As a freelancer or small to medium-sized enterprise (SME), making transactions with foreign payments can be very difficult and tiring. This is due to local banks’ high exchange rates and foreign currency limits.

Thankfully, Wise bank account offers an efficient solution designed to help you send and receive money with a low conversion fee and access to multiple foreign currencies. In this detailed guide, we’ll explore how Wise accounts can help send and receive money across multiple currencies more easily.

What Is A Wise Bank Account?

Regulated by federal and state regulators, Wise provides solutions for business owners and freelancers to transact in foreign currencies.

As a foreign account provider, Wise bank account offers a low-cost and flexible way to help you send and receive money across multiple currencies, holding more than 40+ currencies in one account.

Available for both personal and business use, wise bank accounts use the mid-market exchange rate and charge fees starting from 0.35 for currency exchange.

Getting Started With Wise Bank Account

How To Create a Wise Bank Account?

Creating a Wise bank account is so easy. Here are the detailed steps to follow.

- Download the wise app from the Play Store or Apple Store.

- Click on “Get started.”

- Input your “Email address” and click “Next.”

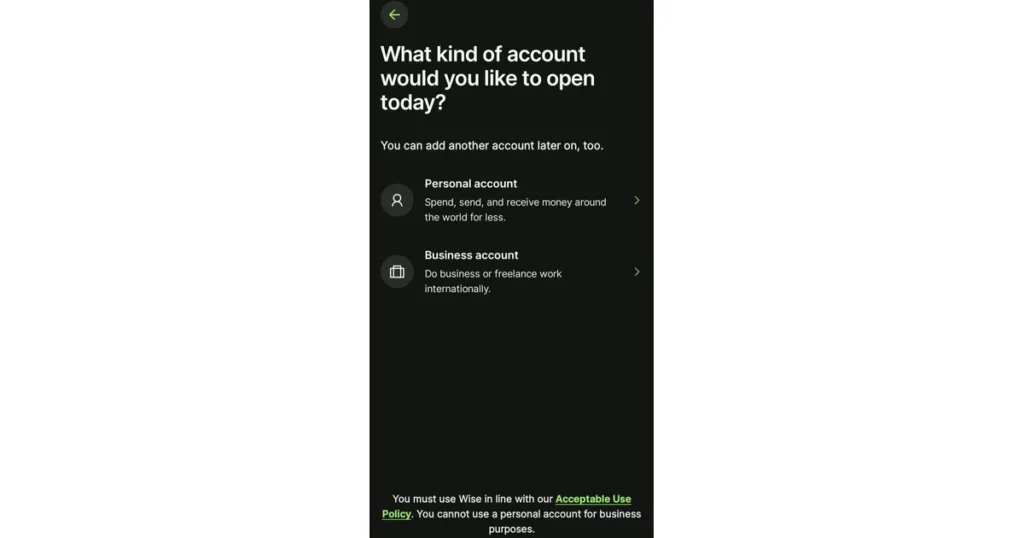

- Select the type of account you want to open “Personal or Business.”

- Input your “Country of residence” and Click “Next.”

- Input your “Phone number.”

- A one-time password will be sent to your number. Enter the “OTP” and click “Next.”

- Confirm your “Personal information” and “Upload a valid ID Document” for verification.

- You can top up your account immediately and get your Wise virtual card for a one-time fee (optional).

An email notification will be sent to you once your Wise international bank account has been verified.

Can I Have a Multiple Wise Bank Account?

No, you can’t, but you can have multiple account details bottled up in one account.

How Long Does It Take To Verify Your Wise Account?

Wise can verify your account in 2 or 3 days once your documents are checked. If you do not receive a notification within 5 days, contact the Wise help centre.

How To Transfer Money With Wise Bank Account

- Sign into your Wise account.

- Click on “Send” on the homepage.

- Select where you want to send money from.

- Input the “Amount” you want to send.

- Input the “Recipient Name” or click on “Add Recipient.”

- Review the details of your transfer.

- Click “Confirm and Send.”

Your transfer will be confirmed via email notification.

How Do I Receive Money In My Wise Account?

You can receive money in your Wise account in three ways which are:

- Sharing your account details

- Payment request

- Receiving payment to your Wise virtual card.

Getting Started With Wise Business Account

How To Open A Wise Business Account?

Opening a Wise business account can help you send and receive money, especially if your business involves international transactions. This guide will walk you through opening a Wise business account.

- Download a wise app from the Google Play Store or Apple Store.

- Input your “Email address.”

- Select “Business account.”

- Fill in your “Personal information” and “Business details.”

- Upload your “ID Document.”

Once your verification is complete, you will be sent an email notification.

What Do I Need To Open A Wise Business Account?

The requirements to open a Wise business account depend on the business type. In general, you will need;

- Your business name and address.

- Details about what your business does.

Wise Account Fees And Pricing

Wise bank accounts only charge you for what you use. There are no subscription or monthly charges and no hidden charges. Here is a list of Wise charges below;

Account Registration

- Wise account registration is free.

Sending Money

- Sending payment fees is from 0.33%, depending on the currency being sent.

Spending With Your Card

- Withdrawal of 200 GBP per month/ per account is free in 2 or less withdrawals.

- The Wise virtual card fee is 7 GBP with no subscription.

- A fee of 0.33% will be charged for money conversion.

- Account top-up transactions charge up to 2%.

- ATM withdrawals that exceed $200 per month are charged a fee of 0.50 per withdrawal plus 1.75% of the money withdrawn.

Receiving Money

- Receiving accounts in different currencies incurs no fee.

- Receiving local transactions (non-wire/non-swift) incurs no charges.

- The fixed fee for receiving USD wire payments per transaction is 6.11 USD.

- The fixed price for receiving CAD swift payments is 10 CAD.

- Receiving swift payments in 21 currencies requires no fee, but the correspondent bank might charge a fee.

Holding Money in Your Account

- Holding up to 40 or more currencies in your account requires no fee.

Can I Hold Multiple Currency In My Wise Account?

You can hold and send more than 40 currencies from your Wise bank account. Wise shares this feature with Payoneer, a foreign bank provider.

Pros and Cons of Wise Bank Account

Below are the pros and cons of using Wise bank account to receive and make payments internationally:

Pros

- The mid-market exchange rate is employed by the Wise bank account.

- Wise bank offers a variety of multi-currency and international options.

- Available for both personal use and business customers like freelancers.

Cons

- Wise bank accounts do not have all the features a bank has.

- Loans, credit, and overdraft options are unavailable on the Wise platform.

- Fees and features in wise accounts may vary according to the user’s location.

Reviews On Wise Bank Account

Aside from reviews on the Google Play Store, other users made comments on Trustpilot. One of the users said, “Wise bank account is simple, useful and has a clear user interface design. On top of that I had a fast transaction process in international transfers. It’s one of those services I truly recommend to my family and friends.”

My Thoughts on Wise Account

My experience with the Wise platform wasn’t so bad. I enjoyed using it, especially considering that I could receive different currencies in my account. Thankfully, the Wise platform is suitable for freelancers like me.

I did not like that they don’t offer virtual card services in certain countries, such as Nigeria, Somalia, Ethiopia, Côte d’Ivoire, Kenya, and some other African countries. This can be a disadvantage for business owners in those regions.

Final Thoughts

Wise is a foreign account provider suitable for freelancers and business owners. Wise Bank offers the best foreign exchange using the mid-market exchange rate. With its features of holding up to 40 currencies and its ability to send and receive money from over 150 countries, freelancers and SMEs wouldn’t find it difficult to receive payments.

Frequently Asked Questions

1. Can I Deposit Naira On Wise?

Yes, you can add money in Naira or any supported currency of your choice.

2. Can I Use Wise As a Business Account?

Definitely, you can. Wise International Bank offers two types of accounts: a personal account and a business account for freelancers, entrepreneurs, and business owners.

3. How Much Money Can I Hold In My Wise Account?

There is no limit on how much your Wise account can hold for most currencies. However, there are exceptions for users receiving USD with a routing number starting with 026. The exceptions are:

- The personal USD limit per year is 35,000,000, while the USD limit per transaction/per day is 20,000,000.

- The business limit for USD per year is 150,000,000, while the USD limit per transaction/per day is 50,000,000.

4. Is Wise Better Than Revolut?

Wise Platform and Revolut offer various financial benefits. A Wise bank account is a simple way to transact internationally, while Revolution offers full banking options and amazing features.

5. What Requirements Do I Need to Open A Wise Bank Account?

You will need a photo of your identification documents, proof of address, and a photo of you holding your Identification document.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist