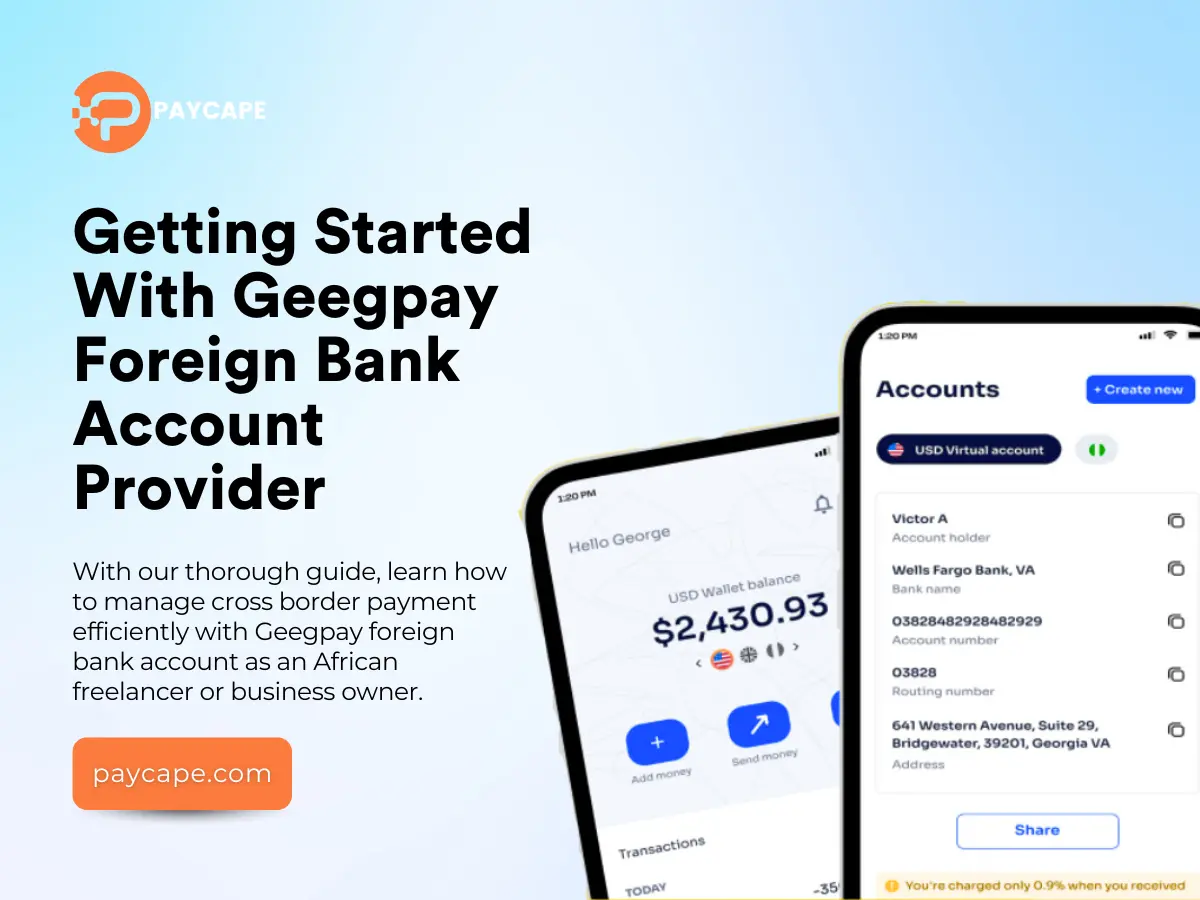

As a freelancer, business owner, or contractor in Africa, receiving payments from overseas can be a challenge. That’s where Geegpay foreign bank account provider comes in – a solution to simplify international transactions. With Geegpay, you can receive payments from anywhere in the world and generate invoices for your employers using the smart invoice feature. In this article, we’ll explore how to create a Geegpay foreign account, streamlining your transaction process and making it easier to get paid for your work. What Is Geegpay Foreign Bank Account? Geegpay foreign bank account was founded in 2022 by Alade Victor to address the payment challenges faced by African freelancers. The platform aims to provide borderless payment solutions, specifically designed to meet the needs of African freelancers and business owners. Recently, Geegpay.co bank account provider had their services officially approved by the Central Bank Of Nigeria. Now they can operate as an International Money Transfer Operator (IMTO). How To Create A Geegpay Foreign Bank Account If you’re finding it difficult to create a Geegpay bank account, here are the steps to follow below: How To Receive Payments With Geegpay Foreign Bank Account Follow the steps below to receive payment with your Geegpay foreign bank account: How To Send Payments With Geegpay Bank Account How To Verify Geegpay Foreign Bank Account Below are the detailed steps to follow: What are Geegpay Bank Charges? The minimum fee Geegpay foreign bank account charges depends on the currency used for the transaction. If it’s a USD transaction, a percentage fee of 1% and $1.50 is charged. Also, if a payment of $2000 is made to your Geegpay bank account, a fee of $20 will be charged in addition to the minimum charge of $1.50. Making it $21.50 in total. For the creation of the Geegpay virtual dollar Mastercard a fee of $3 will be charged. If you’re creating a Visa card, $2 will be charged. The minimum amount to fund both cards is $2. The maximum transaction limit on Geegpay virtual card is $2000 and the daily spending limit is $1000. Make sure to check their website or contact their customer service Support@geegpay.africa for more information on specific charges. How To Create A USD, EUR, And GBP Account On Geegpay Before you create an international account on Geegpay bank account, you will need to have an account on Geegpay bank. Below are the steps: Pros Cons My Thoughts On Geegpay Foreign Bank Account I had a mixed experience with Geegpay foreign bank account. Creating an account was quick and easy, taking less than 10 minutes. However, the verification process was challenging, with my documents being repeatedly rejected. Unfortunately, the customer care service was unresponsive, and I’m still waiting for a resolution. On a positive note, I found the Geegpay interface user-friendly and easy to navigate. To improve, Geegpay should focus on enhancing their customer care service and streamlining the verification process. Reviews on Geegpay Foreign Bank Account A lot of Geegpay bank users shared their experiences via Google Play Store and Trustpilot. A user on Trustpilot said: “If you are a freelancer working with clients outside Nigeria and you aren’t using Geegpay to receive your funds… You are wrong. Geegpay is a lifesaver. Very transparent, reliable, fast and the oga patapata of them all is the sweet conversion rate.. You guys are doing well … Kudos. I’ll choose you over and over.. Having a USD, Euro, or Pounds Virtual account makes you look professional to your clients… Yeah, I kid you not, my dear remote workers. Go get yourself a Geegpay account.” Another user on Google Play Store also said “After submitting all required documents for verification my account got suspended without any reason twice. It’s even annoying that they keep reaching out to me on LinkedIn to use their services but it all ends in frustration. I am a full stack developer in need of a seamless cross border payment solution.” Bottom Line Geegpay foreign bank account offers a seamless payment solution for freelancers and business owners. With multi-currency accounts, Africans can create accounts in foreign currencies and transact with ease. The user-friendly interface and robust features ensure a smooth banking experience. As digital transactions continue to evolve, Geegpay foreign bank account stands out as the ideal solution for African freelancers seeking effortless international transactions. Frequently Asked Questions 1. Which African Country Is Geegpay Available In? This platform is only accessible to those in Nigeria, Ghana, Kenya, Tanzania, Uganda and Egypt. 2. Can Geegpay Convert Naira To Dollars? Yes, Geegpay account can convert naira to dollars. All you need to do is, input the amount of Naira you wish to convert to dollars. 3. Does Geegpay Work With Payoneer? Absolutely! You can create invoices and get paid to your Geegpay account through payment methods like Payoneer. 4. How Long Does It Take Geegpay To Review My Account? The account verification process is usually instant but sometimes it takes 1 to 2 business days.

Grey.co Foreign Bank Account Provider

Are you tired of excessive bank charges when receiving international payments? Grey.co foreign bank account provider offers a solution. With Grey.co, you can easily receive payments from global clients with lower charges and no registration fees. This guide will walk you through the simple process of creating a Grey.co foreign bank account, receiving and sending payments. It will also help you explore Grey.co’s amazing features. Let’s dive in!! What Is Grey.co Foreign Bank Account? Grey.co foreign bank account, formally known as Aboki Africa is a fintech company that is jointly owned by Idorenyin Obong and Femi Aghedo. This platform is primarily created for Africans who work with international clients and get paid in foreign currencies. Grey allows you to create a foreign bank account with which an international account number will be given to you for foreign transactions. It also allows you to convert any foreign currency to your local currency. Features Of Grey.co Foreign Bank Account Grey foreign bank account offers various features. Some of these features include: Getting Started With Grey.co Foreign Bank Account Looking to use Grey.co foreign bank account for your transactions? Here’s how to open an account for free. How To Open A Free Grey.co Foreign Bank Account Before making any transactions with Grey foreign bank account, you will need to create an account. Follow the steps below: Select your “Country” and click “Continue.” Fill in your “Basic Information” and click “Continue.” “Create a password” and click “Next.” Enter the “OTP” sent to your email account to verify your email. You have successfully created a Grey Account. Make sure to complete your “KYC” verification in order to be able to make transactions. How to Send Money With A Grey Account You can send money with your Grey bank account in two ways. Either through your Grey tag or a new recipient. If your recipient uses Grey.co, you can make use of your GreyTag to send money. How To Withdraw Payments From Grey Foreign Account. There are two ways in which you can withdraw from your Grey foreign bank account. How Many Foreign Virtual Bank Accounts Are Available In Grey Account? Currently, the only virtual accounts that are available on Grey.co foreign bank account are the United States Dollars(USD), European Euros (EUR) and British Pounds (GBP). My Thoughts On Grey Foreign Account I had a smooth experience opening a foreign bank account with Grey, and found the user interface intuitive. However, I’ve had difficulty getting help from their customer support team, as they haven’t responded to my issue with linking my bank account. While Grey.co foreign bank account excels in some areas, they need to improve their customer support. Reviews on Grey.co Foreign Bank Account To let you know what users think about Grey.co foreign bank account, I decided to get reviews from Google Play Store and Trustpilot. A user commented on Google Play Store. The user said, “You have the best customer service! I had an issue with creating my dollar card because my driver license expired. One of your customer care representatives guided me through it, though it was late in the night. As if It wasn’t enough the platform I tried using it to purchase something from rejected it. The same person guided me through it again and it was approved.” Another user on Trustpilot said “A stupid app… you do a job and receive your payment but these people hold onto your money and start telling you nonsense stories. Their US account does not work. Please don’t let people try to send money to the account cause both of you would lose it…. Please look for another alternative. I’ve lost so much within how many days.” Conclusion Grey.co bank account offers a seamless and efficient way to send and receive international payments. It has various features, and favorable exchange rates which users would enjoy. While the platform excels in many areas, improvements are needed in customer support. Furthermore, Grey foreign bank account makes it possible to create multiple foreign virtual bank accounts and receive payments in various currencies. So, if you’re a freelancer or business owner, you can make use of Grey.co for your transactions. Frequently Asked Questions 1. Can I Link My Grey Account To Payoneer? Yes, you can. All you need to do is, Your Payoneer has been linked successfully to your Grey bank account. 2. Can I Receive Money From Abroad With Grey? Definitely! Grey account makes it possible for users to receive payments in foreign currencies. 3. What Currencies are Supported in Grey? The currencies supported in Grey includes: 4. How Can I Open a Grey Foreign Bank Account? 5. What are Grey Transaction Limits? Below are Grey.co bank account transaction limits: Deposit limit Withdrawal limits.