Over the past few years, we have seen an incredible increase in the Nigerian fintech space, and the Palmpay account is not an exception. The Palmpay app is a platform you can use to make transfers, pay several bills, make online payments, and even get an ATM card that you can use to withdraw from Nigerian ATMs.

Palmpay prides itself in the act of giving its users the ability to earn as they pay and in this blog post, we will look at how you can get started. You will learn how to download the app, set up your account, and begin your Palmpay ride.

What is Palmpay?

Palmpay is a mobile money operator in Nigeria that offers a convenient and easy way to send and receive money. The app is designed as an easy-to-use fintech platform that allows it to use an all-inclusive banking service. You can then Palmpay account to pay bills, shop online, and send money to friends and family either to their PalmPay account bank or other recognized banks in Nigeria.

You don’t have to panic about the security of your money because, besides the fact that Palmpay has been in operation since 2018, they are licensed by the Central Bank of Nigeria (CBN). Your deposits will be issued by Nigerian Deposit Insurance Corporation (NDIC). Palmpay is also a global company not just in Nigeria but in Ghana, Tanzania, and the United Kingdom.

Why Use the PalmPay Account?

Whether as an individual or a business owner, having a PalmPay account comes with a lot of benefits. One of them is its very reliable and fast network. The PalmPay platform, unlike other fintech platforms, boasts 99% successful transactions. You even get notified when you’re making a transfer to an account with server downtime or traffic.

Another thing you’ll enjoy using a PalmPay account is the numerous discounts and coupons. Unlike several other fintech platforms, the PalmPay Application offers numerous amazing and exciting discounts with every transfer or purchase you make. This also includes free transfers to other banks.

Getting on Board and Setting Up a Palmpay Account

To enjoy the several opportunities available on the PalmPay platform, you must create an account and the first step to that is downloading the App. You can get the application from the Google Play Store or the Apple Store, depending on which device you get. Once the application is installed on your phone, you can go ahead and sign up for a PalmPay account.

Signing Up

When you open the application on your device, you will be asked to input a valid phone number and if you have an invite code, you can use it. A one-time password will be sent to your phone number and you’ll use this to verify your account. Once you are verified, you have access to the platform’s services. This is just like the procedure with the Opay platform.

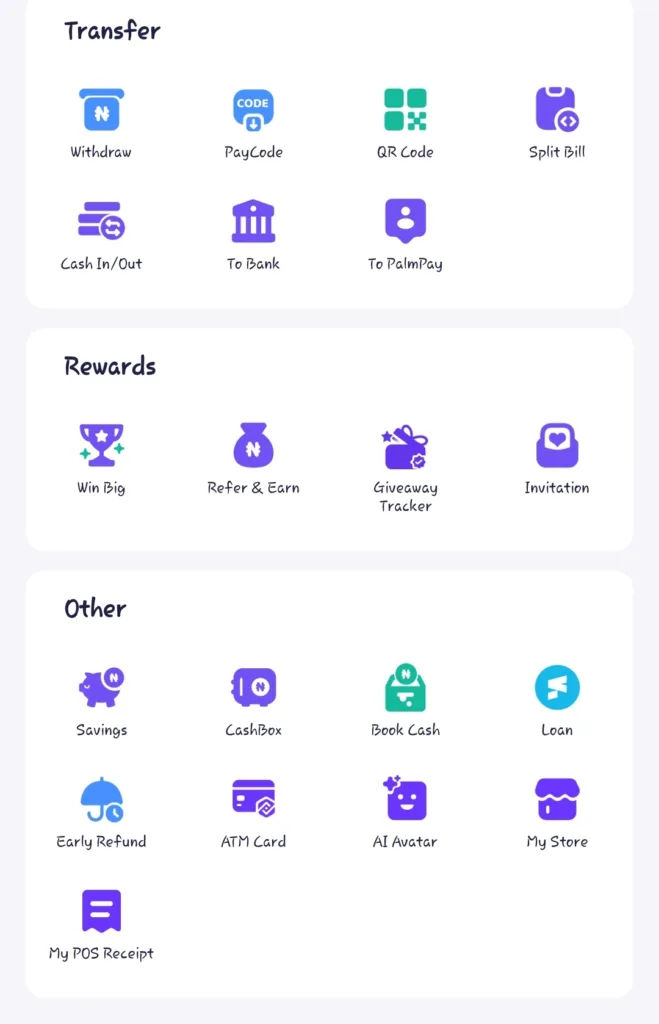

Exploring the Features of PalmPay

After you have set up your PalmPay account, the next thing is to add funds to your account so you can start enjoying all the benefits on the platform.

Funding your PalmPay Account

When you open the PalmPay app, you will see the “Add Funds” button next to your balance, click on it, and select from the several means available. On the PalmPay app, you can fund your account via cash transfer from another banking app and cash deposit through an agent.

You can also fund your account directly through an ATM card or another bank account. You will just have to link the card or bank to your PalmPay account and verify the first time. After that, you can easily add money to your account by just punching in the amount and input your password.

Paying Bills

On the PalmPay platform, you can pay several bills conveniently from your account balance. Besides airtime and data bundle, you can easily pay for electricity, TV services (like DStv, GOtv, etc.), pay for water, and other Government payments. You can explore the bill payments available on the PalmPay app to see the one that suits you.

You can also use your PalmPay account to pay for split bill payments between you and your friends.

Rewards and Loans

Aside from the discounts and coupons you receive on the PalmPay platform, you can borrow from them at a low rate. After using the app for transactions for a few months, you will be eligible to borrow Flexi which you can use to buy airtime. The more you repay on time, the higher the amount you can borrow will be. You can also get eligibility for Flexi cash that you can use for other transactions other than airtime.

PalmPay rewards come in different ways and means. One of them is the money you get when you refer a new user using your referral link or code. You can get as high as 10,000 NGN from referring new users. There is also the trailing cash, daily rewards, etc. PalmPay account is your all-in-one fintech platform.

Conclusion

The PalmPay account isn’t just for sending and receiving money but also for several rewards and incentives. You can make money while spending your money.

If you’re not using Palmpay already, start today and embrace the cashless flow. Download PalmPay, sign up, and bank in a way that fits you.

Other popular licensed mobile money in Nigeria include PagaTech, PocketApp, Parkway, Kegow, NowNow, KongaPay, FirstMonie, Fortis Mobile, etc.

Frequently Asked Questions on PalmPay

Where is the PalmPay office located?

The Nigerian head office of PalmPay is at No. 20, Opebi Road, Ikeja in Lagos. The Ghanaian head office is at 54, Senchi Street, Airport Residential Area, Accra.

They have 22 other offices in Nigeria. The office is in Abia, Abuja, Akwa, Anambra, Bayelsa, Benue, Cross River, Delta, Edo, Ekiti, Enugu, Imo, Kaduna, Kano, Kogi, Kwara, Ogun, Ondo, Osun, Oyo, Plateau, River, Sokoto and Yobe. You can click here to see the state’s locations.

Is the PalmPay account secured?

The PalmPay app has security measures like PIN and transaction encryption that protect users from fraud. You can also use your fingerprint to authorize payments which means no other person will be able to make transactions without your consent.

How can I contact PalmPay customer care?

You can reach PalmPay customer service via phone, email, in-app live chat, or even on social media. You can call them for general complaints at +234 2018886888 or send an email to support@palmpay.com.

Is PalmPay registered in Nigeria?

PalmPay is a CBN-licensed mobile money operator in Nigeria. It is owned by a Chinese-based company, Transsion Holdings and NetEase.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist