Cleva USD Banking is a Nigerian fintech solution on a mission to streamline cross-border payments and global transactions for individuals, freelancers, and businesses across Africa. Founded by seasoned professionals Tolu Alabi and Philip Abel, the platform specifically simplifies how Africans earn, hold, and manage their money in US dollars, tackling the common hurdles of international transactions.

For freelancers, remote workers, and businesses dealing internationally, one of the most persistent challenges is receiving payments from global clients swiftly and cost-effectively. Cleva directly addresses this pain point by offering a US-based USD account, allowing users to receive payments as easily as a local US citizen. This guide will explore how the Cleva USD bank account works and how you can use it to streamline your international earnings.

What is Cleva USD Banking?

Cleva USD Banking empowers African freelancers, remote workers, and SMEs by simplifying how they manage international transactions. It provides users with a US-based account to receive, hold, and save in USD seamlessly. The platform has gained significant backing from top-tier investors like Y Combinator, underscoring its credibility and potential in the fintech space.

A key feature of Cleva is the transparency and speed of its payment processing. When you receive funds, the timing is clear:

- For ACH transfers: 1-3 business days.

- For Wire transfers from US banks: Within hours or 1 business day.

- For transfers from non-US banks: 1-5 business days.

This makes Cleva a reliable and efficient hub for all your international financial activities.

How to Set Up Your Cleva USD Bank Account

Although Cleva is a relatively new foreign bank account provider, it has already made a significant impression with its user-friendly interface. Signing up for a Cleva foreign bank account is a breeze, taking only a few minutes to complete.

You can get a referral bonus after creating a Cleva foreign bank account. Cleva rewards you with $5 directly after your referral makes an initial deposit of $300. Therefore, to begin earning, your first step is to create your own account using the step-by-step guide below.

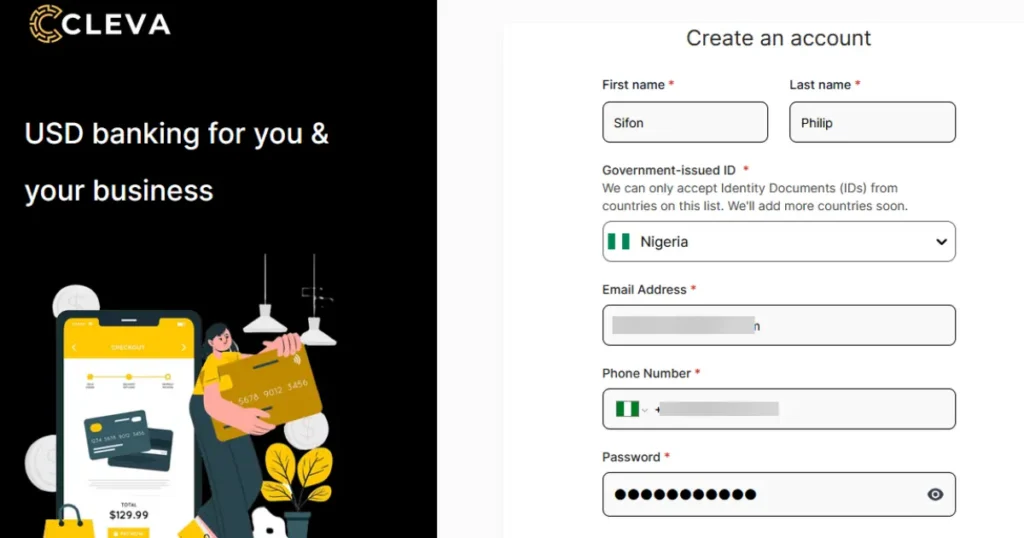

How to Open a Cleva Account

- “Download” Cleva bank on the Google Play Store or App Store

- Click on “Create an account”

- Fill out the form provided. Ensure to select what you’d be using the Cleva banking platform for

- Then click on “Continue”

- You’ll need to verify your email. This usually takes 5 secs

How To Create a Cleva USD Bank Account

Before you can open a Cleva USD bank account, you need to complete your KYC verification. The verification process involves three steps, and Cleva bank takes one day to get you verified. Follow the steps below to start your KYC verification:

- On the app, click on “Click here to complete KYC”

- Select the ID you wish to upload

- Go ahead to upload the document chosen and a picture of you holding the document

N/B: Your KYC verification will take 2-5 days to complete. Once it’s successful, you can go ahead and create an account.

After Cleva confirms your KYC documents, proceed with the following steps:

- “Log in to” your Cleva bank account

- At the top of your screen, click on “Open Cleva USD account”

- Select “Create USD account”

Once you’ve done this, your USD account is ready for use.

How to Create a Cleva USD Bank Virtual Card

Create your Cleva USD virtual card quickly through a straightforward process that supports secure online spending. To start, you pay a one-time $3 fee that Cleva deducts from your USD account. This single fee covers the $2 card creation cost and adds $1 to your card balance, activating it for immediate use. Please also note that Cleva charges a $0.30 fee for certain declined transaction attempts.

If you’re ready to create your card, just follow these simple steps:

- Log in to your Cleva application.

- Navigate to the “Cards” section at the bottom of your screen.

- Select “Create card” to finalize the process.

Once you complete the process, your new Cleva USD virtual card will be ready for secure online payments..

Fund Your Cleva USD Bank Virtual Card

After creating your Cleva USD card, on the card section, do the following:

- Click on “Top up”

- Enter the amount you’d like to fund your card

- Click on “Add funds”

N/B: You can only fund your Cleva USD virtual card through your Cleva USD bank account.

Pros and Cons of Cleva USD Banking

Cleva bank has various benefits that make the platform worth using. However, there are certain limitations you need to be aware of. Below are the pros and cons of Cleva banking platform.

Pros of Cleva USD Bank

- You can protect your account with either a PIN or a fingerprint

- Users can receive payment from platforms like Upwork, Payoneer, Fiverr, PayPal,

- You can create a virtual USD card

- As a freelancer, you can receive payments through ACH and wire transfers

Cons of Cleva Bank

- It’s only available in Nigeria

- For now, you can’t create a Naira account

If you’re looking for a foreign bank account provider that allows you to create a Naira account, you can check out Geegpay foreign bank account or Grey foreign bank account.

Users’ Thoughts on Cleva USD Bank

Below are reviews from Cleva bank users on the Google Play Store:

Final Thoughts on Cleva USD Bank Account

Cleva provides a user-friendly and essential solution for Nigerian freelancers and SMEs to receive international payments seamlessly. Specifically, its straightforward sign-up process and attractive referral program create a convenient and secure platform for managing global transactions.

Ultimately, while Cleva is still evolving and has limitations — such as the inability to fund the account locally — its core benefits are undeniable. Therefore, for anyone seeking a reliable hub to earn in USD from international clients, Cleva proves to be a highly valuable tool. Consequently, we recommend trying Cleva to experience a simplified approach to global banking.

Frequently Asked Questions (FAQs)

Currently, Cleva’s services are primarily available to residents of Nigeria. You need a Nigerian proof of address to open and verify an account.

Transfer times depend on the sender’s method. You typically receive funds from US ACH transfers in 1-3 business days and from US wire transfers within hours or 1 business day.

The one-time $3 fee covers two things: a $2 card creation charge and an initial $1 top-up that is immediately available on your card for spending.bi is the founder of Cleva Foreign Bank Account. Her co-founder is Abel Philip.

No, you cannot directly fund your Cleva account with a local currency card or transfer. The account is designed to be funded by receiving payments from international clients.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist