Seeing the limitations physical virtual cards have, Changera decided to create a virtual dollar card that would help individuals in their day-to-day transactions. With Changera virtual dollar card, you can pay for purchases online with ease. In addition, if you run ads, you can also make use of Changera virtual cards for payment. Furthermore, Changera doesn’t link its virtual dollar card to its account.

This is done to protect user’s privacy. In this article, you’ll learn all you need to know about Changera virtual dollar card. You’ll also learn how to create and fund your virtual dollar card.

What Is a Virtual Dollar Card?

A virtual dollar card is similar to a physical dollar card. It’s a prepaid card that can be used to make online transactions with ease.

All You Need To Know About Changera

Changera is a virtual dollar card operator that is owned by Bitmama, the company that bought Payday. It is located in Philadelphia, USA. Changera provides virtual dollar cards to individuals in Nigeria, Ivory Coast, Canada, Senegal, Kenya, Ghana, Cameroon, and Uganda. The platform has three plans that users can subscribe to.

These plans are the free, freelancer, and premium plans. Each of these plans has its various benefits. Below are some of each plan.

Free Plan

This plan is forever free; however, you can only access limited features on the Changera app. If you’re using the free plan, you get access to:

- Access to Changera virtual cards with spending limits of up to $5,000 per month

- Gain instant access to 3 crypto wallets on Changera. Receive crypto deposit and convert to fiat

- Purchase or gift airtime and data across the world

- Book flights to anywhere in the world

- Voucher and Bill payments across the world

Freelancer Plan

This plan costs $50 per year and as the name implies, it is best for freelancers. Below are what you get access to:

- Access up to 7 multicurrency wallets

- Perform currency conversions and make payments with the 7 currencies to over 70 countries worldwide

- Access to Changera virtual cards with spending limits of up to $50,000 per month

- Gain instant access to 3 crypto wallets on Changera. Receive crypto and convert to fiat

- Purchase or gift airtime and data across the world

- Book flights to anywhere in the world

Premium Plan

Changera’s premium plan costs $100 per year. The plan has everything in both the free and freelancer plan. As a premium plan user, you gain access to:

- Perform currency conversions and make payments with 15+ currencies, to over 150 countries worldwide

- Access to Changera virtual cards with spending limits of up to $100,000 per month

- Gain instant access to 3 crypto wallets on Changera. Receive crypto deposit and convert to fiat

- Purchase or gift airtime and data across the world

If all you’d like to make use of Changera virtual dollar card is for payment, then it’s best you stick with the free plan.

How Does Changera Work?

Changera is currently available on Google Play Store and App Store. All you need to do is download the app to access the virtual dollar card. However, before you can create a Changera virtual dollar card, you’ll need to open an account if you don’t have one. That’s the only way to claim your card. Additionally, Changera allows users to create a USD, GBP, and EUR account.

If you wish to create an account on Changera, follow the steps below:

- “Download” Changera mobile app from your Play Store or App Store

- Once it’s successfully installed, “Open” the mobile app

- Click on “Sign Up”

- Select your “Country”

- Fill in your details in the Sign Up” form

- Tick the boxes at the far end of your screen and click on “Continue”

- Input the verification code sent to your email and click on “Continue”

- Proceed to create a “Transaction PIN”

- Click on “Continue.” Confirm your PIN and click on “Confirm PIN”

- Click on “Go to dashboard.”

Your Changera account has been successfully created. Now it’s time to create your changera virtual dollar card.

How To Create Changera Virtual Dollar Card

Before Changera allows you to create a virtual card, you’ll be required to complete your verification. For the verification, you’ll need to have either your NIN slip, National ID card, or Driver’s license. Once your verification has been approved, you can go ahead to create your card.

- Select the “Card” tab at the end of your screen

- Click on “Get my virtual card” and click on continue

- Fill in your “User information”

- Click on “Submit details.”

- Input the amount you’d like to fund your virtual dollar card

- Select “Create card.”

- Create a “Transaction pin” and confirm the pin

Your Changera virtual dollar card is ready!!

How To Fund Your Changera Virtual USD Card

Once you’ve created your Changera virtual dollar card or exhausted the amount in your virtual dollar card, it’s important that you fund your card for further transactions. You can fund your card by following the steps below:

- Click on the “Card” menu at the bottom of your screen

- Select “Fund card”

- Input the amount you’d like to fund your card

- Click on “Fund wallet.”

- Your funds will reflect on your card

There’s no limit on Changera virtual dollar card. However, the maximum amount that you can hold at any time is $2500.

My Thoughts On Changera

It was weird that after submitting my NIN slip, I was taken back to the signup page and when I tried completing my verification, I couldn’t; I was shown an error message instead. Also, when I reached out to the customer service team in the app, I was told I’d be responded to in two hours. I sent a message by 6 am, so from this, it’s clear that Changera’s customer service isn’t available 24/7.

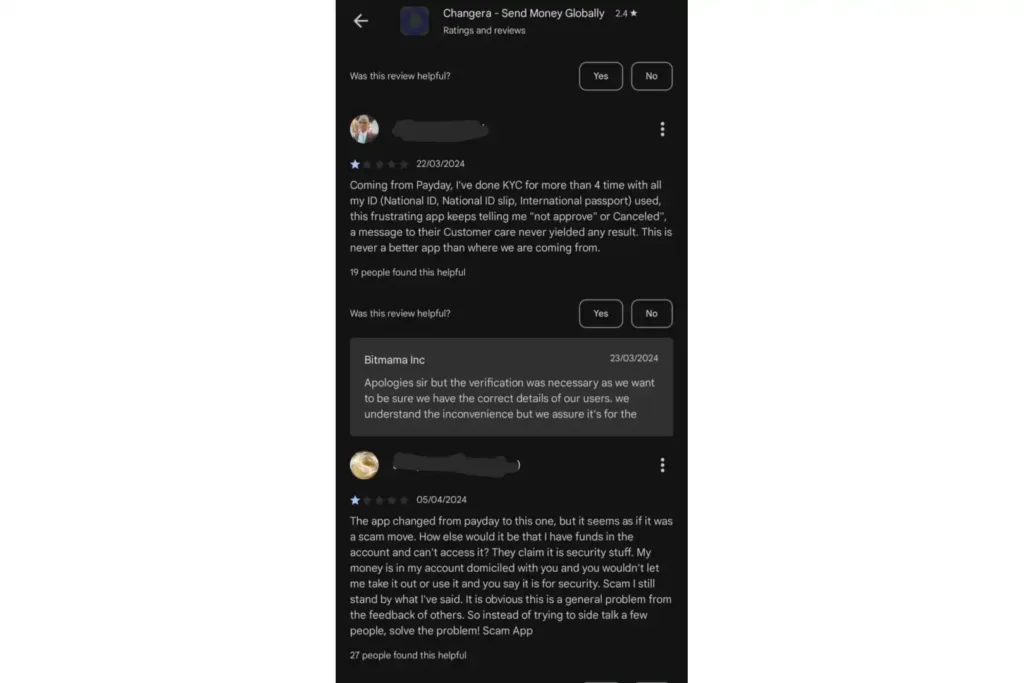

Reviews On Changera

The reviews that were given were mainly about the app. No one talked about the experience using the Changera virtual dollar card. On the Google Play Store, Changera has an app rating of 2.4. Users are really not pleased with the app. Below is a screenshot of some of the reviews.

Conclusion

Changera virtual dollar card offers a convenient and secure way to make online transactions, especially for individuals in countries with limited online payment options. Also, with its three plans – free, freelancer, and premium – users can choose the best option for their needs.

Despite the fact that the app has received negative reviews, the Changera virtual dollar card itself can help make online payments better. To access the card and fund it, all you need to do is follow the steps listed in the article. Lastly, If you encounter any issue while using the Changera virtual dollar card, you can reach out to them at support@changera.co or you can reach out to them on X, Instagram, LinkedIn, or Facebook.

Frequently Asked Questions

Changera charges a card fee of $1 and a funding fee of 1.5 USD for any amount you fund your account with.

There is no daily limit on the Changera virtual card. The maximum amount a card can hold is $2500 and a spending limit of $5000 per month, depending on your Changera plan.

Yes, it does. All you need to do is follow the steps to link your Changera card to your PayPal account.

– Sign in to your PayPal account with your email and password.

– Tap on the wallet link on the left side of the screen.

– Click on “Link a credit or debit card,” then Click on “Credit or Debit card.”

– Enter your Changera card details.

– Click “Link the Card.”

Changera virtual card can be used on all platforms that accept Visa cards like Netflix, Amazon, AliExpress, Prime, YouTube, and so many others. There are no restrictions when it comes to Changera virtual cards.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist