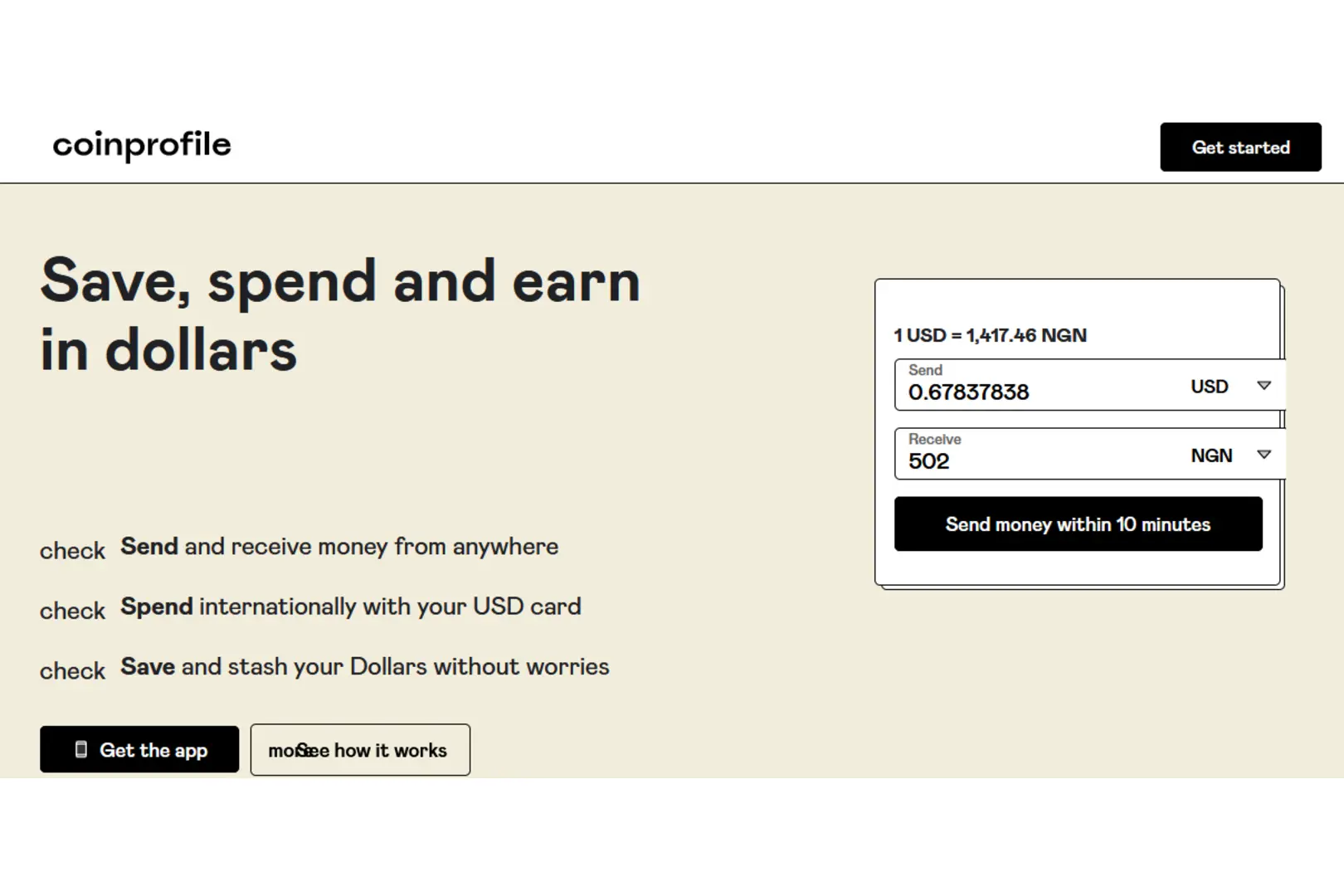

The Coinprofile virtual dollar card is a payment solution designed to make your online transactions simpler and well-organized. With the coinprofile app, you can create a virtual dollar card in less than 3 minutes giving you a functional 16-digit card number, expiry date, and CVV to use for all your online transactions. Also gives you the freedom to stream, shop, and transact across borders without stress or limitations with added competitive exchange rates and low fees. So why wait? This article provides a clear guide on how to create and fund your Coinprofile virtual dollar card. What Is Coinprofile? Coinprofile is a virtual dollar card operator that allows users to receive and send money to friends and family around the world. Furthermore, Coinprofile provides users with a virtual dollar card they can use for their online transactions any day and anytime. This virtual dollar card operator can’t be found on Google Play Store or App Store. However, you can only access and download this operator through their webpage— coinprofile. One outstanding thing about Coinprofile is that it allows users to send money inform of BTC to other banks. When the BTC is sent, the recipient doesn’t have to convert the cryptocurrency as they’d be receiving it as their local currency. How To Create A Coinprofile Account Below are steps on how to create a Coinprofile account. You can also request the Coinprofile app by Clicking on “Get the app” Note: Getting the app might take a while, for easy access to your Coinprofile account make use of the webpage. How Can I Fund My Coinprofile Account? The process of funding your Coinprofile account is a very easy one. Here are the steps to follow Note: you can select the currency in Naira(NGN), USD, or BTC. How To Fund Your Coinprofile Account Through Bank Transfer, Binance, and Crypto Funding With Bank You have successfully funded your account via the Bank Funding With Binance Your account balance will be updated upon confirmation of your payment Funding With Crypto Note: you can send in BTC, ETH, USDT, BNB, USDC, and CUSD Your account balance will be updated upon confirmation of your payment Create A Coinprofile Virtual Dollar Card You can follow the steps below to create a Coinprofile Virtual Dollar Card, which is easy; Your virtual dollar card will be ready within 3 minutes. How To Fund Coinprofile Virtual Dollar Card Firstly, you will need to fund your coinprofile account before you can fund your virtual card. Here are the steps to follow to fund your Coinprofile virtual dollar card. Congratulations, your virtual card has been successfully funded. My Thoughts On Coinprofile Virtual Dollar Card My experience with Coinprofile wasn’t so bad, the process of creating the virtual card is easy and straightforward with an affordable creation fee and I can make secure online transactions without exposing my primary payment method. One thing I didn’t like about using Coinprofile is that their customer service is mostly unavailable. Also, I filled out a request form to get the app but I’m yet to receive any feedback. User Reviews on Coinprofile Virtual Dollar Card A Coinprofile user on Medium shared his experience on Coinprofile app and He said, “It is way faster than using your mobile banking apps. The platform allows users to save in dollars and earn 5% interest on savings. You can deposit crypto and get a debit card so you can spend your money in any country of your choice. This is an alternative to Binance P2P and it offers a superior user interface, faster transactions, and no trading disputes as we currently experience on Binance P2P.” Final Thoughts on Coinprofile Virtual Dollar Card The coinprofile virtual card facilitates international transactions including, Amazon, Google, Spotify, and other platforms. The virtual card helps Nigerians cross the obstacle of international transactions. However, to get started download or access the app on their webpage, create an account, create your virtual card, and fund your card for seamless online transactions. Finally, there is a monthly spending limit on the virtual dollar card which is $25k. If you reach the limit before the month runs out, you will have to wait till the following month to continue making transactions with your card. Frequently Asked Questions 1 How Much Do I Need To Create Coinprofile Virtual Dollar Card? To create a virtual dollar card on Coinprofile, you will need a one-time card creation fee of $1 and a maximum funding amount of $5 and you will be charged a funding fee of $1.5 for any funding you make. Note: a maintenance fee of $3 will be charged monthly only when you make at least 1 transaction in a month. 2. How Can I Reach Out To Coinprofile Customer Support? For any issues you encounter, while using the Coinprofile app or the virtual dollar card, you can reach out via Coinprofile or email their customer support via support@coinprofile.com 3. What Do I Need To Verify My Coinprofile Account? For your verification, you will need your BVN number and any Government-issued ID of your choice. You Can Also Read: How To Create Accrue Virtual Dollar Card: All You Need To Know Bitnob Virtual Dollar Card: All You Need To Know

Frequently Asked Questions About Mobile Money Operators In Nigeria

Nigeria is one of the forefronts of mobile money-using countries in Africa. But with technological advancements and the emergence of new products, there are several questions ensuing and in this post, we will be answering some of those top questions. In this blog, we’ll be providing answers to both the complex and simple questions about mobile money operators in Nigeria. This is to help you navigate and understand these financial institutions in Nigeria. So, if you’ve been curious about mobile money operators in Nigeria, keep reading! What are Mobile Money Operators? Mobile Money Operators, also abbreviated as MMOs, are companies that allow you to use your phone to manage your money. They build financial systems that allow you to carry out transactions, among other things. Although, you would, oftentimes, need a smartphone to have and use a mobile money account. However, you can also have access to MMOs without having a data connection. How many licensed mobile money operators are there in Nigeria? According to the Central Bank of Nigeria (CBN), 21 mobile money operators have CBN licenses. The Nigeria Deposit Insurance Corporation (NDIC) has 18 non-bank-led MMOs and 13 bank-led MMOs. Some of these MMOs are Abeg Technologies, Fortis Mobile, KongaPay, FirstMonie, Kegow, etc. You should also know that not all mobile banking platforms are licensed as MMOs. For instance, the popular Kuda and Moniepoint are not MMOs but microfinance banks. What is Mobile Money Weakness? Mobile money operators have several issues and weaknesses but one of them is the lack of agents in rural areas. This makes it rather hard for the mobile money providers to achieve their main goal which is to provide financial inclusion for underbanked and unbanked communities. Another weakness is the lack of trust from customers, especially for savings purposes, among others. Is OPay a Mobile Money? The popular Opay is a company licensed by the Central Bank of Nigeria (CBN) to operate fully as a mobile money operator in Nigeria. The company was launched in 2018 and quickly rose to the top, securing the interests of several Nigerians, due to their seamless transactions, low fees, and rewards systems. Is Moniepoint CBN approved? Yes, Moniepoint Bank is licensed by the CBN. They were awarded as the most inclusive payment in Nigeria in 2022 by CBN. As against popular opinions that the platform is an MMO, Moniepoint has a license to operate as a microfinance bank. It is a definitive bank for small and medium-sized enterprises, SMEs, in Nigeria which is regulated by CBN. Is Piggyvest approved by CBN? Piggyvest isn’t a mobile money operator in Nigeria, although they have a subsidiary that is licensed as an MMO, PocketApp. PiggyVest itself is a financial institution with a license to operate as a microfinance bank in Nigeria. They provide you with a savings and investment platform and your money is insured by the Nigeria Deposit Insurance Corporation (NDIC). Which bank owns PalmPay? PalmPay is a financial services provider co-owned by Chinese-based Transsion Holdings and NetEase. Transsion Holdings is a mobile phone manufacturing firm in China. Their subsidiaries are Techno Mobile, Infinix Mobile, and Itel Mobile. PalmPay isn’t owned by a bank but a mobile phone manufacturing firm. Who regulates mobile money in Nigeria? The primary regulator for mobile money operators in Nigeria is the Central Bank of Nigeria (CBN). The CBN is the body that defines and issues licenses to Mobile Money Operators (MMOs). They monitor the overall mobile money ecosystem in the country. There are also other players involved: Does Nigeria do Mobile Money? Yes, Nigeria does have mobile money services and they’ve seen tremendous growth, hitting an impressive 89% year-on-year growth as of Q1,2024. Mobile mobile operators have an association in Nigeria, AMMBAN. What is another name for Mobile Money? Other names that are often used interchangeably with mobile money are wallet (or e-wallet), mobile wallet, mobile bank and some just call them fintech. While not direct replacements, these terms are used in the context of mobile money transactions in Nigeria. What are the disadvantages of mobile money? Even though mobile money has several advantages, there are still some risks, some of which are: What is the use of mobile money in Nigeria? The main objective of mobile money in Nigeria is to provide financial services to unbanked and underbanked communities in the country. This has largely led to individuals, also called agents, making financial services available mostly through PoS machines on the streets and shops. What is the difference between mobile money and mobile banking? While both mobile money and mobile banking utilize mobile phones for financial transactions, they differ in their functionality and operations. Mobile money services act as mobile wallets which are completely independent of an existing commercial bank. Whereas, mobile banking is the baking application of an existing commercial bank. Mobile money is for anyone with a phone, promoting financial inclusion, while mobile banking complements your traditional bank account, offering on-the-go convenience. Also, mobile money lets you send and receive money with the help of a mobile phone and the Internet, while Mobile Banking allows you to carry out banking-related transactions or transfers through a bank app. How Does the Mobile Money Work? Mobile money works like a digital ecosystem built around your mobile phone that allows you to conduct financial transactions conveniently. The first stage is creating an account with a mobile money provider (MMO). Most of the time, your phone number and some basic identification documents are all you need. Once verified, you’ll have a mobile money account that is directly linked to your phone number. Thereafter, you can add funds to your mobile money account. You can easily do this by transferring from a bank account or you can visit a mobile money agent who will accept cash and credit your account. With funds loaded, you can send and receive money using the mobile money app or the MMO’s USSD code. You can perform various other transactions like Paying bills for utilities or subscriptions, buying airtimes, making in-store purchases at shops and vendors, etc. What is the regulatory framework for mobile payments? The regulatory framework for mobile payments in Nigeria was established by the CBN through the “Framework and Guidelines on Mobile