Requesting for invoice is a common activity that occurs frequently between buyers and sellers for different purposes.

How to Create an Invoice: Invoice Template

In the chain of running a business, one of the very important things you need to have in place is your invoice. Without an invoice, you may not get paid when you have completed a job because your client has not received the quotation for the job you did. If you haven’t done this before or you are still new to running a business, perhaps what you still have now is a startup, this article is for you. You will learn here how you can create a professionally-looking invoice. One of the best ways to achieve this is using an invoice template. Keep reading to learn how to create an invoice that will amaze your clients and get you paid faster. What Are The Basics Of An Invoice? Before you start creating your business’s invoice either from scratch or using an invoice template, it is very important that you first understand the basics. You can personalize your invoice in whatever way you want but some very core things must appear on your invoice, which are: 1. Business Details The first and most obvious thing that should be on your invoice is your business name and logo (if available). You can also include your business address and other necessary details that can inform your client where the invoice is from. 2. Client’s Details Close to your details, you must include your client’s details such as the name and address. If you are dealing with a mid/big-sized company, you might include the name of the person who will process the payment. 3. Date You must also include the invoice date on your invoice. This date will include the date the invoice was issued and the due date. 4. Invoice Number You must also include an invoice number on your invoice which aids bookkeeping and referencing. 5. Transaction Details This section is where you write the goods and/or services you rendered and its corresponding amount. You can sum it up at the end to show the subtotal amount charged. 6. Amount Owing After you have clearly stated the transaction details, you can make other necessary payments, such as taxes, to the amount that’s expected from the client. 7. Payment Methods The next thing, after all the above has been put in place, is that you include the payment methods. This is where you include how you want to receive your payment. 8. Other Terms of Payment Lastly, you must also include your payment conditions. This is where you state how many days the client has until payment. After the due date, can set a certain percentage as an increment, either daily, weekly, or monthly. How Can I Create an Invoice From Templates? Having understood the necessities of an invoice, let’s see how invoices can be easily created from Invoice templates across different platforms. Creating invoices from Google Docs/MS Word Microsoft Word and Google Docs are two platforms that serve a similar purpose which is writing. The major difference between the two is that Google Docs is managed on cloud storage while Microsoft Word can only be managed locally on your device. To use Google Docs, you’ll need to log in to your account on a browser, check the workspace of your account, and select Google Docs among other options available. When you open Google Docs, you’ll see the templates section up and a blank sheet beside it to create a new file. Click on the templates section and search for the Invoice template. You’ll see several templates on the invoice, choose the one that you prefer by clicking on it and edit the details to suit your needs. Almost the same procedure applies to Microsoft Word. Once you open the application on your device, you will see the templates section. Click to open it and search for an invoice. Select your desired Invoice template and edit as appropriate. If you ask which one is preferred among the two, I’ll choose Google Docs. That’s because you can easily forward the invoice to the client mail without wasting time. Another better way of doing this is by using online invoicing software. Creating Invoices From Online Software If you’re not using any of the above programs or their templates, you can use free online invoice software. This software helps in creating a more professional-looking invoice but with other benefits. With these platforms, you can easily send your invoice, track when your client receives it and even use a more suitable payment method. There are also some invoicing software with automated payment. To use this platform, you’ll just need to create an account and use your details to fill up their templates. They’re often less stressful to use and examples include Square, Zoho Invoice, etc. Other platforms you can use in creating your invoice include but are not limited to, Microsoft Excel, Canva, etc. What Are The Benefits Of Using An Invoice Template? Instead of wasting time crafting invoices from scratch every time, you can use the predesigned invoice template that you can simply fill in. This saves you valuable time and also increases your efficiency leading to little or no errors. Invoice templates are easy to use to generate invoices on the go. More importantly, invoice templates ensure a consistent look for all your invoices. This fosters a positive brand image and makes a good impression on clients. Consistency also benefits your operations by making record-keeping less conspicuous. Finally, faster invoice creation leads to faster payments from clients. By getting invoices out the door quickly using an invoice template, you can improve your cash flow and reduce the risk of late payments. Conclusion Using invoice templates can help you improve your productivity and focus on other aspects of your business. You can easily create an invoice using any of the options mentioned above. These platforms not only save you time but also make it easier to collect money. If cash comes in on time, you can establish a financially stable firm. In establishing a financially stable firm, you can check out other articles on budgeting, auto-billing, automated payment for

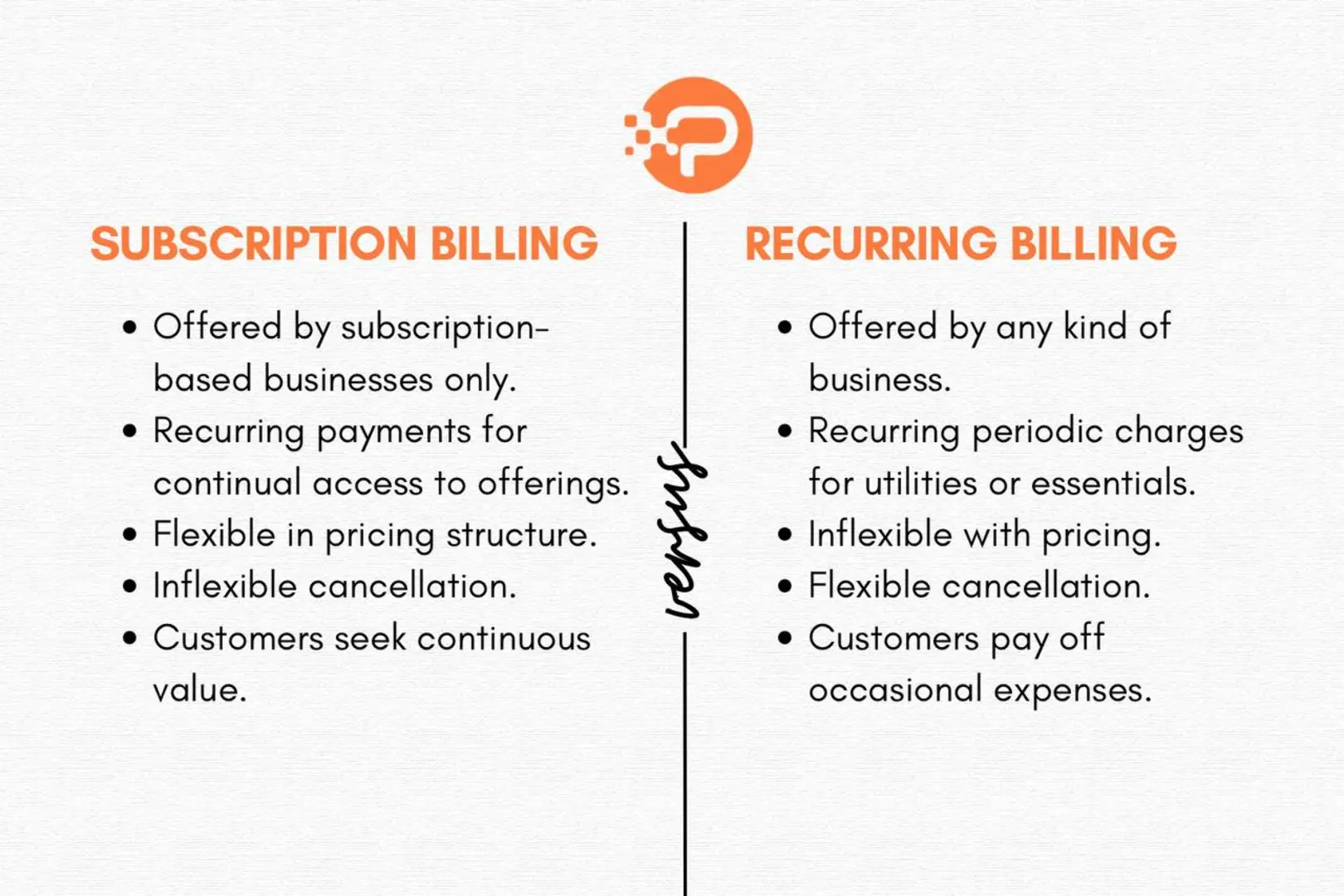

Subscription Billing versus Recurring Billing: Understanding the Key Differences

Subscription billing specifically refers to recurring charges for subscription-based businesses, while recurring billing refers to recurring charges for any business.

Automated Payment for Small Businesses

Running a small business can be like having a hundred jobs at once! And on top of everything, you still need to keep your money flowing seamlessly. But what if you could spend less time worrying about bills and more time on the fun stuff by automating your small business? Running a small business can be like having a hundred jobs at once! And on top of everything, you still need to keep your money flowing seamlessly. But what if you could spend less time worrying about bills and more time on the fun stuff by automating your small business? This blog post is all about how small businesses can automate their payments. We’ll talk about things like setting up automatic payments for things you buy every month and making it easier for customers to pay you. We’ll also discuss the benefits of automating your payments, such as improved cash flow, reduced administrative burden, and happier customers. What Does Automated Payment For Small Business Means? Automatic payment is an electronic way of making payments that are preset to complete certain transactions to certain people at a certain time. You can set up automatic payments as a one-off thing or make recurring payments with either a fixed or variable rate. You can check out one of our articles that extensively explains what automated payment systems are. Here, we’ll be focusing on automated payment for small businesses. An automated payment system for small businesses is a tool that can help build a business by making time available for other things. This is essential as small businesses often have a small number of people doing several things. Automating payment systems won’t only make your work easy but also more efficient, smart, and fast. You can easily create more time for invoicing, billing systems, marketing, and evenbudgeting. Automated systems also accept recurring payments that can help your small business receive payment faster and improve your cash flow. What are the Types of Automated Payments for Small Businesses? Different types of automated payment systems can be easily used by small and growing businesses.The most widely used kind of automated payment for small businesses is the recurring payment option. The types used include: Fixed-amount automated payment One of the best-automated payments for small businesses is the fixed amount payment. This type charges per payment which means you don’t have to pay when you’re not using the platform. Variable amount auto payment Automatic payment amounts change from invoice to invoice, based on the services purchased by the client during that pay period. This is a frequent payment plan for independent creatives such as graphic designers and writers, whose services to customers vary monthly based on what is needed. Pre-approval transactions Finally, some automated payments for small businesses involve pre-approving a credit card that will be chargedshortly after a service is rendered. These payments are less used among freelancers, but they are popular in services like Uber drivers. In this case, you’ll need to pre-approve your card when your account is set up and are charged after the service. What are the benefits of using Automated Payment for Small Business? Automated payment for small businesses offers a lot of benefits to both the business and the clients that use it. One of the major benefits is the enhancement of cash flow. Automated payments help small businesses not to worry about when their payments will come in and help you plan what you use your funds for. Clients also usually find it convenient to use. It helps them to present a payment and forget about it knowing that when the due time comes, the payments will be automatically made without any additional approval. Instead of manually creating invoices each month and then processing payments, you easily automate all of them. You will spend less time invoicing and more time focusing on critical company problems. Another thing that automated payment for small businesses does is that it helps keep your money organized. They make it easy to see where your money goes, so you can spend it on the things that help your business grow! How Do I Set up Automated Payments for Small Businesses? Setting up automated payments for small businesses usually begins with deep research to find a suitable platform for your business. There are several platforms online that your client can use in making automatic payments such as PayPal, Stripe, Square, etc.Most of these will charge you a transaction fee which is an affordable credit card processing for small businesses. Some also include recurring payments. After choosing your preferred platform, the next thing to do is to create your merchant account. Also, you must ensure you look out for the security measures of the platform, although most of the platforms are highly secured and encrypted. Once your account is ready, you can first have a controlled testing where you ascertain all the functionalities. And then, you market it to your users. You must let your customers know about the automated payment implementation and how they can use it. The payment methods on your invoice can be updated and included in automated payment. You can also easily create a link from the payment platformthat you can click and just make a payment. Lastly, automated payment for small businesses can be offered to users with incentives when it’s been used. This is to encourage your client to adopt the payment method as their preferred option. This could be giving a discount to the payment made through the automated system. Conclusion Using automated payment for small businesses often offers better efficiency, accountability, and security than you’ll experience with cash payments. There is also a high tendency that your client will find it more convenient, especially for recurring payments. Automatic payments are like clockwork – the money moves quickly and securely, freeing you up to focus on other important tasks. Plus, with automated payments, you have a clear record of every transaction. No more misplaced receipts or wondering if a payment went through. Everything is documented and easily accessible. There is also software you can use online for invoice and payment making that makes your invoice process seamless and highly effective. These tools integrate with your automatic payment system, so you can create invoices, send them electronically, and receive payments – all in one place! Frequently Asked Questions How to set up automatic payments for business? To set up an automated payment for your small business, you can select a payment processor online and sign up. You will then connect the payment processor and connect it to your online store if you run an e-commerce store. Your customer can then pick the item they want and select a recurring payment

What is Subscription Billing?

Subscription billing is the automated process of billing subscribers at regular intervals, usually monthly, quarterly, or annually, for a continual supply of their preferred goods or services for a period

Automated Invoice Processing

The traditional invoicing process comes with frustration: stacks of paper, matching purchase orders, and manual invoice data entry which gives enough room for errors and delays in the proceeding time. Delays in processing invoices can lead to delays in invoice payout which thus strains relationships. In this blog post, you’ll learn how you can fix this with automated invoice processing. We’ll explore the world of automated invoice processing, looking at how it works how and you can automate your invoice process for faster payment. What is Automated Invoice Processing? As the name implies, automated invoice processing is the automation and streamlining of invoice processing workflow. The automation can cover the entire invoice processing workflow. It starts from the extraction of invoice data to invoice review and approval. This process automatically pays invoices which in turn reduces the accounts payable process. The account officers also get relieved to focus on other strategic tasks. You don’t just save time and money with automated invoice processing, you also reduce errors and fraud. One of the key features of an automated invoice system is that it provides standardized coding, and automates approvals. There’s usually a dashboard as well that shows the status of invoices. Many invoicing software aids their payment by integrating with ERP platforms that help save time and increase accuracy. How Does Automated Invoice Processing Work? The automated invoice processing software automates every step involved in the traditional way of processing invoices. In the traditional way of invoice processing, an account officer receives an invoice, verifies the details of the description, and the payment detail is set up in their system and ready for approval and payment. The automation of invoicing takes a smarter and quicker approach to the workflow above. The system directly receives the invoice sent by the supplier, immediately scans it and then the details are sent as data to your accounting system. The next thing is that the data will be transformed into a searchable text document that can be mapped by the automated management system.This will enable the tracking of the data entered into the ERP system in real time. The type of details saved in the data stored includes the company/supplier name, detailed description of the purchase, purchase amount, and the account of the invoice. The last thing is that the automated invoicing system sends the account of the payment to the concerned party that reviews and endorses the payment. In cases where the system cannot automatically make the payment due to the chances of possible error, it is held on for a human to review. How To Automate Invoice Processing The good news about automating your invoice processing is that it doesn’t require a complete revamp of your systems. The first thing you must do is select a suitable invoice automation software for your business. There’s a range of software available, from cloud-based solutions to enterprise resource planning (ERP) integrations.You must consider factors like your business size, the volume of the invoice you receive, and your budget when selecting a solution. Once you’ve gotten your preferred software, integrate it with your existing accounting software. This will allow for a quick setup and transfer of the company’s data without having to manually input the data. You must also configure your software to match the unique workflow of your company.This might include restricting the automatic payment approval to a certain amount threshold. After setting up the automation and configuring a unique workflow, you must now test it in a controlled environment. This means you’ll deploy the software locally to be used by selected people and get their feedback. The feedback you then use to make necessary changes and improvements. The Automated invoice processing can then be integrated into your company’s general workflow. It receives the invoices from your vendors, uses machine learning in reading and extracting information, and makes approvals where necessary. Which Invoice Processing Tasks Can You Automate? The overall process of invoice automation is to streamline the entire invoice processing cycle, starting from the capturing of data to approval and even archiving. Some of the specific processes that this system automates in invoicing are: Data Entry Automated invoice processing can be enabled to accurately and quickly capture the details of an invoice using Optical Character Recognition(OCR). Information like the vendor information invoice date, line items, and total amount.This cuts out the manual time spent on manual data entry. Data validation Automated invoice processing also helps in verifying the details of the invoice you received against some predefined rules or existing data in your accounting system. You’ll also be saving time here and your account team only gets to manually review the ones that are flagged during the automation process. Coding and Matching You can also automatically assign specific codes to line items on an invoice to easily reference and even analyze the invoice. This will also simplify the tax payment to the authorities. Your automated process can also use some algorithm to flag duplicate payments or bills for the same purchase. Approval and Archiving Another step you can automate is approval. You can set your automated invoice processing to approve the payment. Provided you have the required payment method option and it’s within your set jurisdiction. You can also set your approval to a certain amount, based on the size of your company. Invoice automation systems can also help you archive invoices in a centralized and searchable location. This makes it easier to find an invoice, an easier alternative when compared to the traditional process. You can tackle the repetitive, rule-based tasks of the invoice processing cycle and introduce errors using automation. Conclusion The traditional paper-based invoice process is a relic of the past and by embracing automated invoice processing, you can unlock a lot of benefits for your business. Automated invoice processing allows the accounting department to achieve more, from streamlined workflows and reduced errors to faster approvals and happier vendors. Take the first step towards a more efficient future by exploring invoice automation solutions today. Remember, an automated invoice process will lead to a happier accounting team, improved cash flow for the business, and a strategic advantage in today’s competitive landscape. So add a layer of machine learning to your workflow today! Frequently Asked Questions What is an automated invoice processing configuration? Automated invoice processing configuration is the process of setting up a “paperless” invoice processing system that suits your company’s specific needs. This process usually involves utilizing various technologies and defining rules within the system to streamline the accounts payable (AP) workflow. How do I create an automated invoice processing workflow? To create an automated invoice processing workflow, you must analyze your current system to pinpoint time-consuming steps. This step could be data entry or even the manual way of monitoring who

What is Recurring Billing?

Recurring billing is the automated process of billing customers at regular intervals for a continual supply of product offerings.

What is Automation in Billing

Automated billing is a system that handles, streamlines, and automates billing, invoicing, and payment processes with little or no human intervention. This system offers

Subscription Billing Management Software

Subscription billing management software is a tool for automating and streamlining the billing processes of subscription-based businesses.

What is an Automated Payment System?

An automated payment system is an electronic system that is used by businesses to automate their payment processes. It covers several forms of payment from customer transactions to payment of salaries.