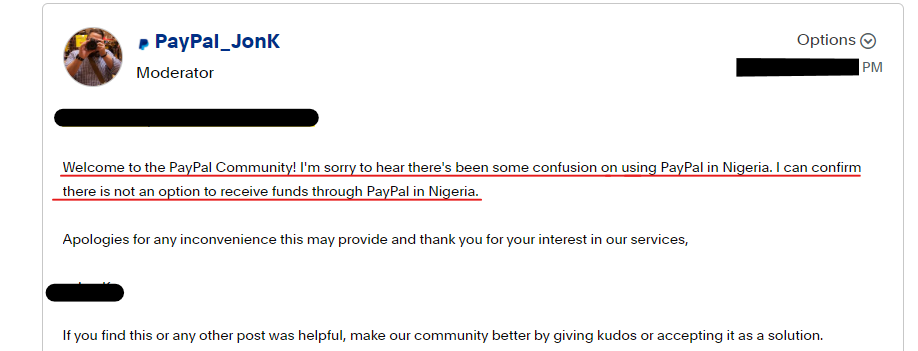

First things first, Nigerians were originally banned from using PayPal – this changed in 2014. Now, Nigerians are only partially restricted from using some of PayPal features – including receiving money.

So, if you want to use PayPal in Nigeria, then you’ll only be able to send money to other accounts. You won’t be able to receive funds or anything like that.

To clarify, if you find yourself in Nigeria and wish to take advantage of the convenience of PayPal, you’re still in for a bit of a hurdle. The current scenario permits Nigerians to send money through PayPal, but receiving funds remains a challenge.

However, the good news is that there’s a workaround, and we’re here to spill the secrets that will empower you to both send and receive money seamlessly via PayPal in Nigeria. Read on to know how to use PayPal in Nigeria.

Before you continue reading!

To ensure the accuracy of the information presented in this guide, we took the initiative to open a Nigerian PayPal account ourselves. This firsthand experience allows us to provide you with verified and up-to-date information, ensuring that the content of this guide is based on real experiences.

What is a PayPal Account?

A PayPal account is an online financial platform that allows users to make electronic transactions. You can securely send and receive money, and conduct various financial activities over the internet with your PayPal account.

PayPal serves as an intermediary between individuals, eCommerce businesses, freelancers, and online merchants, providing a convenient and widely accepted payment method for transferring funds.

Key features of a PayPal account include:

- Sending and Receiving Money: Users can send money to friends, family, or businesses, and also receive funds from others. This is particularly useful for online transactions, freelance work, or splitting bills.

- Online Payments: PayPal is widely accepted by online merchants as a payment method. Users can make purchases on eCommerce websites, subscribe to services, and pay for goods and services securely using their PayPal account.

- Linking Bank Accounts and Credit/Debit Cards: To facilitate transactions, users can link their PayPal accounts to their bank accounts or credit/debit cards. This allows for easy transfers of funds between the PayPal account and linked financial sources.

- Security Features: PayPal employs various security measures to protect users’ financial information. This includes encryption, fraud detection, and buyer/seller protection for eligible transactions.

- International Transactions: PayPal facilitates transactions in multiple currencies, making it a convenient option for international payments. Just like contactless payments, users can send and receive money globally without the need for traditional banking methods.

- Business Accounts: In addition to personal accounts, PayPal offers business accounts with additional features tailored for businesses, such as invoicing, payment processing, and integration with eCommerce platforms.

- Mobile Apps: PayPal provides mobile applications for iOS and Android devices, allowing users to manage their accounts, send money, and make payments on the go.

Now that you know what a PayPal account is, let’s look at how PayPal works in Nigeria.

How Does PayPal Work in Nigeria?

Let’s clear your doubts first – is PayPal available in Nigeria? Yes, it is! Just check the link – www.paypal.com/ng/home.

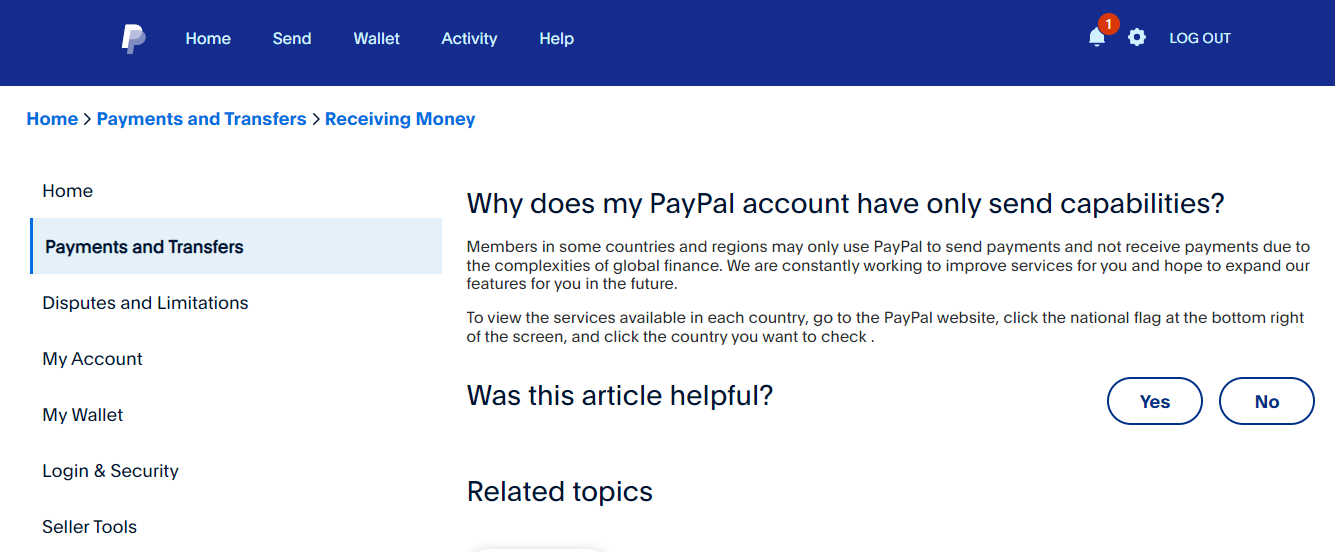

Just like we established earlier, you can only send money and shop online with your Nigerian PayPal account. One other limitation you may encounter with using PayPal in Nigeria is that you can only open a personal account.

Back to the question – how does PayPal work in Nigeria?

Let’s see!

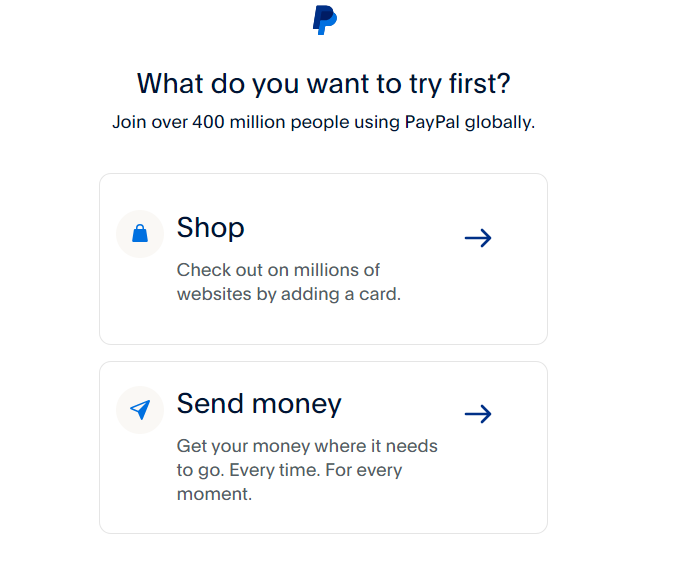

Account Creation

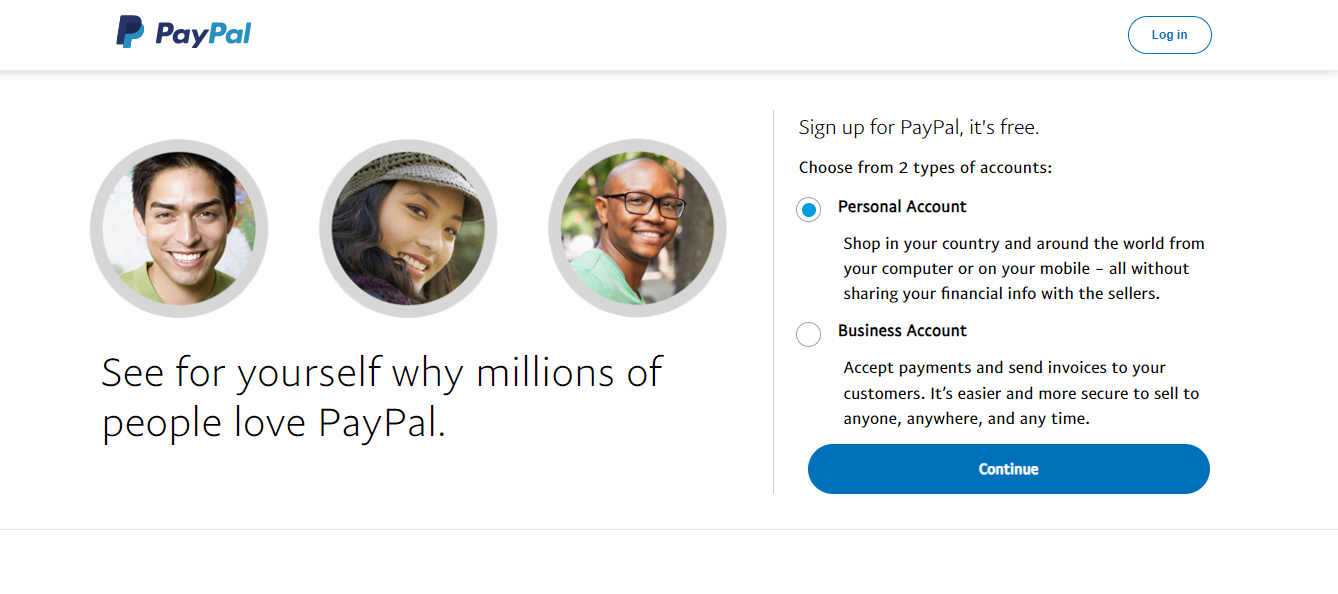

Individuals can create a PayPal account in Nigeria. Visit the PayPal Nigeria website and sign up by providing the necessary information. However, you can only create a personal account with the www.paypal.com/ng/ link.

If you are looking to open a business account, then you may need to stick around to the end of this article to see how to do that!

Account Verification

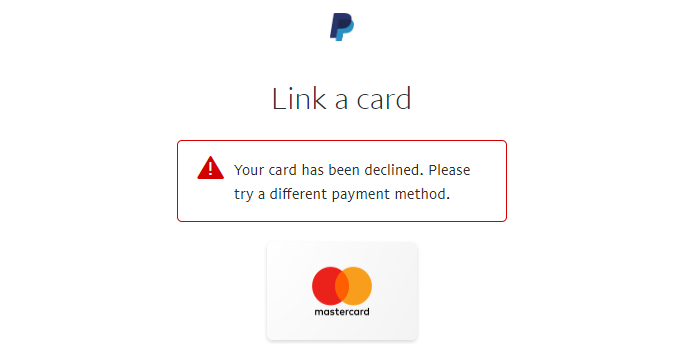

PayPal typically requires account verification through a linked bank account or credit/debit card. Once you add your debit or credit card, PayPal will ask to verify the card by making a deduction of $1.95.

After the deduction, PayPal will send a 4-digit code to you via the transaction receipt you’ll receive from your bank. Usually, it takes 1 – 5 days, but it could be less than that, depending on your bank.

Now, the problem is that you may not be able to add a regular naira debit/credit card (this may be due to the banking policies in Nigeria). However, if you have a prepaid card or a virtual USD card, then you are good to go.

Sending and Receiving Money

Once your account is set up and verified, you can use PayPal to send money. You can make payments to online merchants that accept PayPal and link your account to online eCommerce business websites like AliExpress and Amazon.

Now, note that on your PayPal dashboard, the Receive button may not work. You only have the option to send money from your account.

Funding Your Account

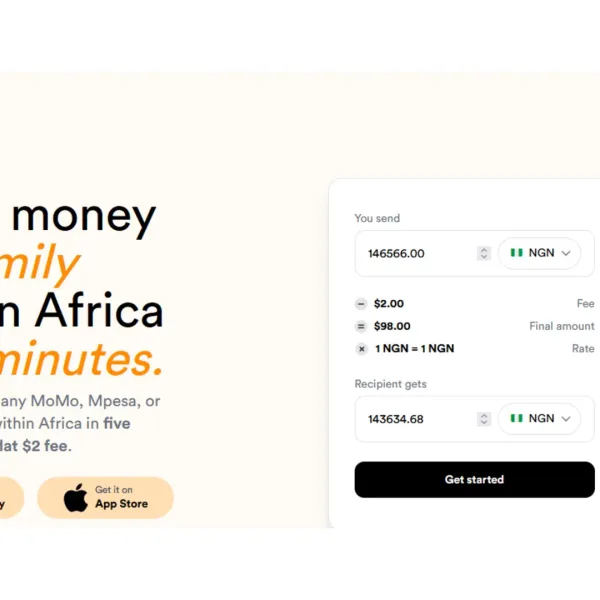

Another thing worth mentioning about opening a Nigerian PayPal account is that you cannot fund your PayPal wallet. With each transaction you make, funds are deducted directly from your linked card or bank account.

We suggest using either a Grey virtual USD card or ChipperCash virtual USD card. You can also opt for prepaid cards – but be prepared for the hefty fx conversion rates.

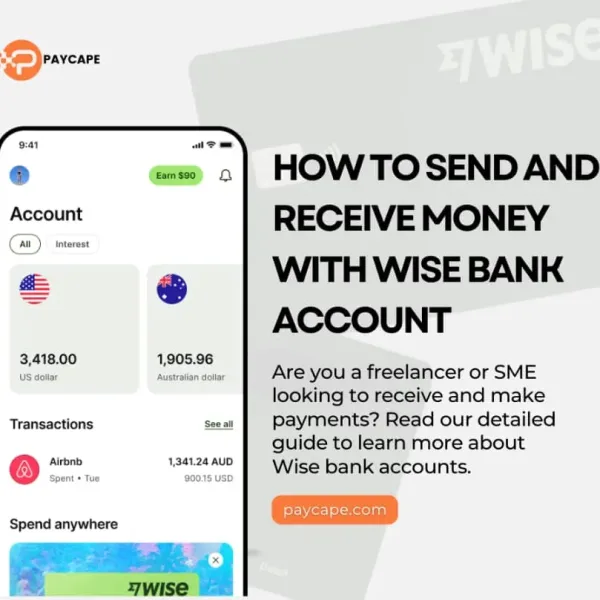

With all these limitations, it is understandable if you want to switch to a PayPal alternative, like Payoneer or TransferWise. At this point you may even consider paying with Western Union or direct wire transfer.

However, remember that we have good news. There is a way to beat the system and actually open a PayPal account that has all the features you’ll need – sending money, receiving money, and opening a business account.

Let’s find out what you need to do!

How to Open a PayPal Account in Nigeria

There are several – ok, maybe just two – ways to open a functional PayPal account in Nigeria.

The first way is the one that everyone knows:

- Open the link www.paypal.com/ng/home.

- Locate the signup button on the page.

- Fill in all your signup details – email, password, name, address, and phone number.

- Verify your phone number.

- Verify your email address.

- Add your credit/debit card details (only prepaid or virtual cards actually work).

- Verify your card (allow PayPal to remove the $1.95 charge from your account – they’ll return it).

- Confirm the code that PayPal sends via your bank transaction narration email.

- Add your profile photo.

- Start sending money.

With the second method, you may not be able to open a personal account but you’ll have full access to PayPal business functionalities. However, if you have access to an international phone number, then you may be able to open a personal PayPal account following these steps.

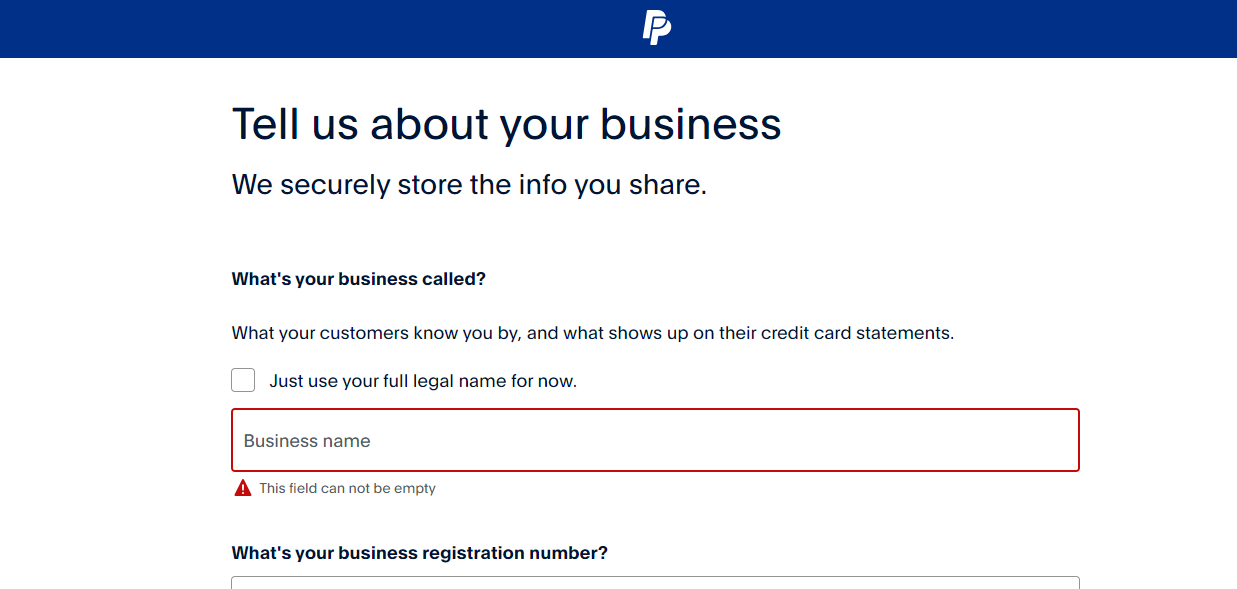

Note that, the steps detailed below will help you open a PayPal Business account in Nigeria. You can use the business account for personal reasons – but, you should be ready for the transaction charges that PayPal deducts on every transaction you make.

Before we continue, the trick to opening PayPal in Nigeria is in the URL. Rather than using a /ng/ link, you can use a different country code. In this guide, we used a /ls/ code.

Here’s the way to open a PayPal account in Nigeria that no one talks about:

- Open the link www.paypal.com/ls/.

- Navigate to the signup button.

- Choose the type of PayPal account you want – preferably business (you may not have all the requirements for a personal account).

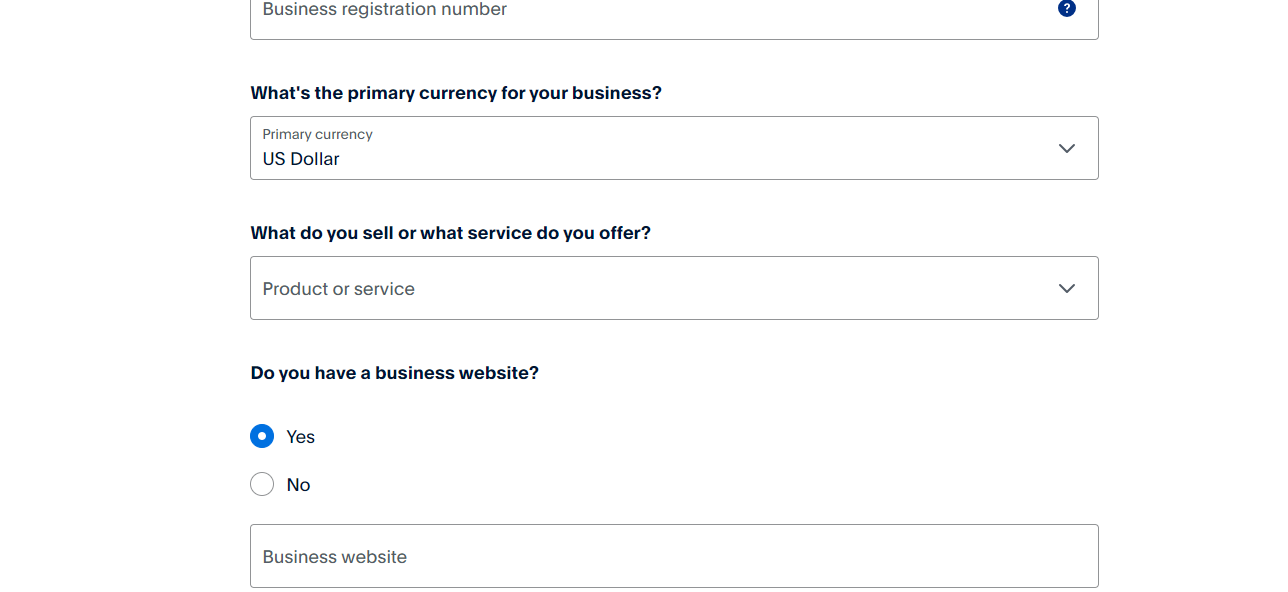

- Fill up your information. Note that, you may be required to add some business details as well (business registration number, business type, and business address).

- If you don’t have a business, you can just skip the steps and go ahead to confirm your phone number and email address.

- Once all these are completed, you’ll be able to add your virtual card or prepaid card and bank account. However, you can only add a U.S bank account (you can get a U.S account from TransferWise or Payoneer).

- Follow the steps above to confirm your card and bank account.

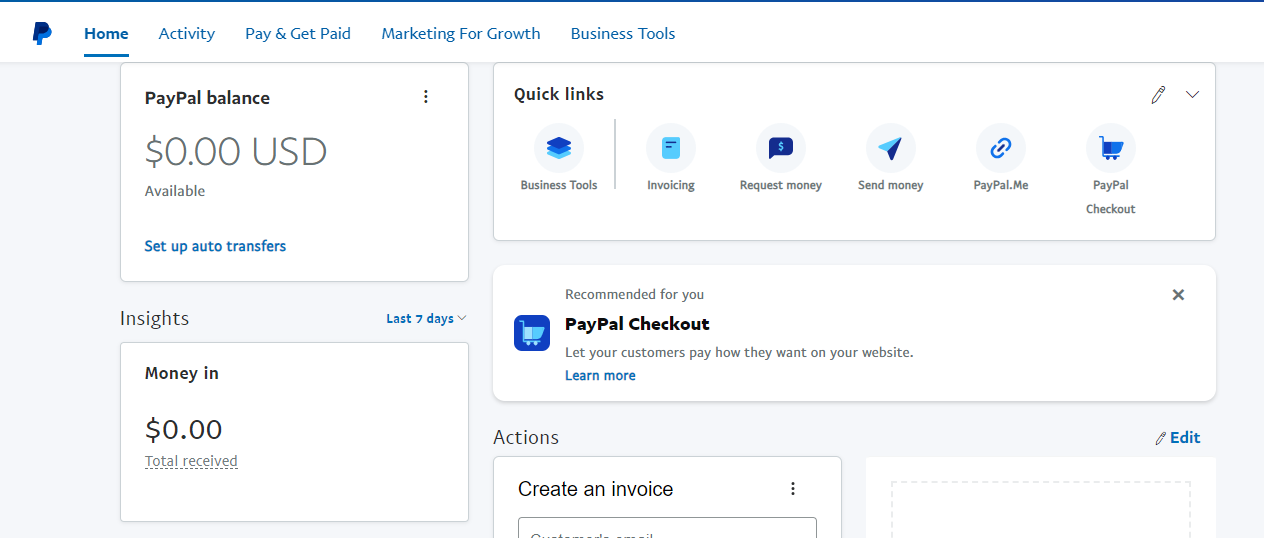

- Fund your account with your card or by receiving payments.

- Explore the various PayPal features.

- Start enjoying your account.

How to Withdraw From PayPal

Now that you have your own PayPal account, you can withdraw money from your account seamlessly. Note that you can only withdraw from the Lesotho (/ls/) PayPal account.

Here’s how to withdraw money from your PayPal account:

- Make sure your prepaid card or U.S bank account is linked to your PayPal account and confirmed.

- Once there is funds in your account, make sure there are no limitations to withdraw the money.

- Click Transfer Money below your PayPal balance.

- Click in minutes or in 1-3 days.

- Follow the instructions.

- If you selected Instant Transfer, you should see the money in your bank account in minutes, but this timeframe may vary depending on the bank. If you don’t see the money in your bank account after 30 minutes, contact your bank for more information.

- The Standard transfer to your bank typically completes in 1 business day, but depending on your bank’s clearing process, it may take 3-5 business days.

How to Receive Payment From PayPal in Nigeria

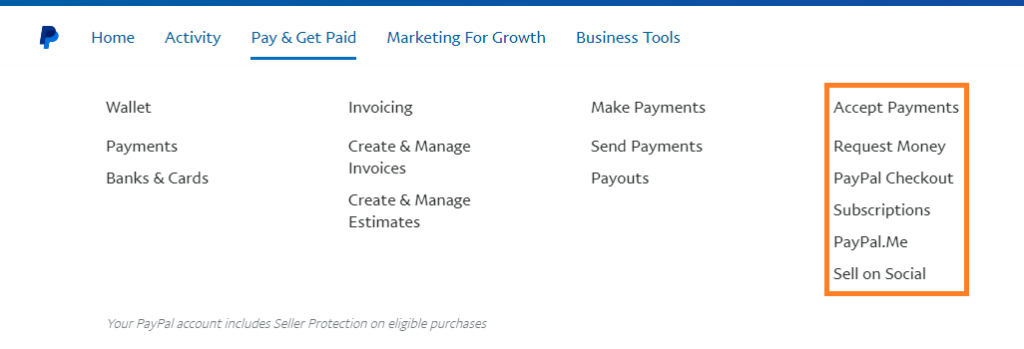

Again, you can only receive payment from PayPal in Nigeria if you use a different country code to open your account. Since you can only open a business account, you can receive payments from PayPal in Nigeria several ways.

Some of these ways are – sharing your email address, requesting payment from your dashboard, using your paypal.me link, creating an invoice, or adding PayPal checkout to a website.

Here’s how to receive payments from PayPal in Nigeria:

- Log in to your PayPal dashboard.

- Navigate to the Pay & Get Paid tab.

- Select the way you want to receive payments.

- Receive your payment.

Frequently Asked Questions About How to Use PayPal in Nigeria

Let’s answer a few questions about how to use PayPal in Nigeria!

Yes, PayPal works in Nigeria now. However, there are a few limitations and restrictions on the Nigerian PayPal account.

No, Opay or any other Nigerian bank account cannot receive money from PayPal. You can only link your prepaid card or virtual USD card to your PayPal account.

Yes, you can receive money on PayPal without linking a bank account. However, it is important you add and confirm your debit or credit card.