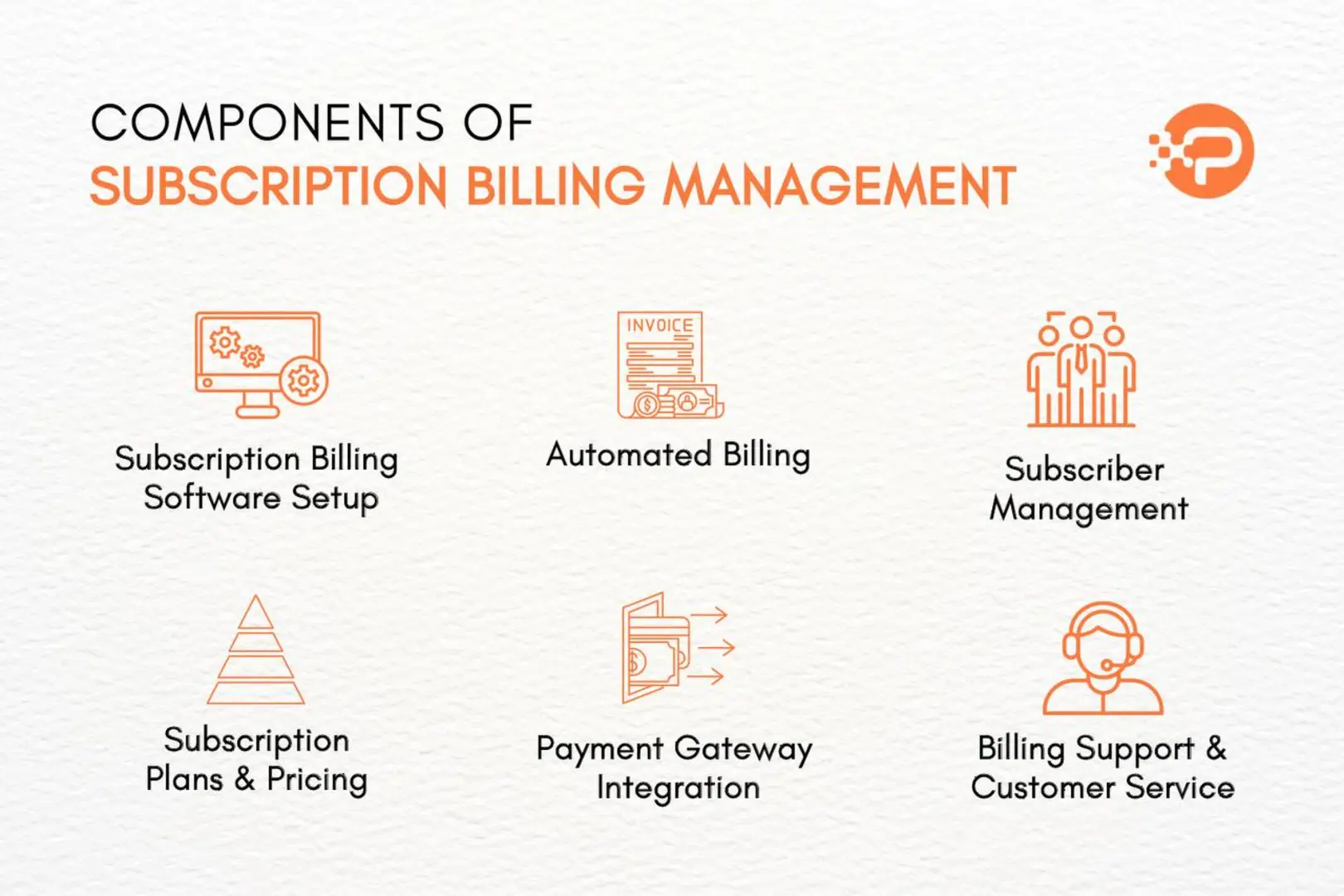

Subscription billing management is the process of managing recurring billings for subscription-based services or products.

Invoice Payment Methods Explained

Invoice payment is a planned transaction where funds are sent by a customer (the company/client) to a vendor (the seller).

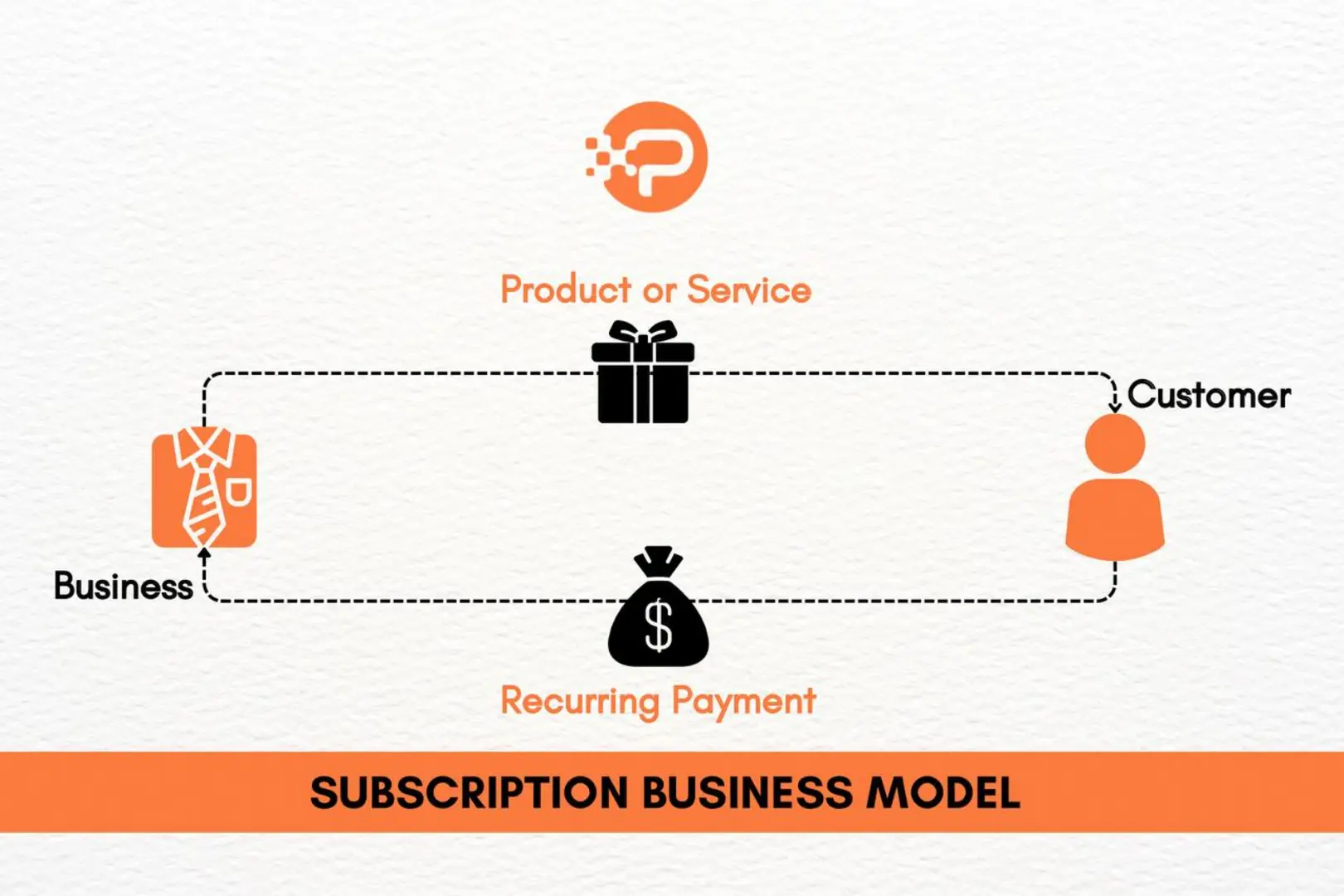

Subscription Business Model: Overview, Gains, Types, How it Works and Metrics to Track

The subscription business model is a model whereby customers pay a recurring fee regularly for a product or service.

Top Free Online Invoicing and Payment Processing Tools

Online invoicing and payment processing are two must-have web-based tools that are essential for today’s businesses.

What are Subscription Payment Methods? Definition, Types, Pros & Cons

Subscription payment methods are tools, gateways and systems that allow consumers to pay for services or products on a recurring basis.

What is Payment Processing?

Payment processing, in a simple term, is the action, or set of actions, that conducts the transaction of funds between two parties. It converts your swipes, clicks, and taps into successful transactions.

Getting Started With Online Invoicing Software

Whether you run a startup with a bootstrapped budget and a team of two, or a fully blown firm with a dedicated accounts department and hundreds of employees, streamlining your invoicing process is crucial for business success. You don’t need to waste hours chasing down missing information, correcting errors, and printing and mailing invoices anymore. In today’s fast-paced digital world, there are several online invoicing software available that can automate invoice production and reduce invoice mistakes. This will enhance cash flow, and keep your finances organized, saving a significant amount of time. Read on to learn more about online invoicing software. What is Online Invoicing Software? As the name implies, online invoicing software is the online tool used to cut out the paperwork on invoicing. With the aid of a phone, computer, or tablet, with access to the internet, you can use the online invoicing software. An internet connection is important because your invoices are saved in the cloud which makes your financial documents organized in one easy-to-use platform. Online invoicing software is mostly user-friendly and easy to use, especially if you have no prior accounting expertise or experience. It will ensure that all legally essential information is imputed accurately. By using this software, you can manage multiple invoices within minutes on any device connected to the internet. You can also use some of the platforms to connect your bank account for automatic bank reconciliation. What are the Benefits of Digital Over Traditional Invoicing? As technology advances, there are also more innovations in the field of invoicing. Beyond the traditional paperwork, discover how digital invoicing can revolutionize your business by enhancing accuracy, payment processes, record keeping, etc. Better record-keeping Online invoicing software generally tracks all invoicing activities, giving your organization organized and accessible documentation of your billing history. This eliminates the need to manually file and look through stacks of paper bills. Everything is arranged with only a few clicks. Improved accuracy Online invoicing software lowers the possibility of human mistakes, resulting in bills that are accurate and consistent. With automatic calculations and pre-filled templates, you can say goodbye to the days of figure crunching and double-checking. Faster payment processing Online invoices can be provided rapidly, allowing clients to make payments quickly. This not only increases cash flow for businesses but also shortens the time it takes for them to receive payments. No more waiting for mail or fretting about misplaced cheques. Enhanced security Online invoicing offers greater security compared to paper invoices. It can be encrypted and protected from unauthorized access, ensuring that sensitive financial information remains confidential. With secure online invoicing and payment processing tools, businesses and their customers can have peace of mind. Eco-friendly Online invoicing can also help to make your business more sustainable and ecologically friendly by reducing the need for paper and physical shipping. It lowers the carbon footprint associated with paper manufacture, printing, and shipping. Going digital is beneficial to both the business and the environment. Factors to Consider When Selecting an Online Invoicing Software With the advancement of several invoicing software online, it is important to be able to make an informed decision when selecting a platform. Some of the key things you must keep in mind are: You must also check the invoicing software’s integration possibilities with your existing tools, like your accounting software or payment processor. Some of the platforms you can use for online invoicing are Zoho Invoice, Xero, Invoicely, etc. How to Generate Invoice Online You can use an online invoicing platform to generate GST-compliant invoices in a fast and efficient way. After you have chosen your preferred online invoicing software, you can follow the steps mentioned below: Once you are done, you can review the invoice and send it to your clients using the online invoicing software. If you need to produce invoices online on a recurrently, you can choose the appropriate interval, which is the period for delivering the invoice. Once you’ve done that, you will be able to send the same invoice to your clients regularly. On some platforms, you can also choose auto-billing if you want to automate the invoicing process and collect money directly through your payment method. Conclusion Don’t wait any longer to ditch the paper chase and embrace the digital age. With a variety of user-friendly and affordable online invoicing solutions available, there’s a perfect platform you can use to revolutionize the way you manage your invoices. Choose one that allows you to create personalized invoices, automates payment collection, connects with other business tools, generates informative reports, and is mobile-friendly. Finally, you must ensure your ideal invoicing solution meets your present invoicing requirements and is within your expense. It must also have the flexibility to assist your organization as it expands. Take control of your finances, free up valuable time, and empower your business to thrive with the power of online invoicing. Start using online invoice software for your business today and see it for yourself. Frequently Asked Questions What is online billing software? Online billing software is an accounting system for invoice processing and payment services. Organizations can automate and streamline their accounting process. Just like online invoicing software, billing software makes it easier to charge consumers for the products or services they have received. What is the difference between a bill and an invoice? Both bill and invoice are used in requesting with a slight difference. An invoice is a detailed document used to request payment and is issued before payment. A bill is rather a simple form of payment that can be issued before or after payment. Invoice is often between B2C, like freelancers, while the bill is often between B2C like in restaurants. Why do we use invoice software? Online invoicing software is used to improve the cash flow and manage the financial health of a business. This helps make you more efficient by saving you time, cost, effort, and resources. Online invoicing software gives your business a professional appearance. What information is mandatory for invoicing? When creating your invoice, 5 things are crucial you put on it. What is the opposite of an

The 10 Best Subscription Billing Software in 2024

Discover the 10 best subscription billing software available in the market today.

What is Invoicing?

In the business world, the efficient flow of cash is the lifeblood of any organization. Getting paid by clients promptly is critical for maintaining operations and fueling growth, either in startups or established business. This is where invoicing comes in. It is the formal document that serves as the backbone of ensuring you get compensated for the valuable products or services you provide. But an invoice is more than just a bill; it serves as a vital record of the transaction, protects both buyer and seller and plays a key role in your company’s financial health. This blog will look into the world of invoicing, explaining what it is, why it’s important, and how you can create one. What is an Invoice? According to the Cambridge English Dictionary, an invoice is “a statement listing goods or services provided and their prices, used in business as a record of sale”. An invoice outlines how much your client owes you when payment is due, and what services you provide. This document is a foundation for the small business accounting system. It specifies a customer’s responsibility to pay for the prices listed in the statement. What are The Functions of Invoicing? When running a business, it is important to issue an invoice to demand payment. Beyond being a “bill of payment”, it is also a legal document that binds the buyer and the suppliers together to stated criteria. It serves as a legal proof of agreement. You can also do an invoice analysis that can assist your organization in gathering information from your customers’ purchasing behaviors to detect trends, popular items, peak buying hours, and other factors. This helps to create effective marketing tactics. What are the Types of Invoicing? Now that you know what a basic invoice is and its function, let’s look at some of the different types. The most common form used for everyday transactions is the standard invoice. It has the details of the products or services provided, the quantities, prices, and payment terms. The type that is closely related to the standard invoice is the debit and credit invoice. They are used for minor changes on the original invoice such as increase and decrease of values, refunds, discounts, or corrections to mistakes. Another type of invoice is the commercial invoice. The commercial invoice is the invoice used for products that are sold internationally. Commercial invoices include information about the sale that is necessary to compute customs charges on cross-border transactions. Another form of the invoice is the Timesheet invoice. This is used by firms that pay their employees per hour. A timesheet is an invoice used when a firm or employee invoices based on the number of hours worked and the hourly rate of compensation. This is mostly used among freelancers. There are other types of the invoice such as the pro forma invoice, final invoice, recurring invoice, past due invoice, retainer, and e-invoice. With the advent of technology, you can generate most of these invoices using online invoicing software. How To Create an Invoice Now that you have a broader knowledge of what an invoice is and some of the several available types, your next question is probably, “How do I create an invoice step by step”. That is exactly what this section addresses. Below is a step-by-step approach to how you can make an invoice: Step 1: In the header of your invoice, showcase your business name and contact details with the invoice ID as a touch of excellence. Step 2: The next thing you add is your client/customer information, name, address, mail, and anything. Step 3: Here is where you show the date when you issued the invoice, very important. Step 4: Clearly state a detailed breakdown of the service/product you are selling. Include the quantities and their prices. Step 5: Calculate and sum up all the prices to give the total amount. Step 6: You then include all necessary taxes, discounts, or customs charges. Step 7: Add all the money together to give a gross total that you expect your client/customer will pay. Step 8: You can have a payment conditions box, where you provide the payment methods and terms you desire. Step 9: Lastly, you will include your business’s terms and conditions at the conclusion. Following these steps will make it simple to create an invoice. Note that you do not have to follow each step exactly as suggested; you may change things up to make it your own. However, creating timely and precise bills with all relevant elements on a monthly basis is not a simple undertaking. If you’re wondering how to manage invoices successfully one option is to automate them. What Is an Invoice ID? In invoicing, there is a need for an invoice ID which is a unique number that a company generates for each invoice. The ID is important because it serves as a unique identifier for each client transaction. The invoice number can contain both letters and numbers, without having to number them consecutively. It is best to have a consistent invoice ID arrangement to prevent sending the same number of invoices multiple times. How Can I Assign an Invoice Number? Having a smart invoicing system is the cornerstone of healthy cash flow and there are several approaches you can use to achieve that. One of them is the sequential approach to invoicing. In this approach, you can assign an invoice number sequentially. For instance, if you are running an investment platform, you can use something like invst-0001, invst-0002, invst-0003… Another format that you can use is the chronological format. Here, the invoice number incorporates the date. For instance, when you issue an invoice on April 3rd, 2024, you could be numbering it “20240403-001” (year-month-day-sequential number). When you issue an invoice, it can help with quick referencing. Lastly, you can also assign an invoice ID using a customer-based numbering. If you like to use unique numbers as your customer’s ID, then you can easily switch it into an invoice ID number. For example, if you are dealing with a company called FAANG, you could have the invoice

Subscription Payments: A Beginner’s Guide

Did you know that the subscription business model, which has become remarkably popular in recent years, has actually existed since the 16th century?