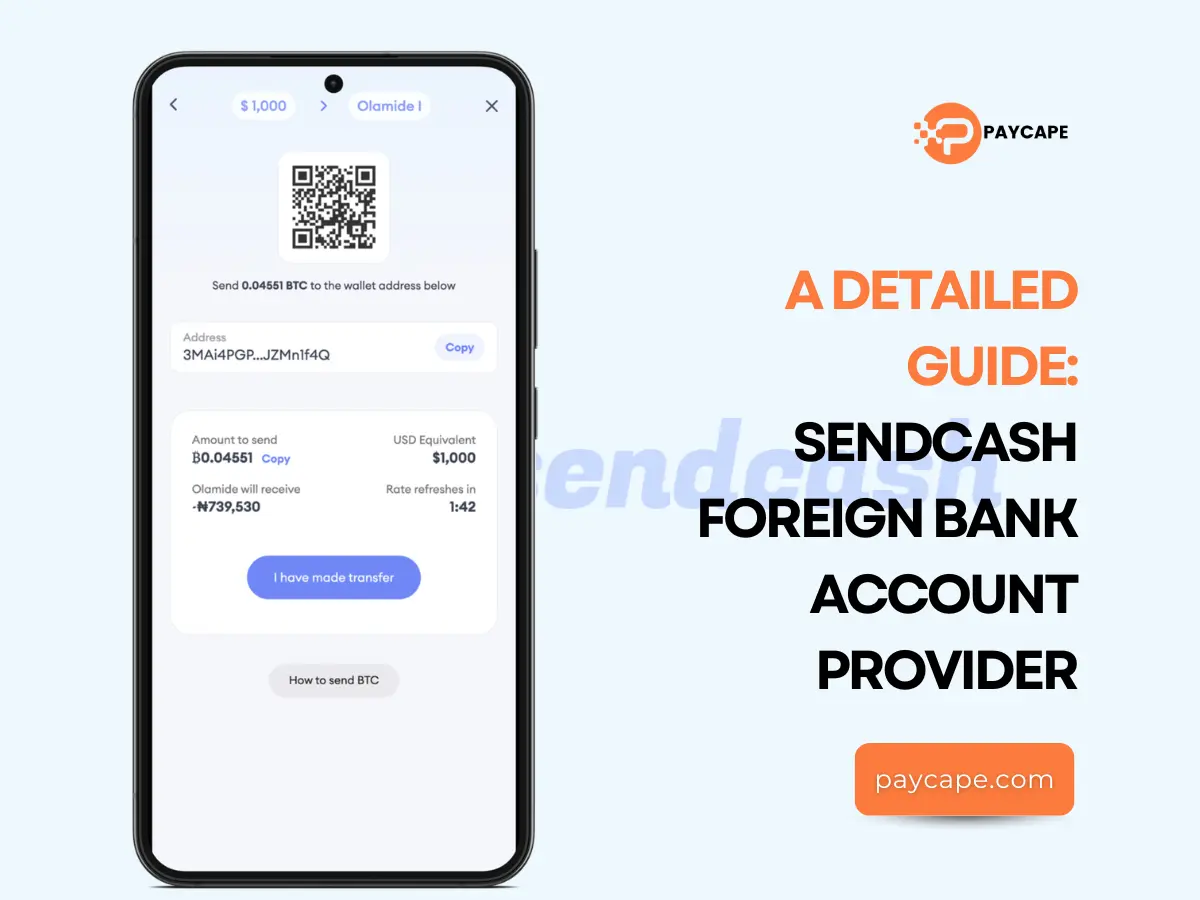

Want to grow your business without borders getting in the way? Sendcash foreign bank account is here to help! With its easy-to-use platform, you can send and receive money from anywhere worldwide. No more hassle, just simple, fast, and affordable international transactions. In this article, you’ll learn how to get the most out of your Sendcash foreign bank account and take your business to the next level. What is Sendcash Foreign Bank? Sendcash is a foreign bank account that helps people send and receive money across borders, especially in Nigeria. It’s easy to use and works in over 80 countries. With Sendcash bank account, you can even create a custom link to receive payments. Sendcash was created in 2020 by the Helicarrier Group to make international money transfers simple and hassle-free. Features Of Sendcash Foreign Bank Getting Started With Sendcash Foreign Bank Account Sending and receiving money as a Nigerian freelancer or SME is now easier with a Sendcash bank account. How To Open A Sendcash Bank Account You have successfully created an account on Sendcash. How To Create A Sendcash GBP And USD Account Below is a detailed guide on how to open a GBP and USD account. You can now receive money internationally in your USD/GBP account. How To Receive Money With Sendcash Foreign Bank Account As a freelancer, Receiving money from international clients has now become easier with the Sendcash foreign account. Below is a step-by-step guide to follow. Once the transaction process is completed, you will receive a notification in your email address. How To Withdraw From Sendcash Foreign Bank Account You can withdraw from your Sendcash foreign bank account in these few steps: The recipient will receive the money within 1 to 2 hours. Sendcash Foreign Bank Account Fees And Limits Pros and Cons of Sendcash Foreign Bank Account Pros Cons Reviews On Sendcash Foreign Bank Account Below are some reviews from Sendcash users on Trustpilot and Google Play Store. A user on Trustpilot said “After receiving emails concerning why my transactions may have been canceled, I checked with my banking institution and we determined the problem lies with the merchant, sendmoney.com system. Even when I’ve attempted to use my debit card to recharge my husband’s cell phone, every transaction is denied, so I use my bank account instead. If I upload credits and data for the month, I should be able to do both transactions as one, but now I always have to do separate transactions and one typically cancels for whatever their system issues are. If I’m able to find another way of recharging his cell data and credits, I’ll never use sendmoney.com in the future. There are too many technical issues involved with this company.” Another User on Google Play Store said, “This is my most reliable solution for getting money from the US to Nigeria. Best rates, trustworthy team, and great customer care service make the Sendcash experience awesome.” My Thoughts On Sendcash Foreign Bank Account One of the first things that struck me was its user-friendly interface which made navigating through the platform easy. However, the account creation process was more time-consuming than I thought. To make matters worse their customer care service was unresponsive for days. I strongly believe that there’s room for improvement. Bottom Line In conclusion, Sendcash foreign bank account offers an efficient solution for African freelancers and SMEs to send and receive money from over 80 countries. With features like dual foreign bank accounts, currency conversion, and unique payment methods. It provides a fast and secure banking experience. However, it is currently available only in Nigeria. So if you are a business owner or a freelancer in Nigeria, you can make use of Sendcash foreign bank account for your transactions. Frequently Asked Questions 1. How Much Does It Cost To Create A USD/GBP Account? No amount is needed to create a foreign account. 2. How Can I Reach Out To Sendcash Foreign Bank Customer Service? For any complaint, contact their customer service at support@sendcash.africa. 3. Why Is My Account Restricted? Account restriction is a result of security checks, receiving beyond transaction limit and Naira withdrawal beyond account. You can contact their customer service to help you review the restriction. 4. How To Verify Sendcash Bank Account? To verify your Sendcash account, you will need a utility bill that is less than three months old and a Valid ID. 5. Can I Use Sendcash Foreign Bank Account As A Business Account? Yes! As a business owner, you can use your Sendcash foreign bank account to receive money from your customers.

Trending Now