PayPal is finally fully available in Nigeria, and this time, it’s official. After nearly two decades of restricted access. Nigerians can now send money, receive international payments, and withdraw funds in Naira through a groundbreaking partnership between PayPal and Nigerian fintech giant Paga, announced on January 27, 2026.

If you’re a freelancer, online seller, remote worker, or digital entrepreneur in Nigeria, this is the news you’ve been waiting for. This guide covers everything you need to know about how PayPal works in Nigeria in 2026, including the new PayPal-Paga integration. How to open an account, how to receive payments, and the best alternatives if PayPal still doesn’t meet your needs.

What’s New: The PayPal-Paga Partnership

The biggest update to PayPal in Nigeria is the official PayPal-Paga integration, launched on January 27, 2026. Here’s what changed and what it means for you:

What the Partnership Enables:

- Nigerian users can now receive PayPal payments from over 200 countries, something that was previously blocked

- Funds can be withdrawn instantly in Naira through your Paga wallet

- You can hold balances in USD and spend globally at any merchant that accepts PayPal

- Nigerian merchants can now reach PayPal’s global network of over 400 million users in up to 25 currencies

- You can also receive payments from Venmo users in the United States, since Venmo is interoperable with PayPal

How the PayPal-Paga Integration Works:

To take advantage of this, you simply log into the Paga app, link your existing (or new) PayPal account to your Paga wallet, and you’re good to go. Once linked, you can receive PayPal payments, view your PayPal balance inside Paga, convert funds to Naira, transfer to your Nigerian bank account, pay bills, or spend via Paga’s Visa card.

What is a PayPal Account?

PayPal is one of the world’s most widely used online payment platforms, allowing users to send and receive money, pay for goods and services online, and manage international transactions. It acts as a secure intermediary between individuals, freelancers, eCommerce businesses, and online merchants.

Key features of a PayPal account include:

- Sending and Receiving Money: Transfer funds to friends, family, clients, or businesses globally

- Online Payments: Accepted by millions of merchants worldwide, including Amazon, AliExpress, Adobe, Spotify, eBay, and thousands of others

- Linking Bank Accounts and Cards: Connect your debit/credit card or bank account to fund transactions

- Multi-Currency Support: Send and receive in multiple currencies with automatic conversion

- Security Features: Encryption, fraud detection, and buyer/seller protection for eligible transactions

- Invoicing and Business Tools: Business accounts offer invoicing, payment processing, and eCommerce integrations

- Mobile Apps: Available on iOS and Android for easy account management on the go

How Does PayPal Work in Nigeria in 2026?

Yes, PayPal is fully available in Nigeria. You can verify this by visiting www.paypal.com/ng/home.

Here’s a clear breakdown of what Nigerian PayPal accounts can and cannot do in 2026:

| Feature | Personal Account | Via Paga Integration |

| Send Money | Yes | Yes |

| Shop Online Globally | Yes | Yes |

| Receive International Payments | Still restricted | Yes (via Paga) |

| Withdraw to Nigerian Bank | Not directly | Yes (via Paga in Naira) |

| Open Business Account | Limited | Yes (via paypal.com/ls workaround) |

| Link Nigerian Naira Card | Unreliable | Unreliable |

| Link USD Dollar Card | Recommended | Recommended |

The bottom line: A standard Nigerian personal PayPal account (via paypal.com/ng) is still primarily for sending money and shopping. To receive payments and withdraw to Naira, you need to use the Paga integration or set up an account using a different country code (see below).

What Cards Work With PayPal in Nigeria?

Card linking is one of the most frustrating aspects of using PayPal in Nigeria. Here’s what you need to know:

Cards that work well:

- Virtual USD cards from platforms like Grey, Chipper Cash, or Cleva

- Dollar-denominated debit/credit cards linked to domiciliary accounts (e.g., from Zenith Bank, GTBank, UBA, FCMB, Access Bank)

- International prepaid Visa or Mastercard (note: typically carry higher FX conversion rates)

Cards that don’t work:

- Standard Naira Mastercard or Visa debit cards, these are frequently declined by PayPal due to CBN FX restrictions and PayPal’s anti-fraud systems

- Verve cards are not supported at all

Card Verification Process: When you link a supported card, PayPal will charge approximately $1.95 to verify it. A 4-digit code will appear in your bank transaction description or statement within 1–5 business days. Enter that code on PayPal to complete verification.

How to Open a PayPal Account in Nigeria

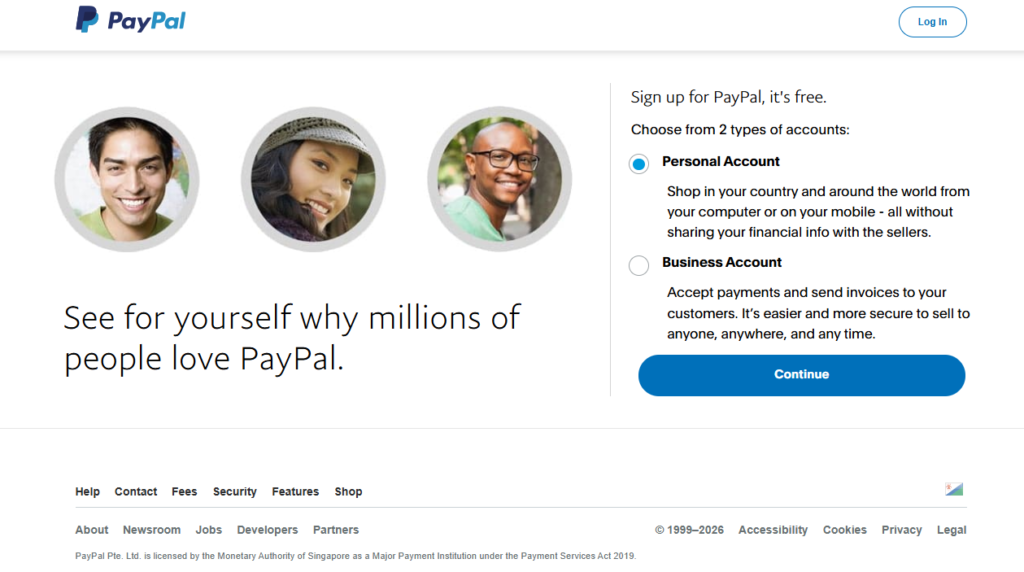

There are two main ways to open a PayPal account in Nigeria, depending on what features you need.

Method 1: Standard Nigerian Personal Account

This is the most straightforward method. Best for sending money and shopping online.

- Visit www.paypal.com/ng/home

- Click Sign Up and select Personal Account

- Enter your details: full name, email address, phone number, and home address

- Verify your phone number via SMS OTP

- Verify your email address by clicking the link PayPal sends you

- Add your USD virtual card or dollar-denominated debit card (Naira cards are unreliable)

- Approve the $1.95 verification charge from PayPal

- Check your bank transaction narration for the 4-digit code and enter it on PayPal

- Add a profile photo and complete your profile

- You’re ready to send money and shop globally

Limitation: With this account, you cannot receive payments or withdraw to a Nigerian bank account. Link it to Paga (see below) to unlock receiving and withdrawal.

Method 2: Full-Featured Account via Paga Integration (Recommended)

This is the best option in 2026 if you want to both send and receive money.

Step 1: Create your PayPal account

Follow Method 1 above, or use a different country code (e.g., www.paypal.com/ls/) to open a Business account with more functionality. The /ls/ (Lesotho) URL trick is a known workaround that allows Nigerians to open a PayPal Business account with receiving capabilities.

Step 2: Link PayPal to Paga

- Download the Paga app (available on iOS and Android)

- Create or log in to your Paga account

- Navigate to the PayPal integration section within the Paga app

- Follow the prompts to link your PayPal account to your Paga wallet

- Once linked, you can receive international PayPal payments directly and withdraw in Naira. If you would like a clearer walkthrough of the setup process, you can explore a detailed beginner’s guide to getting started with PagaTech for additional support.

What you can do with the Paga-PayPal integration:

- Receive payments from clients in the US, UK, Europe, and 200+ countries

- Receive payments from Venmo users in the United States

- View your PayPal balance inside the Paga app

- Convert funds and withdraw in Nigerian Naira instantly

- Transfer to any Nigerian bank account

- Spend via Paga’s Visa card

- Pay bills and merchants within Paga’s ecosystem

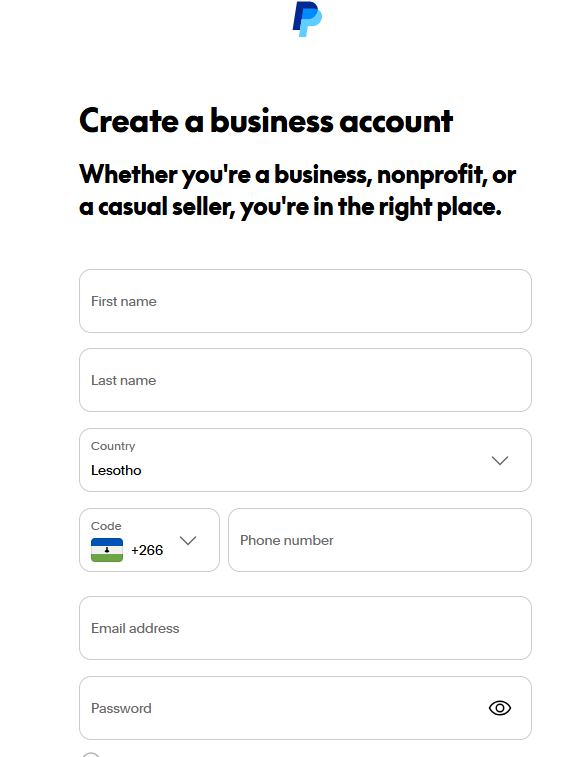

Method 3: Business Account via Alternative Country Code (Advanced)

If you need a standalone PayPal Business account for more advanced merchant features like invoicing and website checkout:

- Open the link www.paypal.com/ls/

- Click Sign Up and select Business Account

- Fill in your personal and business details (business name, type, registration number if available)

- If you don’t have a registered business, you can still proceed, skip business fields where possible, and verify your phone and email

- Add your virtual USD card or a US bank account (available from platforms like Wise or Payoneer)

- Complete verification and fund your account

- Begin accepting payments via invoices, payment links, or website checkout

Important: When using the /ls/ method, currency conversion rates and available features may differ slightly. PayPal also has the right to review and limit accounts that appear to be using country codes inconsistently, so keep your account activity legitimate.

How to Receive Money on PayPal in Nigeria

With the Paga-PayPal integration, receiving money in Nigeria is now genuinely possible. Here’s how:

Via Paga (Recommended):

- Ensure your PayPal account is linked to your Paga wallet

- Share your PayPal email address with the person paying you

- The sender pays you through PayPal as normal

- The payment appears in your PayPal balance and is accessible through your Paga app

- Convert to Naira and withdraw to your Nigerian bank account, or spend directly

Via PayPal Business Account:

- Log in to your PayPal Business dashboard

- Navigate to Pay & Get Paid

- Choose how to request payment:

- Share your PayPal email for direct transfers

- Use your PayPal.me link

- Send a PayPal Invoice to your client

- Add PayPal Checkout to your website

- Receive payment and withdraw via linked USD card or US bank account (Wise/Payoneer)

How to Withdraw From PayPal in Nigeria

Via Paga (Easiest Method):

- Open the Paga app and access your linked PayPal balance

- Select the option to convert and withdraw

- Choose to receive in Naira

- Transfer to your linked Nigerian bank account

- Funds typically arrive instantly or within a few minutes

Via USD Card or US Bank Account:

- Ensure a virtual USD card or US bank account (Wise/Payoneer) is linked and verified in your PayPal account

- Click Transfer Money on your PayPal dashboard

- Select In Minutes (Instant Transfer) or 1–3 Days (Standard Transfer)

- Follow the prompts to complete the withdrawal

- For instant transfers, funds appear within minutes; standard transfers take 1–3 business days (possibly up to 5 depending on your bank).

PayPal Business Account in Nigeria

A PayPal Business account is the best option for freelancers, online sellers, digital service providers, and eCommerce merchants who need to:

- Issue professional invoices to international clients

- Accept payments via PayPal Checkout on a website

- Access merchant tools and reporting features

- Reach 400+ million PayPal users worldwide

With the 2026 Paga partnership, Nigerian merchants can now settle international PayPal payments locally in Naira through Paga’s infrastructure. This is a major development for Nigerian SMEs, Upwork/Fiverr freelancers, and anyone selling digital products globally.

To set up a PayPal Business account in Nigeria:

- Use the /ls/ URL method described above, OR

- Open via paypal.com/ng and upgrade to a business account where available, then connect to Paga for receiving capabilities

PayPal Fees in Nigeria

PayPal charges fees for certain transactions. Here’s what to expect in Nigeria:

- Sending money (personal): Free when funded by PayPal balance or bank account; fees apply when using a card

- Receiving payments (business): Typically 2.9% + $0.30 per transaction for goods and services payments (international rates may vary)

- Currency conversion: PayPal adds a conversion spread (typically 3–4% above the base exchange rate)

- Paga withdrawal fees: Paga may charge a small fee for converting and withdrawing PayPal funds. Check the Paga app for current rates

- Instant Transfer fee: A small percentage may apply for instant transfers via card.

Frequently Asked Questions

Can I receive money with PayPal in Nigeria?

Yes! As of January 2026, Nigerians can receive international PayPal payments by linking their PayPal account to a Paga wallet. This was not possible with standard Nigerian PayPal accounts before the Paga partnership.

Can I withdraw PayPal money to my Nigerian bank account?

Yes, through Paga. Once your PayPal account is linked to Paga, you can convert your PayPal balance to Naira and transfer it to any Nigerian bank account.

Which Nigerian banks work with PayPal?

No Nigerian bank directly integrates with PayPal for withdrawals. However, dollar-denominated cards from banks like GTBank, Zenith, UBA, Access Bank, and FCMB can sometimes be used to link and verify a PayPal account for sending purposes. For withdrawals, use Paga.

Can I use a Naira card with PayPal in Nigeria?

Naira debit cards (including Naira Mastercard and Verve cards) are generally not accepted by PayPal. Use a virtual USD card (from Grey or Chipper Cash) or a dollar-denominated card from a domiciliary account for best results.

What is the PayPal-Paga partnership?

Announced on January 27, 2026, PayPal and Paga (Nigeria’s leading mobile payments platform with 21 million+ users) formed an official integration. Nigerian users can now link their PayPal accounts to Paga wallets to receive international payments and withdraw in Naira, something previously unavailable.

Final Thoughts

PayPal’s return to Nigeria through the Paga partnership is a landmark moment for Nigerian freelancers, digital entrepreneurs, and online businesses. After nearly two decades of being locked out of receiving international payments, Nigerians now have a legitimate, functional pathway to access PayPal’s global payment network.

That said, it’s important to stay realistic. Nigeria’s homegrown fintech ecosystem, including Paystack, Flutterwave, Paga, Payoneer, and others, built powerful alternatives during PayPal’s absence. The best approach in 2026 is to use PayPal where your clients or platforms require it, while keeping alternatives handy for the best rates and reliability.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist