In today’s digital era, subscription-based services are booming, but managing subscription billing can be challenging.

Whether you run a startup or an established enterprise, mastering subscription billing is crucial for maximizing revenue, retaining customers, and thriving in the competitive subscription economy.

In this article, we will delve into the key aspects of subscription billing management, including its definition, importance, key components, common challenges, and best practices. Let’s learn!

What is Subscription Billing Management?

Subscription billing management is the process of managing recurring billings for subscription-based services or products.

It entails setting up billing systems, managing customer subscriptions, processing payments, and ensuring accuracy and efficiency in billing procedures.

Businesses that efficiently manage subscription billing maintain a consistent stream of revenue, drive long-term growth in the subscription economy, and improve customer satisfaction.

Importance of Subscription Billing Management

Subscription billing management must be mastered by subscription-based businesses, and here is why:

- Customer Loyalty: Effective subscription billing management provides transparent billing, seamless payment experiences, and priority support for customers, which reduces churn and facilitates customer engagement and loyalty.

- Revenue Stability: Subscription billing management is vital for maintaining a steady stream of revenue for subscription-based businesses. It boosts and stabilizes revenue by automating payment reminders and subscription billing processes.

- Financial Planning: Subscription billing management allows businesses to estimate their revenue, allocate their resources, and make sound financial decisions. Furthermore, effective billing management supports scalability and business expansion by optimizing billing processes and maximizing revenue potential.

- Competitive Advantage: With the subscription business model trending in the global market, businesses that jump on it are positioned for more visibility. Efficient subscription billing management and premium customer experiences therefore give your business a competitive advantage.

- Data-Driven Insights: Subscription billing management provides valuable insights into consumer behavior, allowing businesses to tailor their offerings and improve their marketing strategies.

- Operational Efficiency: Effective billing management improves billing processes by reducing manual workload and human errors.

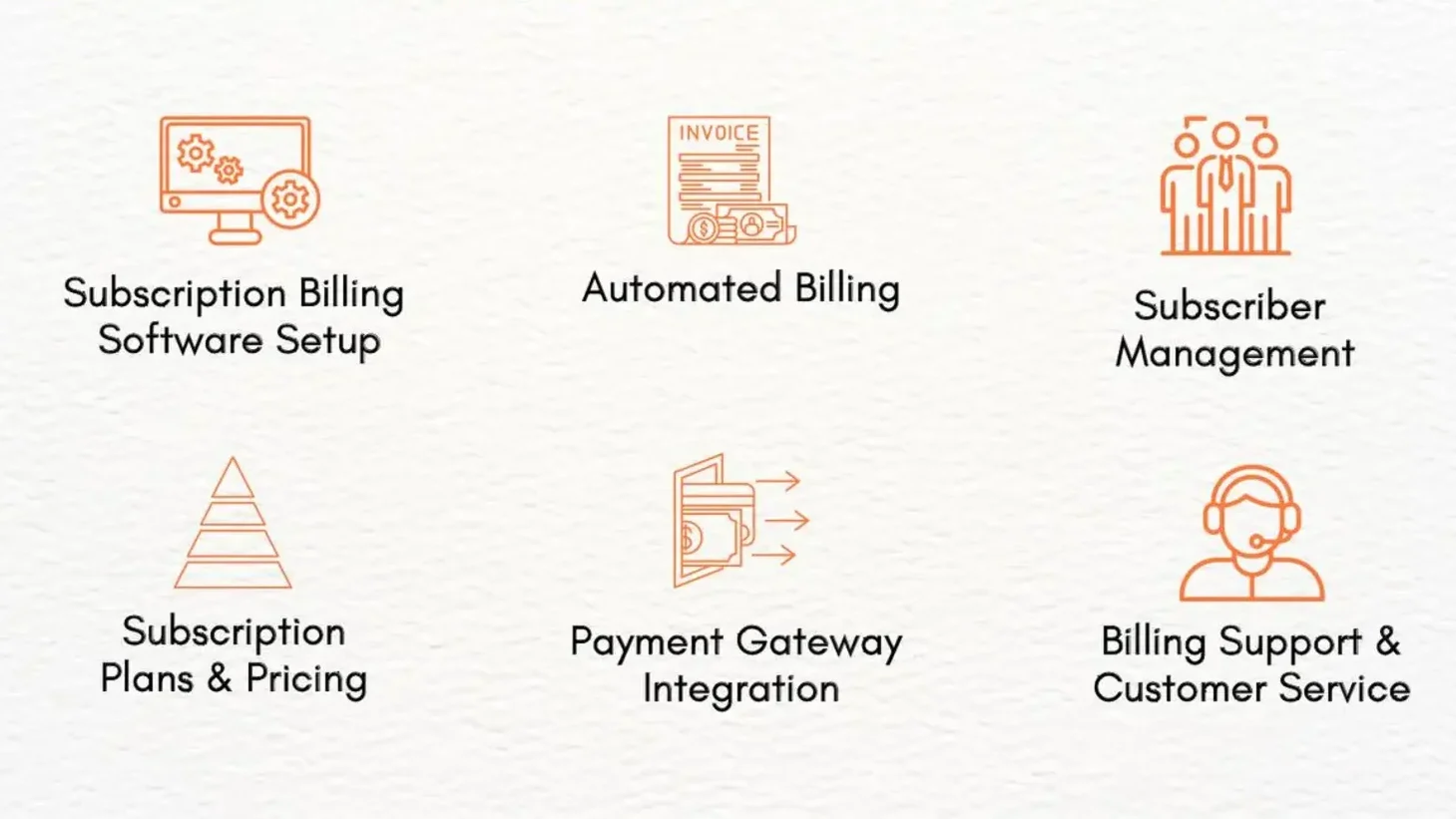

Key Components of Subscription Billing Management

Subscription billing management is like a system comprising vital organs. If one of its organs malfunctions, the system is jeopardized. The following are the key components of subscription billing management that must be effectively handled per time:

Billing System Setup

The first key component of subscription billing management is a robust subscription billing software. You need to set up a subscription billing software that is capable of handling recurring billing cycles, invoicing, payment processing, subscription management, customer management, and revenue tracking. By leveraging the right subscription billing software, your business can reduce administrative overhead, enhance billing accuracy, and improve customer experience.

I wrote an unbiased review of the top 10 subscription billing software in 2024, clearly stating their pros, cons and prices. Click here to find one suitable for your business.

Subscription Plans and Pricing

There are different kinds of subscription plans that businesses can adopt to serve their subscribers. Your business must strive to offer plans that align with your customer preferences and budget. Your pricing strategies must reflect a balance between affordability and profitability.

Types of Subscription Plans or Payment Models

Here are some common subscription plans that you can adopt and even use simultaneously:

- Fixed Recurring Payments: In this subscription payment model, customers pay a fixed sum at regular intervals to access a product or service. It is widely used for services like gym memberships or software subscriptions.

- Usage-Based Pricing: Unlike fixed recurring payments, usage-based pricing models charge clients depending on their use of a service or product. For example, Snowflake Inc. charges its customers based on the usage of computer and data storage.

- Tiered Pricing: The tiered pricing subscription model offers customers multiple subscription tiers with varying features and rates. As a result, customers can choose the tier that best meets their requirements and budget. Zoho Subscriptions, for example, offers standard, professional, premium, and elite tiers with increasing levels of functionality and customer support.

- Freemium Model: The freemium subscription payment model provides a free basic version of a service or product, with the option to upgrade to a paid premium version with more features or functionality.

- Bundle Pricing: Bundle pricing is a subscription payment model where businesses offer multiple products or services as a package at a discounted rate.

Automated Billing

Automated billing is a system that helps businesses automate their billing, invoicing, and payment processes. It reduces manual errors, ensures billing accuracy, saves time, and saves resources.

Use a robust subscription billing software that sends automated reminders to reduce late payments from customers and improve cash flow. It would also send automated bills and invoices to your subscribers.

Payment Gateway Integration

A payment gateway is an online tool that your business can use to securely process payments using different payment methods, such as debit or credit card payments, digital wallets, and bank transfers from customers. It transfers information between the payment portal—such as a website or mobile app—and the payment processor or acquiring bank.

Integrating secure payment gateways can help your business accept various subscription payment methods and currencies, providing convenience to your customers while ensuring transaction security and compliance with payment regulations.

Common Payment Gateways

Some of the most common payment gateways for subscription-based businesses to harness are:

- Stripe: Stripe is an all-in-one payment gateway and processor. It has a comprehensive payment system, easy integration, and supports over 135 currencies. It follows the most stringent PCI DSS security standards. Using Stripe, your business can also customize your customer’s checkout experience.

- PayPal: PayPal is a widely recognized and trusted payment gateway with recurring billing features. It also offers mobile and in-person payment solutions, among other financial services. With its advanced security features, PayPal ensures that your customers’ data remains safe.

- Square: Square is a payment processor that also doubles as a payment gateway. Its end-to-end payment processor streamlines the payment process, from capturing subscriber payment information to making payment to your business account in 1 to 2 working days. It has an intuitive interface and strong security measures.

- Authorize.net: Authorize.net is a reliable payment gateway with subscription billing capabilities. It was named “Best API Integration” for 2 years in a row. Authorize.net accepts payments via credit cards, contactless payments, and eChecks in person and on the go.

- Adyen: Adyen is a payment processor and gateway that processes end-to-end payments. It also manages customer data and finances securely.

Subscriber Management

Subscription management is the process of managing your customers’ subscriptions from sign-up to cancellation. It entails keeping track of customer subscriptions, managing account information, and handling upgrades, downgrades, and subscription cancellations.

If you use an intuitive subscription billing software such as Zoho Subscriptions, you will find subscriber management to be less manual or burdensome. Also, providing self-service options empowers customers to manage their subscriptions themselves, thereby reducing administrative burden.

Billing Support and Customer Service

Customer satisfaction and loyalty are bolstered by responsive customer support, clear communication and transparency in resolving billing disputes. You must ensure, to the best of your ability, that your customers remain satisfied.

Common Challenges in Subscription Billing Management

Heads up! Subscription billing management is not always a smooth sail. Here are some challenges to expect and avoid:

- Billing Errors: Billing errors may occur from time to time owing to manual errors or system glitches, resulting in customer dissatisfaction and revenue loss.

- Failed Payments: Payments may be declined due to insufficient funds, expired cards, or network problems. This disrupts cash flow and requires follow-up for resolution.

- Churn and Subscriber Attrition: Many factors, such as subpar goods or services, high pricing, inefficient marketing, or more alluring offers from other businesses, can cause churn. High churn rates impact revenue and profitability, necessitating efforts to improve customer retention and reduce churn.

- Compliance Risks: Noncompliance with regulatory regulations such as PCI DSS or GDPR may lead to fines, penalties, and reputational damage.

- Subscription Changes: Managing subscription changes, such as upgrades or downgrades, can be tedious. Also, poor subscription management may lead to customer frustration and billing errors.

Best Practices for Subscription Billing Management

Here are some important measures to take to prevent unneeded complications in subscription billing management. They will reduce your worries and make it easier to manage subscription billings.

- Transparent Pricing: To prevent misunderstandings and disagreements later on, communicate pricing, billing cycles, and subscription terms to customers upfront.

- Flexible Billing: To accommodate different customer preferences and budgets, provide flexible billing options, such as monthly, quarterly, or annual billing cycles.

- Automated Payment Reminders: Set up automated payment reminders to reduce late payments and improve cash flow.

- Regular Billing Audits: Conduct regular audits of your billing systems and processes to identify issues and implement corrections.

- Data Security and Compliance: Ensure that you adhere to data protection regulations and implement robust security measures to protect customer billing information.

- Continuous Improvement: If you want your customers to be satisfied, you must be on a continuous growth curve. Acknowledge and work on customer feedback. Also, track key billing metrics, such as ARPU, churn rate, and MRR, to assess business performance, identify trends, and make data-driven decisions.

Tips for Effective Subscription Billing Management

Let me conclude with a few tips for effective subscription billing management. If you don’t learn anything else from this article, remember these tips!

First, invest in reliable and reputable subscription billing software that offers robust subscription management features and end-to-end payment processing.

Second, communicate proactively and explicitly with your customers about billing changes and subscription options. Maintain your integrity in business.

Third, automate your billing processes and enable self-service where possible to improve efficiency and minimize errors.

Fourth, adhere to data protection regulations and compliance requirements to mitigate risks related to data security and privacy.

Fifth, invest in responsive and knowledgeable customer support for billing inquiries and issues. Let your customers attest to the fact that your response time is short and their voices are heard.

Sixth, constantly track your key billing metrics to assess performance, identify trends, and make data-driven decisions. No profit, no business!

Frequently Asked Questions About Subscription Billing Management

What is subscription billing?

Subscription billing is the automated process of billing subscribers at regular intervals, usually monthly, quarterly, or annually, for a continual supply of their preferred goods or services for a period.

What is billing management?

Billing management is the process of overseeing and controlling the entire billing cycle, from creating invoices to receiving payments, in a way that’s efficient, accurate, and customer-friendly.

Effective billing management involves:

- Generating clear and correct invoices.

- Managing different payment methods and channels.

- Tracking and following up on payments.

- Handling disputes and refunds.

- Analyzing billing data to optimize processes.

What is subscription billing software?

Subscription billing software is a solution that automates invoicing and payment processing for businesses. It streamlines invoicing, manages diverse payment plans, coordinates payments and manages adjustments in subscriptions with precision.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist