Are you looking for ways to shop, pay, and transact seamlessly? Bitnob Virtual Dollar Card offers such an experience. This card is easy to create and can be used by Africans. However, for you to have access to the Bitnob Virtual Dollar card, you need to have an account, fund the account, and create a Virtual Dollar Card with an amount.

In this article, you will find out how to create an account on Bitnob, how to create a Virtual Dollar Card, fund your account, the various Limits and Charges, and some other benefits of Bitnob.

What Is Bitnob Virtual Dollar Card?

A Bitnob dollar card is a virtual card that can be loaded with dollars to make all of your online transactions. It gives users a Visa card that they can use to make transactions and subscriptions on various online platforms such as AliExpress, Amazon, H&M, and Shein. Subscribe to online streaming services such as; Spotify, Netflix, Amazon Prime, and iTunes.

Which African Country Can Bitnob Be Used?

Bitnob supports transactions in eight African countries, including Ghana, Togo, Nigeria, Kenya, Rwanda, the Benin Republic, Senegal, and Ivory Coast.

Note: only people in Kenya can deposit directly using the mobile money gateway.

How to Open A Bitnob Account

Below are steps on how to open a bitnob account

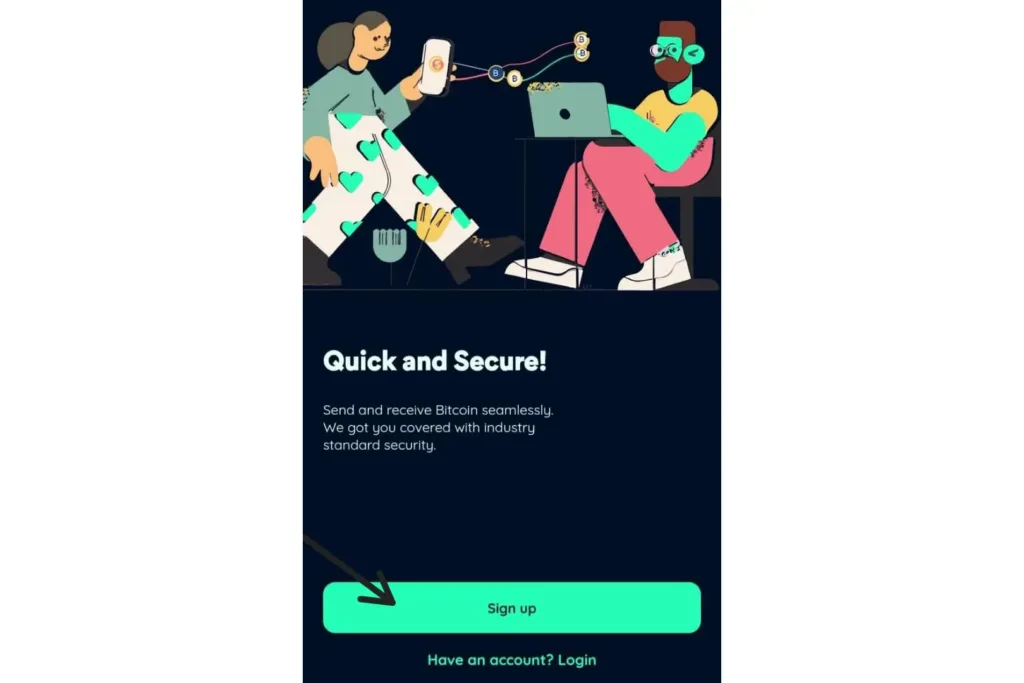

- First of all, Download the Bitnob app on the Google Play Store or on the App Store

- Open your Bitnob app and Click on “Sign up”

- Input your “Personal Details”

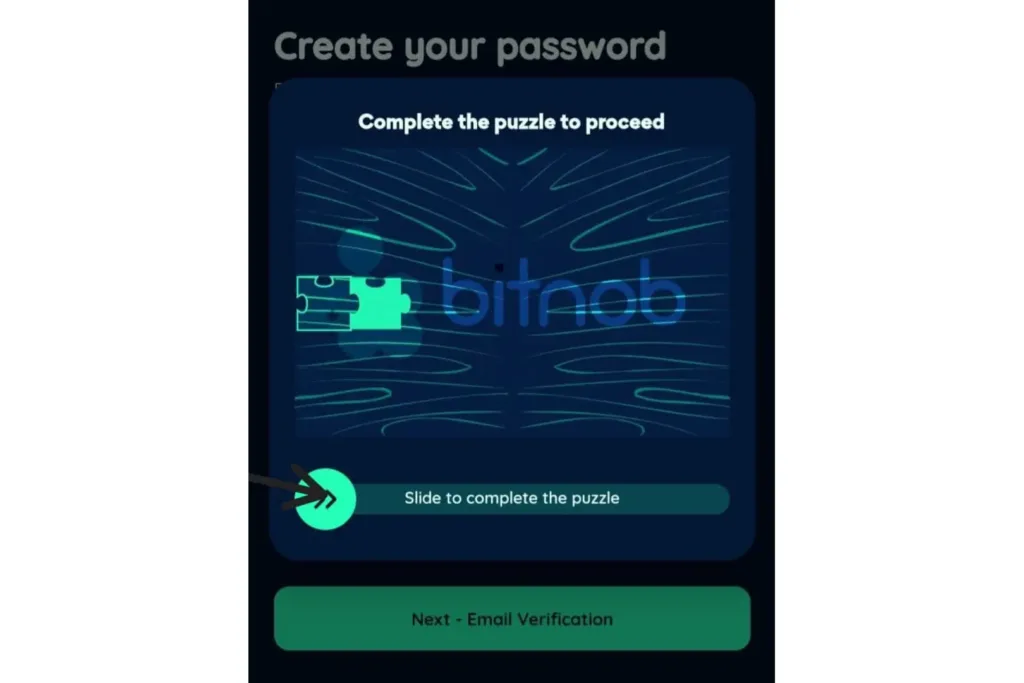

- Click “ Next” – Create Password

- Input a strong password and confirm it

- Tick the box to agree to Bitnob “Terms and services and private policy”

- Click “Next” – Email verification

- Tap on your screen to move the missing piece of the jigsaw to complete the puzzle

- You will receive a one-time password known as “OTP” in your email

- Enter your “OTP”

- Click on “ Verify Email”

- Input the right “Country Code” then input your phone number and Click on “Send Code”

- You will be sent a one-time password known as “OTP” to your phone number

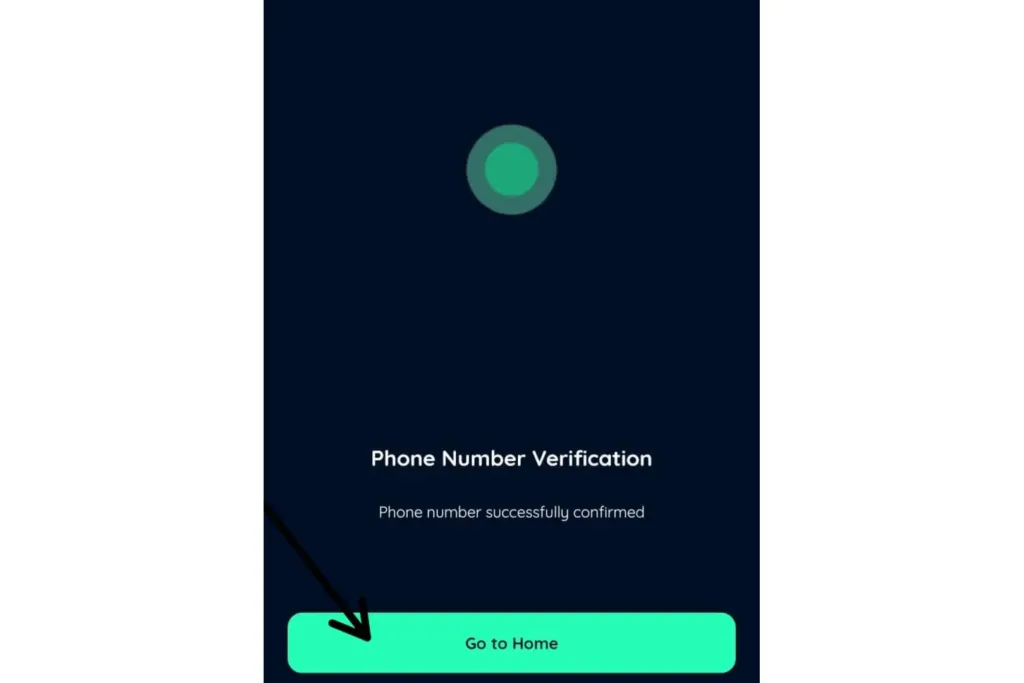

- Input the “OTP” sent to you, then Click on “Verify code”

- Click on “Go to Home”

Congratulations, you have successfully created a Bitnob account.

How To Fund A Bitnob Account

After creating a Bitnob account, you will need to fund it in order to make transactions online and Bitnob allows users to easily fund their account using two different services or methods.

Below are steps to follow when funding your Bitnob account;

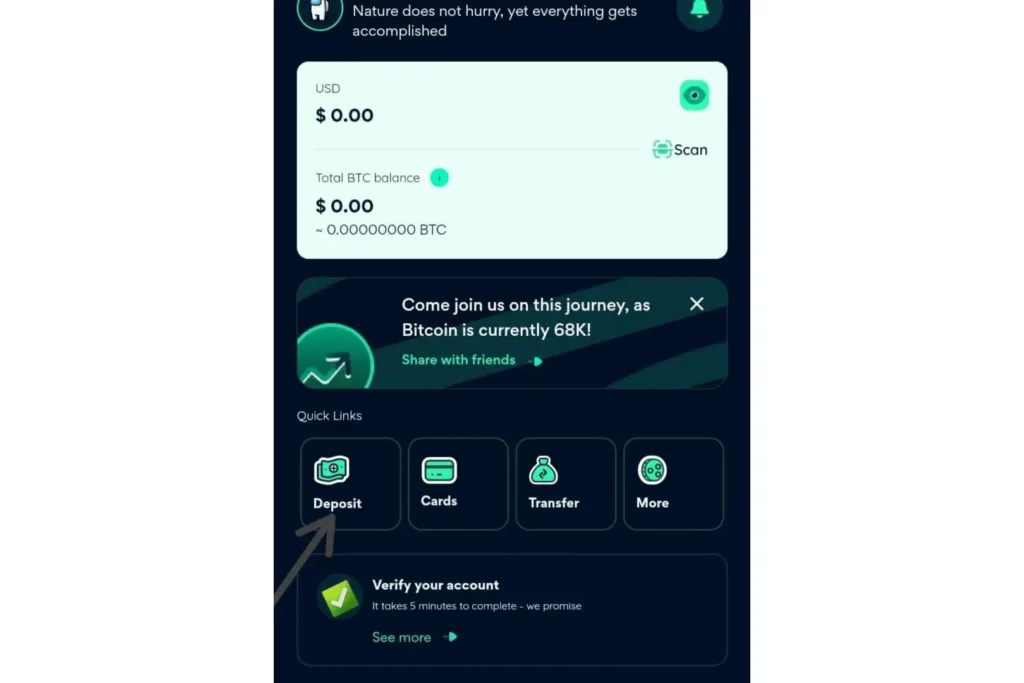

- Log into your Bitnob account

- Click on “Deposit” on the Homepage

- Choose your funding method

For Funding With Local Currency

- Click on “Fund with Local Currency”

- Next, click on “Change Currency” to select the currency you are funding your account with.

- Enter the “Amount” you want to deposit in your wallet.

- Next, choose your “Payment Method”-Mobile Money or Bank Transfer

- Click on “Continue”

- Copy the account details displayed and deposit the exact money in the invoice

- After the deposit has been made, Click on “ I have made this Payment”

- Then click on “Confirm” after you have made the payment.

Congratulations, you have successfully funded your account with Local Currency.

For Funding With Binance Pay

- Click on “Fund with Binance Pay”

- Enter the amount you want to deposit in your account and Click on “Next”

- Click on “Open Binance App” or “Open Web Link” depending on your choice.

- The amount you are funding will be displayed on the Binance app, then Click “Continue”.

- Verify your Payment using the method of choice.

- After Payment, return to your Bitnob account and check your “USD Account Balance”.

You have successfully funded your account with Binance Pay.

How To Get A Bitnob Virtual Dollar Card

Before you create a Bitnob virtual dollar card, you must have created a Bitnob account.

To create a Bitnob virtual card, follow these steps;

- Sign into your account, then click on “Cards”.

- Click on “Create Virtual card”.

- Click on “Start Verification”.

- Click on “ Verify my account” and complete your “KYC”.

- Customize your card by changing the color and by giving it a name

- Input the amount you want to fund your account with then Click on “Next – Create Card”.

- Enter your “Transaction Pin”

Congratulations, You have successfully created a Bitnob Virtual Dollar Card.

How to Fund A Bitnob Virtual Dollar Card

- Sign into your “Bitnob account”

- Click on “Cards”.

- Click on “Card Top up” under your Visa card

- Input the “amount” you would top it up with

- Enter your “transaction pin” and Click on “Top up”.

What are Bitnob Virtual Dollar Card Charges and Limits?

Below are the various limits and charges placed on the Bitnob Virtual Dollar Card:

The amount Bitnob charges to create a virtual dollar card is $1 and the minimum amount you’ll need to create the virtual dollar card is $3.

The maximum amount a card can hold per time is $5000.

The maximum amount a bitnob virtual dollar can carry is $10,000. This means a card cannot carry more than a $10,000 balance at a time.

The Bitnob Dollar Card exchange rate is dependent on the current market price. It is displayed on the Homepage of the Bitnob app.

My Thoughts On Bitnob

Well, the Bitnob app has a lot of amazing features and benefits with a beautiful user interface. The virtual card is so easy to create and also very easy and affordable to fund. The verification process is very slow and the Local funding deposit is only available for just one African country which is Kenya and also the payment method is only available in Mobile Money but aside from all these, Bitnob is a great app.

Users Review on Bitnob

Quite a lot of users of Bitnob made comments on their experiences with the Bitnob app on Trustpilot and Google Play. This is a comment from Bitnob, a user on Trustpilot. One of the users said, “This is the best payment company in Africa.

I use them to send money to my family in Kenya and use the Virtual card to buy products on AliExpress, pay for my Netflix subscription, and pay for my Spotify subscription.

I recommend it to anyone looking to make payment across any online platform most especially cross-border payment in Africa”.

Another user on Google Play said, “First time trying to use this app. I am having an exhausting experience, from bad customer service not responding because the number of customers exceeds the number of staff handling customer needs.

I made a deposit and tried to send money to Kenya but the process is showing errors and no one is able to respond to me. Right now, I am stuck at the moment, in all if you are one who wants a seamless experience without fear and frustration do not use this app because you would be frustrated”.

Conclusion

Bitnob is a fintech company that offers different features and amazing benefits to its users. Bitnob allows users to send and receive money across Africa and globally. Additionally, the fintech also has a Virtual Dollar Card that allows users to make transactions on different platforms. However, creating a Bitnob Virtual Dollar Card will require a transaction fee of $1 and a minimum of $3.

Furthermore, it is very important that your Virtual Dollar Card is funded before making any transaction to avoid termination of your card. Lastly, if you encounter any issues while trying to create a Bitnob account or a Bitnob Virtual Dollar Card, Kindly reach out to their customer care service – Help and Support which can be found on the Bitnob app.

Frequently Asked Questions

1. Is There A Card Maintenance Fee for the Bitnob Virtual Dollar Card?

There is no card maintenance fee attached to the Bitnob virtual dollar card.

2. Does Bitnob Charge a Fee For Cross-Border Payments?

Yes, they do, this is because the virtual cards are specified in the United States dollars(USD). The fees are charged when payments are made in other currencies.

3. How Many Virtual Dollar Cards Can I Create on Bitnob?

You can only create one virtual dollar card at a time. Bitnob also has a limited lifeline that allows you to create and cancel cards just 3 times.

4. What Happens if My Card Gets Declined Due to Insufficient Funds?

If your card gets Declined 5 times, you will be charged $1 and your card will be restricted. Before you make a transaction online, make sure your card has enough funds.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist