Budgeting is paramount when it comes to managing your finances. It’s about planning your income, expenses, and savings. Without a budget, you’re likely to spend your money without any real plan, and you won’t be able to keep track of where it’s all going.

This can lead to a lot of expenses that you might not even be aware of, which can really mess up your finances and leave you in debt. That’s why budgeting, whether using a spreadsheet, a budgeting app, or pen and paper, is key to keeping your finances stable and secure.

In this article, we will discuss how to budget your money using a simple yet powerful technique known as the 50/30/20 rule. Immerse yourself in this article, as we journey towards your financial freedom. Ready, set, go!

What is the 50/30/20 Rule?

Imagine your income as a mouth-watering cake that consists of three flavors: red velvet, chocolate, and vanilla. Let’s say you love the red velvet flavor, so it makes up half of your cake.

The chocolate flavor is your next favorite, so it makes up 30% of your cake. Vanilla is not your favorite, but your mother likes it. So, to make her happy, one-fifth of your cake is vanilla flavor.

When your cake arrives, you cut it into neat portions, each with its respective flavor, to enjoy every bite to the fullest. The red velvet flavor portion of your cake represents 50% of your income.

The chocolate flavor portion of your cake represents 30% of your income. Finally, the vanilla flavor portion of your cake represents 20% of your income. This cake analogy represents the 50/30/20 rule.

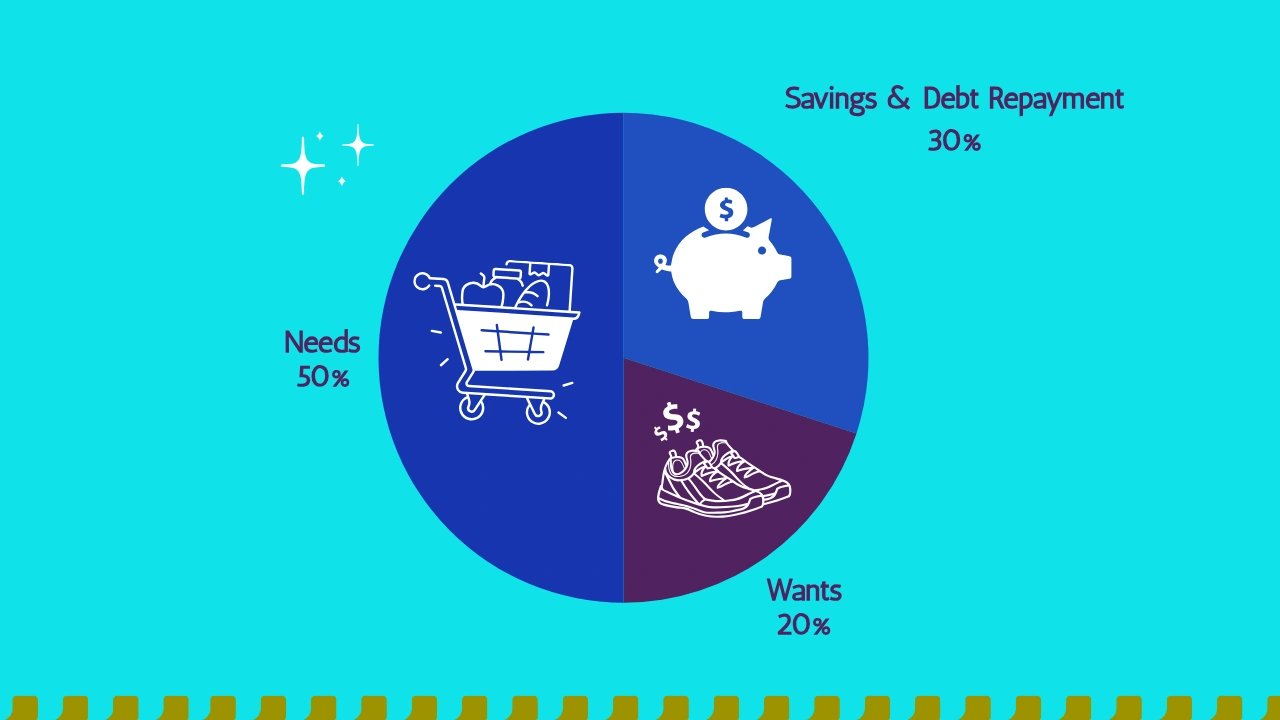

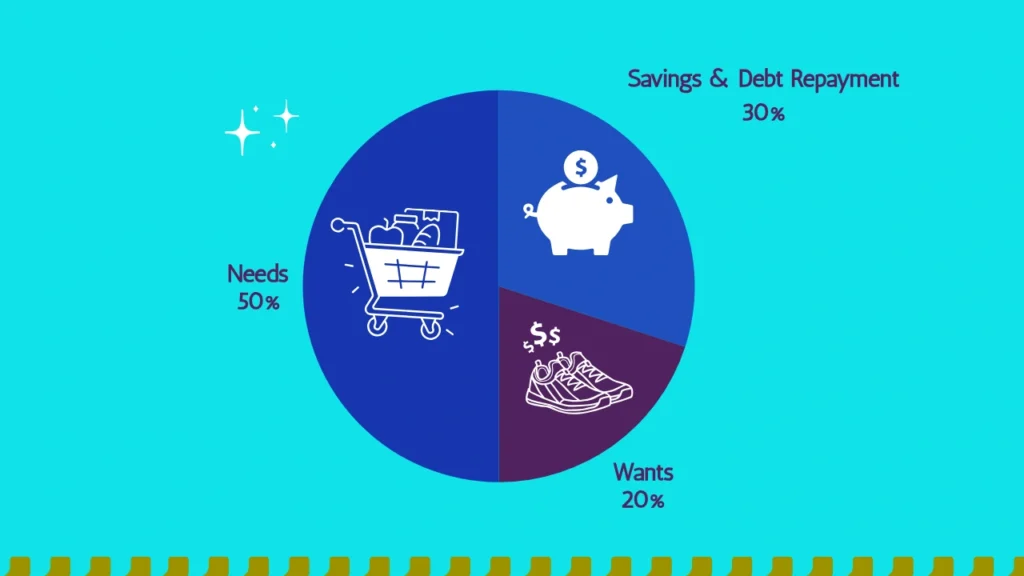

The 50/30/20 rule, also known as the “balanced money formula,” suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayments.

The 50/30/20 rule is often attributed to Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, who elucidated the rule in their book, “All Your Worth: The Ultimate Lifetime Money Plan.” However, it is worth noting that while they popularized this rule, its principles have been advocated by various financial experts before their book was published.

Brief Digression into Other Budgeting Rules

You may not be familiar with other budgeting rules. Here is a quick rundown of a few other budgeting rules besides the 50/30/20 rule.

- Zero-Based Budgeting: In this method, every dollar of your income is assigned a specific purpose, such as expenses, savings, or debt repayment. The goal is to “zero out” your budget so that your income minus your expenses equals zero. It requires meticulous tracking and planning, but can be very effective in controlling spending and maximizing savings.

- Envelope System: This is a cash-based budgeting method where you allocate a certain amount of cash to different categories, such as groceries, entertainment, transportation, and place each amount in separate envelopes. Once an envelope is empty, you stop spending in that category for the month. It’s a tangible way to stick to your budget and avoid overspending.

- Percentage-Based Budgeting: Similar to the 50/30/20 rule, this method involves allocating percentages of your income to different categories, but the ratios may vary based on your priorities and financial goals. For example, you might allocate 25% to housing, 15% to transportation, 10% to savings, and so on.

- Pay Yourself First: This strategy involves prioritizing savings by setting aside a portion of your income as soon as you receive it, before paying any bills or expenses. This ensures that savings become a non-negotiable part of your budget and helps you build wealth over time.

- Bi-Weekly Budgeting: Instead of budgeting monthly, some people prefer to manage their finances based on their bi-weekly paychecks. This can help align your budget more closely with your actual cash flow and make it easier to track expenses throughout the month.

The 50/30/20 Rule Explained

Alright, let us dive back into the heart of this article. We’re going to take a closer look at the 50/30/20 rule and really break down how to allocate your resources.

50% Allocation to Needs

“Needs” refer to the essential requirements for day-to-day survival, such as air, water, food, sleep, clothing, shelter, income, and so on. According to Maslow’s hierarchy of needs, people must first satisfy their basic physiological needs, such as food, clothing, and shelter, before they can fulfill their self-actualization needs, such as morality, purpose, and acceptance.

This is largely true because only a physically healthy person can resist the immoral temptation of theft or seek to fulfill destiny.

Needs vary from person to person, based on various factors, such as age, location, and health status. For instance, a pregnant woman may require monthly hospital visits as a necessity, while a healthy man in his prime may not need to visit a hospital for months.

The 50/30/20 rule recommends that half of your income after taxes should cover your monthly needs. If 50% of your income cannot meet your needs, it may be a sign that your current phase of life requires more money than you are making.

30% Allocation to Wants

“Wants” refer to the things we desire or crave but do not need for survival. They are the extras, the cherry on top of life’s sundae. Wants to encompass a wide range of goods, services, experiences, and indulgences that bring us pleasure, entertainment, or convenience.

These can include dining out at fancy restaurants, splurging on designer clothes, treating ourselves to luxurious vacations, or enjoying entertainment like movies or video games. Wants to enhance our quality of life and make it more enjoyable, but they’re not essential for our survival or well-being.

Although wants may appear to be lavish expenses, they can overlap with your needs category by including any desired upgrades to your necessities. However, the 50/30/20 rule suggests that these upgrades remain within the confines of 30% of your income.

For example, a black lady doctor may need to purchase a “work-wig” because she cannot make time to constantly manipulate her hair into pretty weaves. She may upgrade her need by planning to buy a 10” Vietnam raw donor bone straight wig, instead of a 10” China human hair blend wig.

However, if this 10” Vietnam raw donor bone straight wig is 5 times her 30% allocation for wants, she may need to purchase the China 10” human hair blend wig instead, or pay in installments for a 10” Vietnam raw donor bone straight wig.

20% Allocation to Savings & Debt Repayment

Savings are like a financial safety net, a stash of money that you set aside for the future. It is the portion of your income that you don’t spend right away but keep aside for emergencies, big purchases, or long-term goals.

Savings can come in different forms, like putting money into a savings account, investing in stocks or bonds, or contributing to a retirement fund. Whether it’s for unexpected expenses, a dream vacation, or building a nest egg for the future, savings give you peace of mind and financial security.

Saving is also important for debt repayment. It would be inconsiderate to lavish money on your wants, such as a 10” Vietnam raw donor bone straight wig, yet ignore the repayment of a business loan you took from LAPO Microfinance Bank.

Anyone who earns should save. Even children should be taught to save, so they do not grow to be irresponsible adults. The 50/30/20 rule teaches you to save 20% of your income to secure your financial future and repay your debts.

Hypothetical Application of the 50/30/20 Rule

Suppose you are a young Muslim guy who earns 150,000 Nigerian Naira (NGN) per month. Well, this is not a lot of money about the United States dollar, but master’s degree holders in Nigeria earn this, so let’s work with it.

Dividing your income according to the 50/30/20 rule, we have the following:

- 50% of your income is 75,000 NGN.

- 30% of your income is 45,000 NGN.

- 20% of your income is 30,000 NGN.

Your needs are:

- Housing: 20,000 NGN

- Transportation: 25,000 NGN

- Feeding: 25,000 NGN

- Total: 75,000 NGN

This makes up exactly 50% of your income. However, if your needs slightly exceed 75,000 NGN, it would be reasonable, as the 50/30/20 rule is not set in stone.

Your wants are:

- A clean haircut: 1,000 NGN

- A fake Apple earpiece: 2,000 NGN

- Parent’s allowance: 10,000 NGN

- Fiancée’s allowance: 10,000 NGN

- Restaurant Date: 7,000 NGN

- Total: 30,000 NGN

This makes 20% of your income, as opposed to 30%. As a wise chap, you can save the extra 10% for unforeseen circumstances in Nigeria.

Your savings:

- Savings account: N45,000

This makes 20% of your income, as opposed to 30%, which is applaudable.

Pros of the 50/30/20 Rule

Here are some perks of following the rules for budgeting:

- Simplified Budgeting: The 50/30/20 rule is a user-friendly way of budgeting that is easy to comprehend, making it ideal for beginners.

- Spending Flexibility: It allows you to have some flexibility in spending by differentiating between needs and wants, so you can enjoy spending on things you love without feeling too restricted.

- Focus on Savings: By setting aside 20% of your income for savings and/or debt repayment, this rule promotes financial responsibility and encourages you to develop a habit of saving over time.

- Debt Reduction: Prioritizing a portion of your income towards debt repayment can speed up your journey to becoming debt-free, providing financial freedom in the long run.

Cons of the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting method, but it may not be suitable for everyone’s financial situation and goals. Here are three cons of this rule:

- Not One Size Fits All: The 50/30/20 rule is a general framework, and it may not work for people with high living expenses or significant debt.

- Limited Focus on Important Financial Goals: The rule does not consider other vital financial goals such as retirement savings, emergency funds, or investing, which may require more than the allocated 20% for savings.

- Limited Focus on Long-Term Wealth Building: While the rule promotes saving, it may not emphasize investing for long-term wealth accumulation, which is crucial for achieving financial independence and retirement security.

Ready to Budget Using the 50/30/20 Rule?

Since we are all in various places and phases financially, some of us may need to adjust the 50/30/20 rule to align with our specific financial priorities and goals. The 50/30/20 rule aims to help you budget your money better towards financial freedom, not to stifle you.

We have now come to the end of this article! I hope you can now apply the 50/30/20 rule correctly. Towards financial freedom, we move!

Frequently Asked Questions

What is the 50/30/20 rule in Nigeria?

The 50/30/20 rule in Nigeria is the same as it is around the world. Also known as the “balanced money formula,” it recommends allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

Does the 50/30/20 rule work?

Yes, the 50/30/20 rule works, especially for budgeting novices with few financial commitments or debts to repay. However, it may not apply to persons with significant financial liabilities, bigger investment risk appetites, or peculiar financial needs.

What is the 40/40/20 rule?

The 40/40/20 rule is Grant Cardone’s alternative budgeting ratio, which is better suited for building wealth. It suggests that you should set aside 40% of your income for taxes, 40% for savings, and 20% for needs.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist