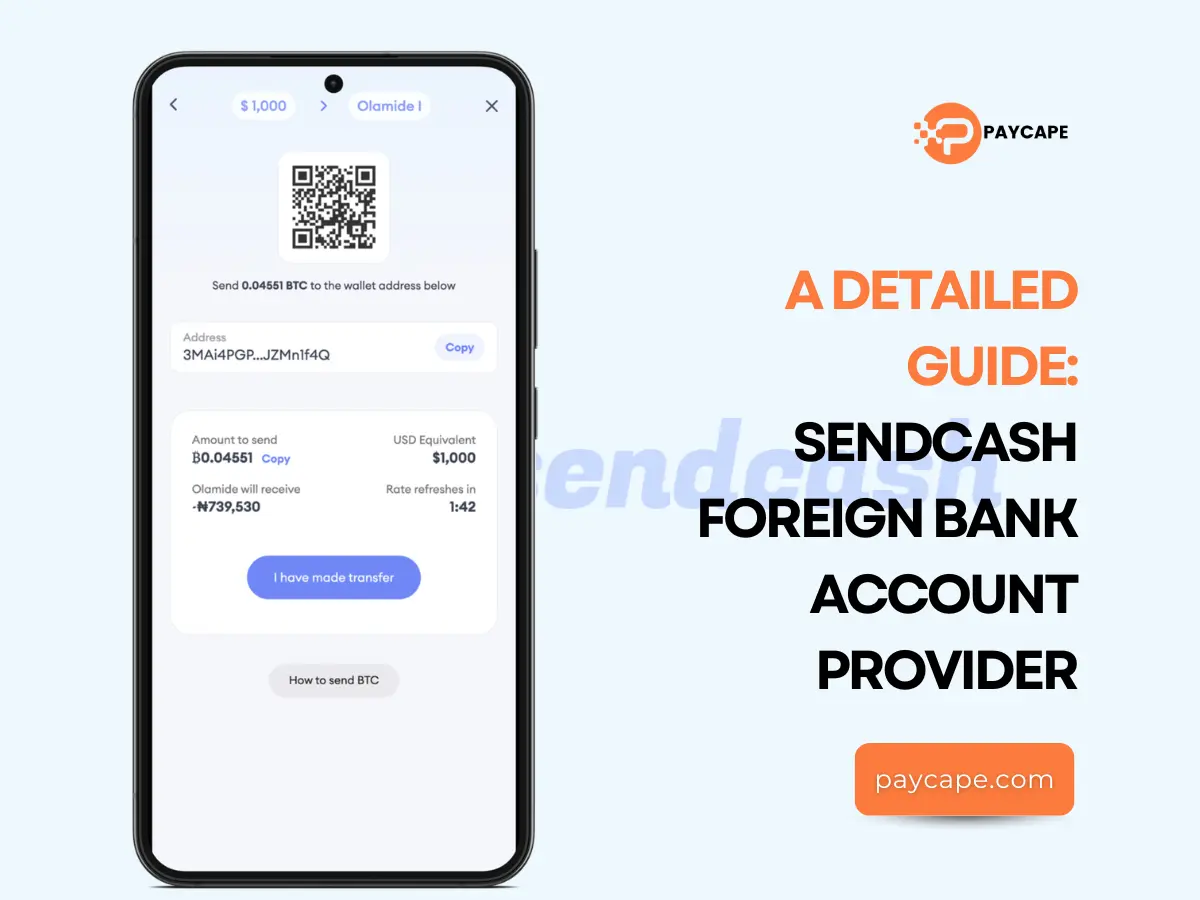

Want to grow your business without borders getting in the way? Sendcash foreign bank account is here to help! With its easy-to-use platform, you can send and receive money from anywhere worldwide. No more hassle, just simple, fast, and affordable international transactions. In this article, you’ll learn how to get the most out of your Sendcash foreign bank account and take your business to the next level. What is Sendcash Foreign Bank? Sendcash is a foreign bank account that helps people send and receive money across borders, especially in Nigeria. It’s easy to use and works in over 80 countries. With Sendcash bank account, you can even create a custom link to receive payments. Sendcash was created in 2020 by the Helicarrier Group to make international money transfers simple and hassle-free. Features Of Sendcash Foreign Bank Getting Started With Sendcash Foreign Bank Account Sending and receiving money as a Nigerian freelancer or SME is now easier with a Sendcash bank account. How To Open A Sendcash Bank Account You have successfully created an account on Sendcash. How To Create A Sendcash GBP And USD Account Below is a detailed guide on how to open a GBP and USD account. You can now receive money internationally in your USD/GBP account. How To Receive Money With Sendcash Foreign Bank Account As a freelancer, Receiving money from international clients has now become easier with the Sendcash foreign account. Below is a step-by-step guide to follow. Once the transaction process is completed, you will receive a notification in your email address. How To Withdraw From Sendcash Foreign Bank Account You can withdraw from your Sendcash foreign bank account in these few steps: The recipient will receive the money within 1 to 2 hours. Sendcash Foreign Bank Account Fees And Limits Pros and Cons of Sendcash Foreign Bank Account Pros Cons Reviews On Sendcash Foreign Bank Account Below are some reviews from Sendcash users on Trustpilot and Google Play Store. A user on Trustpilot said “After receiving emails concerning why my transactions may have been canceled, I checked with my banking institution and we determined the problem lies with the merchant, sendmoney.com system. Even when I’ve attempted to use my debit card to recharge my husband’s cell phone, every transaction is denied, so I use my bank account instead. If I upload credits and data for the month, I should be able to do both transactions as one, but now I always have to do separate transactions and one typically cancels for whatever their system issues are. If I’m able to find another way of recharging his cell data and credits, I’ll never use sendmoney.com in the future. There are too many technical issues involved with this company.” Another User on Google Play Store said, “This is my most reliable solution for getting money from the US to Nigeria. Best rates, trustworthy team, and great customer care service make the Sendcash experience awesome.” My Thoughts On Sendcash Foreign Bank Account One of the first things that struck me was its user-friendly interface which made navigating through the platform easy. However, the account creation process was more time-consuming than I thought. To make matters worse their customer care service was unresponsive for days. I strongly believe that there’s room for improvement. Bottom Line In conclusion, Sendcash foreign bank account offers an efficient solution for African freelancers and SMEs to send and receive money from over 80 countries. With features like dual foreign bank accounts, currency conversion, and unique payment methods. It provides a fast and secure banking experience. However, it is currently available only in Nigeria. So if you are a business owner or a freelancer in Nigeria, you can make use of Sendcash foreign bank account for your transactions. Frequently Asked Questions 1. How Much Does It Cost To Create A USD/GBP Account? No amount is needed to create a foreign account. 2. How Can I Reach Out To Sendcash Foreign Bank Customer Service? For any complaint, contact their customer service at support@sendcash.africa. 3. Why Is My Account Restricted? Account restriction is a result of security checks, receiving beyond transaction limit and Naira withdrawal beyond account. You can contact their customer service to help you review the restriction. 4. How To Verify Sendcash Bank Account? To verify your Sendcash account, you will need a utility bill that is less than three months old and a Valid ID. 5. Can I Use Sendcash Foreign Bank Account As A Business Account? Yes! As a business owner, you can use your Sendcash foreign bank account to receive money from your customers.

All You Need To Know About Skrill Foreign Bank Account Provider

Skrill Foreign Bank Account makes it easy for freelancers and small businesses to handle international payments. This service simplifies sending and receiving money in different currencies, without the hassle and high fees of traditional banking. With a Skrill Foreign Bank Account, businesses can work with clients and partners from around the world. They can also grow their business with ease. Keep reading to find out the benefits Skrill foreign bank account offers, how to open an account, and much more. What is Skrill Foreign Bank? Skrill foreign bank account, formerly known as Moneybookers is a popular digital wallet provider that allows users to send and receive payments. It is a key part of Paysafe limited and was established in 2001 to provide efficient money transfer services. Skrill foreign bank account has expanded its reach to several African countries. Some of these countries include Nigeria, Kenya, Chad, Tanzania, Ghana, Algeria, Central Africa Republic, South Africa, Congo, Egypt, Morocco and Western Sahara. The Skrill foreign bank account provides its users with amazing benefits. However, there are certain disadvantages you also need to be aware of. One of their pros in that they support multiple currencies. On the other hand, they are not accessible in some African countries and relatively a high conversion and withdrawal fee. How To Open A Skrill Foreign Bank Account Here are quick steps to follow to create a Skrill bank account. How Do I Add My Bank Account To My Skrill Account? You have successfully added your bank account to your Skrill foreign bank account. Skrill Foreign Bank Accounts Types There are three types of Skrill foreign bank accounts you can choose from. 1. Full Merchant Account: This account allows users to send and receive payments to customers. It offers users the opportunity to use the full API-based services. This type of account offers businesses the control over their payment processes. It is also ideal for online providers, ecommerce businesses, and companies with high-volume transactions. 2. Expense Account: This account allows users to only send payments via email address. It is a cost-effective option for only those who want to send money. This type of account is ideal for freelancers and SMEs who need to manage outgoing payments. 3. Wallet To Wallet: This type of account allows you send and receive money from customers or partners using your email address. It offers a user-friendly method of making payments. This account is ideal for freelancers or business owners who are looking for an easy way to transfer money. How To Receive Money With Skrill Bank Account You can receive payments from a Skrill account as an individual or a business entity. Below are the ways to receive money. 1. How To Receive Money From Skrill Account 2. How To Receive Money From Bank Account How To Send Money With Skrill Account You can send payments in various ways. 1. How To Make Payments To Bank 2. How To Send Money To Mobile Account 3. How To Send Money By Email Address Skrill Business Account SMEs looking for how to expand their international operations can now achieve it, through Skrill business account. By using the Skrill business account, SMEs can efficiently send and receive money and enhance financial flexibility. How To Open Skrill Business Account Creating a Skrill business account is simple and fast. Below is a detailed step to follow. What Do I Need To Open A Skrill Business Account? The requirements to open a Skrill business account is straightforward and easy. Here are the the requirements: How Much Does It Cost To Open A Skrill Business Bank Account? Creating a Skrill business account requires no startup fee or charges. Skrill Fees And Limits 1. Skrill International & Domestic Transfer 2. Receiving Money 3. Service Fee 4. Currency Exchange Rate Note: if your Skrill foreign bank account is not in a currency other than Euro, a fee of 1.50% will be charged when a transaction is made using cryptocurrencies service. 5. Prepaid Cards Fees Transaction Limits The limits for every transaction is visible under the transaction option. Note: Prices are subject to change, so be sure to check their website for specific details before making any payments. Reviews On Skrill Foreign Bank Account Some users of the Skrill foreign bank account shared their experiences on Google Play Store and Trustpilot. A user on the Google Play Store said: “Terrible app that restricts your account for anything you do. Want to add a dollar? Restricted! Want to update your contact information? Restricted! Can’t talk to a real person, reply emails to customer support bounce back. As soon as I get my contact information updated, it would be cleared by an incompetent staff that would reject every verification document and get the restriction removed. I am taking my 1 dollar balance and running. I would not trust these guys with any significant amount of money.” Another user on Trustpilot said: “If I could give them -10 Stars I would in a heartbeat. it’s the biggest scamming company I have ever come across. I haven’t been able to access my money for nearly a whole month. I’ve had to raise two official complaints and still I’m getting zero progress every time I contact them. Their customer support team is non-existent. I wouldn’t even think about opening an account with these. If you are doing so, I would definitely use alternatives including stripe, PayPal, whatever it may be. stay away from them.” My Thoughts On Skrill Foreign Bank Account On the positive side, Skrill foreign bank account offers a convenient and easy way to manage global transactions, making it easier for users to handle their payments across borders. This digital platform is user-friendly and its security measures give me the assurance of the safety of my money. However, there are a few setbacks, the transaction fees are on the high side which would not be ideal for everyone. Additionally, their customer support service can be slow at times which can be very frustrating