If you’re hunting for the best online banking app in Nigeria, you’re in good company. With over 35 million Nigerians now using mobile money platforms, digital banking has moved from convenience to necessity. This guide walks you through the top online-only banking platforms making waves in 2026, helping you choose the right one for your needs.

What Makes an App the Best Online Banking App in Nigeria?

Before we jump in, let’s set what we mean by the best online banking app in Nigeria. For our purposes, it’s an app that:

- Let’s you open an account quickly using just your phone and BVN, without long branch visits.

- Offers user-friendly, reliable service on mobile networks common in Africa (including places with slower data).

- Keeps fees low (or zero) for basic services like transfers, bill payments, or savings.

- Gives you security you trust (licensed by the Central Bank of Nigeria, insured deposits, encryption).

- Offers extra features many Nigerians care about: savings goals, virtual cards, international payments, business functionality, and rewards.

- Has strong support for everyday use: paying electricity bills, topping up airtime, sending money to family, maybe even merchant or business operations.

These criteria reflect what many users have in mind when comparing digital banking platforms in Nigeria.

With that in mind, let’s dive into our top ten apps.

Top 10 Best Online Banking Apps in Nigeria for 2026

Based on current user adoption, transaction volumes, and industry recognition, here are the digital banks leading Nigeria’s fintech revolution.

1. OPay

OPay dominates Nigeria’s mobile payments scene with over 35 million users and one million SMEs on its platform. What started as a ride-hailing payment solution has evolved into one of Africa’s most comprehensive financial super-apps.

Key Features:

- Lightning-fast transfers with real-time bank suggestions

- Biometric face verification for large transactions

- Zero maintenance fees with low transaction charges

- Savings and investment options

Pros: Extremely reliable even during peak hours; wide acceptance among merchants; comprehensive lifestyle features beyond banking.

Cons: Interface can feel cluttered with many services; customer support response times vary.

Best For: Young professionals, students, and freelancers who want an all-in-one app for payments, savings, and lifestyle services.

2. Moniepoint

Moniepoint is Nigeria’s first digital banking unicorn, processing over 800 million monthly transactions worth billions of dollars. While it started as a POS provider for businesses, it has transformed into a comprehensive banking platform.

Key Features:

- Ultra-reliable transactions even during peak business hours

- Expense cards for business spending management

- Working capital loans for registered businesses

- Widely accepted POS network across Nigeria

Pros: Unmatched reliability for business transactions; strong infrastructure supporting high volumes; excellent for merchant payments.

Cons: Interface prioritizes function over aesthetics; fewer lifestyle features compared to competitors.

Best For: SME owners, traders, market sellers, and businesses that process multiple daily transactions and need bulletproof reliability.

3. PalmPay

PalmPay claims to process more transactions than any traditional bank in Nigeria, with 15 million daily transactions. Launched in 2019, this digital bank has grown explosively by focusing on mass-market users.

Key Features:

- Over 500,000 agent locations for cash deposits/withdrawals

- Loyalty points and cashback on transactions

- Gamified interface making banking approachable

- Free transfers within PalmPay network

Pros: Massive agent network ensures accessibility everywhere; 25% of users report it was their first-ever financial account, showing strong financial inclusion impact.

Cons: App can be slower during peak periods; some users report account restriction issues.

Best For: First-time digital banking users, people in remote areas needing cash access points, and bargain hunters who love rewards and discounts.

4. Kuda Bank

Kuda pioneered true app-first banking in Nigeria, with transaction volume exceeding ₦14 trillion in 2025. Often called “the bank of the free,” Kuda revolutionized digital banking by eliminating hidden fees.

Key Features:

- 25 free monthly transfers with zero maintenance fees

- Virtual cards for seamless online shopping

- Budgeting and spending analytics tools

- Integration with stock trading platforms

Pros: Clean, intuitive interface perfect for beginners; transparent pricing with no hidden charges; strong focus on helping users save money.

Cons: Customer support can be slow during high-volume periods

Best For: Young professionals, freelancers, students, and anyone seeking transparent, fee-free banking with strong savings features.

5. V Bank (VFD Microfinance Bank)

V Bank by VFD is a fully digital bank offering free banking services to Nigerians. Launched in March 2020, it quickly gained traction with users seeking straightforward digital banking.

Key Features:

- Instant account opening process

- Free transfers to all Nigerian banks

- Bill payment services for utilities and airtime

- Simple, no-frills interface

Pros: Emphasizes simplicity without overwhelming features; reliable for basic banking needs; quick account setup.

Cons: Limited advanced features compared to full-service apps; smaller agent network for cash services.

Best For: Users who want reliable, straightforward digital banking without excessive bells and whistles cluttering the experience.

6. ALAT by Wema

ALAT was Nigeria’s first fully digital bank when it launched, pioneering the app-only banking model. Backed by Wema Bank’s traditional banking infrastructure, ALAT combines fintech innovation with established financial stability.

Key Features:

- Lifestyle integration with entertainment and shopping deals

- Movie ticket and restaurant booking within the app

- Exclusive merchant offers and discounts

- Bill payments and airtime purchases

Pros: Hybrid approach combining digital innovation with traditional banking stability; lifestyle features beyond banking.

Cons: Interface feels less modern compared to newer competitors; limited loan offerings.

Best For: Tech-savvy Nigerians who appreciate lifestyle integrations and want a digital bank backed by established banking infrastructure.

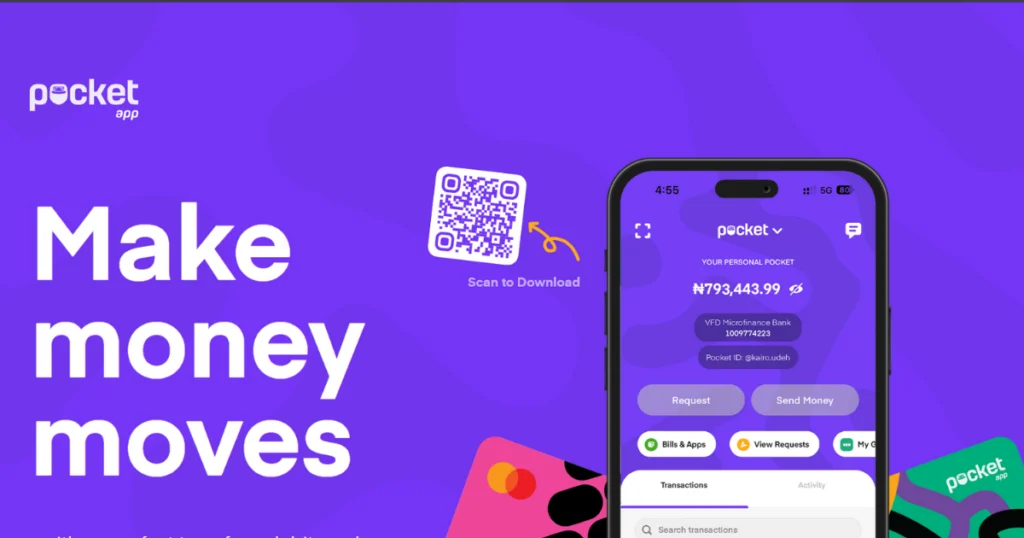

7. PocketApp by PiggyVest

Formerly known as Abeg app, PocketApp by PiggyVest is a social commerce and payments app targeted at young savers and tech-savvy business owners. It was granted approval in principle (AIP) by the CBN to operate as a Mobile Money Operator.

Key Features:

- Seamless integration with PiggyVest savings accounts

- Group wallets for managing shared expenses (2-100 people)

- Customized business account numbers

- Free peer-to-peer transfers using Pocket ID

Pros: Responsive and reliable with swift issue resolution; unique social commerce features perfect for online sellers; strong integration with PiggyVest ecosystem.

Cons: Some users report occasional login loop issues; interface learning curve for new users.

Best For: Young entrepreneurs, online sellers, groups managing shared finances, and existing PiggyVest users looking to expand their financial ecosystem.

8. Paga

Paga is Nigeria’s leading mobile money platform serving 23 million users through 27,000+ agents nationwide. As Nigeria’s pioneer in mobile money services, Paga has evolved into a comprehensive financial solutions provider.

Key Features:

- Dual currency accounts (US Dollar and Nigerian Naira) are manageable from one app

- Physical and virtual Visa debit cards for global payments

- Cross-border transfers between US and Nigerian accounts

- Partnership with Western Union for international transfers

Pros: Versatile payment options work even in low-internet areas; strong for diaspora and cross-border transactions.

Cons: Fees may be higher than some competitors; some users report funding wallet challenges.

Best For: Nigerians in diaspora managing finances across borders, freelancers receiving international payments, and users needing both Naira and Dollar accounts.

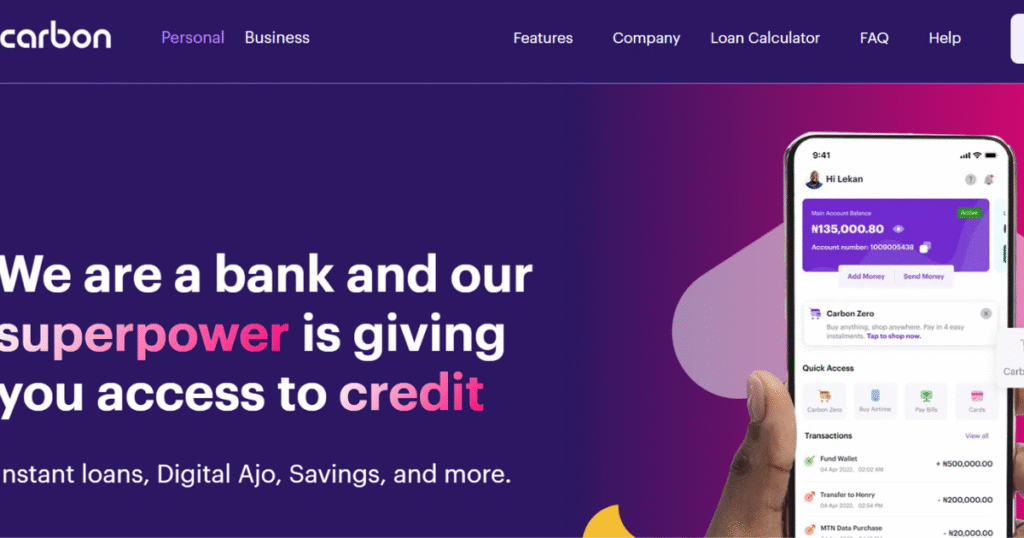

9. Carbon (formerly Paylater)

Carbon pioneered instant digital lending in Nigeria before expanding into full banking services. The app combines banking, investing, and bill payments with particularly strong lending features.

Key Features:

- Instant collateral-free loans based on financial behavior

- Investment opportunities in fixed-income securities

- Bill payment services

- Carbon Zero account with no maintenance fees

Pros: Industry-leading instant loan approval process; diverse investment options; helps users build credit history.

Cons: Loan approval amounts depend heavily on usage history; newer users may face lower limits initially.

Best For: Freelancers and gig workers needing quick credit access, investors looking for verified opportunities, and users focused on building financial flexibility.

10. Providus Bank

Providus Bank’s mobile app offers stable, corporate-friendly banking with a smooth user experience, making it popular among professionals and startups. Founded in 2016, Providus Bank has positioned itself as a digital-first institution.

Key Features:

- Banking-as-a-service platform supported by APIs

- Multi-currency support (NGN, USD, GBP cards)

- Business and corporate account options

- Open banking integrations for fintechs

Pros: Reliable with good user experience; strong corporate and business banking capabilities.

Cons: Mobile app has reported stability issues on some devices; interface less intuitive than newer fintech competitors.

Best For: Professionals, startups, tech companies, and businesses needing stable cross-border and corporate-friendly banking solutions with API integrations.

How to Choose Your Ideal Online Banking App

Selecting the best online banking app in Nigeria for your specific situation requires thoughtful consideration of your unique needs and banking habits. Your primary use case should heavily influence your choice, and don’t forget other factors like security measures, ease of use, and reliable customer support.

Conclusion

Finding the best online banking app in Nigeria ultimately depends on your unique financial needs, transaction patterns, and priorities. Whether you need Moniepoint’s bulletproof reliability for business, OPay’s comprehensive lifestyle features, Kuda’s transparent fee-free banking, PocketApp’s e-commerce integration, or Paga’s cross-border capabilities, there’s a digital bank designed specifically for your situation.

Looking to make even smarter financial decisions beyond choosing a banking app? PayCape helps you navigate Africa’s complex digital finance landscape with comprehensive reviews, detailed comparisons, and expert recommendations for banking apps, payment solutions, investment platforms, and other financial tools.

Frequently Asked Questions

Based on user feedback and transaction success rates, Moniepoint consistently ranks as the most reliable, particularly favored by businesses for its stability during peak hours and ability to handle high transaction volumes without failing. OPay also receives high marks for rarely failing transactions.

Absolutely! Many Nigerians successfully use multiple banking apps simultaneously to leverage different features and ensure backup options. You can easily manage several digital bank accounts on one phone without any technical issues.

Licensed digital banks regulated by the Central Bank of Nigeria (CBN) are generally safe and provide consumer protection. Always follow best practices like never sharing PINs or OTPs, enabling biometric authentication, and downloading apps only from official stores.

Most online-only banks like Kuda, OPay, PalmPay, and V Bank offer zero maintenance fees as a major competitive advantage over traditional banks. Always check each platform’s fee structure for your specific usage patterns before committing.