Grey is a virtual dollar card operator that has made it easy to save and also receive money from clients and loved ones internationally. The Fintech company has also made it easy to buy goods and services online without stress through its virtual dollar card.

Now, you can access all the international platforms with ease. This article has all the answers to your questions on Grey’s virtual dollar card. So, keep reading!

What Is Grey Virtual USD Card?

Grey.co owns the Grey virtual USD card. The company created it to help Africans buy goods and services easily. Furthermore, Grey offers a Mastercard virtual dollar card that can be accessed on the Grey mobile app. This card, offered by Grey, can only be used for three years.

How To Create a Grey Dollar Card

Before you create a Grey dollar card, you’ll have to download the Grey app from the Google Play Store or App Store. Once you’ve done this, you can create your Grey USD Card.

You can follow the steps below to create a Grey USD dollar card, which is easy.

- Open your Grey app

- Fund your dollar account with at least $5

- At the bottom of your screen, click on cards

- Click on Create my virtual card

- Click on confirm to pay a one-time fee of $5.00

- Then, click on Create My Virtual card

Note: Grey doesn’t charge card maintenance or funding fees.

How To Fund Your Grey USD Dollar Card

After creating your Grey virtual dollar card, you’ll need to fund it in order to make transactions online. To fund your Grey virtual dollar card, follow the steps below:

- Ensure that you have funds in your account. If you don’t, you can send funds to your Naira, GBP, EUR, or account through a bank transfer

- Click on Virtual cards

- Click on the Add Money tab

- Select the drop-down menu with the account to be debited option

- Choose the account in which you have funds in

- Enter the amount you want to be debited

- Click on continue

- Proceed to refresh your dashboard

- Your card is successfully funded

Note: You’ll have to pay a conversion fee when funding your virtual dollar card from any of your accounts that aren’t in USD. The minimum amount of money you can fund your Grey dollar virtual card with is $2, and the maximum amount is $2500 per transaction.

Additionally, you can withdraw your funds from your Grey virtual dollar card. All you need to do is contact support@grey.co and state the amount you wish to withdraw.

How To Shop Online With Your Grey Virtual USD Card

If you’re looking for ways to shop online with your Grey dollar card, you must first have an idea of the acceptable platforms where you can use the dollar card.

Here are some platforms you can use your card on.

- Airpeace, Kenyan, or British Airways

- Spotify, Apple Music, Netflix, Starlink, Amazon, etc

- AltSchool, Udemy, Udacity, etc

- Shein, Amazon, Zara, Shopify, etc

Now that you have an idea, let’s go ahead and find out how to shop from one of these platforms.

How To Shop On Amazon With a Grey Virtual Dollar Card

- Select the checkout card tab

- Add your card details

- Fill in your card details on the form(get this information in the cards section of your dashboard)

- After filling in your details, add your card

- Go ahead and verify your payment option

- Cross-check your details and place your order

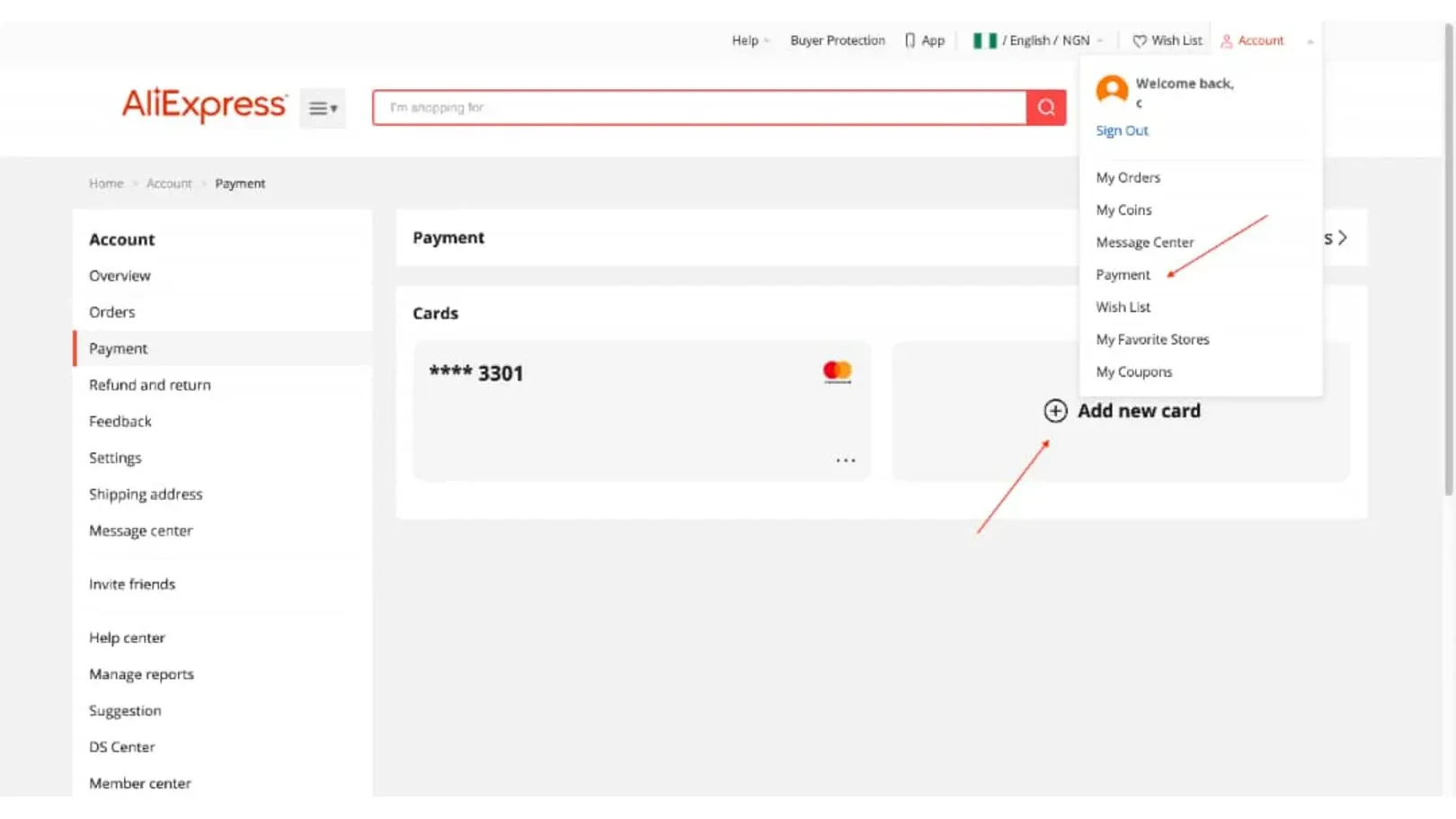

Can I Use Grey Virtual Dollar Card On Aliexpress?: How To Shop On AliExpress With Grey Virtual Dollar Card

- Ensure that there are funds in your Grey dollar card

- Log in to your AliExpress account

- Click on payment

- Select Add new card

- Ensure you enter your card details correctly

- Once you add your card, AliExpress will deduct $1 for verification purposes

Note: AliExpress will return the $1 it takes within 1-7 business days

How To View Your Transaction Limits On Grey Virtual USD Card

Here’s how you can check your transaction limit on your dollar card:

- Go to your Grey mobile app and log in

- At the bottom of your screen, you’ll see the more tab. Click on it

- Select transaction limits

- You can decide to either view withdrawal limits or deposit limits

Note: There’s no limit on the Grey dollar virtual cart, but you can spend up to $10,000.

How To Receive Payments From PayPal Using Grey Virtual USD Card

If you can make use of PayPal to send and receive funds internationally, then you can link it to either your UK, GBP, or EU Grey account. You can do that by following the steps below:

- Ensure to use the name on your PayPal account to open your Grey account

- Confirm your bank account on PayPal before withdrawing

Note: Any withdrawal you make from PayPal takes up to 1-3 working days before you can receive it.

What Transactions Can’t Be Done With The Grey Virtual USD Card?

The Grey virtual dollar card can’t be used for betting, P2P, or cryptocurrency. Additionally, if you try to make a transfer twice with your card and it fails, your card will be frozen. If your card gets reactivated, and you make the same transfer twice, and it fails due to insufficient funds, your card will be terminated.

Can I Increase My Transfer or Deposit Limit on Grey?

Currently, Grey doesn’t allow users to increase their deposit or spending limit on their account. All you can do is reset your account’s daily limit in order to split all transactions across several days. Luckily, Grey’s daily limit is higher than the usual limit you’d get on any domiciliary bank account.

Final Thoughts

From our detailed guide, we are sure you now have an idea of how the Grey dollar card works. With this card, you can purchase goods and services from popular online platforms with ease.

Furthermore, it’s important that your account is funded before you make transfers using your Grey virtual dollar card to prevent your card from being blocked. Lastly, for any issues you have with the platform, you can reach out to Grey.co on their social media handles, such as Instagram, X, and LinkedIn.

Frequently Asked Questions

1. How Long Does A Grey Virtual Card Last?

The card lasts for exactly three years. A one-time card creation fee is charged at $4 and an additional funding fee of $1.

2. What Are The Requirements To Create A Grey USD Virtual Card?

To create your Grey virtual dollar card, you will be required to have finished your KYC registration before making any transactions on Grey.

3. How do I Contact Grey Customer Service?

The fastest way to contact Grey customer service is through the in-chat on the mobile app or you can send an email support@grey.co.

4 Do I Need To Have A Virtual Account To Get A Card?

No, all you need to do is to top up in your local currency and switch to USD.

You Might Also Like: All You Need To Know About Chipper Virtual Dollar Card

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist