In the business world, the efficient flow of cash is the lifeblood of any organization. Getting paid by clients promptly, maybe through automated processesss, is critical for maintaining operations and fueling growth, either in startups or established businesses.

This guide explains everything about invoicing, automation of invoices, payment processing, billing, and how small businesses can scale up to these functionalities. Grab a popcorn, rest your back, and get ready to learn all about invoicing.

What is Invoicing?

Invoicing is the formal document that serves as the backbone of ensuring you get compensated for the valuable products or services you provide. But an invoice is more than just a bill; it serves as a vital record of the transaction, protects both buyer and seller, and plays a key role in your company’s financial health.

What is an Invoice?

According to the Cambridge English Dictionary, an invoice is “a statement listing goods or services provided and their prices, used in business as a record of sale”. An invoice outlines how much your client owes you when payment is due, and what services you provide.

This document is a foundation for the small business accounting system. It specifies a customer’s responsibility to pay for the prices listed in the statement.

What are The Functions of Invoicing?

When running a business, it is important to issue an invoice to demand payment.Beyond being a “bill of payment”, it is also a legal document that binds the buyer and the suppliers together to stated criteria. It serves as a legal proof of agreement.

You can also do an invoice analysis that can assist your organization in gathering information from your customers’ purchasing behaviors to detect trends, popular items, peak buying hours, and other factors. This helps to create effective marketing tactics.

What are the Types of Invoicing?

Now that you know what a basic invoice is and its function, let’s look at some of the different types.

The most common form used for everyday transactions is the standard invoice. It has the details of the products or services provided, the quantities, prices, and payment terms.

The type that is closely related to the standard invoice is the debit and credit invoice. Theyare used for minor changes on the original invoice such as increase and decrease of values, refunds, discounts, or corrections to mistakes.

Another type of invoice is the commercial invoice. The commercial invoice is the invoice used for products that are sold internationally. Commercial invoices include information about the sale that is necessary to compute customs charges on cross-border transactions.

Another form of the invoice is the Timesheet invoice. Thisis used by firms that pay their employees per hour. A timesheet is an invoice used when a firm or employee invoices based on the number of hours worked and the hourly rate of compensation. Thisis mostly used among freelancers.

There are other types of the invoice such as the pro forma invoice, final invoice, recurring invoice, past due invoice, retainer, and e-invoice. With the advent of technology, you can generate most of these invoices using online invoicing software.

What Is an Invoice ID?

In invoicing, there is a need for an invoice ID which is a unique number that a company generates for each invoice. The ID is important because it serves as a unique identifier for each client transaction.

The invoice number can contain both letters and numbers, without having to number them consecutively. It is best to have a consistent invoice ID arrangement to prevent sending the same number of invoices multiple times.

How Can I Assign an Invoice Number?

Having a smart invoicing system is the cornerstone of healthy cash flow and there are several approaches you can use to achieve that. One of them is the sequential approach to invoicing. In this approach, you can assign an invoice number sequentially. For instance, if you are running an investment platform, you can use something like invst-0001, invst-0002, invst-0003…

Another format that you can use is the chronological format. Here, the invoice number incorporates the date. For instance, when you issue an invoice on April 3rd, 2024, you could be numbering it “20240403-001” (year-month-day-sequential number). When you issue an invoice, it can help with quick referencing.

Lastly, you can also assign an invoice ID using a customer-based numbering. If you like to use unique numbers as your customer’s ID, then you can easily switch it into an invoice ID number. For example, if you are dealing with a company called FAANG, you could have the invoice ID to be FAANG-001.

Remember that the style you adoptultimately depends on your business needs and preferences. Think of what information would be most helpful for you and your clients when referencing invoices.

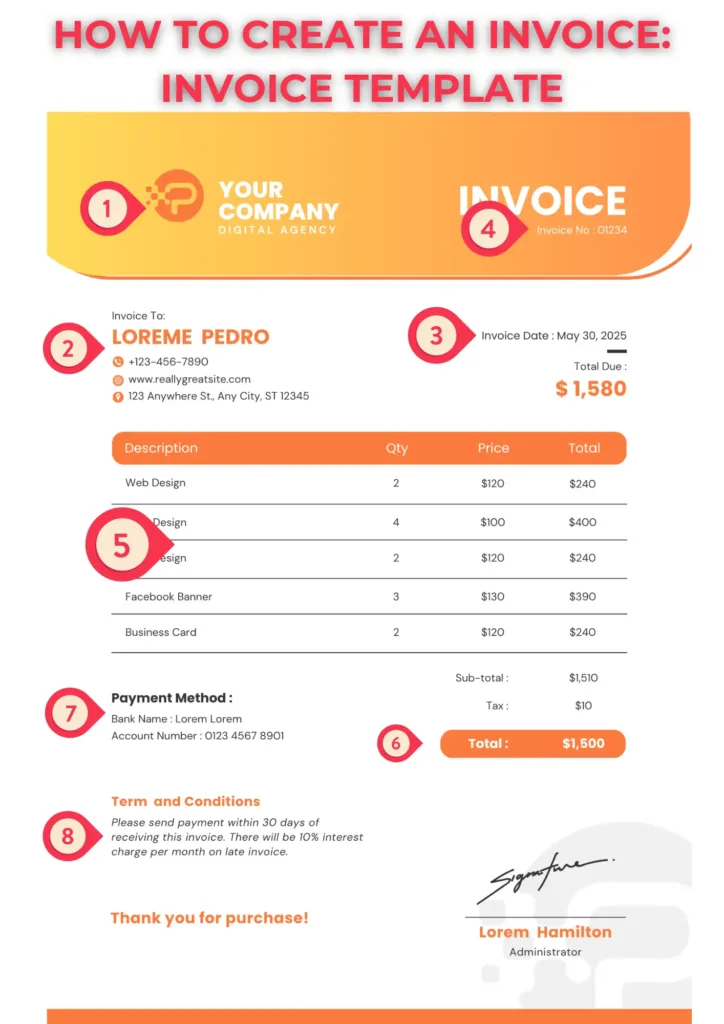

How to Create an Invoice: Invoice Template

You will learn here how you can create a professionally-looking invoice using an invoice template. Keep reading to learn how to create an invoice that will amaze your clients and get you paid faster.

What are the Basics of An Invoice?

Before you start creating your business’s invoice either from scratch or using an invoice template, it is very important that you first understand the basics. You can personalize your invoice in whatever way you want but some very core things must appear on your invoice, which are:

1. Business Details

The first and most obvious thing that should be on your invoice is your business name and logo (if available). You can also include your business address and other necessary details that can inform your client where the invoice is from.

2. Client’s Details

Close to your details, you must include your client’s details such as the name and address. If you are dealing with a mid/big-sized company, you might include the name of the person who will process the payment.

3. Date

You must also include the invoice date on your invoice. This date will include the date the invoice was issued and the due date.

4. Invoice Number

You must also include an invoice number on your invoice which aids bookkeeping and referencing.

5. Transaction Details

This section is where you write the goods and/or services you rendered and its corresponding amount.You can sum it up at the end to show the subtotal amount charged.

6. Amount Owing

After you have clearly stated the transaction details, you can make other necessary payments, such as taxes, to the amount that’s expected from the client.

7. Payment Methods

The next thing, after all the above has been put in place, is that you include the payment methods.This is where you include how you want to receive your payment.

8. Other Terms of Payment

Lastly, you must also include your payment conditions. This is where you state how many days the client has until payment. After the due date, can set a certain percentage as an increment, either daily, weekly, or monthly.

How Can I Create an Invoice From Templates?

Having understood the necessities of an invoice, let’s see how invoices can be easily created from Invoice templates across different platforms.

Creating invoices from Google Docs/MS Word

Microsoft Word and Google Docs are two platforms that serve a similar purpose which is writing. The major difference between the two is that Google Docs is managed on cloud storage while Microsoft Word can only be managed locally on your device.

To use Google Docs, you’ll need to log in to your account on a browser, check the workspace of your account, and select Google Docs among other options available. When you open Google Docs, you’ll see the templates section up and a blank sheet beside it to create a new file. Click on the templates section and search for the Invoice template.

You’ll see several templates on the invoice, choose the one that you prefer by clicking on it and edit the details to suit your needs.

Almost the same procedure applies to Microsoft Word. Once you open the application on your device, you will see the templates section. Click to open it and search for an invoice. Select your desired Invoice template and edit as appropriate.

If you ask which one is preferred among the two, I’ll choose Google Docs. That’s because you can easily forward the invoice to the client mail without wasting time. Another better way of doing this is by using online invoicing software.

Creating Invoices From Online Software

Ifyou’re not using any of the above programs or their templates, you can use free online invoice software. This software helps in creating a more professional-looking invoice but with other benefits. With these platforms, you can easily send your invoice, track when your client receives it and even use a more suitable payment method.

There are also some invoicing software with automated payment. To use this platform, you’lljust need to create an account and use your details to fill up their templates. They’re often less stressful to use and examples include Square, Zoho Invoice, etc.

Other platforms you can use in creating your invoice include but are not limited to, Microsoft Excel, Canva, etc.

What Are The Benefits Of Using An Invoice Template?

Instead of wasting time crafting invoices from scratch every time, you can use the predesigned invoice template that you can simply fill in. This saves you valuable time and also increases your efficiency leading to little or no errors.

Invoice templates are easy to use to generate invoices on the go. More importantly, invoice templates ensure a consistent look for all your invoices. This fosters a positive brand image and makes a good impression on clients. Consistency also benefits your operations by making record-keeping less conspicuous.

Finally, faster invoice creation leads to faster payments from clients. By getting invoices out the door quickly using an invoice template, you can improve your cash flow and reduce the risk of late payments.Another way to make your invoice processes faster is by using online invoicing software.

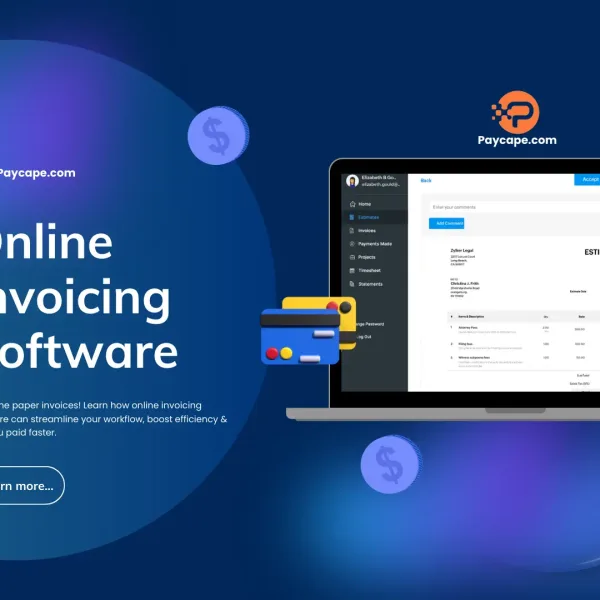

What is Online Invoicing Software?

As the name implies, online invoicing software is the online tool used to cut out the paperwork on invoicing. With the aid of a phone, computer, or tablet, with access to the internet, you can use the online invoicing software. An internet connection is important because your invoices are saved in the cloud which makes your financial documents organized in one easy-to-use platform.

Online invoicing software is mostly user-friendly and easy to use, especially if you have no prior accounting expertise or experience. It will ensure that all legally essential information is imputed accurately. By using this software, you can manage multiple invoices within minutes on any device connected to the internet. You can also use some of the platforms to connect your bank account for automatic bank reconciliation.

What are the Benefits of Digital Over Traditional Invoicing?

As technology advances, there are also more innovations in the field of invoicing. Beyond the traditional paperwork, discover how digital invoicing can revolutionize your business by enhancing accuracy, payment processes, record keeping, etc.

Better record-keeping

Online invoicing software generally tracks all invoicing activities, giving your organization organized and accessible documentation of your billing history. This eliminates the need to manually file and look through stacks of paper bills. Everything is arranged with only a few clicks.

Improved accuracy

Online invoicing software lowers the possibility of human mistakes, resulting in bills that are accurate and consistent. With automatic calculations and pre-filled templates, you can say goodbye to the days of figure crunching and double-checking.

Faster payment processing

Online invoices can be provided rapidly, allowing clients to make payments quickly. Thisnot only increases cash flow for businesses but also shortens the time it takes for them to receive payments. No more waiting for mail or fretting about misplaced cheques.

Enhanced security

Online invoicing offers greater security compared to paper invoices. It can be encrypted and protected from unauthorized access, ensuring that sensitive financial information remains confidential. With secure online invoicing and payment processing tools, businesses and their customers can have peace of mind.

Eco-friendly

Online invoicing can also help to make your business more sustainable and ecologically friendly by reducing the need for paper and physical shipping. It lowers the carbon footprint associated with paper manufacture, printing, and shipping. Going digital is beneficial to both the business and the environment.

Factors to Consider When Selecting an Online Invoicing Software

With the advancement of several invoicing software online, it is importantto be able to make an informed decision when selecting a platform. Some of the key things you must keep in mind are:

Pricing: Determine the cost of the program, taking into account both upfront costs and any continuing subscription or transaction charges.

Features and functionality: Evaluate the various features provided by the platforms and determine the ones that are most important to your business needs.

Scalability: Determine whether the software has plans to scale up with your company and handle a rising quantity of invoices and clients.

User-friendliness: Make sure the platform has an intuitive interface and is simple to utilize since this will save time and shorten the learning curve for you and your staff.

You must also check the invoicing software’s integration possibilities with your existing tools, like your accounting software or payment processor. Some of the platforms you can use for online invoicing are Zoho Invoice, Xero, Invoicely, etc.

How to Generate Invoice Online

You can use an online invoicing platform to generate GST-compliant invoices in a fast and efficient way. After you have chosen your preferred online invoicing software, you can follow the steps mentioned below:

You fill in your details, name and logo, and that of your client into a template provided on the platform.

The next thing is that you will add a brief description of the purpose of the invoice. also fill in the date you issued the invoice.

You include the services/products that have been rendered, their prices, and taxes, where applicable.

You can also mention your business and payment terms and preferred mode of payment.

Once you are done, you can review the invoice and send it to your clients using the online invoicing software. If you need to produce invoices online recurrently, you can choose toautomate the process at an appropriate interval, which is the period for delivering the invoice. Once you’ve done that, you will be able to send the same invoice to your clients regularly.

On some platforms, you can also choose auto-billing if you want to automate the invoicing process and collect money directly through your payment method. Let us look at some of the top free online invoicing and patent tools.

Top Free Online Invoicing and Payment Processing Tools

Freelancers, independent contractors, and even small businesses now have a wealth of free online invoicing and payment processing software at their disposal. Let’s look at some of the top free invoicing and payment processing tools available.

What are Online Invoicing and Payment Processing Tools?

Online invoicing and payment processing are two must-have web-based tools that are essential for today’s businesses. Online invoicing helps you cut out the traditional paperwork when preparing an invoice. With a few clicks, you can easily use a template to prepare an invoice for a client without having to rack your head about how an invoice should look like.

Payment processing, on the other hand, deals directly with payment. It covers the process of payment from a payer and verifies and authorizes the payment, which is when the payee receives the money sent.

Online invoicing software is now integrated with payment gateways that allow your client to pay through the available payment options. This means that you can easily use online invoicing software to create an invoice and add your account to your profile. You will then be able to receive payment from your account directly.

What are the Top Free Online Invoicing Software Tools

To save you from endless research and the possibility of making an unpleasant mistake, I have gathered six (6) top online software that you can use. This software not only allows you to create invoices and send them to your clients but also lets you set up your payment method.

1. FreshBooks

FreshBooks is an online invoicing software that allows you to prepare a personalized invoice, send it to your client, and also receive payments. You can also use this software to snap and convert an invoice to a soft copy.

They offer a 30-day free trial to give you a feel of the paid plan. With FreshBooks, you can auto-schedule payments, track overdue, and even charge late payment fees. You can know when clients open your invoice, cool right? There’s more. You can send your clients invoices in their preferred language. Your client can easily make payments using their credit card or through ACH payments.

2. Square Invoicing

Square Invoices is one of the products offered by Square where you can create an invoice. When you open an account on Square, you can create an invoice, personalize it, and send it to your client. You can also track your invoice to know when your client opens it.

The interesting part is that Square also offers a point-of-sale card reader terminal. This means that they have a payment processor which can work with the invoice as well. When your clients receive the invoice, they see an option to make payment using their card.

They accept most credit cards as well as contactless payments like Gpay and ApplePay. This allows them to pay directly to your account. They can also pay onsite using the payment terminal. This makes it a great option for both in-person and remote payments.

3. Wave

Wave is another platform that you can use both for invoicing and payment processes.It’s an ideal platform for invoice and payment processing for small businesses. The platform allows you to design a professional invoice that will give your small business custom branding.

The billing software has automatic cloud backups. You can also track your invoice to know when it’s opened and set an auto-reminder for clients with overdue payments. Wave offers free access to their invoicing and accounting butyou’ll have to pay to use their payment processing.

4. Zoho Invoice

Another online payment processing platform is Zoho Invoice. Zoho Invoice is a perfect tool for invoice tracking, time tracking, and expense tracking. Its invoicing tool allows you to generate an invoice and estimates. You can also use it to calculate your income tax.

Zoho invoice payment processor is integrated with products like PayPal and Stripe which makes billing seamless. You can also use Zoho Invoice to automate payment reminders and also bill in different currencies with Zoho. With Zoho Invoice, you can generate up to 1000 invoices in a year and you will have to contact their support team if you want to scale it up.

5. Invoice Ninja

Invoice Ninja is another user-friendly platform for your invoice and payment processing. It is an ideal platform for freelancers and people who are just growing their businesses. You can use Invoice Ninja to create customized professional invoices and automate reminders. Although you will have access to unlimited invoices, the free version carries a “Created by Invoice Ninja” watermark. Also, as a free user, you can manage up to 20 clients with auto-billing, and custom taxation.

With Invoice Ninja, you can directly get paid, either in deposits or in partial payments which helps you streamline financial management. When you upgrade to the paid plan, you can even create a custom Invoice Ninja URL where your clients can click and pay invoices.

6. PayPal

This is a very familiar platform that most of your clients will love to have as their payment method. Aside from being known as a payment platform, PayPal also has an invoicing system. You can use it to create, send, and track invoices, using a standard template.

Paypal invoicing also allows you to see paid and unpaid invoices. Your client will receive the invoice through their Paypal and make payments from their available balance or through their linked card.

We hope you found our six top free invoice and payment platforms useful in your search for the best. If you are a Nigerian, make sure you read the article on how to use PayPal in Nigeria. You can utilize the cloud infractures of these platforms in storing your invoice which makes it easy to find when an invoice is requested.

How to Request an Invoice?

Requesting for invoice is a common activity that occurs frequently between buyers and sellers for different purposes. Sometimes, you can request an invoice after a service is rendered and the invoice is missing.

Another instance where you can request an invoice is when you wish to order a particular product from a seller. In this case, you’ll have to list all the products you need and the quantity for each.

You can request an invoice in several different ways. One of the most common and widely used means is through email. You can also request an invoice via phone calls or even invoice portals, for firms that use it. But before we show you how you can uniquely use the different means, there are a few things you need to bear in mind. You must ensure you have the correct details of the supplier/seller and ensure you request the right information. Also, be sure you have an estimated budget for the product/service to avoid delay in payment processing. When you eventually put your request together, you must include your company’s name, contact information, billing and shipping addresses, and, of course, the description of your order.

Now let’s look at how you can request an invoice through the mentioned means.

Request an Invoice Through Email

As mentioned above, the easiest and most used means to request an invoice from a seller/supplier is through email. When sending a mail to request an invoice, the first thing you must do is to find the seller’s contact email. The next thing is to type out your request mail and below is a template you can follow:

Subject: Requesting Invoice

Dear [Seller Name/Company Name],

I am writing to follow up on a recent transaction I made on [date] for [description of service or product]. I would appreciate it if you could send me an invoice for this purchase.

Please let me know if you require any further information from me.

Thank you for your time and assistance.

Best Regards,

[Your Name]

If you’re writing to request an invoice for a product or service you are yet to receive, you can change the body of the letter to a suitable content.

Remember to use polite language when writing your email, and avoid any unnecessary details. Just communicate your request clearly and cut out information that won’t be necessary to your supplier.

Request an Invoice Through Phone Call

While email is a widely accepted means to request an invoice, you can also use a phone call. Phone calls are particularly good when you have a personal or long-term relationship with the company or seller. You can also use phone calls to request an invoice when the transaction you had with the seller is recent.

You will justplace a call to the contact of the seller, briefly explain the situation, and then request an invoice.Ensure you get the name of the person you spoke with as well, in case of follow-up.

While email is preferred, a phone call can be a good option if the transaction is recent or if you need the invoice urgently. Briefly explain the situation and request the invoice. Be sure to get the name of the person you spoke with in case you need to follow up.

Online Invoice Portal

When you are dealing with top firms as your supplier, you might see them using online platforms that allow you to access and download invoices. You check your supplier website or ask them directly if you can request an invoice through such a platform as it’s not a common practice. Some invoicing software with payment processing allows for this kind of transaction.

Why Is It Important To Request An Invoice From A Supplier?

Requesting an invoice from a supplier allows you to keep track of your money flow and claim tax deductions for your purchases. Requesting an invoice also develops your relationship with the provider and indicates that you are serious about acquiring their items.

Also, asking for an invoice will assist in checking that the things you’ve purchased are what you want and fulfill your specifications.

What is Payment Processing?

Another important aspect to understand in accounting is payment processing. Payment processing, in a simple term, is the action, or set of actions, that conducts the transaction of funds between two parties. It converts your swipes, clicks, and taps into successful transactions. Payment processing is the secure electronic transfer of funds from you (the payer) and the business you are buying from (the payee).

Making payment involves several processes, which majorly include authorization, verification, and settlement.These processes are the pillars on which several payment activities take place, such as payment gateway management, invoicing, recurring billing, refunds, and dispute handling.

Payment processing handles various transaction types, not just credit cards. It can handle debit cards, electronic fund transfers (EFTs), contactless payments, and even some digital wallets and cryptocurrencies. It can be used with online invoicing software to improve cash flow, speed, and efficiency.

Why is Payment Processing Important?

Since the use of actual cash exchange is reducing, especially for online and e-commerce businesses, having a versatile payment processor is very important. Besides the fact that it guarantees seamless transactions, it is also optimized. A secure payment processing system will increase customer satisfaction and confidence.

When a platform offers a simple and safe payment method, users are more willing to use it again. Also, payment processing ensures faster access to funds, improved cash flow management, and less administrative work for administrators. This effectiveness helps reduce concerns regarding problems with transaction processing.

Additionally, secure payment processing systems are important for businesses that allow online investing. Investors need to be confident that their funds are secure when they deposit or withdraw money from their investment accounts.

How Does Payment Processing Work?

Since we’ve established that payment processing is the backbone of digital financial transactions, what exactly happens behind the scenes during a swipe or a click? Let’s dissect the process.

The first thing that happens after you initiate the transaction? The payment information is securely encrypted and transmitted to the payment processor. The payment processor then validates the transaction in three steps, authorization, verification, and settlement.

Authorization: The payment processor verifies the details of your card and checks with the issuing bank (the bank that issued your card). This is to ensure you have a sufficient balance.

Verification: The issuing bank may perform additional security checks to prevent fraud. If everything checks out, the authorization is approved.

Settlement: Once authorized, the funds are electronically transferred from your issuing bank to the merchant’s acquiring bank. That is the bank that holds the merchant’s account. The merchant then receives the funds, minus any processing fees.

Understanding the payment process not only sheds light on how our daily transactions work but also helps your businesses. It helps navigate the world of accepting electronic payments.

The Major Types of Payment Processing Methods

There are several methods for processing payments, each catering to unique needs and offering varying levels of convenience and benefits.

Traditional Methods

For several decades, business owners have been using merchant accounts from banks. This account now allows them to accept payment directly into their account from debit or credit cards, and sometimes, ACH payments.

There are also the Point-of-Sale (POS) Systems which are electronic systems that allow businesses to accept in-person payments. The POS system is integrated with merchant accounts for seamless processing.

Modern Payment Methods

Payment Gateways: These act as online portals that securely connect websites and mobile apps to payment processors. They facilitate transactions without requiring merchants to handle sensitive data directly.

Mobile Wallets (Apple Pay, Google Pay): These are digital wallets that are stored on smartphones to allow contactless payments at enabled stores. Transactions are secured using near-field communication (NFC) technology.

Digital Payment Networks (PayPal, Venmo): These online platforms allow users to send and receive money electronically, often linked to bank accounts or debit cards. You can use them on platforms that integrate them into their network.

ACH Payment: This is the direct transfer between bank accounts, the Automated Clearing House payments. They are often used for recurring bills or larger transactions because they are more secure without any third party involved.

Emerging Method

Cryptocurrency Payments: This is a relatively new method that leverages digital currencies like Bitcoin, Ethereum, and Litecoin for transactions. Cryptocurrency processing allows for fast, borderless payments without relying on traditional financial institutions.

However, it’s important to note that cryptocurrency is a volatile market, and its adoption by businesses is still evolving as well as regulatory compliance.

With the availability of different payment processors, your business can cater to a diverse amount of users online. Your choice of payment processing method could depend on factors like the type of business, transaction volume, budget, and target audience. You can also automate your payment processes.

What is an Automated Payment System?

An automated payment system is an electronic system that is used by businesses to automate their payment processes. It covers several forms of payment from customer transactions to payment of salaries.

Automated payment systems don’t just automate payment processes but help businesses improve, streamline, and optimize their financial procedures. These automated payment systems are versatile andthey facilitate payment across several payment methods like cards, wire transfers, digital (contactless) payments, EFTs, and many more.

How Does Payment Automation Work?

Generally speaking, payment automation involves the use of automated techniques to handle a variety of payment-related data and carry out associated activities with little or no human intervention.

The online invoicing software is one of the major processes used with automated payment systems. The system takes an invoice in different formats, interprets the information on it, and then stores it. On storing the data, the system reviews it and determines if it will be automatically approved or held for manual review if any irregularities appear.

Another key instance of how automated payment systems work is ACH verification. Automated Clearing House, ACH, is an electronic mode of payment that involves the direct transfer of money from one account to the other. The process of ACH requires the bank details to be verified butthis can be doneeasily on automated payment systems.

What are the Benefits of Automated Payment Systems?

Automated payment systems have numerous benefits that are practically inexhaustible, from cost savings to better security. These benefits don’t apply to you alone but also to your customers. Below are some of the significant advantages of using an automated payment system.

Time and Cost Savings

The use of manual payment processing doesn’t just take time to handle the paperwork but is also costly. With the use of an automated payment system, you can cut down the amount you spend on accounts payable staff and payment procedures.

Automated payment systems are fast and efficient, performing most of the manual work like data capture and authentication, using technology.

Reduced Risk of Human Error

One of the greatest risks of manual payment processing is human error, especially when you have a lot of transactions. Automated payment systems solve this problem by using complex algorithms that don’t feel stressed or tired. You don’t need to worry about wrong input of data thereby avoiding issues with your customers.

Greater Transparency and Accountability

Automated payment systems use a dashboard that shows everything related to your payment activity. This implies that with a few clicks, you can visualize data of all the payment transactions you’ve made. You can then make actionable informed decisions based on the insights you get.

Better Security

Another significant benefit of automated payment systems is that they are secure. These systems use technology that caneasily detect fraudulent activities and hold them for staff to verify. They also,mostly, use a cloud-based network whichnot only secures your data from local desktop malfunctions but also gives access to authorized users.

Improved Cash Flow

Businesses benefit from faster payment collections made possible by automated payment systems, which also improve cash flow. Financial stability is improved by speeding up the receivables cycle through real-time transaction processing and automated reminders for past-due payments.

The Best Practices When Using an Automated Payment System

Automated payment systems are no doubt a game-changer for businesses, streamlining finances and saving valuable time with better security. But to ensure they function at their peak, you need to implement some practice, important practices. Some of the key things to do are:

Test and Monitor Regularly

Whenever you are using a new system, ensure you test it thoroughly before deploying it for public use. After which you must ensure you train the authorized user(s) on how to optimally use it.

It is also crucial that you monitor the system from time to time after first use. Just like any other software, your automated payment system needs to be kept up-to-date. Regularly install updates to patch security vulnerabilities and ensure you have the latest features.

Security

When setting up your account, ensure you use strong passwords and two-factor authentication, if applicable. This Will be another form of firewall to prevent your account from possible malicious activities.

Provide Multiple Payment Options

One way you also optimize the use of automated payment systems is to offer a variety of payment options like ACH transfers, credit cards, etc. As a result, you can strengthen vendor relationships by not just supporting their methods but also paying them more quickly and effectively.

Seek Internal and Partner Buy-in

You must get everyone on board. You must ensure you train every staff member on the new system you’re using and address any of their concerns. If you work with vendors or partners, ensure their systems can integrate smoothly for seamless automated transactions.

How to Select Payment Automation Software

When choosing the best payment automation system, you should always conduct thorough research. After all, each organization is unique, as is every payment automation platform now on the market.

In general, the most crucial factor to consider throughout the choosing process is the capacity to handle any invoice processing scenario that may emerge in the business you run. A payment automation system that does not fully automate all invoice processing operations will result in much lower time and hard cost reductions.

It’s also critical to examine whether a payment automation system will work seamlessly with your company’s existing enterprise resource planning (ERP) solution. Synchronizing data and building a simplified procedure with little manual intervention is essential for a successful automated accounts payable process.

In the ever-changing technological landscape, automated payment systems have evolved as an essential component of modern financial operations. Small businesses are not left behind and that is why we have the next section mainly on payment automation for small businesses.

Automated Payment for Small Businesses

Automatic payment is an electronic way of making payments that are preset to complete certain transactions to certain people at a certain time. You can set up automatic payments as a one-off thing or makerecurring payments with either a fixed or variable rate.

You can check out one of our articles that extensively explains what automated payment systems are. Here, we’ll be focusing on automated payment for small businesses. An automated payment system for small businesses is a tool that can help build a business by making time available for other things. This is essential as small businesses often have a small number of people doing several things.

Automating payment systems won’t only make your work easy but also more efficient, smart, and fast. You can easily create more time for invoicing, billing systems, marketing, and evenbudgeting. Automated systems also accept recurring payments that can help your small business receive payment faster and improve your cash flow.

What are the Types of Automated Payments for Small Businesses?

Different types of automated payment systems can be easily used by small and growing businesses.The most widely used kind of automated payment for small businesses is the recurring payment option. The types used include:

Fixed-amount automated payment

One of the best-automated payments for small businesses is the fixed amount payment. This type charges per payment which means you don’t have to pay when you’re not using the platform.

Variable amount auto payment

Automatic payment amounts change from invoice to invoice, based on the services purchased by the client during that pay period. This is a frequent payment plan for independent creatives such as graphic designers and writers, whose services to customers vary monthly based on what is needed.

Pre-approval transactions

Finally, some automated payments for small businesses involve pre-approving a credit card that will be chargedshortly after a service is rendered. These payments are less used among freelancers, but they are popular in services like Uber drivers. In this case, you’ll need to pre-approve your card when your account is set up and are charged after the service.

What are the benefits of using Automated Payment for Small Business?

Automated payment for small businesses offers a lot of benefits to both the business and the clients that use it. One of the major benefits is the enhancement of cash flow. Automated payments help small businesses not to worry about when their payments will come in and help you plan what you use your funds for.

Clients also usually find it convenient to use. It helps them to present a payment and forget about it knowing that when the due time comes, the payments will be automatically made without any additional approval.

Instead of manually creating invoices each month and then processing payments, you easily automate all of them. You will spend less time invoicing and more time focusing on critical company problems.

Another thing that automated payment for small businesses does is that it helps keep your money organized. They make it easy to see where your money goes, so you can spend it on the things that help your business grow!

How Do I Set up Automated Payments for Small Businesses?

Setting up automated payments for small businesses usually begins with deep research to find a suitable platform for your business. There are several platforms online that your client can use in making automatic payments such as PayPal, Stripe, Square, etc.Most of these will charge you a transaction fee which is an affordable credit card processing for small businesses. Some also include recurring payments.

After choosing your preferred platform, the next thing to do is to create your merchant account. Also, you must ensure you look out for the security measures of the platform, although most of the platforms are highly secured and encrypted. Once your account is ready, you can first have a controlled testing where you ascertain all the functionalities. And then, you market it to your users.

You must let your customers know about the automated payment implementation and how they can use it. The payment methods on your invoice can be updated and included in automated payment. You can also easily create a link from the payment platform that you can click and just make a payment.

Lastly, automated payment for small businesses can be offered to users with incentives when it’s been used. This is to encourage your client to adopt the payment method as their preferred option. This could be giving a discount to the payment made through the automated system.

Invoice Payment Methods Explained

Invoice payment is one of the ways you can receive payments from your client with an organized system. Under this subheading, we will look into what invoice payment methods are and the various types available.

What is an Invoice Payment?

Invoice payment is a planned transaction where funds are sent by a customer (the company/client) to a vendor (the seller). The transaction is to make payment for goods or services received from a seller. This helps in keeping the business operations healthy. Properly managing this process aids in resolving difficulties such as late payments and avoiding uncomfortable interactions with your customers.

Invoices are formal documents that contain the details of products or services sold. It also contains the date, an invoice number, the amount payable, and the payment terms. With the advent of technology, there are now several online invoicing software that you can use in creating invoices.This ensures that you are more efficient and timely which in turn fosters good customer relationships and increases.As a freelancer or business tycoon, using these won’t just give you a professional image, but they have payment processors integrated into them which helps ease your cash flow.

What are the Terms of Invoice Payment?

Invoice payment terms are the condition(s) of the payment that are set by the seller. This part of an invoice is where you will see how and when the payments should be made. It also includes all the instructions/conditions the customer must fulfill to pay for the product or services.

The invoice payment terms can vary because the seller has the control to determine the terms. The seller can give a discount for early payment and also set a fine for late payment. When the due date isn’t set, the customer has up to 30 days, after receiving the invoice, to make payment.

Note that, clearly stating your payment terms on your invoices allows your clients to create a budget and allocate funds accordingly.

What are the different types of Payment Methods to Pay an Invoice?

When a client receives the invoice, the next thing is to make payment and that will be based on the options you provided your payment terms. There are different types of payment methods available and each has different benefits and transaction charges. Some of the payment types you can come across include are:

Cash Payment

Cash payment is the oldest tried and trusted mode of payment. Once your client makes cash payments, there’s no need to worry about the processing time, charges, or deposit bouncing. However, this is only a good option for in-person payments for small businesses.

The limitations of cash payment also include theft and mismanagement. It’s also difficult to use for international business, which makes it unideal for freelancers.

Pay by Check

Paying by check is another option you can use to receive payment. But just like cash payment, paying invoices in check is gradually fading away. When compared to other digital payment options, making invoice payments in check takes time, and can easily be canceled or even intercepted by fraudsters. However, some small service-based firms may choose to pay via check. In such instances, paying by check may be the most appropriate alternative.

Paying with Credit or Debit Card

When compared with either cash or check, allowing your clients to make invoice payments with credit or debit cards is more convenient and secure. Usually, you add a link to a secure payment gateway in your invoice payment terms where the client can click to pay.

The only downside of making payments with a card is that they can incur transaction fees from payment providers, especially when it’s international. You can read about contactless cards.

Bank Transfer

Mostly, when most of your transactions are local, you can include bank transfers in your invoice payment terms. You will just have to add your bank account details through which your clients can transfer the payment. The client will make a direct transfer from their account directly into yours.

Bank transfers are one of the most secure, cheapest, and quickest modes of payment. It can also be very convenient for your customers.

Online Payment/Mobile app

When it comes to online payment, there are several options available. An example is one of the world’s most widely used payment platforms, Paypal. This platform makes it possible for both small and large businesses, even techies and business folks. They make provision for digital cards and mobile wallets.

You can use online payment platforms to create professional invoices. You can also use them to set up an auto-reminder that will allow you to keep up with late payments. Other forms of online payment are contactless payment such as Gpay, Apple Pay, etc.

Other payment methods that can be used with invoice payment are Automatic bill payments and ACH payments.

How To Choose The Right Invoice Payment Method

Choosing the right method involves balancing several needs such as speed, fees, security, and client preferences.

You must consider how long it will take the funds to be settled in your account after the payment has been initiated.This helps in cash flow management. Most often, invoice payment methods that are faster and more secure, like PayPal and Payoneer, incur high fees. Although these platforms cost more to use, not using them could be detrimental. This is because they are often widely used which means your clients will most likely love to use them.

Security is also a primary concern, both for you and your customer. Regardless of how it affects other factors, choosing a secure platform must be a top priority. Fortunately, most online payment methods available use strong security firewalls to protect.

You must also consider the time it takes to set up the payment you choose on your invoice payment terms. One of the fastest is bank transfer or credit/debit payment.

Before we end this guide with a detailed explanation of what automated invoice processing is, let us look a little closer at what automated billing is.

What is Automated Billing?

Automated billing is a system that handles, streamlines, and automates billing, invoicing, and payment processes with little or no human intervention. This system offers consistent, error-free, and timely billing cycles by combining many functions, which improves the efficiency of operations and ensures accurate revenue monitoring.

The use of automated systems helps in adaptability and real-life insights whichhelps businesses to adapt to recent technological advancement, real-time insights, and scalability. In the next section, you will see the intricacies of how automated billing works.

How Does Automated Billing Work?

Automated billing isn’t just a technological upgrade butit empowers businesses to operate more efficiently. The steps taken to achieve this are:

Data integration

The first line of action for automated billing systems is to get in sync with your company’s database and other Customer Relationship Management (CRM) tools you are using.

Invoice generation

The next thing is that the automated billing generates invoices from the data it pulls from your database. The invoices are generated at regular intervals.

Payment processing

Several automated billing systems integrate several payment gateways. This is to allow your users to have access to several payment options possible. You can read our article on payment processing to have the full idea.

Proactive notifications

Automated billing systems reduce late payments by sending timely notifications to your customers before their payment is due. This can be through SMS or email notifications.

Overall, billing automation improves the billing process by ensuring timely and accurate invoicing, payment collection, and financial management for organizations of all sizes and industries.

How Do I Automate My Billing Process?

Automating your billing process starts by conducting research based on your unique needs and industry requirements. For instance, if you run a consulting firm with recurring customers. Part of your major concern will be invoice creation and maybe payment notifications.

Another thing you’ll need to consider is the billing system that will easily work with your existing accounting software. This is crucial as you’ll have to use some of the data on that software.

The next important step is your customer portal. This will give the users access and enable them to submit online payments with invoices, and even update or change their payment method when needed.

Finally, you can customize the system with your business details, logo, name, etc.

Boost Your Growth Through Automated Bill

Automated billing systems can clear your hiccups and boost your efficiency. Incorporating automated billing systems is the right move for SaaS businessesconsideringthe wave of technological advancement.

As mentioned before, these tools will help you implement pricing strategies, minimize your mistakes, increase cash flow, and also enhance your invoice. There are also features like easy payment and subscription management.

Remember that the automation journey is part of your digital transformation, which is a necessary stage for effective growth.

What are the Key Benefits of Using an Automatic Billing System

Besides helping you boost your business, there are other benefits to integrating automated billing systems into your work processes. One of these benefits is higher accuracy.

Higher Accuracy

There are tendencies to make mistakes when you manually handle your billing processes. This could lead to huge losses for the business and using an automated billing system can save you from such calamity. This tool rightly enters the bill amount, due date, the inventory sold, and other terms.

Saves cost

Another thing is that you save costs. Usually, the upfront payment for an automatic can always look huge but in the long run, the cost of papers, the cost of reworking errors, and FTE costs. You can save more than half the amount you spend on your traditional invoicing system.

Saves Time

Manually handling your invoice a lot, from creating to processing your invoices. There are also late paying customers to follow up.

The Automated billing systems simply automate this process thereby saving you more time to focus on other things.

Improved Efficiency

Another benefit of an automated billing system is the general improvement it brings. As your business grows, the accounting department might get less efficient due to several billing processes they’ll have to handle.

This can be handled efficiently using the automated billing system. You’ll also get real-time insights into your billing processes and, thus, easily see errors and other discrepancies quickly.

Improves Payment Follow-up Processes.

By automating your billing system, your customers can also easily get notified immediately when there’s a failed payment. Thiseasily be missed when done manually, either because the account officer isn’t on the seat or an oversight.

Your automation will also leave a space for human intervention for any further verification and confirmation.

Data management

An automated billing management solution connects with other systems and stores customers’ billing and invoice data in a single database. In comparison to typical invoicing systems, this simplifies data access and management.

Flexible Payment Options

An automated billing system allows customers to choose from a variety of payment methods. It supports a variety of payment options, including credit/debit terms, ACH or wire transfers, and purchase orders, while adhering to invoicing requirements and industry standards.

Automated Invoice Processing

As the name implies, automated invoice processing is the automation and streamlining of invoice processing workflow. The automation can cover the entire invoice processing workflow. It starts from the extraction of invoice data to invoice review and approval.

This process automatically pays invoices which in turn reduces the accounts payable process. The account officers also get relieved to focus on other strategic tasks. You don’t just save time and money with automated invoice processing, you also reduce errors and fraud.

One of the key features of an automated invoice system is that it provides standardized coding, and automates approvals. There’s usually a dashboard as well that shows the status of invoices. Many invoicing software aids their payment by integrating with ERP platforms that help save time and increase accuracy.

How Does Automated Invoice Processing Work?

The automated invoice processing software automates every step involved in the traditional way of processing invoices. In the traditional way of invoice processing, an account officer receives an invoice, verifies the details of the description, and the payment detail is set up in their system and ready for approval and payment.

The automation of invoicing takes a smarter and quicker approach to the workflow above. The system directly receives the invoice sent by the supplier, immediately scans it and then the details are sent as data to your accounting system. The next thing is that the data will be transformed into a searchable text document that can be mapped by the automated management system.This will enable the tracking of the data entered into the ERP system in real time.

The type of details saved in the data stored includes the company/supplier name, detailed description of the purchase, purchase amount, and the account of the invoice. The last thing is that the automated invoicing system sends the account of the payment to the concerned party that reviews and endorses the payment. In cases where the system cannot automatically make the payment due to the chances of possible error, it is held on for a human to review.

How To Automate Invoice Processing

The good news about automating your invoice processing is that it doesn’t require a complete revamp of your systems. The first thing you must do is select a suitable invoice automation software for your business. There’s a range of software available, from cloud-based solutions to enterprise resource planning (ERP) integrations.You must consider factors like your business size, the volume of the invoice you receive, and your budget when selecting a solution.

Once you’ve gotten your preferred software, integrate it with your existing accounting software. This will allow for a quick setup and transfer of the company’s data without having to manually input the data. You must also configure your software to match the unique workflow of your company.This might include restricting the automatic payment approval to a certain amount threshold.

After setting up the automation and configuring a unique workflow, you must now test it in a controlled environment. This means you’ll deploy the software locally to be used by selected people and get their feedback. The feedback you then use to make necessary changes and improvements.

The Automated invoice processing can then be integrated into your company’s general workflow. It receives the invoices from your vendors, uses machine learning in reading and extracting information, and makes approvals where necessary.

Which Invoice Processing Tasks Can You Automate?

The overall process of invoice automation is to streamline the entire invoice processing cycle, starting from the capturing of data to approval and even archiving. Some of the specific processes that this system automates in invoicing are:

Data Entry

Automated invoice processing can be enabled to accurately and quickly capture the details of an invoice using Optical Character Recognition(OCR). Information like the vendor information invoice date, line items, and total amount.This cuts out the manual time spent on manual data entry.

Data validation

Automated invoice processing also helps in verifying the details of the invoice you received against some predefined rules or existing data in your accounting system. You’ll also be saving time here and your account team only gets to manually review the ones that are flagged during the automation process.

Coding and Matching

You can also automatically assign specific codes to line items on an invoice to easily reference and even analyze the invoice. This will also simplify the tax payment to the authorities.

Your automated process can also use some algorithm to flag duplicate payments or bills for the same purchase.

Approval and Archiving

Another step you can automate is approval. You can set your automated invoice processing to approve the payment. Provided you have the required payment method option andit’s within your set jurisdiction. You can also set your approval to a certain amount, based on the size of your company.

Invoice automation systems can also help you archive invoices in a centralized and searchable location. This makes it easier to find an invoice, an easier alternative when compared to the traditional process.

You can tackle the repetitive, rule-based tasks of the invoice processing cycle and introduce errors using automation.