Are you looking for a mobile application to easily sign up for to make transactions fast and easy? Do you need to open a new bank for daily transactions but you want to avoid the long queue in banking halls? Opening an Opay account is the answer to all questions.

Opay is an online banking application with a license from the CBN as a mobile operator. In this blog, we’ll be looking at how Opay works, how to open an account, and many more.

What is Opay?

Opay is one of the best mobile money operators in Nigeria. It was launched in Nigeria in 2018 and ever since then, it has grown in the services it offers. With Opay, you don’t just make mobile payments but conduct several other financial activities. You can use their app for transactions, expenses, savings, loans, airtime data purchases, etc.

Opay has gained popularity over the years not just because of the number of services it offers but also its ease of use and competitive pricing and incentives. You can use Opay to bank on your mobile phone and somewhere in your blog, you’ll be learning how you can download, install, and create an account.

Setting Up Your Opay Account

The first step to setting up your Opay account is to download the app from your device application store, either on Google Play Store or Apple Store. Just search for Opay and click the install or get button. The Opay application will be installed on your smartphone and then the next thing is to sign up.

Requirements for signing up

To sign up, there are certain requirements you must have and the primary requirement is a valid Nigerian phone number. This is very important because it will be used to generate your account number.

You’ll also need to provide your Bank Verification Number (BVN) and you must ensure that the name you use in registering is the same as the name on your BVN. If you desire to upgrade your account, you will be asked to provide additional information like a valid ID and a utility bill.

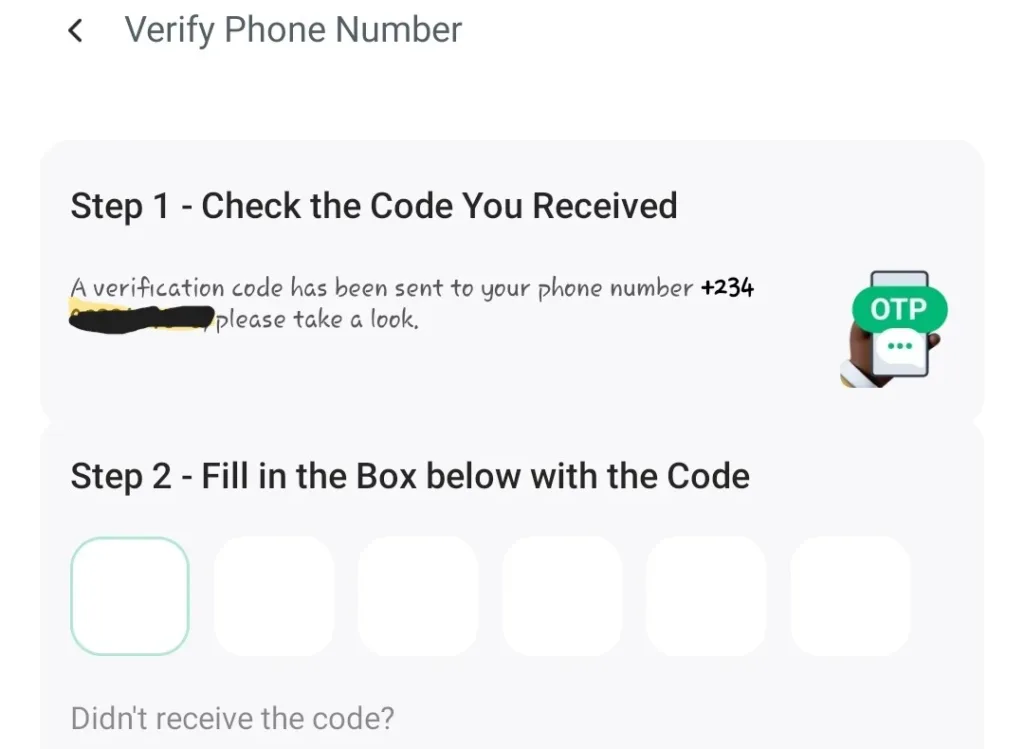

Verification Process

After you’ve correctly answered all the questions when creating an account, you will receive an SMS from Opay on the number you used in registering, which is why it must be valid. You enter the One Time Password (OTP) sent to you to activate your account and viola, your Opay account is ready to use.

Funding your Opay Account

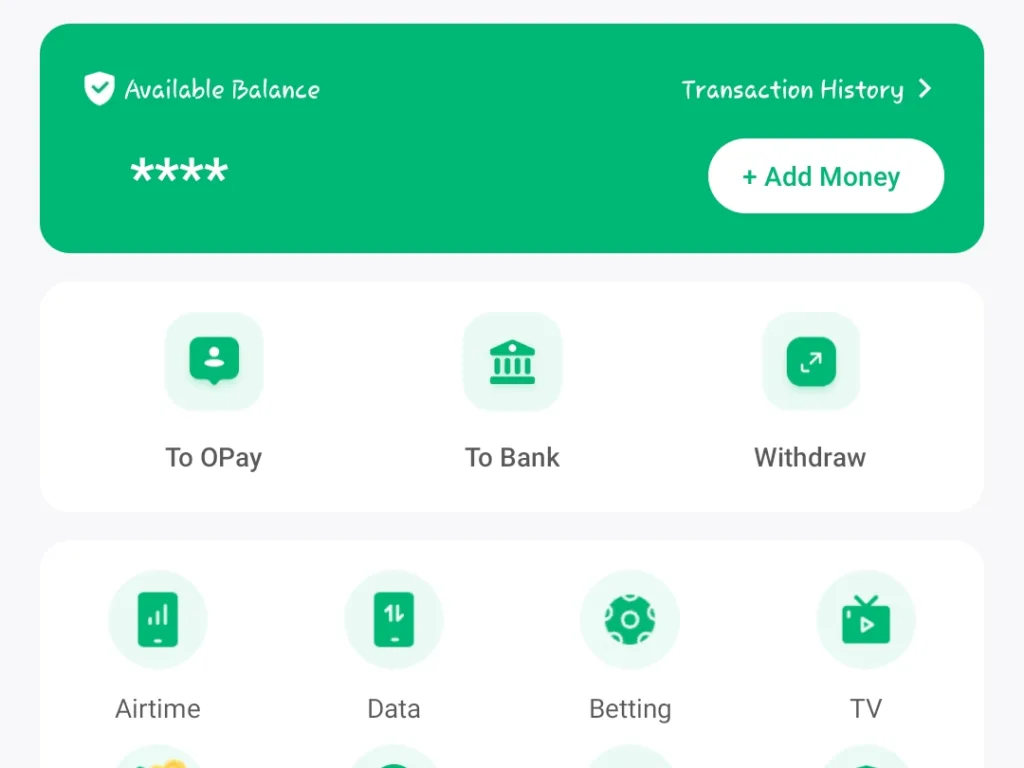

After you’ve successfully created your Opay account, the next thing is to fund your account. This funding, in a way, helps you to verify if your account is already functional and working normally. You don’t want to receive a payment that will “hang”. Unlike the conventional commercial bank’s way of banking, you can fund your Opay account in several ways.

You can fund your Opay account in three different ways, through an ATM card, bank app, or agent. When you want to fund through an ATM card, you will:

- Click on your balance on Opay and click “Add money”

- Then you select “add new payment option”

- Click on the card icon andyou will be directed to a page where you’ll fill in your card details.

- Once you do that and it’s approved, you can now add money by choosing an amount.

Another way is to add funds from your commercial bank app or USSD. Simply go to your banking app and navigate to where you make transfers. Search for Opay among the list of banks and use Input your account number for instant transfer.

You can also fund your account through an Opay agent. You’ll give the agent your Opay account number after which the amount you desire will be transferred to you. You must also know that you can also use some other mobile money operator’s agent to fund your account.

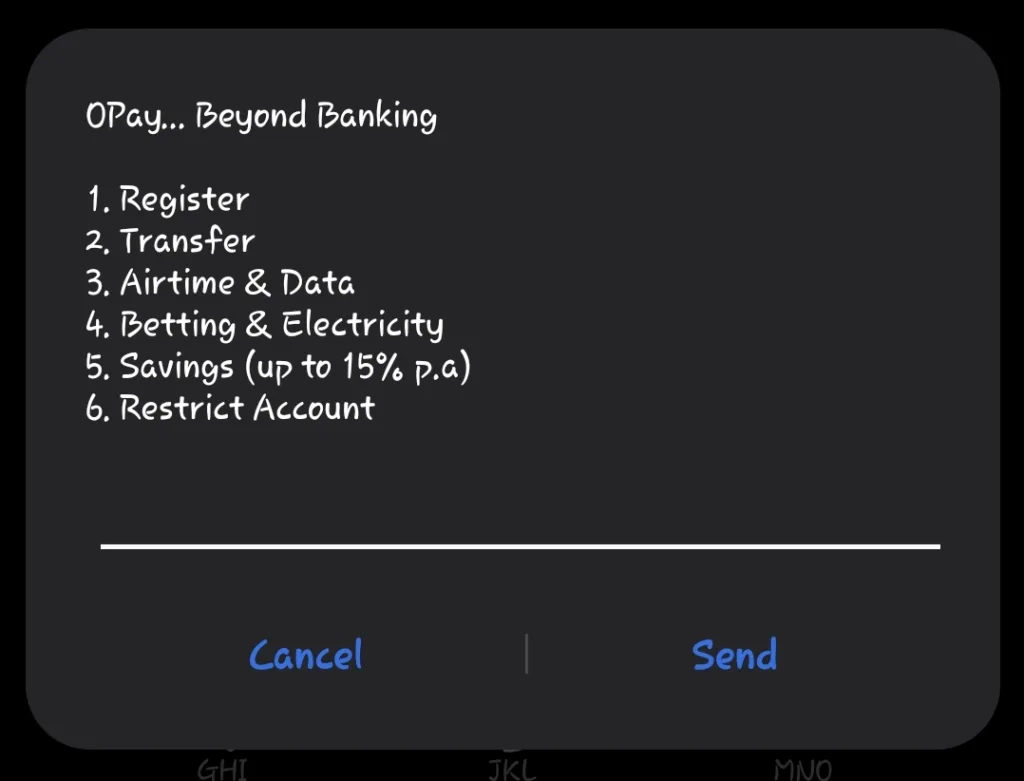

How to Use Opay USSD Code

Besides funding your account, the Opay USSD code can do loads of financial adventures. This ranges from transfers to balance checks and others. To use the USSD code to operate your Opay account, the code is *955#. You can dial this on your mobile phone, not necessarily a smartphone. What can you use Opay USSD code for, you can:

One of the benefits of using USSD is that you can use it to restrict your Opay account. It comes in handy when your phone is misplaced or stolen. You can use the USSD to restrict your account, thereby preventing fraudulent activity.

What are the Benefits of Opening an Opay Account?

Opay has over 20% of the customers in the Nigerian population which means there are a lot of benefits. First and foremost, the Opay account is easily accessible. You can easily access the account after verification and it is very simple to use.

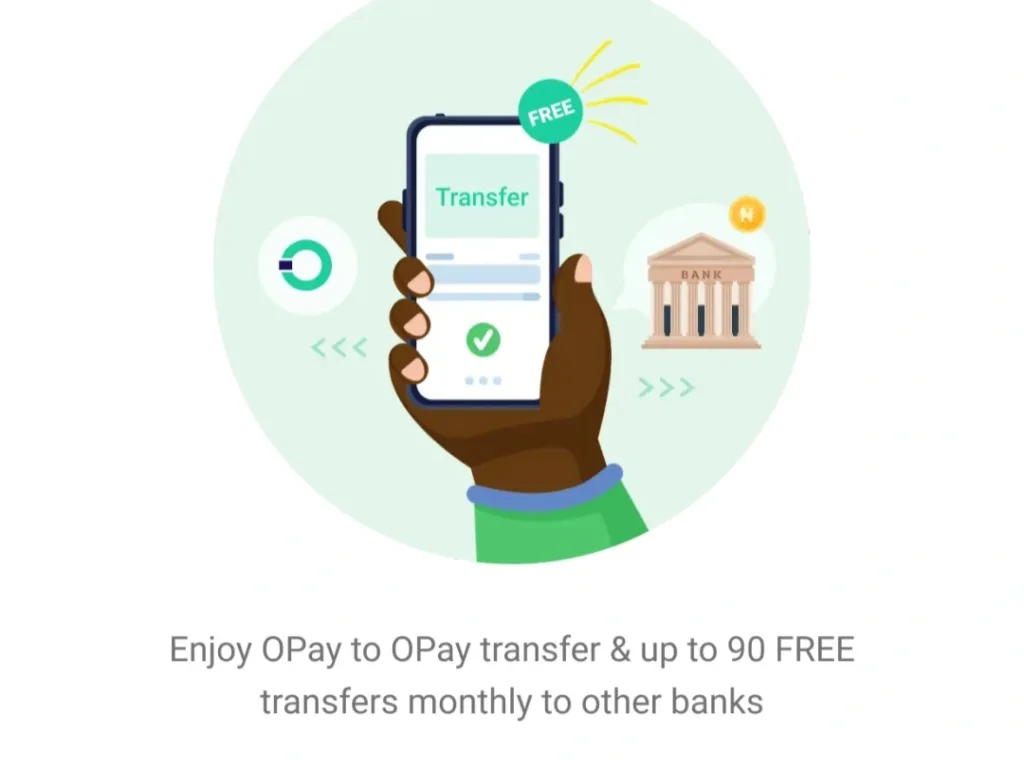

Another benefit is their low charges for their transactions. Unlike other commercial banks, you can use an Opay account to make three free transactions every day. They also have a track record of successful transfers in most of the transfers made on the platforms. Besides that, the transfers are also very fast, almost instantly.

On top of that, the app runs on a very secure system. The transactions on the application are secured through encryption and biometric authentication, making it hard for scammers to use.

Another juicy benefit of the Opay account is that it gives incentives to new users and referrals. This amount usually varies from as high as 1200 to 500 NGN. So, tell me, what’s there not to like in Opay?

What Are People Saying About Opay?

Below is what both Android and iPhone users are saying about the Opay app.

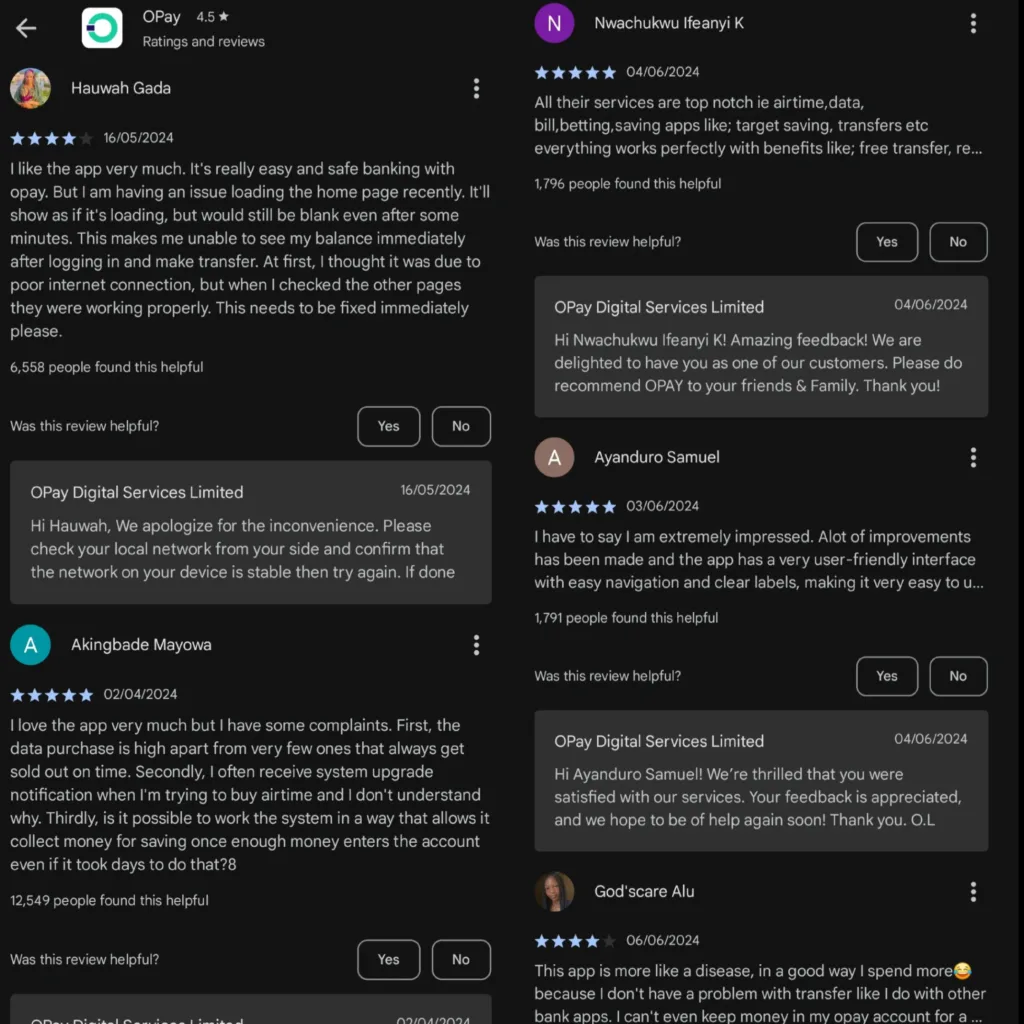

A cross-section of Play Store reviews:

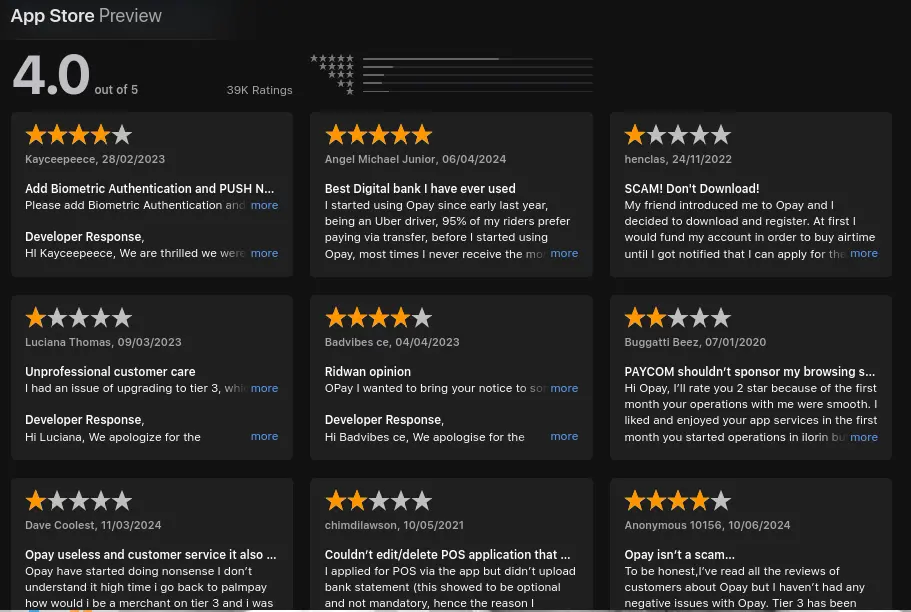

A cross-section of App Store reviews:

Bottom Line

Opay isn’t just a banking App but a complete institution. Just as their mantra, you can use your Opay account beyond banking, you can pay bills, and recharge for airtime and data.

Remember that it is very important that you NEVER share your OTP and PIN with any third party. If you don’t like using the Opay account, you can check other licensed mobile money operators in Nigeria like Palmpay, Paga, and Firstmonie. There are also other mobile apps like KongaPay, NowNow, PocketApp, Kegow, Parkway, and Fortis Mobile Money.

Frequently Asked Questions About Opay

How Do I Contact Opay Customer Service?

Opay makes available several means to reach their customer service to tackle the issues they often face. There’s the in-app bot that helps provide solutions to common issues. They also have customer service reps in-app that help provide personalized help to customers.

Another way you can reach their customer service is through their social media handle. Sometimes, they may not be able to respond because of the huge number of DMs they have, you can just tag them under a top post. You can thank me later.

Lastly, you can always call their customer care at +234 700 888 8328. You can also reach them on WhatsApp at +234 916 599 8936 or by email at customerservice@opay-inc.com.

Where is the Opay office located?

If you’re wondering, “Where are Opay offices located”, they have customer service centers in 15 out of the 36 states in Nigeria. They have offices in Abuja, Abeokuta, Ibadan, Jos, Kaduna, Kano, Osogbo, Benue, Akwa Ibom, Imo, Abia, Kogi, Port Harcourt, Edo and three offices in Lagos. You can check out the locations and their address here.

Is OPay a bank in Nigeria?

As mentioned earlier, the Opay app is a CBN-licensed mobile money operator in Nigeria. You can not compare them to other financial institutions like commercial banks, microfinance banks, etc.

Who owns OPay banking?

Opay belongs to a Chinese man named Yahui Zhou. He is the chairman and CEO of the popular web browser, Opera.