Do you want to know more about the Cardify Africa virtual dollar card? I’ve taken the time to share all we know in this detailed article. From how to create an account to how you can claim your Cardify Africa virtual dollar card, you’ll find that all here. Additionally, I’ll be letting you know our thoughts and what the audience has to say about the Cardify Africa virtual dollar card.

But first..

What Is Cardify Africa?

Cardify Africa is a virtual dollar card operator that issues users within Ghana and Nigeria a virtual dollar card to pay for goods and services online. It also lets you spend, exchange, buy, and save money. To access Cardify, all you need to do is download the Cardify mobile app from the Google Play Store or App Store.

How Does Cardify Africa Virtual Dollar Card Work?

You’ll have to fund the Cardify Africa virtual dollar card before it works. However, it’s impossible to find your card if your registration process isn’t complete. To learn more about how to get your Cardify virtual dollar card working, keep reading.

How To Open A Cardify Africa Account

Before you can claim your Cardify Africa virtual dollar card, you’ll need to open an account with them. Cardify Africa allows you to own NGN/GH, USD, and GBP accounts. So, if it’s your first time learning about Cardify, you can follow the steps below to open an account:

- Download the Cardify mobile app from Google Play Store or App Store

- Open the “Cardify Africa mobile app” on your device

- Click on “Register an account.”

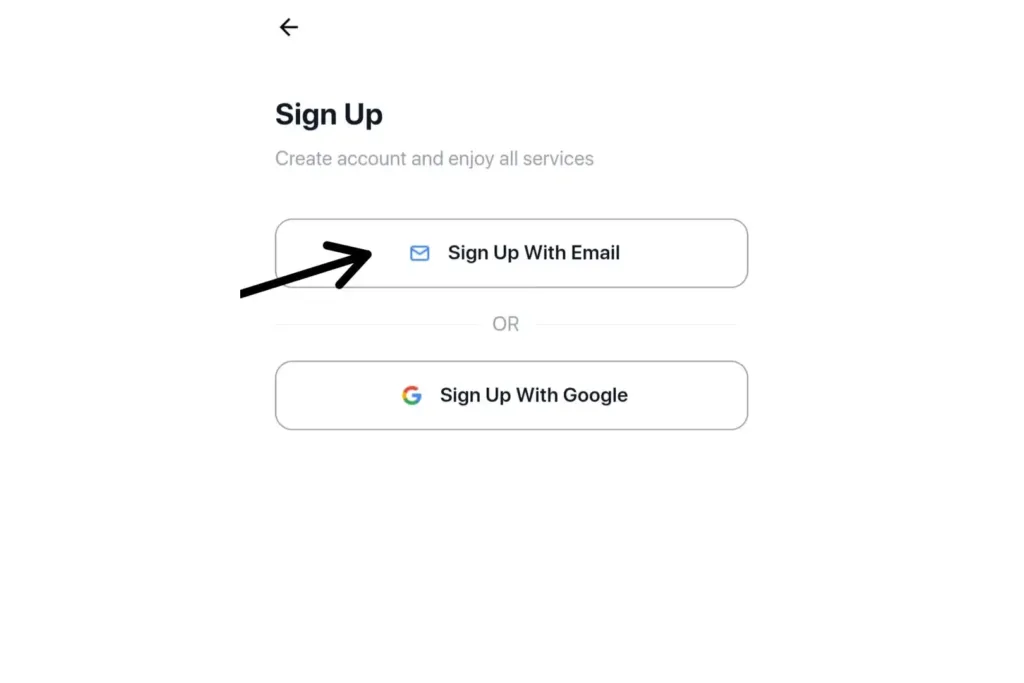

- Sign Up using “Your Email”

Note: Cardify Africa doesn’t allow signing up with your Google account. Also, when signing up with your email address, you’ll need to put your phone number.

- Put in a “Valid phone number”

- Fill your details in the “Sign Up form,” tick the box, and “Register.“

- Input the OTP sent to your number and click on “Verify phone number.”

Your Cardify account is ready.

How To Fund A Cardify Account

Below are the steps to follow if you’re trying to fund your Cardify Nigerian or Ghanaian account:

- Click on your “NGN or GH account”

- Select “Deposit”

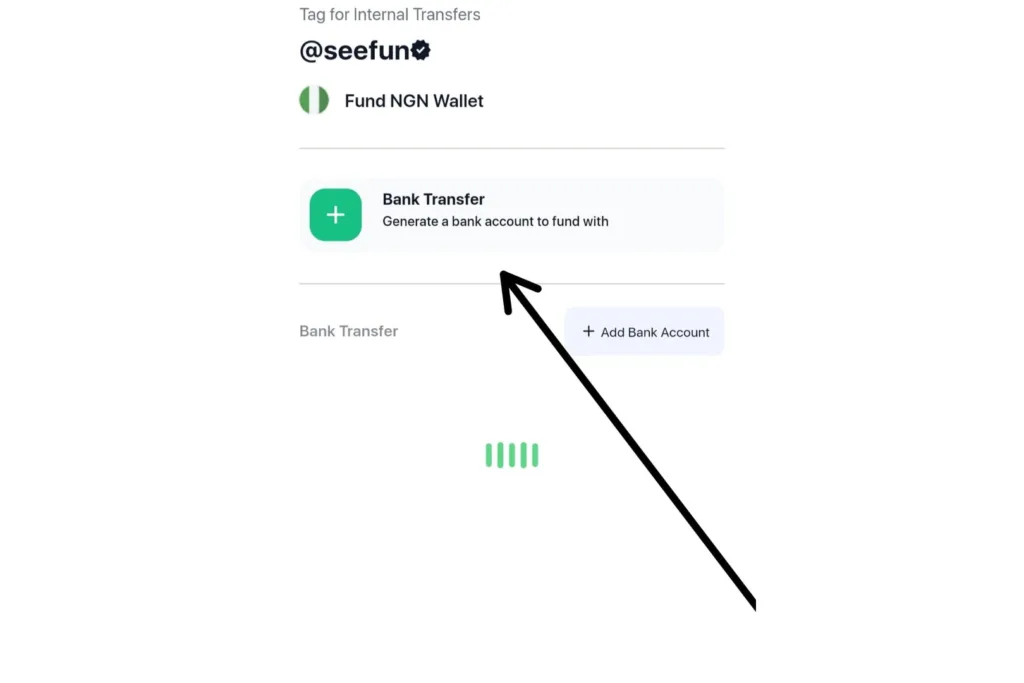

- Click on “Bank transfer”

Note: If you haven’t verified for level 2, you’ll need to do that before you can proceed

- When the message pops up, “Click here”

You’ll be taken to a page where you’ll see the requirements for level 2 verification

- Click on “Continue.”

- Select “BVN” verification, then input your BVN

If the number you used for your BVN is no longer in use, you can verify your account manually

- Proceed to do your “2FA”

- Then go back to fund your account

After you’ve selected bank transfer, the system will generate a dedicated account for you

- Transfer the amount you’d like to fund your account with

- Refresh the page, and your money will be added

How To Fund Cardify Africa Dollar Account

- Click on “USD account”

- Choose “Deposit”

- Click on fund wallet with “Stablecoins”

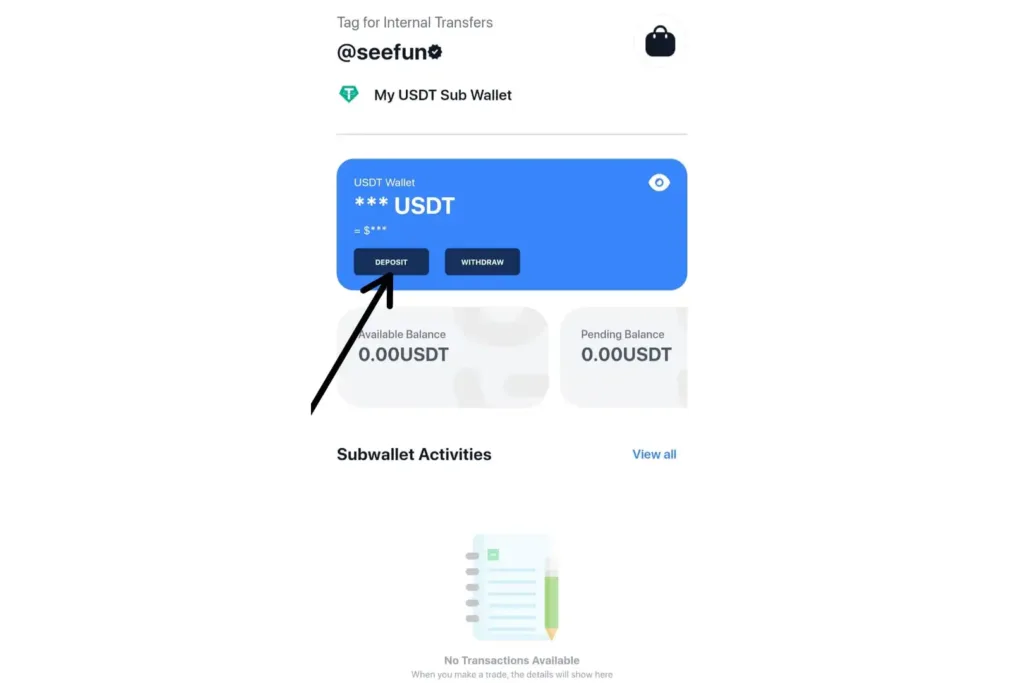

- Cick on “USDT wallet”

- Click on “Deposit”

- Select “address” provided

- Open your digital wallet and scan the code provided or input the address

Note: You can only send USDT TRC20

How To Swap Your NGN To USD

If you don’t have access to cryptocurrency, you can swap your Naira or Ghana cedis for USD all you need to do is follow the steps below:

- Click on “Swap”

- Input the amount you’d like to swap

- Click on “Proceed”

How Can I Create and Fund Cardify Africa Virtual Dollar Card

Cardify Africa has various virtual dollar cards that users can choose from. The card fee for the basic dollar card and standard card is the same. To get the Deluxe dollar card, you’ll have to pay extra. Below are the steps to follow to create your Cardify Africa virtual dollar card:

- At the bottom of your screen, click on “Cards.”

- Select the card you’d like to “Create”

- Select the wallet you’d like to fund your card from

- Input the amount you’d like to fund your card

- Put in your “PIN”

- “Tick” the box just before the create tab

- Click on create

If you wish to get a Deluxe dollar card, you’ll have to verify your account by submitting your ID card; it can be your National ID, Voter’s card, International passport, or Driver’s license.

Additionally, the amount you need to create your Cardify basic and standard virtual dollar card is a minimum of $8. $3 is for the card issuance fee and funding fee. The extra $5 is the least amount you can fund your card.

Reviews On Google Play Store About Cardify Africa

From a review on Google Play Store, a user complained that the card couldn’t be used to make a payment for a purchase that cost $1. Another user complained that the card was rejected when they tried to make a purchase, and after 24 hours, their money was deducted and hasn’t been refunded.

Others complained that their help desk was poor and that sometimes their money was deducted without explanation(it’s important to note that Cardify Africa stated that they had no card maintenance fee). On the other hand, those who found this platform useful were those who used the account to send and receive money. Only a few people spoke about the swift payment they received when they used the card for online payment.

My Thoughts

When I made use of Cardify Africa, the onboarding process was straightforward. However, I didn’t like the idea of being asked for my phone number when I was asked to sign up using my email address. Also, I didn’t like the fact that for every action I take on the app, messages are sent to my phone number.

Furthermore, the steps needed to find my dollar and Naira accounts were quite stressful. The designated account number I was meant to transfer to didn’t show up. Well, if you still want to find your NGN account, you need to have a lot of patience in order to understand how it works. I didn’t have that much patience.

Conclusion

Cardify Africa virtual dollar card can help you with various payments online. If you need any help, you can reach out to their customer support on the mobile app. Additionally, endeavour to do proper research before deciding to settle for Cardify Africa virtual dollar card operator. If you’re a crypto trader, you can make use of this app to save your coins.

Frequently Asked Questions

You can fund your Cardify Africa virtual dollar card using your NGN or USD wallet (Binance Pay, BUSD, USDT, and any other option). This allows you to change and assign funds to your card.

Yes, it does, you can use the Cardify Africa virtual dollar card on any platform, including AliExpress. All you need to do is fund your card, shop, and enjoy swift and secure transactions.

Cardify Africa was founded and owned by Tunde Ibrahim Aderemi who is widely known as Tunde Buremo.

For any issues you might come across in the process of using the app or the virtual card, you can reach out to their support team at support@cardify.co.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist