If you find yourself spending more money than you’re making, then it’s time to get on a budget. Learning how to create a budget will help you track how you spend money monthly and keep your expenses in check.

From eCommerce businesses and brick-and-mortar store owners to freelancers and professionals, everyone needs a budget. Let’s be real, creating a budget is a proactive step toward financial health.

Without a budget, it’s easy to lose track of where your money goes. Learning how to create a budget will give you a roadmap for your spending. It will also help you achieve your financial goals and ensure that you live within your means.

Now, there are several types of budgets, from zero-based budgets and personal budgets to capital budgets and operating budgets, depending on what you need them for. Each of these budgets has the singular aim to help you manage the way you spend.

Creating a budget is not just about restricting your spending. It’s a strategic plan that empowers you to allocate your financial resources effectively.

Let’s look at how to create a budget plan and some budget templates you can use.

How to Create a Budget Plan

Creating a budget plan is a pivotal step towards managing your finances effectively, achieving your financial goals, and ensuring long-term financial stability.

Here’s a step-by-step guide on how to create a comprehensive budget plan:

1. Define Your Financial Goals

Before diving into the numbers, take a moment to articulate your financial goals. Whether it’s saving for a down payment on a house, starting a SaaS business, learning new tech skills, or building an emergency fund, knowing your destination will guide your budgeting journey.

2. Assess Your Income

Start with a clear understanding of your income. Include your salary, bonuses, side gig earnings, or any other sources of income. This forms the foundation upon which your budget will be built.

3. List Your Expenses

A detailed list of expenses is the backbone of your budget. Categorize them as fixed (unchanging) and variable (flexible). Fixed expenses include essentials like rent and utilities, while variable expenses encompass discretionary spending such as entertainment and dining out.

4. Prioritize Your Expenses

Not all expenses are created equal. Prioritize them based on necessity. Essential fixed costs, like housing and utilities, should be addressed first, followed by discretionary spending.

5. Allocate Funds

With a clear understanding of your income and expenses, allocate specific amounts to each category. Start with essential fixed costs, then move on to variable expenses and financial goals. The key is to ensure that every penny has a purpose.

6. Create a Spending Plan

Once you’ve allocated funds to different categories, it’s time to create a spending plan. This plan outlines how you intend to spend your money throughout the month. Be realistic and ensure that your plan aligns with your financial goals.

7. Monitor and Adjust

Budgeting isn’t a set-it-and-forget-it activity. You must regularly monitor your spending against your budget. If you notice discrepancies or changes in your financial situation, be prepared to adjust your budget accordingly. Flexibility is key to maintaining a successful budget.

8. Emergency Fund

Including an emergency fund category in your budget is crucial. Life is unpredictable, and having a financial cushion can prevent budgetary disasters when unexpected expenses arise. Aim to build an emergency fund that covers three to six months’ worth of living expenses.

9. Savings and Debt Repayment

Prioritize contributions to savings and debt repayment in your budget. Whether you’re saving for a specific goal or working on eliminating debt, allocating funds to these categories ensures progress towards financial stability.

10. Review and Reflect

Periodically review your budget to assess its effectiveness. Reflect on your financial goals and whether your budget aligns with your evolving needs. Adjust categories, reallocate funds, and celebrate milestones as you progress on your financial journey.

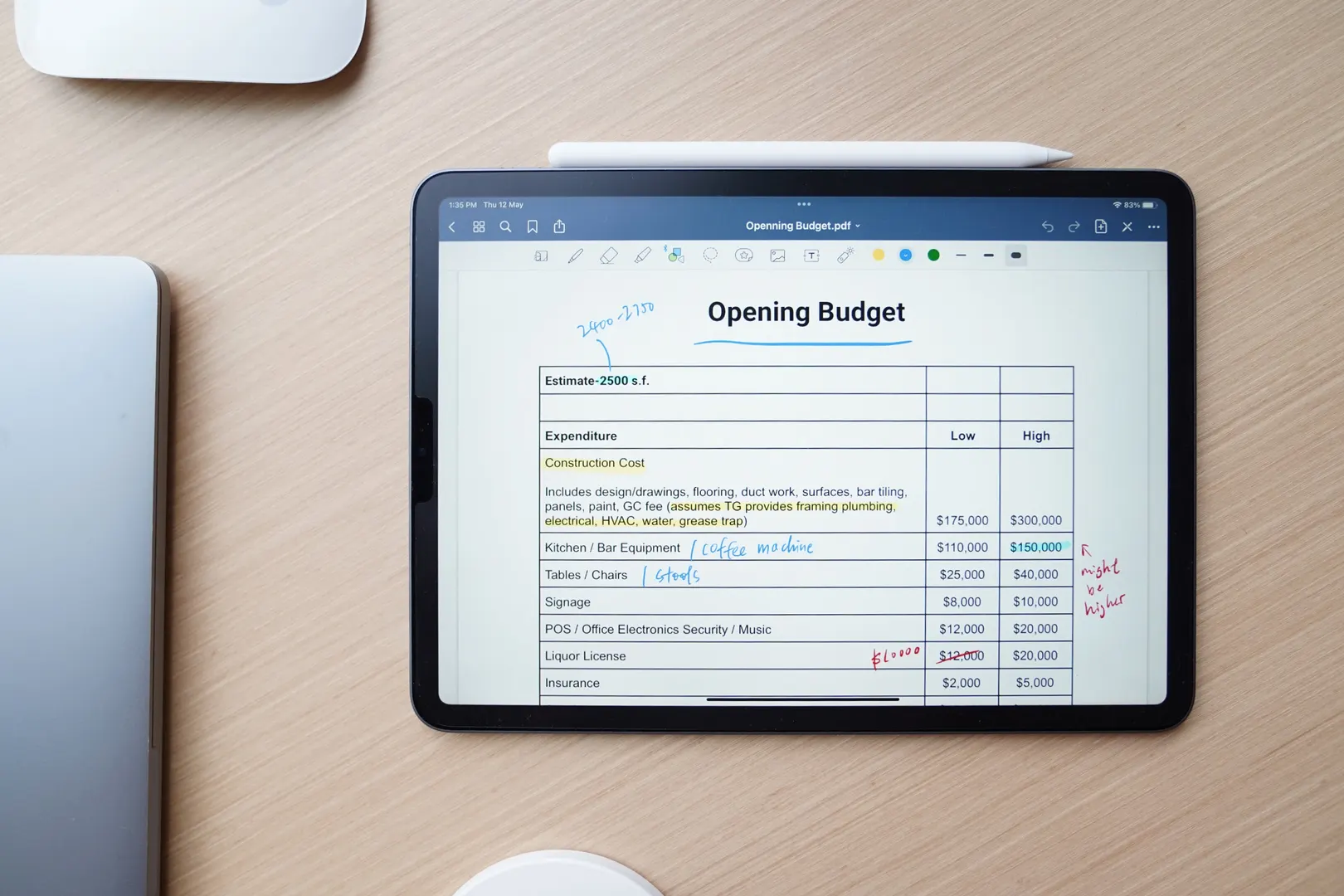

11. Use a Budget Template

Using a budget template is a great idea. You can use the template to organize your income, expenses, and allocations. Templates provide a visual representation of your financial plan and make it easier to track and manage your budget. There are several free budget templates you can download online.

12. Automate if Possible

Consider automating your savings and bill payments. Setting up automatic transfers to savings and automating bill payments ensures consistency and helps you avoid late fees.

13. Seek Professional Advice

If you find budgeting challenging or have complex financial situations, consider seeking advice from financial professionals. They can provide guidance on budgeting strategies, goal setting, and overall financial planning.

14. Stay Consistent

Budgeting is an ongoing process. Stay consistent with your budgeting habits, and regularly revisit and adjust your plan as needed. Consistency is key to long-term financial success.

15. Track Your Expenses

Keep a close eye on your spending by tracking expenses regularly. This can be done manually or by using budgeting apps that categorize your expenditures. Understanding where your money goes is crucial for effective budgeting.

How to Create a Budget Spreadsheet

Creating a budget spreadsheet is an excellent way to organize and track your income, expenses, and financial goals.

Here’s a step-by-step guide on how to create a budget spreadsheet using a common tool like Microsoft Excel or Google Sheets:

1. Open a New Spreadsheet

Open a new spreadsheet in Microsoft Excel or Google Sheets.

2. Create Basic Categories

Label the first column with categories such as “Income,” “Fixed Expenses,” “Variable Expenses,” “Savings,” and “Debt Repayment.”

3. Set Up Rows for Each Category

In the rows beneath each category, leave space for itemizing specific income sources or expenses.

4. Label Columns

Label the columns across the top with months or weeks, depending on the frequency of your budgeting (e.g., January, February, etc.).

5. Input Income

Under the “Income” category, list all sources of income for each month. This could include your salary, bonuses, side gig income, or any other sources of money.

6. Input Fixed Expenses

In the “Fixed Expenses” category, list recurring monthly costs such as rent/mortgage, utilities, insurance, and loan payments.

7. Input Variable Expenses

In the “Variable Expenses” category, list discretionary spending like groceries, entertainment, dining out, and transportation. Estimate amounts for each category based on your past spending habits.

8. Allocate for Savings

Create a section for savings. This can include emergency funds, retirement savings, or other specific savings goals. Allocate funds based on your financial goals.

9. Allocate for Debt Repayment

If you have outstanding debts, create a section for debt repayment. Allocate funds to repay debts strategically.

10. Formula for Totals

In the last row of each category, use the sum formula to total the amounts for each month. This will give you an overview of the total income, expenses, savings, and debt repayment for each period.

11. Visualize with Charts (Optional)

To make your budget more visually appealing and easy to understand, consider creating charts or graphs summarizing your financial data. This step is optional but can enhance the clarity of your budget.

12. Include a Contingency Fund

Reserve a portion for a contingency fund to account for unexpected expenses. This will provide a safety net for any unplanned financial needs.

13. Add Notes or Comments (Optional)

Use the comment feature to add notes or comments on specific entries. This can be useful for providing explanations or reminders about certain transactions.

14. Format for Readability

Format your spreadsheet for readability. Use bold fonts for category headings, color-coding for different sections, and any other formatting that makes the information clear and easy to interpret.

15. Save and Regularly Update

Save your budget spreadsheet to a location where you can easily access and update it. Regularly update your budget with actual income and expense figures to track your financial progress.

16. Utilize Built-in Templates (Optional)

Both Excel and Google Sheets offer built-in budget templates. You can use these as a starting point and customize them according to your preferences.

17. Share and Collaborate (Google Sheets)

If you’re using Google Sheets, you can share the spreadsheet with family members, partners, or anyone involved in the budgeting process. This allows for collaborative budgeting.

Ready to scale your fintech across Africa?

Join Paycape to get discovered, find partners, and stay compliant across West Africa

Join the Waitlist