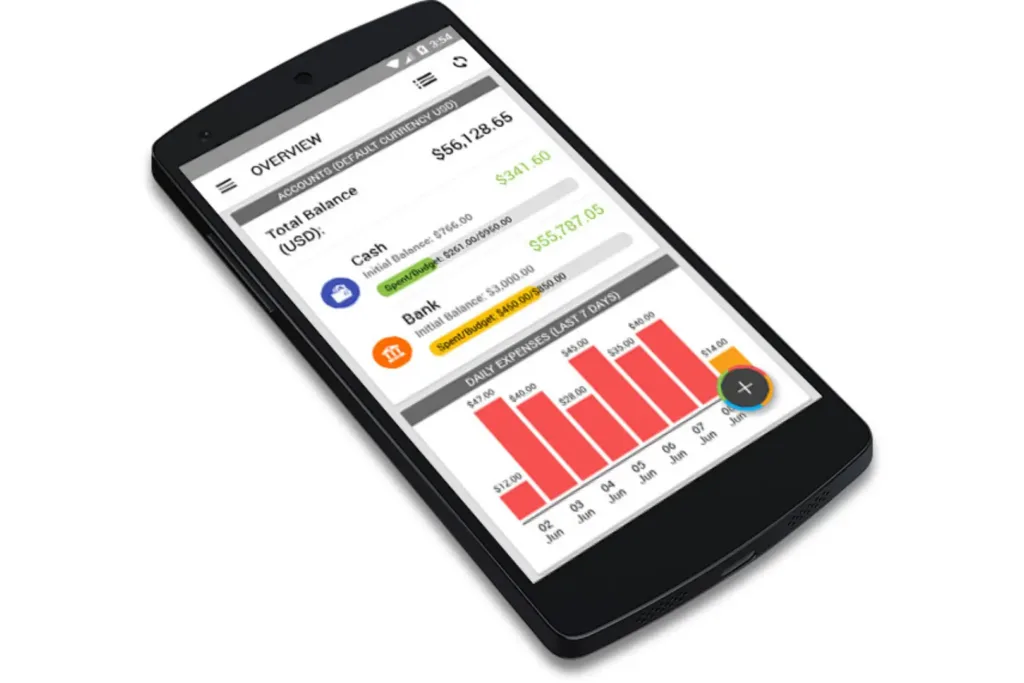

Tracking Your Expenses

Imagine going on a 10-hour road trip without Google Maps. You could end up lost or waste time, fuel and money. Similarly, without tracking your expenses, you are essentially navigating your financial journey blindly.

By meticulously recording your purchases, you gain invaluable insight into your spending habits. This clarity allows you to identify areas where you can cut back or make more mindful choices. It’s like shining a light on your finances, revealing opportunities to save that may have otherwise gone unnoticed.

Plus, with the plethora of budgeting apps and tools available today, tracking expenses has never been more convenient. So, if you’re serious about saving money in 2024, consider tracking your expenses a priority.

Paying Off Debts

When you carry debt, you’re not just paying back what you borrowed; you’re also shelling out extra money in the form of interest. High-interest debts, like credit card balances or personal loans, can eat away at your finances, leaving you with less money to save or invest in the long run.

By prioritizing debt repayment, you’re essentially saving yourself from paying unnecessary interest fees, freeing up more of your income for future savings goals. Plus, once you’re debt-free, you can redirect those payments towards building your emergency fund, investing for retirement, or achieving other financial milestones.

So, while it may not seem as flashy as investing in the stock market or saving for a dream vacation, paying off debts is a solid foundation for building a healthier financial future.

Negotiate Your Bills

African mothers are experts in negotiation. It worked in their time, and it still works! Many open market sellers and service providers, such as internet providers and insurance companies, are often willing to offer discounts or incentives to retain customers.

By taking the initiative to negotiate, you can potentially lower your bills and free up more money to put towards your savings goals. It’s a simple yet effective way to make your hard-earned money last in today’s economy.

Invest

Unlike traditional savings accounts, which typically offer low interest rates that struggle to keep pace with inflation, investing allows your money to work harder for you. By spreading your funds across a range of diverse assets like stocks, bonds, real estate, and commodities, you can reduce risk and increase your chances of earning higher returns in the long run.

What’s more, investing has never been more accessible or cost-effective, thanks to advancements in technology. You can start with small amounts and gradually build your investment portfolio over time.

However, it’s crucial to educate yourself, seek professional advice, and stay up-to-date on market trends before making any investment decisions. This way, you can make informed choices that align with your risk appetite and financial goals.

Building an Emergency Fund

Building an emergency fund is like creating a financial safety net for unexpected expenses or crises that life may throw your way. It involves setting aside a specific amount of money in a readily accessible account, typically equivalent to three to six months’ worth of living expenses.

Unlike regular savings, which are often earmarked for specific goals or purchases, an emergency fund is reserved exclusively for unforeseen circumstances, providing peace of mind and financial stability during challenging times.

You can start by setting a realistic goal for your fund, aiming for at least three to six months’ worth of living expenses. Then, commit to consistently saving a portion of your income each month until you reach that target. Small, regular contributions can add up over time to provide peace of mind when you need it most.

Maximizing Employee Benefits

Maximizing employee benefits isn’t just about understanding what’s offered; it’s about strategically leveraging those offerings to optimize your financial well-being in 2024 and beyond.

Companies commonly provide employees with benefits such as healthcare coverage, retirement plans, and professional development opportunities.

With the changing landscape of employment and evolving market trends, companies typically modify their benefit packages to stay competitive. By staying informed about these changes, you can take advantage of new offerings or negotiate for better terms that could result in cost savings or enhanced coverage.

Reviewing Your Banking Options

Have you ever gone through your bank statement only to find ridiculous fees, such as bogus SMS charges, unexplained money losses, coupled with really small interest? If this is true for you, you may need to change banks!

In order to maximize your savings, it’s important to periodically review your banking options. By so doing, you can minimize fees, maximize interest earnings and take advantage of promotions or incentives offered by banking options that align with your financial goals.

Getting a Side Hustle

Yes, yes, I know getting a good job may be tough, not to mention a side hustle. But really, it is possible!

Think of your main income as the stream that covers your essential expenses and meets your financial obligations. Then, think of your side hustle as the stream that allows you to save more and enjoy your life.

Whether it is a small business, freelancing, tutoring, or selling services online, investing your spare time in a side hustle not only diversifies your income but could be the key to substantial savings in this economy. If you can get one, please do!

Jump on a Savings Challenge

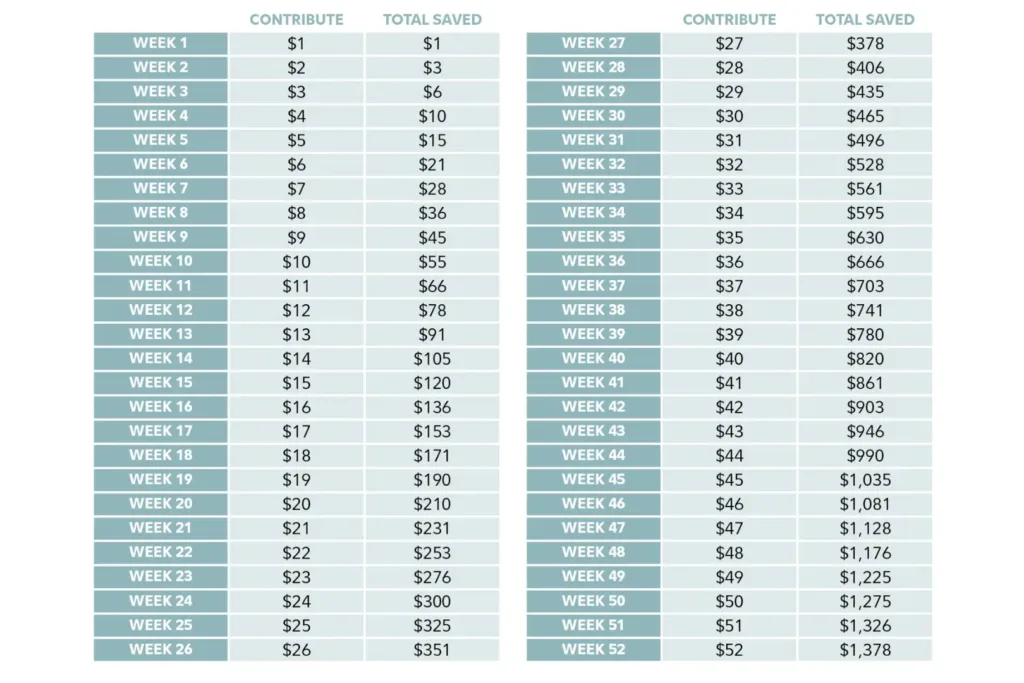

Jumping on a savings challenge is a great way to save in 2024 because it adds an element of fun and motivation to your saving journey.

For instance, you could jump on the “52-Week Money Challenge,” where you save a specific amount each week corresponding to the week number (e.g., $1 in week 1, $2 in week 2, and so on). By the end of the year, assuming you are faithful to the process, you’ll have saved $1,378.

If you are struggling to save, particularly due to unaccountability, you should jump on a savings challenge!

Will You Save Better?

Saving is not an easy task, but it is necessary for a brighter future. We cannot continue to blame the economy for our failure to save. In fact, the economy should be the driving force behind relentless savings.

While it is unlikely that you will apply all the best 15 ways to save in 2024, you should apply some. When all is said and done, will you save more in 2024?

Frequently Asked Questions

What is the 100 envelope challenge?

This is a simple savings challenge in which you number 100 envelopes from 1 to 100 and save the corresponding amount of money in dollars every day for 100 days. By the end of the 100 envelope challenge, you should have saved $5,050.

How much money can you save in 52 weeks?

You can save exactly, more or less than what you plan to save in 52 weeks. However, following the 52-week challenge, where you save a specific amount each week corresponding to the week number (e.g., $1 in week 1, $2 in week 2, and so on), you can save $1,378 in 52 weeks.

What is the 30-day rule to save money?

The 30-day savings rule recommends that you postpone all your unplanned purchases for 30 days and save the money you intended to spend. This gives you enough time to consider the need for that purchase. If you decide that you need to make the purchase after 30 days, you can go ahead.

2 Comments

Your comment is awaiting moderation.

I have been checking out some of your posts and i can state pretty clever stuff. I will surely bookmark your blog.

Wow, I love this write-up. I will start following some of the ways to save and have more money lined up for me in 2024. Thanks.

Thank you, Betty. That’s the goal of this article!