The subscription business model is a hot trend in the global market today. Due to its convenient and reliable process and methods, businesses and customers alike seem to be hooked on it!

In this article, we will discuss what the subscription business model entails, types and examples of subscription business models, how to set up subscription payments for your business, as well as important metrics to track if you plan to adopt the subscription business model. Let’s dive in!

What is the Subscription Business Model?

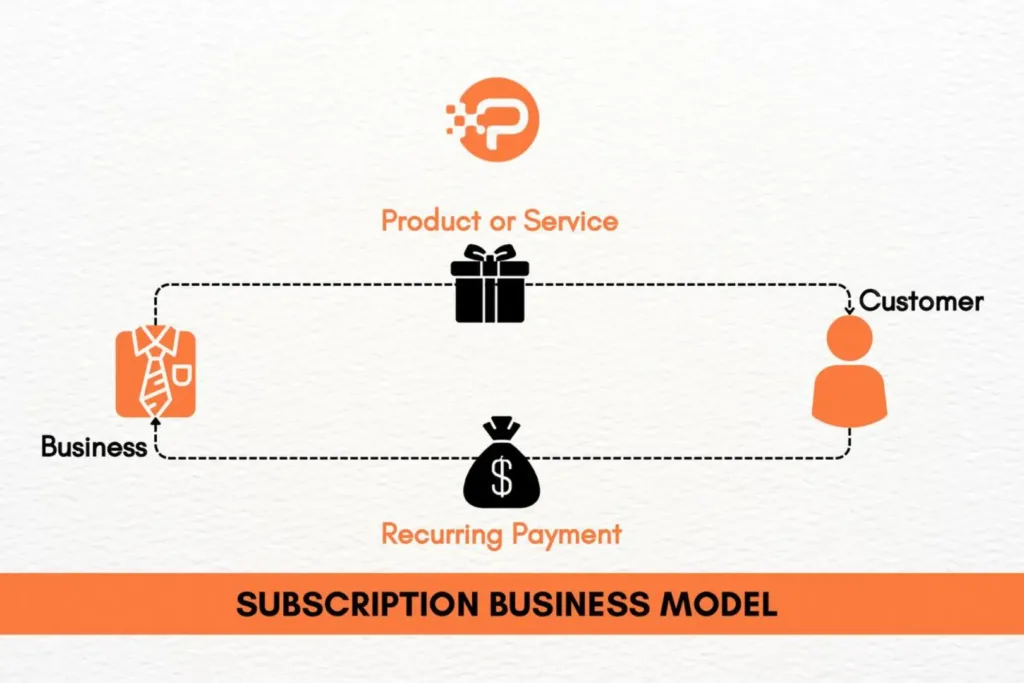

The subscription business model is a model whereby customers pay a recurring fee regularly for a product or service.

This model offers consumers the convenience of accessing products and services without expensive one-time or repetitive manual payments. For instance, instead of paying a lump sum for a product, customers can pay a recurring fee on a regular basis, such as monthly, for a product or service they are interested in.

Businesses, on the other hand, also enjoy recurring revenue streams and increased customer loyalty. The goal, therefore, of this model is to retain customers’ loyalty with quality service as the connecting point.

The Gains of the Subscription Business Model

Subscriptions benefit businesses and customers in different ways. As the model evolves, we can anticipate more benefits for businesses and customers.

- Predictability of Revenue: Instead of depending on random one-time purchases, businesses can forecast revenue based on the number of their subscribers and their subscription plans. With subscribers committed to paying for product offerings at regular intervals, such as monthly or annually, businesses can project their financial performance, plan their investments, and allocate their resources efficiently.

- Building Long-lasting Customer Relationships: The subscription business model fosters long-lasting customer relationships based on mutual trust and satisfaction by pushing businesses to provide continuous value, address customer feedback, and offer personalized experiences tailored to customer preferences. PostPaddy, for example, is a subscription-based social media management solution that allows users to provide feedback on their user experience and suggest new features to be added. This is one of the most beautiful things about the subscription business model.

- Flexibility and Convenience: The subscription business model provides flexibility by allowing customers to select plans that meet their specific demands and budget. Subscribers can upgrade, downgrade, or cancel their subscriptions at any moment as their preferences evolve. Moreover, the convenience of automatic renewals and seamless access to product offerings saves time and effort, enhancing the overall customer experience.

- Affordability: The recurring payment mechanism structure provides affordability by spreading costs over time rather than demanding a significant upfront payment. Some subscriptions even provide discounts for annual payments! This makes high-quality products and services available to a broader spectrum of clients. There are so many iPhone users on this table!

- Customers Can Access More: The subscription business model encourages customers to explore and access additional products by offering bundled packages. With access to a variety of products for a fixed fee, customers are motivated to make the most of their subscriptions, trying out different offerings and discovering new favorites. Furthermore, businesses frequently launch new products or exclusive content to keep customers interested, providing more value and incentives to explore their offers further. This encourages users to renew their subscriptions and engage with the company’s ecosystem, resulting in higher usage and customer satisfaction.

Types and Examples of Subscription Business Models

Different subscription business models appeal to different customer demographics. Outlined below are some common types and examples to note.

- Content Subscription Model: Here, customers pay a recurring fee to access digital content, such as music, movies, e-books or courses. Examples of businesses which adopt the content subscription business model are Netflix and Spotify.

- Product Subscription Model: Here, customers pay a recurring fee for regular deliveries of physical goods, such as magazines and meal kits. Examples of businesses that adopt the product subscription business model are Blue Apron and Birchbox.

- Software-as-a-Service (SaaS): Here, businesses offer software applications hosted in the cloud via subscription. This model provides users with access to software without the need for installation or maintenance. Examples of businesses that adopt the SaaS subscription business model are Microsoft and Adobe.

- Membership Subscription Model: Here, customers pay a recurring fee for exclusive benefits offered by a business. This model is common in industries such as retail (for example, Amazon Prime) and fitness (for example, gym memberships).

- Freemium Model: Here, companies offer a basic version of their product or service for free. Customers can then choose to upgrade to a premium subscription to access additional features. Dropbox is an example of a business that adopts the freemium subscription business model, offering limited storage for free and more storage for a paid subscription.

How the Subscription Business Model Works

Here is an outline of how the subscription business model typically works:

- Sign-Up: First, customers register for a subscription plan offered by a business through a website, mobile app or in person.

- Payment Setup: Second, the customers provide their payment details, such as credit card information, and consent to recurring payments at regular intervals.

- Access Granted: Once payment is confirmed, customers access the product, service, or content included in their subscription plan.

- Enjoyment of Service: Customers enjoy the benefits of their subscription as planned.

- Automated Renewal: Subscriptions are typically set to auto-renew. That is, payments are automatically deducted from the customer’s account at the end of each billing cycle.

- Flexibility: Depending on the subscription model, customers can upgrade, downgrade, or cancel their subscription at any time through their account settings or customer support.

- Continuous Value: The business continues to give value to their subscribers throughout their subscription period, aiming to retain them as long-term customers.

- Customer Support: Businesses provide customer support to address issues and receive feedback from their subscribers to ensure a positive customer experience.

How Can You Set Up a Subscription Payment for Your Business?

Setting up subscription payments for your business is a simple process that can boost your revenue streams and customer relationships. Here’s a simple guide on how to get started:

Step 1: Choose the Right Payment Processor

Select a reliable payment processor that supports subscription billing, such as Stripe, Recurly or PayPal. Make sure it integrates seamlessly with your e-commerce platform. Additionally, choose a processor that offers robust security features to protect sensitive customer data.

Step 2: Define Your Subscription Plans

Set the pricing tiers, billing intervals, and features for your subscription plans. Consider providing several options to cater to different customer needs and budgets. It is important to clearly communicate the benefits of each subscription plan to attract subscribers and increase conversions.

Step 3: Set Up Your Payment Gateway

To receive payments from your customers, you must integrate your website or e-commerce platform with your payment processor. Follow your payment provider’s instructions to configure subscription billing settings, such as billing cycles, trial periods, and automatic renewals. Testing the payment flow is critical to ensuring your customers have a smooth and secure checkout experience.

Step 4: Implement Subscription Management System

Subscription management software such as Chargebee, Recurly, or Zuora can help you automate billing, invoicing, and customer administration duties. These platforms offer comprehensive solutions for managing customer accounts, subscriptions, and payment disputes. Do well to harness them.

Step 5: Clearly Communicate Subscription Terms

Clearly communicate your subscription terms, pricing, and cancellation policies to customers during the signup process. You should provide transparent billing invoices to establish trust and transparency. Also, make it easy for customers to manage their subscriptions and update payment information when needed.

Step 6: Track Your Performance and Optimize

Regularly track the performance metrics of your subscriptions. Use analytics insights to optimize your pricing, enhance customer retention, and boost overall profitability. It is also important to iterate and refine your subscription offerings based on customer feedback and market trends.

Important Metrics to Track in Subscription Business Models

- Churn Rate: This metric measures the percentage of subscribers who cancel their subscriptions within a specific period. To calculate it, divide the number of cancellations by the total number of subscribers, then multiply by 100.

- Customer Lifetime Value (CLV): This is the total revenue a customer is expected to contribute over their entire relationship with a company. To calculate it, multiply the average purchase value by the average purchase frequency, then multiply that by the average customer lifespan.

- Monthly Recurring Revenue (MRR): Monthly Recurring Revenue is the predictable income a company receives from subscription fees each month. To calculate MRR, sum up the subscription fees collected within a specific month.

- Subscriber Acquisition Cost (SAC): Subscriber Acquisition Cost is the cost to acquire a new subscriber, including marketing and sales expenses. It’s calculated by dividing the total acquisition costs by the number of new subscribers gained during a specific period. For example, if a business spends $500 on marketing and gains 50 new subscribers in a month, the SAC would be $10 per subscriber. This metric helps businesses assess the effectiveness of their marketing strategies and allocate resources efficiently.

- Average Revenue Per User (ARPU): This measures the average revenue generated by each subscriber. To calculate, divide total revenue by the number of subscribers.

Ready to Scale Your Business Using the Subscription Business Model?

The subscription business model is an effective strategy to adopt, particularly in this day and age. Your business could breakthrough in the global market if you harness the best subscription payment software, choose the right subscription payment methods and optimize your performance regularly. Are you ready to take the bold step?

Frequently Asked Questions About the Subscription Business Model

How much does it cost to start a subscription business?

The initial investment required to start a subscription business can range significantly. On the lower end, you might only need around twelve dollars, but on the higher end, costs could soar to over twenty-seven thousand dollars. The average startup cost is typically close to fourteen thousand dollars. These costs can vary widely depending on the specific business model, target market, and operational scale.

What is the most popular subscription service?

Amazon Prime is widely regarded as the most popular subscription service in the United States, with a vast number of consumers enrolled. On a global scale, streaming services such as Netflix and Prime Video are at the forefront in terms of subscriber numbers.

How can I set up subscriptions?

By following these steps, you can effortlessly set up subscription payments and boost your business’s revenue streams and customer relationships:

- Choose a reliable payment processor like Stripe, Recurly, or PayPal that integrates with your e-commerce platform and prioritizes security.

- Define your subscription plans, including pricing tiers, billing intervals, and features, and clearly communicate their benefits.

- Set up your payment gateway by integrating your website with your payment processor and configuring subscription billing settings.

- Use a subscription management system like Chargebee, Recurly, or Zuora to automate billing, invoicing, and customer administration.

- Clearly communicate subscription terms, pricing, and cancellation policies to customers during signup and provide transparent billing invoices.

- Regularly track performance metrics, optimize pricing and customer retention, and refine your subscription offerings based on customer feedback and market trends.