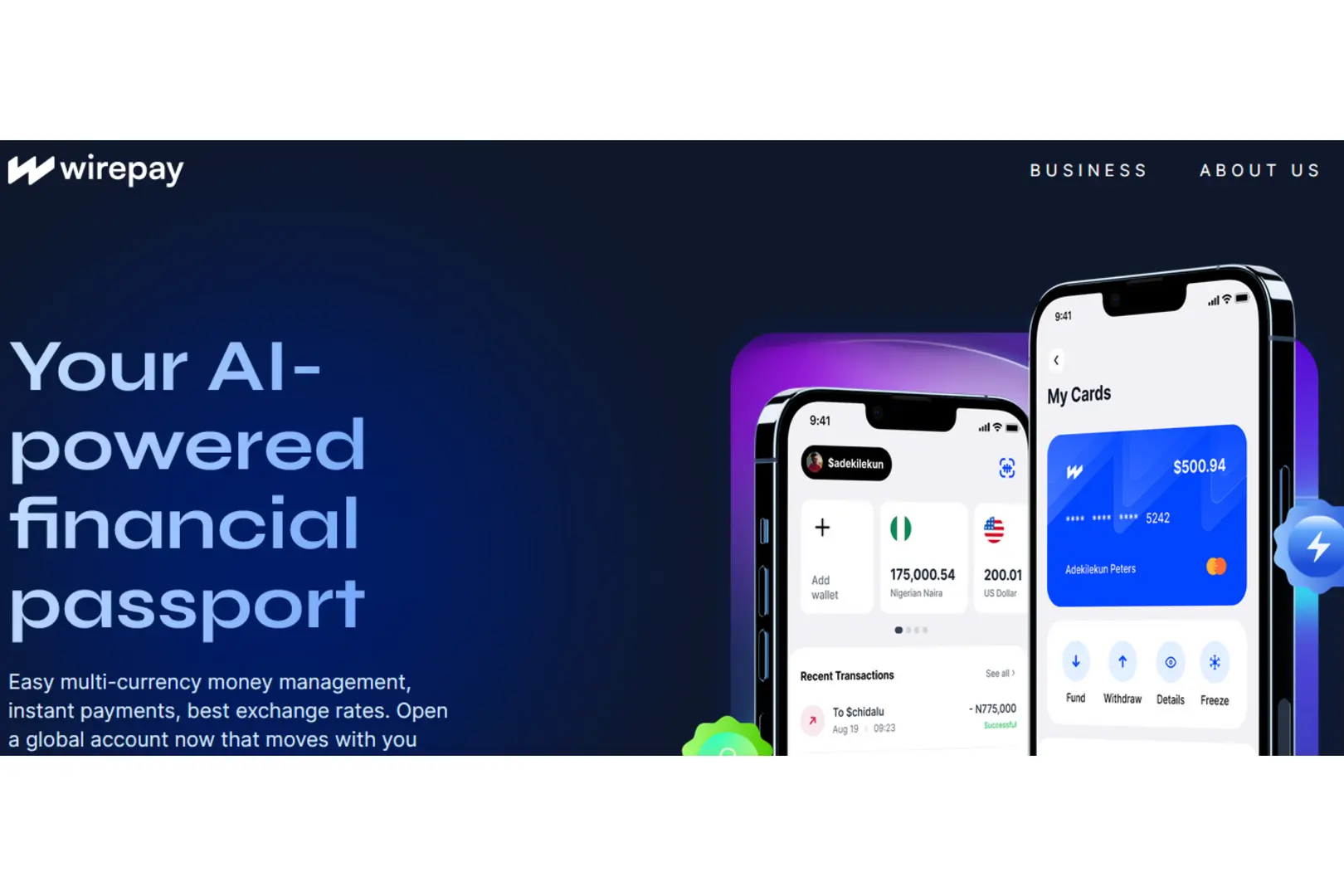

Are you looking for easy ways to send money and also make online transactions? Well, you can make use of a Wirepay virtual card. This card can be used by Africans and it is easy to create. However, to be able to access this card, you’ll need to have an account with the platform and you’ll have to pay an amount to claim the card. Once this is done, you can access your card and make use of it for online transactions. In this article, you’ll get to know more about the Wirepay virtual card, the platforms you can use the card on, and the various limits placed on the card. What is a Virtual Dollar Card? A virtual card is a digital card that is usually funded in US dollars to make transactions online. With the card, you can purchase goods and services on any platform with ease. A virtual dollar card has all the details that are available on a physical debit or credit card. What is Wirepay? Wirepay is a virtual dollar card operator that allows you to send and receive money within Africa using fiat. It also provides you with a virtual dollar card that you can use for making purchases on various platforms online. With Wirepay, you can buy airtime at a discount. How To Create a Wirepay Account Below are the steps you can use to create your Wirepay account. Now, you’ve successfully created an account with Wirepay. How To Fund Your Wirepay Wallet Before you can create a Wirepay virtual dollar card you’ll need to verify your account. For this process, you’ll be required to provide your phone number, ID card, and your BVN. Once your account is verified, you can follow the steps below to fund your account: Note: If you click on the bank transfer option, an account number will be generated for you to send your money to. How To Create a Wirepay Virtual Card Creating a Wirepay virtual dollar card is easy. All you’ll need is to have at least $2 in your wallet and you’re good to go. Just in case you don’t have $2 in your USD wallet, you can exchange your local currency. To do this, just click on exchange at the bottom end of your screen and input the amount you’d like to exchange. Once that is done, you can go ahead and create your Wirepay virtual dollar card. Furthermore, Wirepay allows users to create either a Mastercard or Visa card, and creating any of the cards costs the same amount. To create a Wirepay virtual card, follow the steps below: Now, your card is ready for use. My Thoughts On Wirepay My experience with Wirepay wasn’t so bad. I enjoyed using the platform, especially considering the fact that it has an intuitive user interface. However, I didn’t like the fact that I’ll have to get two OTPs before I can finally access my account. It was somewhat stressful for me. Another thing I didn’t like about using Wirepay was the fact that its customer service wasn’t available 24/7. I sent a query and I was told I’ll get a reply the next day which I didn’t like. However, they sent a reply to my Email 29 minutes later. The email will be sent to you from Malperad— one of the companies they are working with. User Review on Wirepay Virtual Card Aside from the reviews from the Google Play Store, other users made comments on Trustpilot. One of the users said, “These people are thieves, I deposited 1 million nairas in my Ngn account and I was charged 2k for depositing, and I converted it to Ghs. The next thing I was trying to withdraw, it wasn’t available. I waited for about 72 hours for the withdrawal service to be restored. When it was restored the withdrawal fee was increased from 1% to 10%. I can’t take such a thing. losing 70k just like that because I want to use you guys’ platform is not possible to you guys should revert this terrible act.” Below is a screenshot of some comments on the Google Play store. Conclusion Wirepay is a Fintech company that offers various benefits to users. It allows users to send and receive money easily. Wirepay also has a virtual dollar card that allows users to make purchases online on various platforms. Furthermore, when you plan to fund your virtual dollar card, you’ll need to pay a transaction fee of 0.5% capped at $5 for each card funding transaction. However, if the 0.5% funding fee isn’t up to $1, the amount that would be debited is $1. This amount will be deducted directly from your USD wallet. Furthermore, with Wirepay, you can create more than one virtual dollar card and more than one wallet. Lastly, before creating a virtual dollar card with Wirepay, it’s important that you ask their customer service appropriate questions. You wouldn’t want to get shocked when you try withdrawing your funds from your card and it isn’t possible. Before making a step, contact their customer service by sending an email to @support@sendwirepay.com. Frequently Asked Questions 1. Can I Use Wirepay on My Laptop? No, you can’t access Wirepay on your laptop. You can only make use of this virtual dollar card operator on your mobile device. However, Wirepay has a dashboard that businesses can access on a laptop. Visit www.maplerad.com. 2. Can Someone Pay Money Into My Wirepay Virtual Card? No. You can only fund your virtual card from your Wirepay USD wallet balance. 3. How Much Does Wirepay Charge for Virtual Card Creation? Wirepay charges a one-time card creation fee of $2 for each card you create. 4. What countries Does Wirepay work in? Wirepay supports transactions and has wallets for Nigerian Naira (NGN), US Dollars (USD), Ghanaian Cedi (GHS), Kenyan Shillings(KES), and Cameroon Francs(XAF) currencies.

Fortis Mobile Money – All You Need to Know Before Getting Started

In today’s Nigeria, mobile money has become an increasingly popular way for daily financial transactions.This has created so many options and choosing the right platform can be overwhelming. If in your research to find a suitable option you stumbled upon Fortis Mobile Money and you want to know more, then this article is for you. We will see the details of Fortis Mobile Money, a licensed mobile money operator in Nigeria. We’ll explore its features,and account creation process, and uncover some potential drawbacks to consider before you sign up. By the end, you’ll be well-equipped to decide if Fortis Mobile Money is for you. What is Fortis Mobile Money About? Fortis Mobile Money is a CBN-licensed mobile money operator in Nigeria. It prides itself as a bank geared towards providing an inclusive banking service to the people at the bottom of the financial pyramid. Fortis Mobile Money is among the list of CBN-licensed mobile money operators in Nigeria.This means that their deployments conform to both the local regulations and the international security standards. The Fortis Mobile Money is a sister institution to the then Fortis microfinance bank in Abuja, whose license was revoked by CBN and liquidated by NDIC in 2018. Let’s look at what you should expect from the Fortis mobile money. What can you do with the Fortis Mobile Money Application? With the Fortis mobile money application, you can easily do all basic transactions. You can send and receive money, purchase airtime, and subscribe to TV networks. You can also make utility bill payments like Electricity (prepaid), Road Transport (ABC Motors), etc. According to the Fortis website, you can also easily save and budget your income by using the application.I couldn’t confirm this as the app isn’t accepting new users at the moment but immediately I have hands-on experience, I’ll update you. Other information on their website is that they have a provision for ATM cards which can be requested by both their agents and customers. The Fortis application also provides NFC contactless cards and QR code payments. Getting Started with Fortis Mobile Money in 2024 Fortis Mobile, like every other licensed mobile money operator in Nigeria, requires you to open an account using your valid phone number and either your National Identification Number (NIN) or Bank Verification Number (BVN). Before proceeding to sign up, you must choose if you’re opening the account for personal use for your business. You follow the KYC, answer all the questions correctly and you’ll be ready to use your account. The Fortis account can also be accessed through a short banking code. In a bid to reach small and medium enterprises and SMEs, you can use your mobile phone, without the Internet, to create and manage your Fortis account. The USSD code is *540#, although, it is currently not available☹️. User Reviews of Fortis Mobile Money Even though Fortis Mobile Money has been in existence since 2010, the mobile app, “FortisPay” was recently released. The FortisPay was released on the Play Store on the 4th of April 2024. The app already took a good leap, with over a hundred downloads on the Play Store in a month. However, there are no downloads on the App Store at the moment. The Fortis Mobile Money on Play Store has 2 reviews with a 5.0 rating each. However, it will take more than that to ascertain the features of the app. My Thought Fortis Mobile Money is one app that I would advise that it’s only people in its locality to “try out”, with just a small amount. Firstly because it is a known fact their sister bank’s license was revoked and the bank liquidated. This poses a strain and fear of the authenticity of the platform. Another reason I would recommend the app for only Abuja residents is because they only have their office in the federal capital, Abuja. So in the advent of any problem, you can easily walk into their office to stir things up. I recommend that Fortis gets their marketing geared up, their last official video ad was 11 years ago, too bad. They should also improve the user experience design of the application to allow the users to have a feel of the goodness they offer. If you want to try out other licensed mobile money operators in Nigeria, check out Palmpay, Opay, Paga, KongaPay, PocketApp, NowNow, Kegow, Parkway, and FirstBank-owned FirstMonie. Frequently Asked Questions About Fortis Mobile Money What Documents do I Need to Register as an Agent? To have a Fortis Mobile Money POS that you use at your place of work which also qualifies you as an agent, you will need the following: Where is Fortis Mobile Money Located? The Company is located at 2 Lobito Crescent, Off Adetokunbo Ademola Wuse 2, Abuja, FCT 23409, NG. You can also call them at 0809 888 8076.