Are you looking for easy ways to send money and also make online transactions? Well, you can make use of a Wirepay virtual card. This card can be used by Africans and it is easy to create. However, to be able to access this card, you’ll need to have an account with the platform and you’ll have to pay an amount to claim the card.

Once this is done, you can access your card and make use of it for online transactions. In this article, you’ll get to know more about the Wirepay virtual card, the platforms you can use the card on, and the various limits placed on the card.

What is a Virtual Dollar Card?

A virtual card is a digital card that is usually funded in US dollars to make transactions online. With the card, you can purchase goods and services on any platform with ease. A virtual dollar card has all the details that are available on a physical debit or credit card.

What is Wirepay?

Wirepay is a virtual dollar card operator that allows you to send and receive money within Africa using fiat. It also provides you with a virtual dollar card that you can use for making purchases on various platforms online. With Wirepay, you can buy airtime at a discount.

How To Create a Wirepay Account

Below are the steps you can use to create your Wirepay account.

- First of all, download the “Wirepay app”

- “Open” the app and input your “Email address”

- Fill out the “Sign up form.”

- Go to your email, copy the “OTP” sent

- Input the OTP

- Then click on “Sign Up”

- Select “Okay!”

- Input your email address again

- Type in the login “OTP” sent to your email

- Click on “Continue.”

- Create your four-digit PIN and confirm it

Now, you’ve successfully created an account with Wirepay.

How To Fund Your Wirepay Wallet

Before you can create a Wirepay virtual dollar card you’ll need to verify your account. For this process, you’ll be required to provide your phone number, ID card, and your BVN. Once your account is verified, you can follow the steps below to fund your account:

- Click on “Fund”

- Choose the “Method” you’d like to use to fund your wallet

- Then “Proceed” to fund your wallet

Note: If you click on the bank transfer option, an account number will be generated for you to send your money to.

How To Create a Wirepay Virtual Card

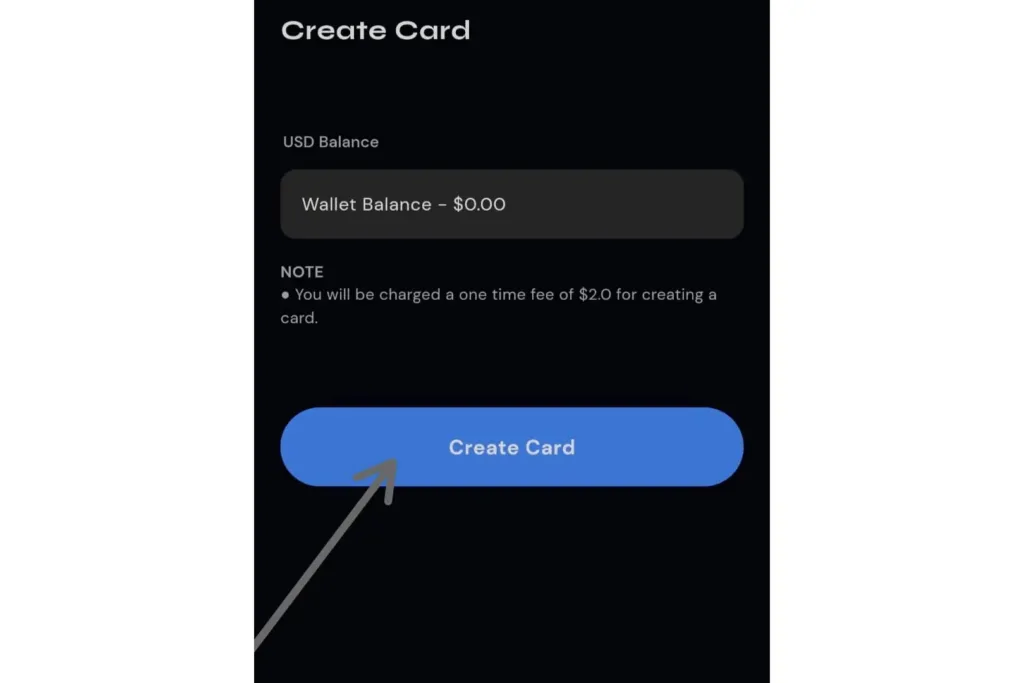

Creating a Wirepay virtual dollar card is easy. All you’ll need is to have at least $2 in your wallet, and you’re good to go. Just in case you don’t have $2 in your USD wallet, you can exchange your local currency. To do this, just click on exchange at the bottom of your screen and input the amount you’d like to exchange.

Once that is done, you can go ahead and create your Wirepay virtual dollar card. Furthermore, Wirepay allows users to create either a Mastercard or Visa card, and creating any of the cards costs the same amount. To create a Wirepay virtual card, follow the steps below:

- On the Wirepay app, click on “Cards.” You’ll find it at the bottom end of your screen

- Select the type of card you’d like to create

- Click on “Create card”

Now, your card is ready for use.

My Thoughts On Wirepay

My experience with Wirepay wasn’t so bad. I enjoyed using the platform, especially considering the fact that it has an intuitive user interface. However, I didn’t like the fact that I would have to get two OTPs before I could finally access my account. It was somewhat stressful for me.

Another thing I didn’t like about using Wirepay was the fact that its customer service wasn’t available 24/7. I sent a query, and I was told I’ll get a reply the next day, which I didn’t like. However, they sent a reply to my Email 29 minutes later. The email will be sent to you from Malperad— one of the companies they are working with.

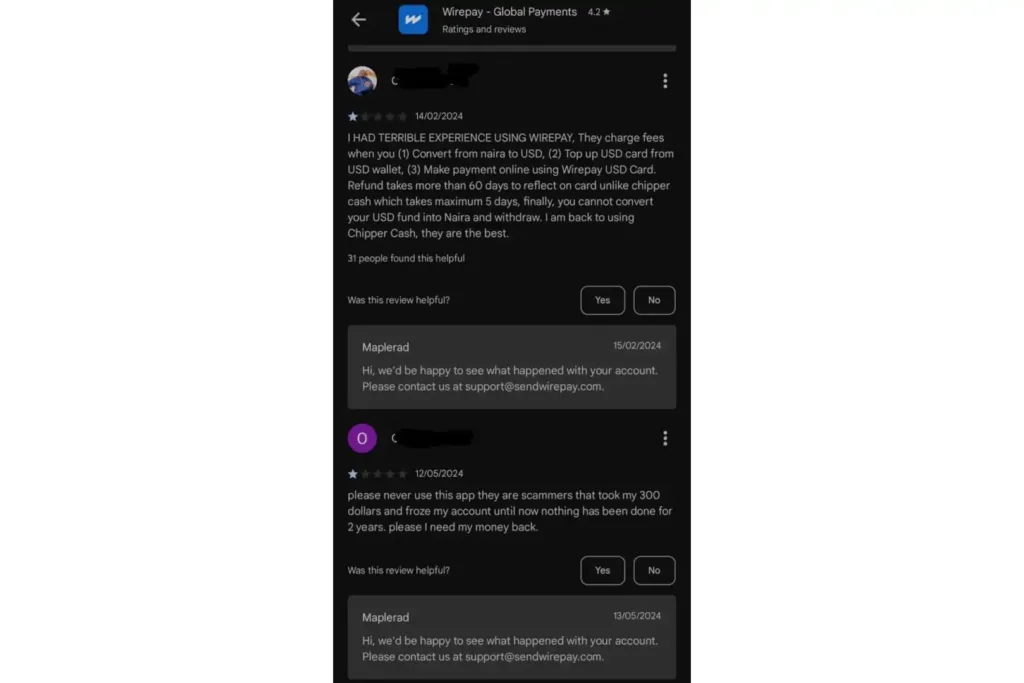

User Review on Wirepay Virtual Card

Aside from the reviews from the Google Play Store, other users made comments on Trustpilot. One of the users said, “These people are thieves, I deposited 1 million naira in my Ngn account and I was charged 2k for depositing, and I converted it to Ghs. The next thing I tried to withdraw, it wasn’t available.

I waited for about 72 hours for the withdrawal service to be restored. When it was restored the withdrawal fee was increased from 1% to 10%. I can’t take such a thing. losing 70k just like that because I want to use you guys’ platform is not possible to you guys should revert this terrible act.”

Below is a screenshot of some comments on the Google Play store.

Conclusion

Wirepay is a Fintech company that offers various benefits to users. It allows users to send and receive money easily. Wirepay also has a virtual dollar card that allows users to make purchases online on various platforms. Furthermore, when you plan to fund your virtual dollar card, you’ll need to pay a transaction fee of 0.5% capped at $5 for each card funding transaction.

However, if the 0.5% funding fee isn’t up to $1, the amount that would be debited is $1. This amount will be deducted directly from your USD wallet. Furthermore, with Wirepay, you can create more than one virtual dollar card and more than one wallet.

Lastly, before creating a virtual dollar card with Wirepay, it’s important that you ask their customer service appropriate questions. You wouldn’t want to get shocked when you try withdrawing your funds from your card and it isn’t possible. Before making a step, contact their customer service by sending an email to support@sendwirepay.com.

Frequently Asked Questions

1. Can I Use Wirepay on My Laptop?

No, you can’t access Wirepay on your laptop. You can only make use of this virtual dollar card on your mobile device. However, Wirepay has a dashboard that businesses can access on a laptop. Visit www.maplerad.com.

2. Can Someone Pay Money Into My Wirepay Virtual Card?

No. You can only fund your virtual card from your Wirepay USD wallet balance.

3. How Much Does Wirepay Charge for Virtual Card Creation?

Wirepay charges a one-time card creation fee of $2 for each card you create.

4. What countries Does Wirepay work in?

Wirepay supports transactions and has wallets for Nigerian Naira (NGN), US Dollars (USD), Ghanaian Cedi (GHS), Kenyan Shillings(KES), and Cameroon Francs(XAF) currencies.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist