Tragedically, the number of scams pulled each year is on the rise. If you’re thinking about traditional scams, you are right. But we have more to fear in this age than ever before—online scams! A quick look at theFBI scammer list should give you an idea of what’s at stake. What are Online Scams? Online scams are fraudulent activities that take place on the internet and are committed using computers or any online technologies. Online scams, cybercrimes, internet frauds—whatever you wish to call them—are not going away anytime soon. Neither is any individual immune from such attacks. Organizations (large, medium, and small) and individuals are all susceptible to one or more forms of Internet fraud. What do you stand to lose? A lot of times, money is not the only aim. In the event of an internet scam, you stand to lose important data like credit card details, your social security number, and other sensitive personal data. Now, organizations are mandated by data protection laws around the world to implement data protection strategies. So, there is no problem at that end. What about your end as an individual? How can you protect your data and money from malicious entities online? This article gives you enough insight into: Online scam attacks can be categorized into the following categories: Phishing: conning victims to divulge personal and financial data through emails, text messages, etc. Malware: This is the use of malicious software to damage or disable the devices of victims. And also steal personal data. Ransomware: this is a type of malware that stops users from accessing data and then demands payment (ransom) to fix it. Denial of service: cuts access flow to a website or online service for negative purposes. Data breach: This affects organizations and individuals alike. It involves stealing confidential or personal data from a secure location to an insecure one for malicious intent. Types of Online Scams Online scams come in varying forms. According to a 2023 FTC report, one in every four scam victims says it started on social media. Nevertheless, that is not the limit to that. Cybercrimes can make use of any digital platform, e.g., email, text messaging, and websites. Here are the major types of online scams to watch out for. Phishing Scams According to the FBI, in 2022, phishing was the most common type of cybercrime in reports. How does phishing work? The main theme of phishing is “impersonation.” In a phishing attack, cybercriminals will impersonate anybody or any entity with a trusted identity. Banks, employers, literally anyone whose authority you trust enough to surrender your personal details. More often than not, these criminals “fish” for valuable information like credit card numbers and passwords. Then they use this information to perpetrate crimes—money theft, identity theft, corporate espionage, etc. Some phishing attacks are sent out en masse to multiple targets at once. While some are more target-specific (spear phishing),. The typical “fishing” spots are the emails, but phishers are expanding territories daily. You can expect to be phished anywhere on the internet. Online Shopping Scams Wherever there is an exchange of money serves as a hunting ground for scammers. With the sporadic boom in online shoppers, it’s logical that scams follow suit. Online shopping scams are terrible enough that Amazon spent $1.2 billion to curb fake products paraded on the platform. One way to spot them is the payment method. They prefer to use non-conventionalpayment methods like cryptocurrency, gift cards, and wire transfers. Where little to no tracks are left. In an online shopping scam, cybercriminals pose as legit stores with fake websites. Some make bolder attempts by displaying fake ads on real sites. These scams use exceptionally low prices for premium goods as bait. Once payment is made, victims would be lucky to receive even counterfeit products. Usually, they don’t receive any item. Credit Card Scams Credit card fraud can happen anytime, anywhere. You can fall victim by text, over the phone, or online. It is so prevalent that in 2022, the FCT received over 440,000 reports of credit card fraud in the US. How do online credit card scams happen? Once your personal information is accessed, it is used to apply for a credit card. This can go on for a long time, with the victim none the wiser. Sometimes, scammers can stage an account takeover. Where they contact the credit card company under the pretense of the cardholder. Then, they change the passwords and lock the owner out. Romance Scams These kinds of scams are the worst. Not only do they rob victims of hard-earned money, they leave a trail of broken hearts. How does it work? Typically, it works with one party—the scammer—deceiving the other–victim into a “romantic” relationship with the intent to take as much money as possible. Some scammer alerts for romance fraud are: Facebook Scams According to the U.S. Federal Trade Commission, hundreds of millions of dollars are lost to scams on social media platforms, including Facebook. On Facebook, you are vulnerable to several forms of cyberattacks. Work-from-home scams, Facebook marketplace scams, romantic scams, etc. Of the several forms of attack, Facebook phishing is the most prevalent. Messages with links are sent to targets, and the links lead to scam websites. With Facebook phishing, you give cybercriminals enough personal information to take over your account(s). How To Avoid Online Scams Internet fraud is everywhere, like a virtual pandemic. What makes it more annoying is that one can avoid it just as easily as it spreads. Prevention is better than cure, it is said. Here are ways you can save yourself from an online scam ( in no particular order) Victim already? Here’s What To Do When You’ve Been Scammed. In Conclusion Online scams are a growing threat in our digital age, targeting individuals and organizations alike. While organizations have guidance under laws like GDPR and NDPR, individuals have none. Protecting yourself requires vigilance and proactive measures. By staying informed about the types of scams, and practicing good cybersecurity habits, you can reduce the risk of falling victim. Remember, prevention

How to Choose The Best Payment Methods For Small Businesses

Imagine that you have poured your heart and soul into building your dream business. It’s thriving, and you’re feeling successful. As your business grows bigger, you notice that new visitors are not making purchases. You then noticed that this is caused by a lack of convenient payment methods. Your customers expect a seamless experience while making payment for your product or service. If they can’t pay how they want, they’ll likely abandon their cart and take their business elsewhere. That is why you need to understand the best payment method for your business. 6 Payment Methods for Small Businesses Cash Cash is the ancestor of all modern payment methods and its place cannot be taken even with the advancement in technology. Since its invention several centuries ago, it has continued to prove itself as a capable payment method. While the birth of newer methods of payment, such as credit cards, etc., has caused a decline in its use, cash is still king in certain environments. For example, if your SME is in Nigeria, then using cash is the major payment method. Why Cash? A substantial number of consumers regard cash as “important or very important.” Most likely because of the anonymity and privacy it provides. There is no need for bank details, identification numbers, and all that hassle. Cash payments are immediate. The customer doesn’t have to wait for an app to load, nor do you need to wait for the money to “settle” in your account. For small businesses with a physical cash is a must-have. Another perfect point is the zero cost of maintenance. This works well for profit maximization. There is no extra cost per transaction. Although, the narrative has changed as there are now several MMOs in Nigeria that minimize costs. Cons As a vendor, large deposits to banks are a red flag for illegal activities. So, you’ll need to make your deposits in smaller amounts (also a red flag!). ACH Payment Method ACH payments are digital payments made through the Automated Clearing House network. Government benefits, payrolls, and consumer bills are some examples of ACH payments. In 2022,$72 trillion was moved through the ACH Network. It provides a secure way of moving money from one bank to another without printing checks or visiting the bank. The ACH allows money to be “pulled” (with consumer authority) by automation. It makes it suitable for businesses with recurring billings. All the customer has to do is input their bank details and transaction details. TheACH payment method has low transaction fees compared to counterparts like wire transfers, etc. Making it suitable for small businesses Cons ACH typically takes 1-3 days for a successful payment. Even at that, no transaction is ever declared successful. This is not good enough for small businesses that will need to confirm transactions immediately. Also, it is restricted only to the U.S. Contactless Payments Rather than entering a pin or swiping, this method allows customers to simply tap their cards for payment. It’s a novelty. While this is a nice development for POS transactions, it’s also worrisome. There are skimming devices and software that record data from the card (the magnetic strip). Credit Card Payment. With this method, customers make payments with cards approved and funded by banks. It is fast, easy, and widely used. This is an acceptable payment all over the world. The downside to card payments is that its transaction fees can discourage most businesses, especially SMEs. However, the amount of popularity its convenience has garnered amongst consumers makes it one of the necessary payment methods for small businesses. Online Payment Method These cover payment methods that require an internet connection. Examples of online payment methods are digital wallets and bank transfers. Why online payments? In this era, an online presence is No. 1 on the “How to Start a Successful Business” manual. Statistics show that 33% of the world’s population are online shoppers. Of course, with an online branch, a payment method is necessary. It is a relatively low-cost option with premium security. Mobile Payments In basic terms, mobile payments are any kind of digital payment made with a mobile phone. E.g. Digital wallets. This, most times, work with online payments but you can also use USSD codes in making transactions. 48% of all global e-commerce transactions are based on mobile payment and as a small business owner, you might want to tap into that number. Statistica also notes that 25% of mobile phone users made payments in 2023. However, just like card payments, transaction fees are on the high side. Although, chances of fraud are low with authentication protocols like fingerprint ID and GPS location. This provides payment security, an added advantage for small businesses. How To Choose The Best Payment Methods for Small Businesses You could just pick any payment method for your business. But that wouldn’t be right. As a growing enterprise, you’ll need to consider the following factors to choose the most suitable method for your business. Some of these factors are: Cost This is usually the first criterion anyone thinks of. You should, too. As much as the cost of each method is important, there are more important criteria, like security. Eventually, you’ll have to strike a perfect balance between cost and security. Customer Preference “The customer is always right.” Maybe not always, but the aim is to achieve customer satisfaction. You can conduct a survey to find out the demographics of your customer base. And know which payment method is most convenient. Location This factor is crucial. What works in Europe might not work in Africa. For instance, the ACH payment method is an option only for businesses in the U.S. In Nigeria, cash is the preferred payment method. You need to study the environment to know which method is best. Security Security should be the top priority when choosing payment methods for small businesses. Different payment methods have different levels of security. Assess each one properly and determine how effective it’ll be for your business. Scalability Businesses aren’t expected to stay small forever. For that,

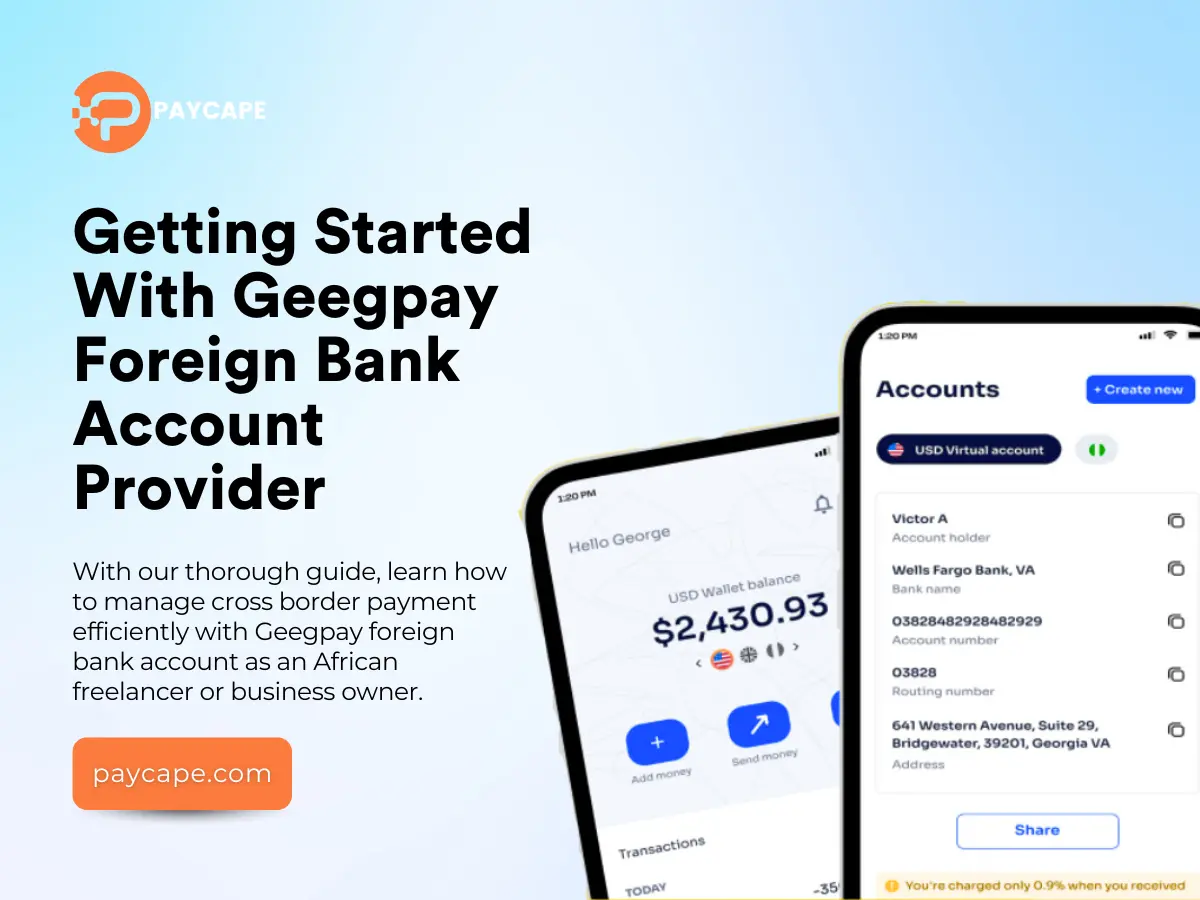

Geegpay Foreign Bank Account Provider

As a freelancer, business owner, or contractor in Africa, receiving payments from overseas can be a challenge. That’s where Geegpay foreign bank account provider comes in – a solution to simplify international transactions. With Geegpay, you can receive payments from anywhere in the world and generate invoices for your employers using the smart invoice feature. In this article, we’ll explore how to create a Geegpay foreign account, streamlining your transaction process and making it easier to get paid for your work. What Is Geegpay Foreign Bank Account? Geegpay foreign bank account was founded in 2022 by Alade Victor to address the payment challenges faced by African freelancers. The platform aims to provide borderless payment solutions, specifically designed to meet the needs of African freelancers and business owners. Recently, Geegpay.co bank account provider had their services officially approved by the Central Bank Of Nigeria. Now they can operate as an International Money Transfer Operator (IMTO). How To Create A Geegpay Foreign Bank Account If you’re finding it difficult to create a Geegpay bank account, here are the steps to follow below: How To Receive Payments With Geegpay Foreign Bank Account Follow the steps below to receive payment with your Geegpay foreign bank account: How To Send Payments With Geegpay Bank Account How To Verify Geegpay Foreign Bank Account Below are the detailed steps to follow: What are Geegpay Bank Charges? The minimum fee Geegpay foreign bank account charges depends on the currency used for the transaction. If it’s a USD transaction, a percentage fee of 1% and $1.50 is charged. Also, if a payment of $2000 is made to your Geegpay bank account, a fee of $20 will be charged in addition to the minimum charge of $1.50. Making it $21.50 in total. For the creation of the Geegpay virtual dollar Mastercard a fee of $3 will be charged. If you’re creating a Visa card, $2 will be charged. The minimum amount to fund both cards is $2. The maximum transaction limit on Geegpay virtual card is $2000 and the daily spending limit is $1000. Make sure to check their website or contact their customer service Support@geegpay.africa for more information on specific charges. How To Create A USD, EUR, And GBP Account On Geegpay Before you create an international account on Geegpay bank account, you will need to have an account on Geegpay bank. Below are the steps: Pros Cons My Thoughts On Geegpay Foreign Bank Account I had a mixed experience with Geegpay foreign bank account. Creating an account was quick and easy, taking less than 10 minutes. However, the verification process was challenging, with my documents being repeatedly rejected. Unfortunately, the customer care service was unresponsive, and I’m still waiting for a resolution. On a positive note, I found the Geegpay interface user-friendly and easy to navigate. To improve, Geegpay should focus on enhancing their customer care service and streamlining the verification process. Reviews on Geegpay Foreign Bank Account A lot of Geegpay bank users shared their experiences via Google Play Store and Trustpilot. A user on Trustpilot said: “If you are a freelancer working with clients outside Nigeria and you aren’t using Geegpay to receive your funds… You are wrong. Geegpay is a lifesaver. Very transparent, reliable, fast and the oga patapata of them all is the sweet conversion rate.. You guys are doing well … Kudos. I’ll choose you over and over.. Having a USD, Euro, or Pounds Virtual account makes you look professional to your clients… Yeah, I kid you not, my dear remote workers. Go get yourself a Geegpay account.” Another user on Google Play Store also said “After submitting all required documents for verification my account got suspended without any reason twice. It’s even annoying that they keep reaching out to me on LinkedIn to use their services but it all ends in frustration. I am a full stack developer in need of a seamless cross border payment solution.” Bottom Line Geegpay foreign bank account offers a seamless payment solution for freelancers and business owners. With multi-currency accounts, Africans can create accounts in foreign currencies and transact with ease. The user-friendly interface and robust features ensure a smooth banking experience. As digital transactions continue to evolve, Geegpay foreign bank account stands out as the ideal solution for African freelancers seeking effortless international transactions. Frequently Asked Questions 1. Which African Country Is Geegpay Available In? This platform is only accessible to those in Nigeria, Ghana, Kenya, Tanzania, Uganda and Egypt. 2. Can Geegpay Convert Naira To Dollars? Yes, Geegpay account can convert naira to dollars. All you need to do is, input the amount of Naira you wish to convert to dollars. 3. Does Geegpay Work With Payoneer? Absolutely! You can create invoices and get paid to your Geegpay account through payment methods like Payoneer. 4. How Long Does It Take Geegpay To Review My Account? The account verification process is usually instant but sometimes it takes 1 to 2 business days.

Grey.co Foreign Bank Account Provider

Are you tired of excessive bank charges when receiving international payments? Grey.co foreign bank account provider offers a solution. With Grey.co, you can easily receive payments from global clients with lower charges and no registration fees. This guide will walk you through the simple process of creating a Grey.co foreign bank account, receiving and sending payments. It will also help you explore Grey.co’s amazing features. Let’s dive in!! What Is Grey.co Foreign Bank Account? Grey.co foreign bank account, formally known as Aboki Africa is a fintech company that is jointly owned by Idorenyin Obong and Femi Aghedo. This platform is primarily created for Africans who work with international clients and get paid in foreign currencies. Grey allows you to create a foreign bank account with which an international account number will be given to you for foreign transactions. It also allows you to convert any foreign currency to your local currency. Features Of Grey.co Foreign Bank Account Grey foreign bank account offers various features. Some of these features include: Getting Started With Grey.co Foreign Bank Account Looking to use Grey.co foreign bank account for your transactions? Here’s how to open an account for free. How To Open A Free Grey.co Foreign Bank Account Before making any transactions with Grey foreign bank account, you will need to create an account. Follow the steps below: Select your “Country” and click “Continue.” Fill in your “Basic Information” and click “Continue.” “Create a password” and click “Next.” Enter the “OTP” sent to your email account to verify your email. You have successfully created a Grey Account. Make sure to complete your “KYC” verification in order to be able to make transactions. How to Send Money With A Grey Account You can send money with your Grey bank account in two ways. Either through your Grey tag or a new recipient. If your recipient uses Grey.co, you can make use of your GreyTag to send money. How To Withdraw Payments From Grey Foreign Account. There are two ways in which you can withdraw from your Grey foreign bank account. How Many Foreign Virtual Bank Accounts Are Available In Grey Account? Currently, the only virtual accounts that are available on Grey.co foreign bank account are the United States Dollars(USD), European Euros (EUR) and British Pounds (GBP). My Thoughts On Grey Foreign Account I had a smooth experience opening a foreign bank account with Grey, and found the user interface intuitive. However, I’ve had difficulty getting help from their customer support team, as they haven’t responded to my issue with linking my bank account. While Grey.co foreign bank account excels in some areas, they need to improve their customer support. Reviews on Grey.co Foreign Bank Account To let you know what users think about Grey.co foreign bank account, I decided to get reviews from Google Play Store and Trustpilot. A user commented on Google Play Store. The user said, “You have the best customer service! I had an issue with creating my dollar card because my driver license expired. One of your customer care representatives guided me through it, though it was late in the night. As if It wasn’t enough the platform I tried using it to purchase something from rejected it. The same person guided me through it again and it was approved.” Another user on Trustpilot said “A stupid app… you do a job and receive your payment but these people hold onto your money and start telling you nonsense stories. Their US account does not work. Please don’t let people try to send money to the account cause both of you would lose it…. Please look for another alternative. I’ve lost so much within how many days.” Conclusion Grey.co bank account offers a seamless and efficient way to send and receive international payments. It has various features, and favorable exchange rates which users would enjoy. While the platform excels in many areas, improvements are needed in customer support. Furthermore, Grey foreign bank account makes it possible to create multiple foreign virtual bank accounts and receive payments in various currencies. So, if you’re a freelancer or business owner, you can make use of Grey.co for your transactions. Frequently Asked Questions 1. Can I Link My Grey Account To Payoneer? Yes, you can. All you need to do is, Your Payoneer has been linked successfully to your Grey bank account. 2. Can I Receive Money From Abroad With Grey? Definitely! Grey account makes it possible for users to receive payments in foreign currencies. 3. What Currencies are Supported in Grey? The currencies supported in Grey includes: 4. How Can I Open a Grey Foreign Bank Account? 5. What are Grey Transaction Limits? Below are Grey.co bank account transaction limits: Deposit limit Withdrawal limits.

What is ACH Payment? Its Types, Benefits And How It Works

The Automated Clearing House (ACH), is run by the NACHA (National Automated Clearing House Association). It is a network that moves money between banks electronically in the U.S. The ACH network move more than $72 trillion in 2022. That was a whole 5% jump from the year before. This shows how important the ACH payment method is. From important transactions like government paychecks and social security benefits down to B2B transfers, the ACH has earned its reputation. As a business owner, staying on top of payment methods is crucial. Why? Statistics report that of the 70% cart abandonment cases, 9% are caused by payment method problems. So, it’s a win-win situation. You provide a convenient payment method and sales boom. The ACH payment method just might be the right one for your business. Read on for more on the ACH transfer method and how it works. What is The ACH Payment Method? ACH payments are electronic transfers of money bewteen banks and credit unions in the United States only. It is different from wire transfers, cash, paper checks, or card transactions. Examples of ACH transactions are: Benefits of ACH Payment Method ACH, as a payment method compared to others, is perfectly cost-effective. Credit and debit cards have processing fees that can add up too fast. This is a premium for businesses that deal with massive B2B transactions. Now, the ACH has transaction fees – an average of $0.29 per payment. But, between that and $25 average wire transactions, the choice is clear. There’s also convenience to consider. For business owners, there is no need for manual work. On the other hand, customers find it hassle-free too. No paperwork; the automated recurring payment of the ACH debit is ideal for recurring billings. Just imagine the number of mistakes that occur when you make payments manually. The wrong account number, inaccurate amount, etc. The ACH payment method eliminates, or at the very least, reduces, the chances of errors. Digital wallets have an average failure rate of 11.5%. Even the most popular credit card averages a 7.9% failure rate. ACH payments, on the other hand, have a mere 2.9% failure rate. This attribute makes it more attractive to business owners. In the event of payment failure, money can be “pulled” from the customer’s account to rectify the problem. Time-saving, low margin of error, non-existent failure rate, and cost-efficient. A dream come true for businesses. Here’s the catch! The ACH payment method works in the U.S. only. Giving wire transfers the advantage. Nevertheless, there are similar networks for overseas transfers that are cheaper than wire transfers. Some banks might also impose a transaction limit. This can be a bit inconvenient, as you have to double-check the limit when making large payments. These limits differ, some biweekly, others daily, monthly, or per transaction. If you’re looking for speedy transfers, the ACH payment method is not for you. Your transaction may take up to 3 days for processing. Another quirk is that with the ACH payment method, no transaction is ever truly confirmed. However, if there is a delay in payment, the Receiving Depository Financial Institution (RDFI) has 48 hours to report it. Consumers can also file a complaint within 60 days for unauthorized or incorrect debit transactions. Types of ACH Payment Methods There are two main categories of the ACH method: Direct deposit and direct payments Direct Deposit: This category is used by businesses and the government to make payments to consumers. Examples are payroll, tax refunds, government benefits, interest payments, etc. Direct payment is the electronic movement of funds to make or receive payment by individuals or organizations. Examples are paying bills, sending money to relatives, buying goods, etc. Under direct payment, there are two payment methods. ACH credit and ACH debit. To better understand, direct payment works with a “push” and “pull” system. In ACH credit, money is pushed into the recipient’s account. As a business owner, this means that the customer handles the transaction. The customer is actively sending the money into your account. While with ACH debit, money is “pulled” from the account of the customer – with consent, of course. This method is best for subscription business models. This takes away the stress of initiating each time. How Does ACH Payment Method Work? In an ACH payment, there are three entities involved. The ACH operator (FedACH or the Electronic Payments Network), the Originating Depository Financial Institution, and the Receiving Depository Financial Institution. Then the Automated Clearing House (ACH) works with both sides of the transaction as a central authority. The whole process is like the mail system. The Originating Depository Financial Institution (ODFI) packages each payment request as a message in outgoing mail. The ACH operator sorts the “messages” into groups headed for different RDFIs. The receiving bank also gets its bundle of “messages.”. This happens at set intervals every business day. Certain factors affect each payment request, such as: How Long Does ACH Payment Method Take? Although cost-effective and secure, time is not a strong suit for ACH payment because there is no precise time. It typically takes anywhere from 1-3 days to process a single payment request. This time frame depends on the type of request and whether it’s a same-day ACH request (which comes with an extra fee). The time of the day the payment is initiated is also a huge factor. Payments initiated early have a higher chance of being processed same-day. Fact: To reduce the incidence of fraud, NACHA introduced a rule in 2021. Originators of WEB transactions are to verify the recipient’s account is: In conclusion, the ACH payment method offers a reliable and cost-effective solution for electronic fund transfers in the U.S. Its awesome advantages include low transaction fees, reduced error rates, etc. Make it a convenient choice for businesses and consumers. Despite limitations such as transaction limits and processing times, the ACH system’s ability to handle a wide range of transactions—from payroll to online payments—makes it worthwhile. While it may not be the fastest, the fact that 94% of American workers receive their pay with it is interesting. Frequently Asked

How To Send and Receive Money With Wise Bank Account: Detailed Guide for Freelancers and SMEs

As a freelancer or small to medium-sized enterprise (SME), making transactions with foreign payments can be very difficult and tiring. This is due to local banks’ high exchange rates and foreign currency limits. Thankfully, Wise bank account offers an efficient solution designed to help you send and receive money with a low conversion fee and access to multiple foreign currencies. In this detailed guide, we’ll explore how Wise accounts can help send and receive money across multiple currencies more easily. What Is A Wise Bank Account? Regulated by federal and state regulators, Wise provides solutions for business owners and freelancers to transact in foreign currencies. As a foreign account provider, Wise bank account offers a low-cost and flexible way to help you send and receive money across multiple currencies, holding more than 40+ currencies in one account. Available for both personal and business use, wise bank accounts use the mid-market exchange rate and charge fees starting from 0.35 for currency exchange. Getting Started With Wise Bank Account How To Create a Wise Bank Account? Creating a Wise bank account is so easy. Here are the detailed steps to follow. An email notification will be sent to you once your Wise international bank account has been verified. Can I Have a Multiple Wise Bank Account? No, you can’t, but you can have multiple account details bottled up in one account. How Long Does It Take To Verify Your Wise Account? Wise can verify your account in 2 or 3 days once your documents are checked. If you do not receive a notification within 5 days, contact the Wise help centre. How To Transfer Money With Wise Bank Account Your transfer will be confirmed via email notification. How Do I Receive Money In My Wise Account? You can receive money in your Wise account in three ways which are: Getting Started With Wise Business Account How To Open A Wise Business Account? Opening a Wise business account can help you send and receive money, especially if your business involves international transactions. This guide will walk you through opening a Wise business account. Once your verification is complete, you will be sent an email notification. What Do I Need To Open A Wise Business Account? The requirements to open a Wise business account depend on the business type. In general, you will need; Wise Account Fees And Pricing Wise bank accounts only charge you for what you use. There are no subscription or monthly charges and no hidden charges. Here is a list of Wise charges below; Account Registration Sending Money Spending With Your Card Receiving Money Holding Money in Your Account Can I Hold Multiple Currency In My Wise Account? You can hold and send more than 40 currencies from your Wise bank account. Wise shares this feature with Payoneer, a foreign bank provider. Pros and Cons of Wise Bank Account Below are the pros and cons of using Wise bank account to receive and make payments internationally: Pros Cons Reviews On Wise Bank Account Aside from reviews on the Google Play Store, other users made comments on Trustpilot. One of the users said, “Wise bank account is simple, useful and has a clear user interface design. On top of that I had a fast transaction process in international transfers. It’s one of those services I truly recommend to my family and friends.” My Thoughts on Wise Account My experience with the Wise platform wasn’t so bad. I enjoyed using it, especially considering that I could receive different currencies in my account. Thankfully, the Wise platform is suitable for freelancers like me. I did not like that they don’t offer virtual card services in certain countries, such as Nigeria, Somalia, Ethiopia, Côte d’Ivoire, Kenya, and some other African countries. This can be a disadvantage for business owners in those regions. Final Thoughts Wise is a foreign account provider suitable for freelancers and business owners. Wise Bank offers the best foreign exchange using the mid-market exchange rate. With its features of holding up to 40 currencies and its ability to send and receive money from over 150 countries, freelancers and SMEs wouldn’t find it difficult to receive payments. Frequently Asked Questions 1. Can I Deposit Naira On Wise? Yes, you can add money in Naira or any supported currency of your choice. 2. Can I Use Wise As a Business Account? Definitely, you can. Wise International Bank offers two types of accounts: a personal account and a business account for freelancers, entrepreneurs, and business owners. 3. How Much Money Can I Hold In My Wise Account? There is no limit on how much your Wise account can hold for most currencies. However, there are exceptions for users receiving USD with a routing number starting with 026. The exceptions are: 4. Is Wise Better Than Revolut? Wise Platform and Revolut offer various financial benefits. A Wise bank account is a simple way to transact internationally, while Revolution offers full banking options and amazing features. 5. What Requirements Do I Need to Open A Wise Bank Account? You will need a photo of your identification documents, proof of address, and a photo of you holding your Identification document.

Payment Method: What It Is, Its Types, and Processes

Transactions are an important part of human relations. It’s not possible for a person to live an entire lifetime without conducting a transaction – uncountable. From rocking a child to bed to rewarding good grades, there will always be an exchange of value between man and society. The most obvious transactions are business transactions. This is where payment is made for goods and services. The payment system has evolved over the centuries. Before the Lydians invented money, there was the trade-by-barter system. Individuals traded items or services they wanted with the ones they had. Now, the world is in the digital age. There are standardized currencies, and businesses now operate online and offline. As a result, consumers have numerous methods of payment to choose from. To stay on top, business owners are finding ways to make payments easier for their customers. Are you a business owner trying to understand payment methods 1or are you looking to stop cart abandonment on your website? This article is an informative guide on payment methods, the types, and how to choose the right one. What is a Payment Method? Simply put, a payment method is how a consumer pays a business for the goods and services purchased. Benefits of The Right Methods of Payment 7 out of 10 customers who fill out their cart abandon it before checkout. 9% of those abandon their cart because of the methods of payment. This means that, with the right payment methods, businesses can increase their sales by a lot. Another point is customer satisfaction. Clients are most comfortable when they can pay with the most convenient method available. The right payment method gives the business a competitive advantage. Types of Payment Methods Thanks to the modern age, the options are almost unlimited—over 200 methods of payment. Here are some types: Cash Physical currencies in the form of banknotes and coins are the most traditional method of payment right now. According to the FIS Worldpay Global Payment Report, 2022,62% of point-of-sale payments in Nigeria are cash. With cash, payment is immediate. No need for electronic devices; no unnecessary internet glitches. When a customer likes your product, the customer pays (straightforward). One point against cash is the increase in online shopping. Goods are now displayed online for shoppers all over the world. It makes cash payments far-fetched. Credit cards Other than cash, there are credit cards too. With credit cards, customers pay with money borrowed from banks and building societies. It allows customers to spread payments over time and receive rewards and points. For business owners in the UK and similar countries, the credit card option is a necessity. With UK residents completing 340 million transactions in 2019 with it, it’s no wonder why. According to Forbes, the majority of US citizens use debit and credit cards. Bank Transfers Another type is bank transfers. This method is most common with B2B and larger transactions. Although well known, compared to others, bank transfers are insecure. Recalling payments made is not possible and it’s a time-consuming process. Mobile Payments Lastly, mobile payments. Mobile payments are methods that can be used on the phone. Examples of mobile payments are mobile wallets, QR codes, and use of payment links. The Most Common Payment Method in Nigeria The debit card is by far the most common payment method in the world today. Statistics show that 42% of all online and in-person payments are made through a debit card. Followed closely by direct debit, cash, and credit card payments. Cheques come in last. In Nigeria though, CASH is king. It’s noteworthy that mobile payments are growing at the highest rate. So, as a business owner, you should probably add this to your list. Online Payment Methods Online payment methods are used when the customer is not physically available. A lot of customers nowadays find it more convenient to shop online. This made a lot of businesses drop the traditional physical store. They now operate online. As such, payment methods had to follow suit. Here are some online payment methods used by businesses. Alternative Payment Methods An alternative payment method is any way by which payment for goods and services is made without using a card or cash that belongs to a recognized major card scheme. Basically, an alternative payment method is an option beyond the traditional credit card, debit card, or cash. Examples of major card schemes are Visa, Mastercard, American Express, etc. Some commonly used alternative payment methods are: Cryptocurrency This is a digital currency mined through complex computational equations. It’s typically stored in a hardware wallet or hot wallet. The disadvantages of cryptocurrency as an alternative payment method are its complexity and high fees. Despite being a new payment method, it hasn’t gained as much traction as expected. Buy Now, Pay Later This method allows customers to buy products or services without making a full payment. Its ace point is customers can spread payments over an agreed period, interest-free. It’s safe to say that it’s like a credit card for those without one. Note: The most common alternative payment method in Nigeria, is online payment services like PayPal and Amazon Pay. In 2021, 7% of Nigerian e-commerce sales were concluded with this method. The reason why is understandable. Paypal is one alternative method accepted in more than 200 countries. Conclusion There it is. All about payment methods and the factors to consider in one article. You should know that there is no limit to the number of payment methods your business can offer. The more—a reasonable number—the better.

Revolut Account Review: How To Open Revolut Bank Account

As a freelancer, getting paid on time and in a convenient manner can be a challenge. Traditional payment methods often have high fees, exchange rate markups, and lengthy processing times. That’s where a Revolut bank account comes in—a digital banking solution that enables freelancers to easily receive payments from clients worldwide. In this article, I’ll explore how Revolut can simplify your payment process, eliminate unnecessary fees and hassles, and allow you to focus on what matters most: growing your business. What is a Revolut Bank Account? Revolut foreign bank account is a financial tech company that offers services for businesses. It was founded in the year 2015 by Nikolay Storonsky and Vlad yatsenko. This bank account offers users debit and credit cards, bank services, virtual cards, stock trading, and more. Furthermore, Revolut bank accounts operate in companies in European economic areas, Singapore, the United States, etc. It also supports transactions in over 30 currencies. Key features of Revolut Bank Account In a Revolut bank account, the quality time for international transfers takes one or two working days. This depends on the transaction type (card payment or bank transfer) and the policy of the recipient bank. In some cases, the transfer might take up to five days. Revolut Bank offers five levels of personal accounts and a business account. The standard personal account charges no fee, while the other four charges a monthly fee in exchange for special services. Personal accounts offer interest of 2.29% gross interest. Also, Revolut offers a joint account to users. This bank account provides quality tools for tracking spending and saving goals. You can create different ‘pockets’ to stay organized. One outstanding feature is that it sends reminders for upcoming bills and subscriptions. Revolut bank allows UK customers to send money in more than 80 currencies. Instead of using interbank rates, Revoult uses its exchange rates. Additionally, money transfers are free on weekdays with certain limits. Revolut Bank Account Pricing Plan Revolut bank account has five pricing plans from which users can choose. These plans include: 1. Standard Account plan This plan is forever free and only grants users access to limited features. It gives you access to: 2. Plus Account plan The Revolut Plus account plan costs £3.99 monthly. This plan gives you access to all features in the standard plan and the following: 3. Premium Account Plan This pricing plan has everything in the Plus plan, including extra benefits. It costs £7.99 monthly. Below are the additional benefits you can enjoy from subscribing to this plan. 4. Metal Account Plan The metal plan costs £14.99 per month. It has everything in the premium plan and extra benefits such as: 5. Ultra Account Plan This is known as the Revolut account introductory offer. It costs £45 and has everything in the metal plan with additional benefits, including: Revolut Business Account Revolut bank account offers different business accounts for freelancers and companies with four pricing levels. Thankfully, you have a chance to choose the plan that best suits your business needs. Revolut Business Account Pricing Plan Revolut business account has four pricing plans, including: The Revolut business account basic plan is a free plan. This plan gives users access to just the core features of Revolut business accounts. It is suitable for small businesses and startups. Also, It offers limited local and international transfers. With this plan, you can save up to 24% annually. This plan costs $30 per month. With this plan you’ll be charged $5 for international transfers and $0.20 for local transfers. This plan costs $119 per month, and you can spend in over 150 currencies. The scale Plan allows you to save 21% on the annual plan. How To Open Revolut Business Account Opening a Revolut business account is fast and easy; all you need to do is follow the steps below: Getting Started With Revolut Bank Account How Can I Open a Revolut Account? Opening a Revoult bank account is simple and straightforward. Below are the steps follow: How To Send Money With Revolut Account You will receive a confirmation that the transaction is successful. What Details Do I Need To Send Money Using Revolut Account? All You need is the recipient’s full name, their bank account number, and bank code. Ways to Pay for Your Revolut Account Transfer You can pay for your Revolut bank account transfer in different ways. Transfer money from your existing bank to your Revolut account using the standard bank transfer. This is for users with a local account linked to their Revolut bank account. You can use your debit and credit card to transfer funds to your Revolut account. You Can use these services to add funds to your Revolut account. Note: You can always generate a new barcode if the previous one expires. Revolut Account Charges Exchange Rates Revolut bank account currency exchange rate varies based on the account plan chosen. Once the limit has been exhausted, a usage fee of 0.5% will be charged. Here’s a summary of the amount charged for the standard and premium plans: Transaction Fee Card Issuance Card Replacement There is a fee for replacing your card, but it depends on the account type and delivery method. Atm Withdrawals Monthly Subscription These fees and limits depend on the region. Therefore, it is advisable to check the latest charges on the website or app. Revolut Account Verification A confirmation will be sent to you once your account is verified. How Long Does it Take For Revolut To Verify My Account? It takes up to 10 minutes for a Revolut bank account to verify your account. It usually takes 2 to 3 days or even a week, which is not very common. Revolut Pros and Cons Below are the Pros and Cons attached to the Revolut bank account. Pros Cons My Thoughts on Revolut Account Revolut bank account offers many amazing features and flexible services. Their free international transactions and access to a variety of currencies are big pluses for

Payoneer Foreign Bank Account For African Freelancers and SMEs

In today’s international marketplace, African freelancers and SMEs need a reliable way of receiving international payments. A Payoneer bank account is designed to meet the needs of African freelancers and online business owners in unique ways. In this article, you get to discover how you can create a Payoneer bank account, and verify it. You’ll also find out the different fees the platform requires. What is Payoneer Bank Account? The Payoneer bank account is an online service that provides online transactions and other services. This foreign bank account allows business-to-business payments. As a business owner or freelancer, you can use this account to receive payments. With a Payoneer bank account, you can receive payments in three currencies such as USD, GBP, and EUR. You can also withdraw to your local bank in your currency or other currencies. Payoneer was established in 2005 and it has grown significantly since then. International companies like Amazon, Walmart, Google, and freelancer websites like Fiverr and Upwork make use of Payoneer bank accounts. So, if you’re a freelancer or business owner using any of these platforms, you can benefit from their cross-border wire transfers. Pros Cons Features of Payoneer Bank Account Payoneer has a variety of amazing features that make Payoneer’s bank account stand out as a frontrunner in the area of online transactions. The features of the Payoneer bank account are as follows: Getting Started With Payoneer Getting started with Payoneer is very easy. Follow the steps below to set up your Payoneer bank account. How To Open a Payoneer Bank Account How Can I Verify My Payoneer Bank Account? Your Payoneer account will be reviewed in 2 to 3 days. How Can I Receive Payment From Payoneer? Your payment request will be sent to the Payer email address which will be used for the transaction. How To Withdraw Money From My Payoneer Bank Account A confirmation email will be sent to you. How To Send Money With Payoneer Bank Account Note: if the currency you have in your balance is different from the recipient’s currency, you will need to convert your currency to that of the person’s currency. Furthermore, a conversion fee will be charged for your transaction. Payoneer Bank Account Fees There are different fees for different services in Payoneer which are: For business and freelance platforms like Fiverr, Upwork, and Airbnb the charges will vary. Conclusion Payoneer bank accounts provide a solution for African freelancers and SMEs seeking to succeed in the international market. With this bank account, receiving international payments and expanding businesses is easier. With Payoneer, you get to enjoy the benefits of low fee charges of 2% when you send payments from your Payoneer account and a 0% fee when you receive payment from a Payoneer account. Quick transfers and a seamless user interface with a variety of features to meet your unique needs. The Payoneer bank account is a game changer for Africans. Frequently Asked Questions 1. Can a Nigerian Own a Payoneer Bank Account? Yes, Payoneer is open to Nigerians. It is also the best choice for online business owners and freelancers in Nigeria. 2. Can I Transfer Money From Payoneer to My Bank Account? Absolutely! You can withdraw money from your Payoneer account to your local bank account in the currency of your choice. 3. Can I Withdraw $10 From My Payoneer? You can withdraw up to $10 from your Payoneer account. The minimum withdrawal amount is $20 with a $1 Payoneer fee. The maximum amount you can withdraw is $3000. 4. How Long Does It Take Payoneer To Verify Account? It takes up to two to three business days for Payoneer to verify your account. Once approved, a confirmation message will be sent to your email account which allows you to request and send payments.

Top 10 Foreign Bank Account Providers for African Freelancers and SME Businesses

Did you know that the African gig economy is a $28 billion market while SMEs account for all businesses in Africa? This actually plays a huge role in driving economic growth across the continent. However, there’s a major challenge faced by African freelancers and SMEs— accessing a secure and reliable international payment solution. This is exactly where foreign bank account providers for African freelancers and SMEs come in. These providers make it easy to carry out international transactions and also provide a secure way to manage your funds. In this article, I’ll provide you with the top 10 foreign bank account providers for African freelancers and SMEs. With this, you can have an idea of the providers you can try out for your next business deal. Table Comparison of The Top 10 Foreign Bank Account Providers for African Freelancers and SMEs Below is a table comparison of the top 10 foreign bank account providers for African freelancers and SMEs. The table contains a brief summary of each foreign bank account provider. Foreign Bank Account Providers for African Freelancers Transaction Fee Country Founded Payoneer 3% or 1% of the transaction amount. For recurring or batch payments, you’ll be charged 2% United States Revolut Varies depending on the plan chosen and the country United Kingdom Wise From 0.33% currency conversion fee and it has a fixed fee which varies by currency United Kingdom Grey.co No foreign transaction fee Nigeria Geegpay 0.9% for payments done on non-US websites. Varies depending on your country Nigeria Leatherback.co No transaction or conversion fees United Kingdom Skrill Varies depending on the transaction method United Kingdom Sendcash Sending with crypto is free while receiving funds with wire transfers costs 1% of the amount sent Nigeria Cleva Banking Varies depending on the transaction method Nigeria Intasend 3.5% of each transaction Kenya The Best 10 Foreign Bank Account Providers for African Freelancers and SMEs Below are our top 10 foreign bank account Providers for African freelancers and SMEs you can use to receive payment: 1. Payoneer- One of The Best Foreign Bank Account Providers for SMEs and Freelancers Payoneer is a foreign bank account provider for African freelancers and SMEs that allows them to send and receive funds internationally. It was created in 2005 and is listed on Nasdaq. One outstanding thing about Payoneer is that it supports 50 languages, including English, Greek, Dutch, and more. Since its founding in New York, the US, Payoneer has helped millions of small and medium-sized businesses grow. Furthermore, this foreign bank provider allows businesses to make payments across the globe. Payoneer has three pricing plans, including the free plan, which allows you to be paid by another Payoneer user. Then there’s a plan that allows you to receive payment directly from your clients. The last plan allows you to get paid directly by marketplaces and networks. Rating: ⭐⭐⭐⭐⭐ 2. Revolut- One of The Popular Foreign Bank Account Providers for Freelancers and SMEs This is a foreign bank account provider founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. Revolut has four pricing plans: standard, plus, premium, metal, and ultra. Each of these pricing plans offers various benefits. Additionally, Revolut allows users to create a virtual card they can make use of for their online transactions. As an African freelancer or SME owner, you can make use of Revolut to send and receive payments. You can also use the foreign bank account provider for currency exchange, stock trading, and cryptocurrency. One outstanding thing about Revolut is that its mobile app allows users to make withdrawals in 120 currencies and transfers in 36 currencies directly from the app. Furthermore, Revolut supports only 23 languages. Rating: ⭐⭐⭐⭐⭐ 3. Wise- One of the best Foreign Bank Account Providers for Freelancers and Sending Funds Wise is a foreign bank account provider for African freelancers and SME businesses. It charges different fees for its services. For Example, you’d pay a certain fee to send funds, use the Wise debit card, receive and add money, and hold funds. Wise international bank accounts are available in 160+ countries and have 40+ currencies. It has a platform known as Wise Platform for large businesses, banks, and other enterprises. The platform makes it easy for users to send, receive, and manage money globally. Wise also has a product known as Wise Business. This product allows businesses to perform cross-border transfers. Rating: ⭐⭐⭐⭐ 4. Leatherback- One of The Best Foreign Bank Account Providers for African Freelancers and SMEs This global Electronic Money Institution makes it possible for businesses and freelancers to be global. Leatherback allows customers to perform cross-border transactions and open multi-currency accounts. According to Ibitade Ibrahim, he founded Leatherback in 2022 after noticing the gap in the market for borderless financial services. Leatherback isn’t the only fintech service in the industry, but it has stood out. The platform offers integrated features that some fintech services don’t offer. These features include invoicing, analytics, and permissions management for businesses operating in diverse markets. For a fintech service that was founded in 2022, it offers about 15 currencies from 21 countries. One outstanding thing about Leatherback is that it has a user-friendly platform. So, if you’re a freelancer or business owner, you can make use of Leatherback for your transaction. Rating: ⭐⭐⭐⭐ 5. Geegpay- Global Foreign Bank Account Providers for African Freelancers and SMEs Geegpay is a foreign bank account provider for the African gig economy. The platform helps freelancers and contractors in Africa to convert currencies, transfer money, and receive payments. It also allows users to create a virtual USD card they can use for online transactions. Furthermore, freelancers can use Geegpay to receive payments from marketplaces like Upwork and Fiverr. The virtual account it offers can be used by business owners to withdraw funds from platforms like PayPal, Payoneer, Deel, etc. Rating: ⭐⭐⭐⭐ 6. Grey- Inclusive Foreign Bank Account Providers for African Freelancers and SMEs If you’ve ever heard of Aboki Africa, that’s what Grey was formerly called. Grey is an international