Imagine trying to buy a book on Amazon with your credit card, and you’re immediately greeted by an error message saying, “Your card has been declined.” Very annoying, right? I totally understand how you feel; I’ve had a similar experience, too. To avoid going through that phase again, I decided to find out the top 15 virtual dollar card operators in Africa.

With these operators, you can seamlessly make payments for all your online transactions, whether it’s for e-commerce, subscription services, or even international travel bookings. Find the top 15 virtual USD card operators you can use in Africa below.

Disclaimer: All the providers listed below are just personal recommendations. Do your research to see if they meet your needs before committing to them.

What Is A Virtual Dollar Card?

A virtual dollar card is similar to a physical debit/credit card, but it is only available online. Just like your physical card, you can put money in your virtual card to make online purchases.

The Top 15 Virtual Card Operators In Africa

Below are the top virtual card operators you can use in Africa:

1. Chipper Cash Virtual Dollar Card Operator

Chipper Cash is a pan-African Fintech company founded by Ham Serunjogi and Maijid Moujaled in 2018. They both decided to build the Chipper Cash app after experiencing frustration trying to make payments to people in some African countries. Currently, Chipper Cash has an app, and it has over 5 million downloads on the Google Play Store.

What Does Chipper Cash Do?

Chipper Cash allows users to send and receive money in the US, UK, and some other African countries, including Nigeria, Uganda, South Africa, Rwanda, and Kenya. Furthermore, it has a reloadable virtual USD card that allows users to make payments for shopping or subscriptions on international platforms.

Furthermore, to claim your Chipper virtual dollar card, you’ll need to have at least 3,000 naira in your wallet if you’re a Nigerian or 42.63 rand for South Africans. For other African countries, you’ll have to convert the amount to your country’s currency to get an idea of how much you’ll need.

However, the amount needed to get a Chipper Virtual USD card varies depending on your country. If you’re in the US, you can get your card for free. Additionally, you can find out Chipper’s cash card spending, withdrawal, and funding here.

Rating: ⭐⭐⭐⭐

2. Grey

Grey is a digital banking platform that allows Africans to open USD, GBP, and EUR accounts for free, enabling them to receive or make payments in over 80 countries globally. This virtual dollar card operator was created by two Nigerians, Idoreyin Obong and Femi Aghedo in order to make it easy for African freelancers and remote workers to receive payment without worrying about exchange rates or transfer fees.

As a remote worker who has used Grey, I’d like to say that the company has achieved its goal. Furthermore, individuals residing in African countries like Nigeria, Kenya, Uganda, and Tanzania can make use of Grey. Additionally, Grey virtual USD card operator has recorded over 500k downloads on the Google Play Store.

Grey Virtual USD Card

Grey provides a virtual USD Mastercard that allows users to make international transactions and payments with any platform that supports USD. You can create your card by visiting their website or directly from their app.

It’s important that you have some money in your dollar wallet to create your virtual card. You’ll need $5 to create and fund your card, i.e., $4 for creating your card and $1 to fund it.

Rating: ⭐⭐⭐

3. Cardify Africa

Cardify Africa is a virtual dollar card operator founded by Tunde Buremo. It is an online platform that helps people manage their digital wallets. Furthermore, Cardify aims to make spending across various fiat and digital currency wallets effortless. With Cardify Africa, you can use cryptocurrency to pay your airtime, mobile data, electricity, and other types of bills.

This digital platform is mostly available to Nigerians. However, the platform offers a virtual dollar card that Africans can use.

Cardify Africa Virtual USD Card

Individuals can use the Cardify Africa virtual USD card to make transactions and pay bills in foreign currencies. The virtual card also allows users to fund their wallets with stablecoins like USDT or BUSD to pay for subscriptions or make purchases on Amazon, Jumia, Aliexpress, and so on.

Furthermore, Cardify offers various dollar card options. You can create a dollar Mastercard, Visa card, or Vervecard. To get any of these cards, you’ll need to fund your dollar wallet with a minimum of $5. This is because you’ll need a $2 fee for card creation.

Rating: ⭐⭐⭐

4. Eversend

Eversend is a virtual dollar card operator that allows Africans to send, receive, and exchange money in various countries, including Nigeria, Uganda, Ghana, Kenya, Rwanda, South Africa, the United Kingdom, and Europe.

This platform was born out of frustration after Stone Atwine couldn’t send funds to his grandma from abroad. Stone prefers to call Eversend a neobank. A neobank is an online banking platform that allows users to check accounts and access credit cards, as well as provides them with tools to help improve their financial health. Furthermore, Eversend can help users convert between UGX, KES, and USD.

Eversend Virtual Dollar Card

Eversend has a virtual dollar card, which you can access on its mobile app. You can use the card to pay for goods and services on international platforms that accept Mastercard. Additionally, Eversend offers users the chance to save up to 13% in foreign exchange fees when topping up their card.

To create an Eversend virtual dollar card, you’ll need to fund your wallet using mobile money, a bank, or credit/debit cards. Since this is your first time creating a dollar card with them, the platform will deduct $1 from your wallet. You’ll also have to pay a monthly maintenance fee of $1.

Rating: ⭐⭐⭐⭐

5. Wirepay Virtual Card Operator

Wirepay is an online banking platform founded in 2020 by Miracle Anyanwu and Obinna Chukwujioke. It allows users to save money in foreign currencies and receive, hold, and send money to loved ones within Africa using traditional fiat currency, USD.

Additionally, you can make transactions using Ghanian Cedi (GHS), Kenyan Shillings(KES), and Cameroon Francs(XAF). Furthermore, you can only access Wirepay via its mobile app, which has over 50k downloads on the Google Play Store.

Wirepay Virtual Dollar Card

Wirepay offers Visa and Mastercard cards to its users and allows the creation of more than one virtual dollar card across the two card schemes. With a Wirepay virtual card, you can pay for goods and services online.

However, you can’t use the card on money transfer platforms like PayPal, WorldRemit, and so on. You can’t also make use of the card on betting sites, adult content sites, and crypto-trading sites.

Furthermore, to create a virtual dollar card on Wirepay, you’ll need to fund your dollar wallet. The platform will deduct a one-time fee of $2 to create your card. Additionally, a transaction fee of 0.5%, capped at $5, will be deducted for each card funding transaction.

Rating: ⭐⭐⭐⭐

6. Geegpay

This is a virtual operator owned by Victor Alade. It was created to help Africans easily receive payments from clients abroad and send money globally. Aside from Grey, Geegpay has received a lot of applause from freelancers in Nigeria because of its transparency and conversion rates.

Furthermore, Geegpay allows users to open virtual USD, GBP, and EUR accounts effortlessly to receive payment from clients or loved ones. You can also easily convert your USD, GBP, and EUR to your local currency.

If you are a remote worker, you can link your Geegpay USD account to platforms like Deel, Payoneer, and Remote.com to convert, receive, and convert payments.

Geegpay Virtual Dollar Card

If you’d like to make use of Geegpay’s virtual dollar card, you’ll need to visit their website. To create your virtual dollar card, you don’t need to convert the money in your wallet to USD. All you need to do is create a new card.

However, to ensure your card creation is successful, you’ll be charged a one-time fee of $3. Additionally, you’ll be required to deposit at least $2 to activate your account and future transactions.

Rating: ⭐⭐⭐⭐

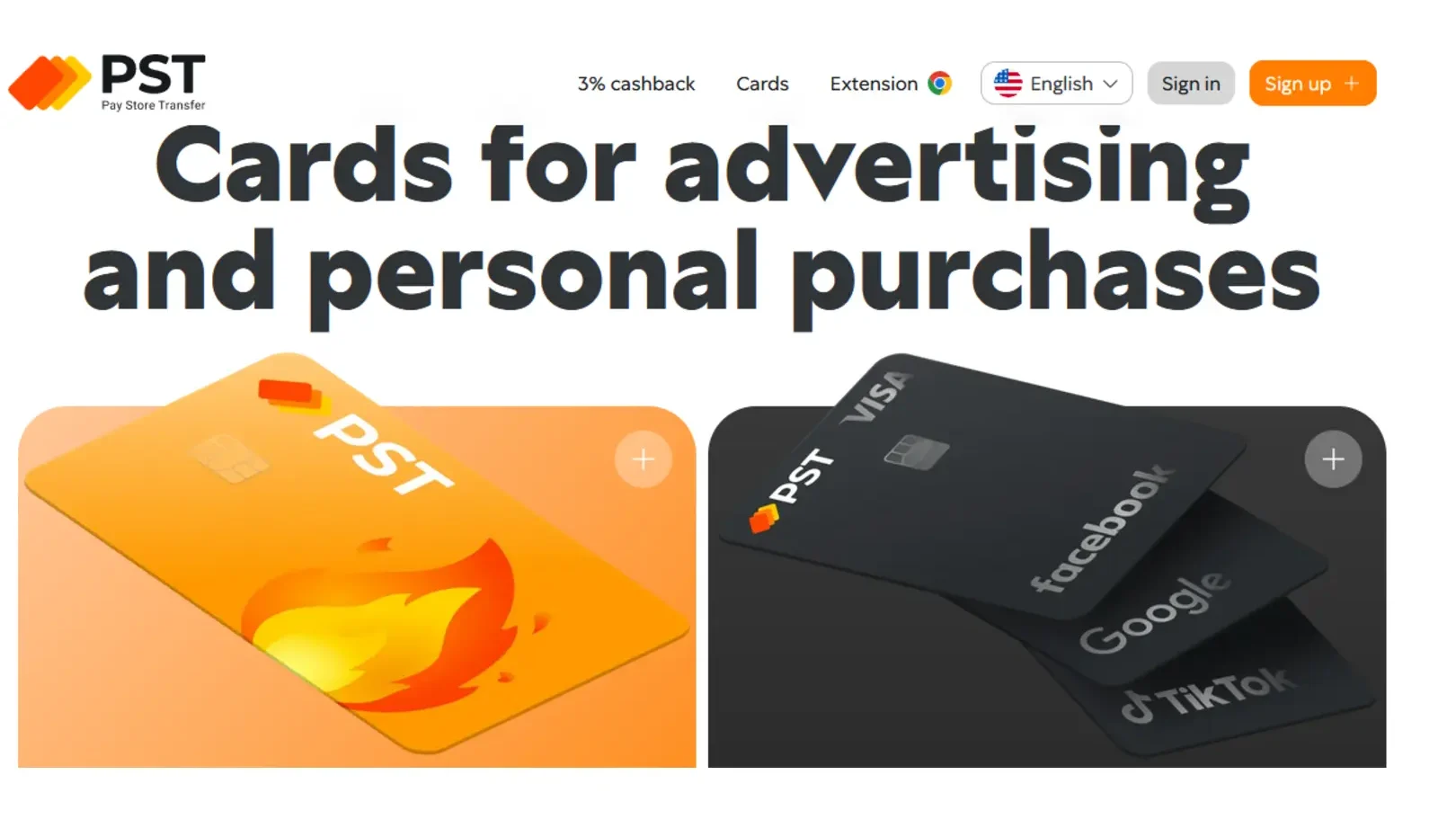

7. PST Virtual Card Operator

PST is a web-based virtual card operator that allows the creation of virtual dollar cards for international payment purposes. This service has a virtual card called PST private that offers a 3% cashback when used to pay for Facebook, Google, and TikTok ads.

Additionally, PST allows you to own a USDT, BTC, USD, or EUR account. One awesome thing about PST is that you can create a virtual dollar card for any service you want to pay for. This means you can have separate cards for advertisements like Facebook ads and so on, as well as a card to make purchases online.

However, you’ll have to deposit a certain top-up fee for each card you wish to create. The starting price for the top-up fee is $2. To create a virtual dollar card with PST, you’ll need to visit their website and sign up using your Google account or email address.

Once you’ve signed up, you’ll need to fund your USDT wallet, as it will be needed to create your card. Additionally, some of these cards have a monthly card maintenance fee, which will be deducted from your account. The maintenance fee for an advertisement virtual card is $10.

Rating: ⭐⭐⭐⭐

8. Bitnob Virtual Card Operator

Bitnob is a virtual card operator that allows users to sell and buy cryptocurrency with ease. The platform can also be used to send and receive money across African countries, including Ghana, Togo, Nigeria, Uganda, Kenya, Rwanda, Benin Republic, Senegal, and Ivory Coast.

However, for now, only Nigerian and Kenyan users can fund their Bitnob accounts using their local currency. Furthermore, Bitnob was founded by Bernard Parah, Adeolu Akinyemi, and Usman Majeed in 2019 and has offices in Nigeria, Ghana, and Kenya. You can download Bitnob from the Google Play Store and App Store.

Bitnob Virtual Dollar Card

This virtual card operator only provides users with a Visa card that can be used to shop and make payments on online platforms like Shein, Amazon, and so on. To create a Bitnob virtual card, you’ll need at least $1 in your USD wallet and $1 to top up your virtual dollar card with up to $100.

If you wish to top up your account with more than $100, 1% of the amount will be charged. One outstanding thing about Bitnob is that no maintenance fee is required. Furthermore, for your international transaction, a 2.5% cross-border fee, along with an extra $0.5 charge per transaction, is usually demanded.

Rating: ⭐⭐⭐

9. Bitsika

Bitsika is a virtual card operator owned by Atsu Davoh, a self-proclaimed product guy in Africa. The provider was launched in 2018 as a USSD product that allowed people to buy and sell Bitcoin.

This Bitsika allows p2p trading for users in Nigeria, Ghana, and Cameroon. This means that users from these countries can exchange their local currencies for cryptocurrencies. Additionally, users can trade cash and cryptocurrencies with zero trading fees.

Over the years, the founder’s vision grew, and he aims to connect Africa financially. Now, Bitsika allows users to send money to people in various African countries. These countries include:

- Nigeria

- Ghana

- Uganda

- Kenya

- Cameron

- Togo

- Benin

- Burkina Faso

- Ivory Coast

- Senegal

Bitsika Virtual Dollar Card

Bitsika offers two virtual card options, standard and premium Visa cards, to users. Users can use this virtual card to make online transactions on various platforms that accept Visa cards. However, an 8% fee will be required for transactions made with the card.

Rating: ⭐⭐⭐

10. Changera

This is a virtual card operator that allows its users to request and make payments across the globe. With this digital app, remote workers and digital nomads don’t have to worry about not getting paid by their clients. Furthermore, Changera has three pricing plans users can choose from.

These plans are free, freelancer, and premium. The free plan gives users access to:

- A max of 3 multicurrency wallets

- Perform currency conversions and make payments with the three currencies to over 20 countries worldwide

- Virtual or physical cards with spending limits of up to $5,000 per month

- 3 crypto wallets on Changera. Receive crypto deposit and convert to fiat

- Purchase or gift airtime and data across the world

- Book flights to anywhere in the world, and so on

Those who subscribe to the freelancer plan have access to:

- GBP and EUR virtual accounts for non-residents or VISA holders to receive foreign deposits

- Make ACH/ SEPA / SWIFT and CRYPTO transfers

- up to 7 multicurrency wallets

- Perform currency conversions and make payments with the seven currencies to over 70 countries worldwide

- Access to our virtual or physical cards with spending limits of up to $50,000 per month, and so on

This plan costs $50 per year.

Lastly, the premium plan costs $100 per year and users have access to:

- GBP and EUR virtual accounts for non-residents or VISA holders to receive foreign deposits

- Make ACH/ SEPA / SWIFT and CRYPTO transfers

- Over 15 multicurrency wallets

- Perform currency conversions and make payments with 15+ currencies to over 150 countries worldwide

- Access to our virtual or physical cards with spending limits of up to $100,000 per month, and so on

Changera Virtual Dollar Card

Before you can get a dollar card from Changera, you’ll need to decide on the plan you’d like to subscribe to. Once that’s done, you’ll need to fund your dollar wallet with at least $3.

This is because you’ll have to pay a card creation fee of $2. Additionally, Changera charges $1 for monthly card maintenance.

Rating: ⭐⭐

11. Moniebee Virtual Card Operator

Moniebee is a trade name for shilling technology solutions. This platform makes it easy to make transfers and pay bills. Moniebee is privately owned by a Nigerian. Furthermore, this virtual card operator is new in the Fintech space.

Moniebee Virtual Dollar Card

Moniebee offers two virtual dollar cards: a Mastercard and a Visa card. To have either of these cards, you’ll need to pay a small fee of $2. Additionally, Moniebee doesn’t charge a monthly card maintenance fee. The only African countries that can use Moniebee virtual dollar cards are Nigeria, Ghana, and Kenya.

12. Payday

Payday is a financial service provider that allows users to request immediate payments, track their inflow and outflow of cash, and have control of their financial transactions.

This service provider offers users the opportunity to have EUR, USD, and GBP accounts where they can manage their funds globally. Payday was acquired by Bitmama, the Nigerian cryptocurrency company that owns Changera.

One downside of Payday is that you can’t withdraw the funds you put in your account. Instead, you have to spend it all on bills, shopping, or subscriptions.

Payday Virtual Dollar Card

Payday has a virtual dollar card feature that allows users to make purchases on online platforms seamlessly and create Visa and Mastercard cards.

Furthermore, you’ll need to pay at least $5 to create a Mastercard or Visa card. Additionally, for transactions below $100, you’ll have to pay a $1 fee, and for transactions above $100, you’ll have to pay a $2 fee.

Rating: ⭐

13. Klasha

Klasha is a technology company that allows Africans to make local and international payments online. Shopping and subscriptions are easy with this operator.

Additionally, Klasha allows e-commerce platforms, websites, and consumers to pay international online merchants in African currencies while the merchants receive the payment in dollars, euros, or pounds.

This app is available to users in Nigeria, Uganda, South Africa, Kenya, and Zambia.

Klasha Virtual Card

Klasha offers its users two virtual dollar card features: the pink and black cards. For the pink card, you’ll have to pay a one-time creation fee of $2.5, a funding charge of 0.5%, and a one -time creation fee of $3.5 for the black card. Additionally, each time you fund your card, you’ll have to pay a funding charge of $1.5.

Rating: ⭐⭐⭐

14. Accrue

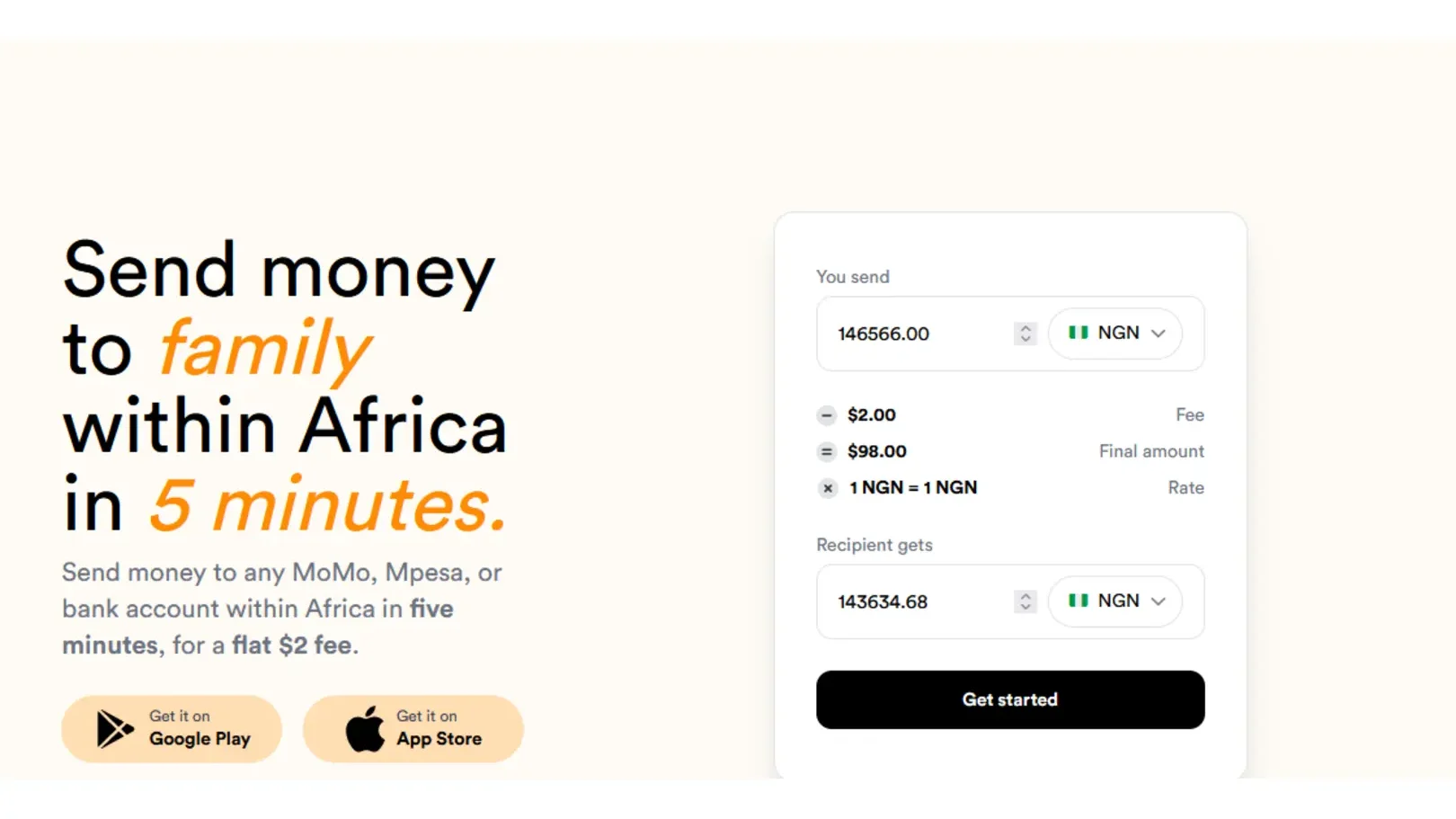

Accrue is a cross-border payment platform that allows Africans to send and receive money from any bank account within Africa. Additionally, the platform allows users to save in dollars and earn up to 5% annual interest. Users can also auto-invest in top-performing stocks or cryptocurrencies with little risk.

Furthermore, Accrue is only available in

- Ghana

- Nigeria

- Kenya

- South Africa

- Cameroon

- Uganda

- Zambia

- Tanzania

- Mali

Accrue Virtual Card

Accrue offers a Mastercard and a Visa card for users to make payments on international platforms. The card’s creation fee is $3, there is a $2 maintenance fee, and there is a 1% transaction fee (minimum $1 and maximum $5). Additionally, anytime you top-up your card, you’ll need to pay a flat fee of $1.

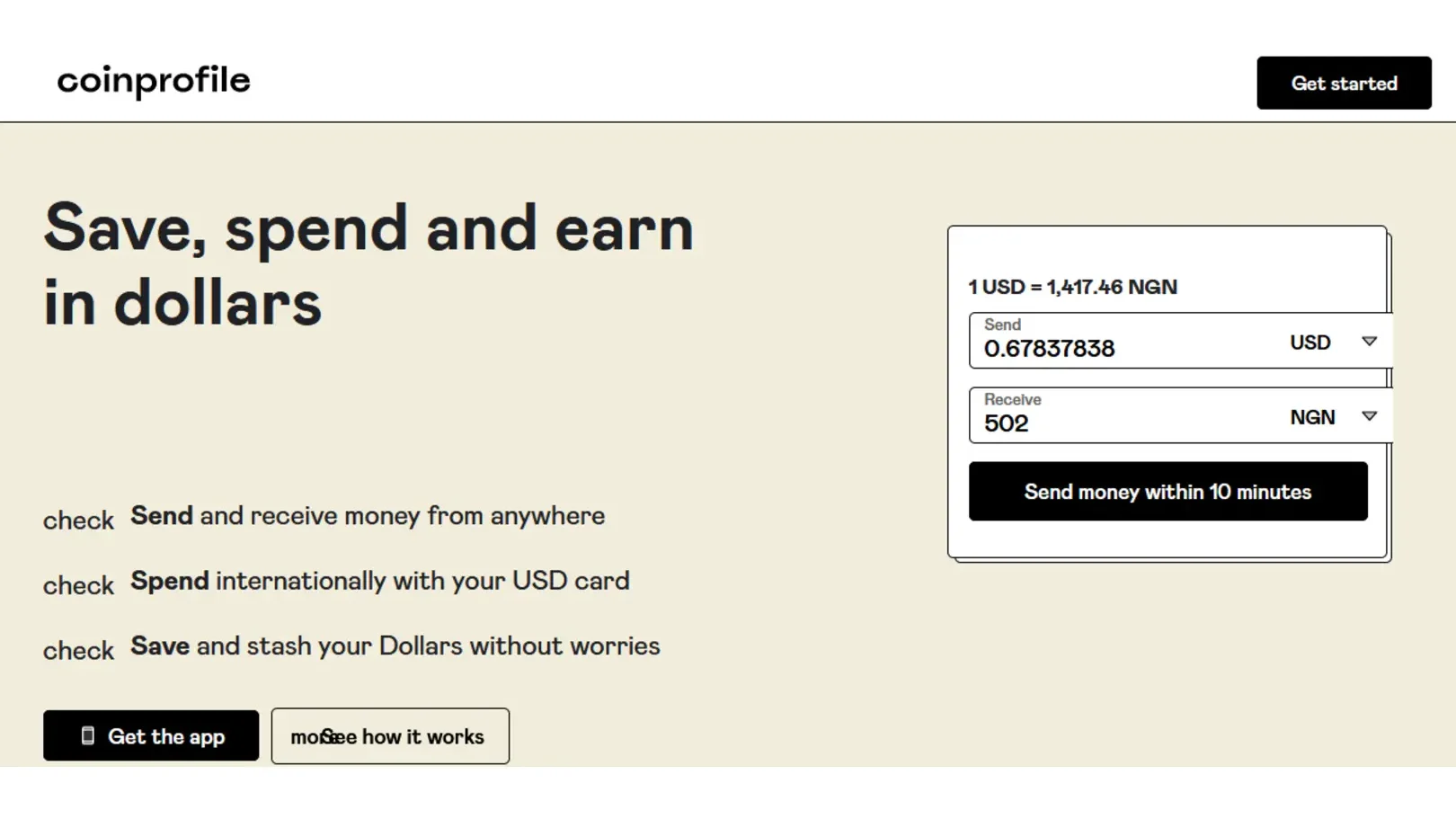

15. Coinprofile

Coinprofile is a fintech company that allows Africans to earn, spend, and save in dollars. The platform also allows users to send crypto directly into a Nigerian account. One awesome thing about this provider is that it offers a virtual dollar card that you can use to buy goods and services internationally.

The amount needed to create a dollar card with Coinprofile is $1, the monthly maintenance fee is $3, and the funding fee required is $1.5.

Final Thoughts on Top 15 Virtual Dollar Card Operators in Africa

With various virtual dollar card operators available, making transactions has become easy. You can now subscribe to your favorite platforms and purchase goods from them with ease.

Furthermore, before you decide on the virtual card operator to use, you must do proper research to find out their fees. Lastly, endeavor to read reviews from other users before making your decision.

You can check out some popular questions asked about virtual dollar card operators here.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist