Sometimes, despite the several security measures put in place by Mobile Money Operators in Nigeria, there is always a question of “How authentic is this mobile money platform?”. A simple answer to that is having an MMO that can be traced back to an existing company and that will be Firstmonie. Firstmonie wallet is an affiliate of the First Bank of Nigeria.

Before we look deeper into what the Firstmonie wallet is all about, if you want to know what mobile money operators are and the top in Nigeria, you can take a quick look at that here. Now, let’s take the veil off the Firstmonie app, especially for those thinking of starting their journey with the brand.

The Firstmonie Platform

The Firstmonie platform is one of the bank-led mobile money operators owned by First Bank Nigeria Limited. Unlike other mobile money operators like Palmpay, Paga, and Opay, where there is no physical bank attached to it, with Firstmonie wallet, you are sure that even if you don’t know any agent close by, you can always enter a First Bank branch to complain.

FirstMonie provides financial services to small and medium enterprises that are in underbanked and unbanked areas using their registered agents and businesses. With the Firstmonie wallet, you can send and receive money. You can also pay bills like TV subscriptions, electricity, etc.

Opening a Firstmonie Wallet

Opening an account on Firstmonie is a bit different from other common platforms like PocketApp, KongaPay, etc, which could be, perhaps, because it’s a bank-led mobile money operator. Before walking you through the process of opening a Firstmonie account, you need to know the requirements to open an account.

Requirements for Firstmonie Wallet

To have a Firstmonie wallet, you will need a valid phone number and a Bank Verification Number (BVN) or your National Identification Number (NIN).

The thing you provide when opening your account is your number. An OTP will be sent to your phone number from FirstBank which you will use for verification.

You will be asked to enter your BVN or NIN. Immediately you do, the name linked to the number you provided will be displayed. You will enter your gender, DOB, and email.

You will also be asked to create a PIN for transactions and set three security questions, after which you will have access to your wallet. The phone you provided will be used as your account number.

What Can Firstmonie be Used For?

Just like other mobile payment platforms, you can use the Firstmonie wallet to send and receive money from banks in Nigeria. You can use the Firstmonie app to send money to other Firstmonie wallets, FirstBank accounts, and other banks.

Firstmonie wallet can be used to buy airtime and data subscriptions. You can also make bill payments such as electricity, internet services, etc.

The Limitations of Firstmonie Mobile Banking

One would have thought that Firstmonie, being a subsidiary of the popular FBN, would have some top-tier services, but the reverse is the case. Aside from the design of the app, which is not giving, below are some other things you may not like about the Firstmonie app:

- You cannot make payment for other TV subsc… ops. The information layout is bad there is also not even a menu icon. You would initially think you cannot make payments for other TV broadcast service providers aside from DStv, but you can. You will need to click on “other bills” and select “Cable TV bills” before you can select any TV you want to subscribe to.

- You pay for transfers through the Firstmonie wallet just like you do for the regular banking apps. Unlike other mobile money operators, Firstmonie deducts money from your balance. The only difference is that you get a cashback on each transaction, which isn’t up to the charges.

- You can only add money by sending the funds from your existing bank account and through Firstmonie agents. Unlike other mobile money operators where you can easily add funds to your wallet using your ATM card.

What People Are Saying About Firstmonie?

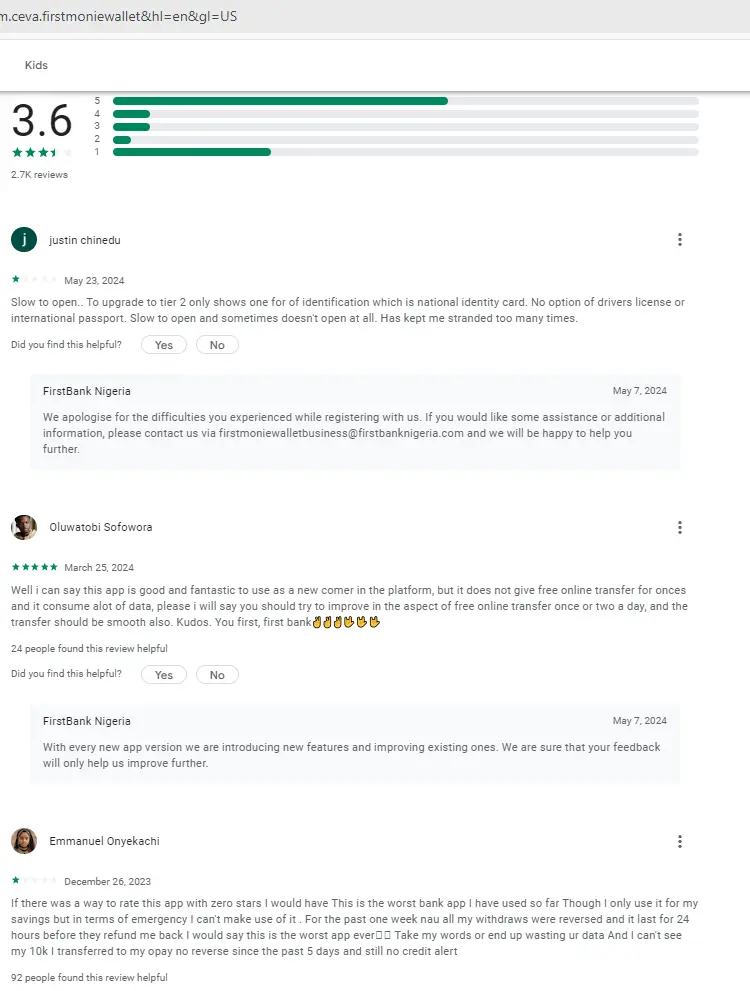

There are 3.6 stars out of over 2700 Google Play Store Reviews for the Firstmonie app. I will personally give it a 2.5/5.

Out of 60 ratings on the App Store, Firstmonie has a 3.1 out of 5. Up to half of the ratings given is a 1 star out of 5.

Final Thoughts

Firstmonie allows users to send and receive money, pay bills, and buy airtime. Though the app interface is basic, it is considered clunky, and it has limitations compared to competitors, such as fees for transfers and limited top-up options.

Ultimately, whether the Firstmonie wallet is a good fit for you depends on your priorities. If security and a traditional banking connection are most important, Firstmonie is a good choice. If a user-friendly interface and extensive features are higher priorities, you might consider exploring other mobile money options. You can download the app from the Google Store or the App Store.

You can also read about other licensed mobile money operators in Nigeria like Kegow, NowNow, Parkway, and Fortis Mobile Money.

Frequently Asked Questions

As mentioned in the article above, the Firstmonie wallet can be used to make payments to different places and organizations, as it is seen on the app. Big payments like electricity bills and even other ones like Linda Ikeji TV payments. You can, of course, send and receive money from/to any bank account in Nigeria. You can also fund your Bet9ja wallet from your Firstmonie wallet.

FirstBank owns Firstmonie, but they are not the same thing. There is another banking app called FirstMobile where you can carry out all transactions on your FirstBank account. You can download FirstMobile for Android here.

Firstmonie Wallet has a license from the Central Bank of Nigeria and also deposit insurance from the Nigeria Deposit Insurance Corporation (NDIC). With this license and insurance, you are sure that your deposits and transactions are safe.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist