Online earning platforms are fast becoming the finance life-saver for many in this age. From getting tech skills for freelancing to starting an eCommerce business, in this day and age, there are several ways to make money online passively and actively. To be honest, with the infrequent inflations, massive layoffs, and economic downtimes, it is important to have a passive source of income.

One passive income source you can take advantage of is online earning platforms. Yes, you read that right. There are online money-earning sites that can bring you streams of income, daily, weekly, or monthly.

It’s not enough to depend on your 9 to 5 job anymore and live from paycheck to paycheck. If the question on your mind is “How can I make $100 a day online?” then you should read this blog.

Wondering how to earn money daily? Let’s find out together!

15 Trusted Online Earning Platforms

The online earning platforms below are unique in their own way. For instance, some platforms are tailored for freelancers and service providers to make money online and some others are great for eCommerce businesses that sell physical and digital products.

You must select an online earning site that aligns with your skills, interests, and goals.

Here are 15 trusted online earning sites that cater to various niches:

1. Upwork

Upwork is a leading freelancing online earning platform where businesses and freelancers connect. From writing and graphic design to programming and marketing, Upwork offers a diverse range of job opportunities.

2. Fiverr

Fiverr is a popular marketplace where freelancers offer services, known as “gigs,” starting at $5. With a wide array of categories, Fiverr allows individuals to showcase their unique talents.

3. Swagbucks

Swagbucks is a platform that pays users for completing online surveys, watching videos, and participating in various online activities. Users earn points (Swagbucks) that can be redeemed for gift cards or PayPal cash.

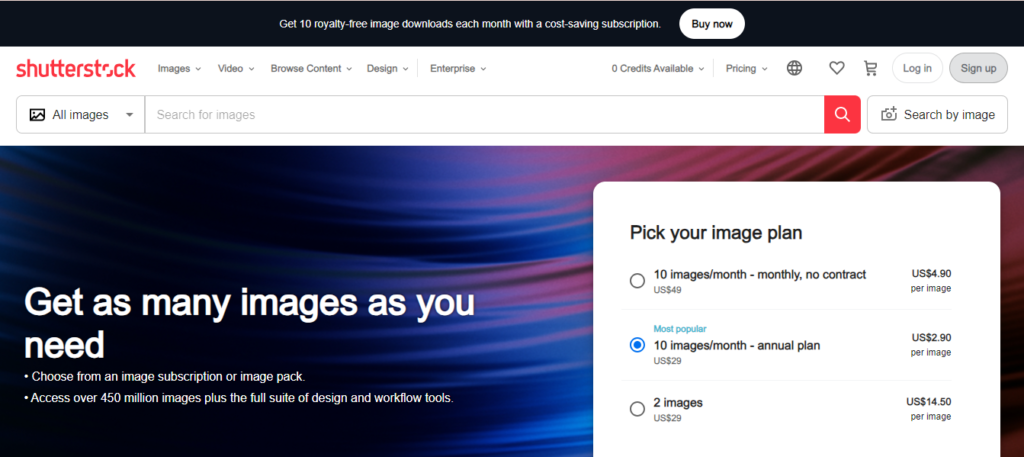

4. Shutterstock

Shutterstock is a stock photography platform where photographers and graphic designers can sell their images. Contributors earn royalties for each download of their photos.

5. Robinhood

Robinhood is a commission-free stock trading platform that allows users to invest in online stocks, ETFs, options, and cryptocurrencies. It’s a user-friendly platform suitable for both beginners and experienced investors.

6. TaskRabbit

TaskRabbit connects users with local freelance labor for various tasks. From household chores to handyman services, TaskRabbit provides an opportunity to earn money by offering your skills and services.

7. Chegg Tutors

Chegg Tutors is an online platform where individuals can offer tutoring services in various subjects. Tutors can connect with students seeking assistance in their studies.

8. Etsy

Etsy is a marketplace for handmade and unique products. Artists and craftspeople can sell their creations, making it an ideal platform for those with a talent for crafting.

9. YouTube

YouTube offers a platform for content creators to share videos and earn money through ad revenue, sponsorships, and memberships. Engaging content and a growing audience are key to success on this platform.

10. Amazon Associates

Amazon Associates is an affiliate marketing program that allows individuals to earn a commission by promoting and selling Amazon products through personalized affiliate links.

11. Remote OK

Remote OK is a job board specifically focused on remote job opportunities. It’s a valuable resource for those seeking full-time or part-time remote work.

12. Rakuten

Rakuten is a cashback platform that allows users to earn money back on their online purchases. When shopping through Rakuten, users receive a percentage of their purchase amount as cashback.

13. Teachable

Teachable is a platform that enables individuals to create and sell online courses. If you possess expertise in a particular subject, you can share your knowledge and earn money through course sales.

14. RealtyMogul

RealtyMogul is a real estate crowdfunding platform that allows investors to pool funds for real estate investments. Users can earn returns through rental income and property appreciation.

15. Patreon

Patreon is a membership platform that enables creators to earn money through subscriptions. Fans can support their favorite creators by becoming patrons and receiving exclusive content.

What are the Best Online Earning Platforms?

Here are some popular online earning platforms across different categories:

Freelancing Websites

- Upwork

- Fiverr

- Freelancer

- Toptal

Gig Economy Jobs

Online Surveys and Reviews

- Swagbucks

- Survey Junkie

- Amazon Mechanical Turk

Stock Photography

- Shutterstock

- Adobe Stock

- iStock

Investing

- Robinhood

- E*TRADE

- TD Ameritrade

Remote Work

- Remote OK

- FlexJobs

- We Work Remotely

Affiliate Marketing

- Amazon Associates

- ClickBank

- ShareASale

Selling Handmade or Digital Products

- Etsy

- Gumroad

- Teachable

Online Tutoring

Real Estate

Content Creation

- YouTube

- Patreon

- Medium (for blogging)

Remote Consulting

Cashback Programs

- Rakuten

- Ibotta

- Honey

13 Daily Online Earning Platforms

Wondering how to make $30 a day? Let’s look at some daily earning websites:

This user-friendly platform offers a simple and intuitive interface for you to pocket some extra cash. Whether you’re watching videos, playing games, or taking surveys, the options are diverse.

The exciting part? You can cash out your rewards through PayPal or snag gift cards from popular retailers like Amazon and Walmart.

If you’re eyeing a few extra bucks during your downtime or aiming for a steady income stream, make sure to explore what Freecash.com has to offer.

This platform pays you to become a secret shopper, letting you visit various businesses and share your experiences. Retail stores, restaurants, or banks – your observations are valuable.

Each assignment brings in a tidy sum, ranging from $5 to $20, making it a rewarding venture.

TryMyUI allows you to transform your spare time into cash by becoming a tester. After a simple sign-up and a sample test, you’re in for paid testing gigs.

Quick, efficient, and paying around $10 per test that takes about 20 minutes – it’s an excellent way to contribute to user interface improvement.

You can share your thoughts on products and services through surveys and market research studies on Trymata. This platform rewards your insights with cash or gift cards, providing a fantastic opportunity to supplement your income.

Whether it’s a special purchase or just adding to your regular earnings, Trymata should be on your radar.

Funds for Writers allow you to earn money online as a writer. You don’t need to be a writing pro to earn $60 per accepted article, each averaging 500 to 600 words. Check out their website, explore the various writing jobs, and turn your passion into a paycheck.

miPic is a platform that turns digital photos into a variety of products. From phone cases to tote bags, you can not only sell your creations but also explore and buy from fellow artists. miPic opens the door for talented photographers and graphic designers to earn from their creativity.

Handy is an app that offers various jobs like cleaning, repairing, and delivery. Create your profile, get hired for tasks around people’s homes, and enjoy weekly payments through direct deposit.

MaxBounty is a platform for affiliate marketers. You can connect with advertisers and earn commissions by promoting various offers, from lead generation to mobile app installs. Known for high payouts and swift transactions, MaxBounty equips you with tools and resources for affiliate success.

Appen is a company that offers diverse remote jobs related to AI. From language data collection to social media evaluation, you can earn up to $15 per hour. Payments are hassle-free through PayPal or direct deposit.

You can earn up to $12 per task with Field Agent. Field Agent is an app that charges for completing tasks like taking photos and filling out surveys. Earn up to $12 per task and receive payments through PayPal or Dwolla.

Validately allows you to earn money daily by participating in user research testing. You can earn money while offering valuable feedback, with daily payments adding to the appeal.

Another online earning site is Clickworker. You can dabble in micro tasks like data entry and copywriting on Clickworker. Clickworker allows you to set your schedule and earn up to $9 per hour. You can receive payments via PayPal.

You can get paid to test websites and apps with UserTesting. Record your screen, provide feedback, and pocket up to $60 per test within 20 minutes. Payments are a breeze through PayPal.

Let’s Make Some Money

As you can see, there are indeed several ways to make money online. There are also several online earning platforms to make money from.

You only need to identify your skills and the right platform. Let’s face it, there is nothing like free money, everyone wants something in return.

One great way to maximize the income you can make from these earning platforms is to have a website. With a website, you can sell your services as a freelancer, implement website monetization strategies, and even sell digital products.

Another way to keep making money online is to invest in online stocks, online mutual funds, Gold, GTA-5, and Cryptocurrency. Online investment offers you enough security and steady online earnings.

No matter what you choose, make sure you do your research and understand the earning platform. One thing you must not fail to do is to learn how to save and plan your personal budget even as you make money from online earning platforms.

Good luck.

Frequently Asked Questions About Online Earning Platforms

Earning online is fast becoming a saving grace for a lot of people around the world. And getting your way around it poses several confusions that need to be cleared. From the general survey, here are some of the frequently asked questions on how to earn money online:

Online earning platforms serve as hubs where individuals can monetize their skills, services, or products. From freelancing to e-commerce and investment opportunities, these platforms facilitate transactions between users and clients or customers, providing a convenient and secure environment for earning money online.

Yes, online earning platforms can be legitimate sources of income, but it’s essential to choose reputable ones. Ensure the platform aligns with your goals, offers transparent terms, and has positive user reviews. Legitimate platforms provide opportunities for users to earn money through various activities such as freelancing, surveys, selling products, or investing.

The skills and qualifications required vary based on the type of online earning platform. For freelancing, skills like writing, graphic design, programming, or marketing are valuable.

Customer service, marketing, and product sourcing expertise may be needed for e-commerce platforms. To optimize your earning potential, learn about the platform’s requirements and make the most of your advantages.

Realistic earnings depend on some factors. The deciding factors include time invested, market demand, and individual skills. While some users earn substantial incomes, others may earn modest amounts. It’s crucial to set realistic expectations, understand the platform’s earning potential, and be willing to adapt strategies to optimize income over time.

Risks include payment delays, platform fees, competition, and potential scams. Mitigate risks by using secure payment methods, researching platforms before joining, and diversifying income streams. Stay vigilant for red flags like unrealistic promises or requests for sensitive information. By understanding and managing risks, you can navigate online earning platforms safely and effectively.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist