Have you ever wished you could send money to your friends with just a few taps and with little to no charges? Do you want to use a mobile money operator other than the common ones like Opay, Palmpay, KongaPay, etc? Then you might want to consider using the NowNow application. This app lets you do almost everything you’d normally do at a bank and on other mobile money operators’ applications. If you are just hearing about this app for the first time, then this article is for you. You will see in detail, what NowNow is all about; its benefits, functions, and how you can get started. What is NowNow? NowNow is a mobile banking application in Nigeria that helps you transact daily without hassle. Just as the name implies, NowNow allows you to perform banking activities quickly. You can send and receive funds, andpay utility bills. The application is designed to be a mobile money operator in Nigeria that is geared towards supporting small and medium enterprises. This is why they’re the first in Africa to have a partnership with Microsoft and got a $13m seed round. All you have to do to start enjoying the “now-now” is to download the NowNow app, create an account, and start to enjoy the features of the NowNow application. Getting Started With NowNow in 2024 To download the NowNow application on your device, just search for “NowNow”. Click on “My-Biz” by NowNow and download/install. To create an account, you’llbe asked for a valid phone number which you will use in registering. The next important thing you’ll need to submit is your NIN, National Identification Number. Ensure you fill in the KYC correctly and your account will be ready to make quick, “NowNow” transactions. After you have registered and your account is ready, the next step is adding funds to your account. Adding money to your NowNow wallet To add funds to your NowNow wallet is simple. One way is by transferring money into your account from an existing bank account. For instance, if you have funds in an existing FirstBank account that you wish to transfer to your new account, you can open your bank app, enter your NowNow number, and send your desired amount to fund your NowNow wallet. You can also add money using your ATM debit card butyou must link the account to your NowNow account. What NowNow Does Differently From Others? As mentioned earlier, there are several CBN-licensed mobile money operatorsbut looking closely at the NowNow wallet, there’s one thing they distinctively do differently from others. Unlike other lists of mobile money operators in Nigeria that give Visa and Verve cards, NowNow gives their customers a physical Mastercard. You get the card after a few days of registration, depending on your location. With this card, you can set withdrawal limits, freeze, lock, and easily unlock the card for transactions. Another thing is that you will enjoy QR contactless payment on the NowNow application. Like most other licensed mobile money operators in Nigeria, the NowNow application transactions are super fast. You can send and receive money without stress. You can also enjoy cashback on every airtime and data recharge you make through the application. My Experience With The NowNow Application Firstly, downloading the app is a lot of trouble. When I was trying to download the app, I noticed the link on their website isn’t working, both the direct one and the one on their blog. The next thing to do is to go and search for it on the Play Store. I searched for it and got even more confused, “Is it MyBiz or TapTap?”. I wasn’t sure it was MyBiz because I don’t run any business but I downloaded it regardless since that’s the closest. I then tried signing up on the app and I was stuck here: After using my phone number and verifying it, I got to this bottleneck spot. So, I have nothing to say as an experience of the app butI’ll show you an extensive screenshot of what the users are saying. My Conclusion NowNow is a mobile money operator in Nigeria that has gained an international audience. Not so many mobile money operators in Nigeria have the backing of such a renowned firm as Mastercard. Notwithstanding, I believe there is still more they can do to their application. You can also read our article on getting started with PagaTech, another mobile money operator in Nigeria. If you use NowNow and you have any comments about the application, you can drop them in the comment section below. Frequently Asked Questions About NowNow How To Contact NowNow Application You can reach out to them physically at their head office at 239/241 Ikorodu Road, By Town Planning Way, Ilupeju, Lagos. You can also reach them virtually via Facebook, Instagram, or X (formerly Twitter) or call them on +234 0700-066-9669. Who is the CEO of NowNow? The Chief Executive Officer of NowNow is Leigh Flounders. You can check his professional profile here on LinkedIn. Is the NowNow app legit? NowNow has a license from the Central Bank of Nigeria (CBN) as a mobile money operator. Aside from that, every deposit you make into your NowNow wallet has insurance from the Nigeria Deposit Insurance Corporation (NDIC). With the license and insurance, it is quiteobvious that the NowNow application is legit.

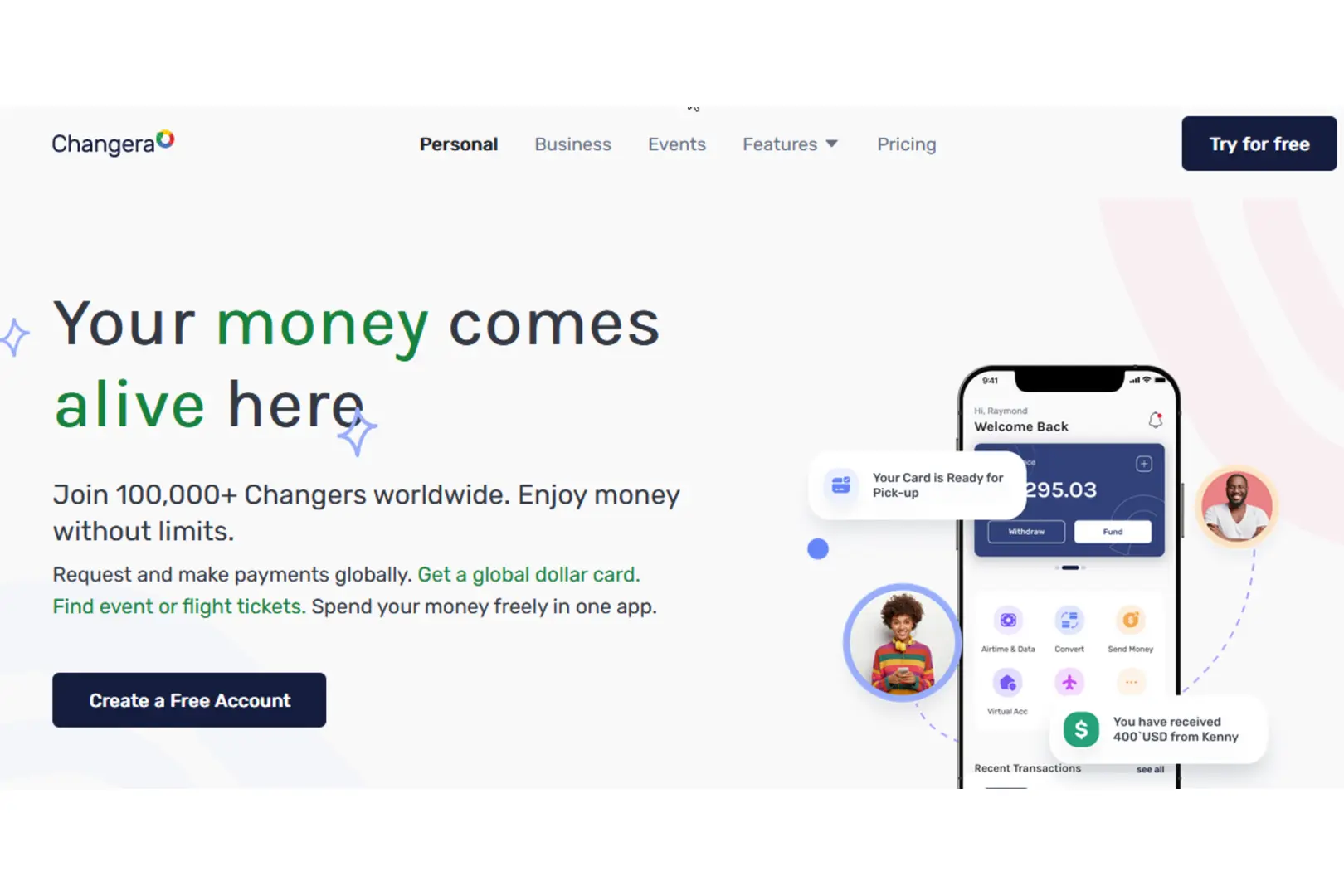

Changera Virtual Dollar Card: How To Create and Fund Your Changera Virtual Dollar Card

Seeing the limitations physical virtual cards have,Changera decided to create a virtual dollar card that would help individuals in their day-to-day transactions. With Changera virtual dollar card, you can pay for purchases online with ease. In addition, if you run ads, you can also make use of Changera virtual cards for payment. Furthermore, Changera doesn’t link its virtual dollar card to its account. This is done to protect user’s privacy. In this article, you’ll learn all you need to know about Changera virtual dollar card. You’ll also learn how to create and fund your virtual dollar card. What Is a Virtual Dollar Card? A virtual dollar card is similar to a physical dollar card. It’s a prepaid card that can be used to make online transactions with ease. All You Need To Know About Changera Changera is avirtual dollar card operator that is owned by Bitmama— the company that bought Payday. It is located in Philadelphia, USA. Changera provides virtual dollar cards to individuals in Nigeria, Ivory Coast, Canada, Senegal, Kenya, Ghana, Cameroon, and Uganda. The platform has three plans that users can subscribe to. These plans are the free, freelancer, and premium plan. Each of these plans has its various benefits. Below are some of each plan. Free Plan This plan is forever free however, you can only access limited features on the Changera app. If you’re using the free plan, you get access to: Freelancer Plan This plan costs $50 per year and as the name implies, it is best for freelancers. Below are what you get access to: Premium Plan Changera premium plan costs $100 per year. The plan has everything in both the free and freelancer plan. As a premium plan user, you gain access to: If all you’d like to make use of Changera virtual dollar card is for payment, then it’s best you stick with the free plan. How Does Changera Work? Changera is currently available on Google Play Store and App Store. All you need to do is download the app to access the virtual dollar card. However, before you can create a Changera virtual dollar card, you’ll need to open an account if you don’t have one. That’s the only way to claim your card. Additionally, Changera allows users to create a USD, GBP, and EUR account. If you wish to create an account on Changera, follow the steps below: Your Changera account has been successfully created. Now it’s time to create your changera virtual dollar card. How To Create Changera Virtual Dollar Card Before Changera allows you to create a virtual card, you’ll be required to complete your verification. For the verification, you’ll need to have either your NIN slip, National ID card, or Driver’s license. Once your verification has been approved, you can go ahead to create your card. Your Changera virtual dollar card is ready!! How To Fund Your Changera Virtual USD Card Once you’ve created your Changera virtual dollar card or exhausted the amount in your virtual dollar card, it’s important that you fund your card for further transactions. You can fund your card by following the steps below: There’s no limit on Changera virtual dollar card. However, the maximum amount that you can hold at any time is $2500. My Thoughts On Changera It was weird that after submitting my NIN slip, I was taken back to the signup page and when I tried completing my verification, I couldn’t; I was shown an error message instead. Also, when I reached out to the customer service team in the app, I was told I’d be responded to in two hours. I sent a message by 6 am, so from this, it’s clear that Changera’s customer service isn’t available 24/7. Reviews On Changera The reviews that were given were mainly about the app. No one talked about the experience using the Changera virtual dollar card. On the Google Play Store, Changera has an app rating of 2.4. Users are really not pleased with the app. Below is a screenshot of some of the reviews. Conclusion Changera virtual dollar card offers a convenient and secure way to make online transactions, especially for individuals in countries with limited online payment options. Also, with its three plans – free, freelancer, and premium – users can choose the best option for their needs. Despite the fact that the app has received negative reviews, the Changera virtual dollar card itself can help make online payments better. To access the card and fund it, all you need to do is follow the steps listed in the article. Lastly, If you encounter any issue while using the Changera virtual dollar card, you can reach out to them at support@changera.co or you can reach out to them on X, Instagram, LinkedIn, or Facebook. Frequently Asked Questions 1. How Much Is A Changera Virtual Dollar Card? Changera charges a card fee of $1 and a funding fee of 1.5 USD for any amount you fund your account with. 2. What Is The Limit On The Changera Virtual Card? There is no daily limit on the Changera virtual card. The maximum amount a card can hold is $2500 and a spending limit of $5000 per month depending on your Changera plan. 3. Does Changera Work With PayPal? Yes, it does, all you need to do is follow the steps to link your Changera card to your PayPal account. 4. Where Can I Use My Changera Virtual Dollar Card? Changera virtual card can be used on all platforms that accept Visa cards like Netflix, Amazon, AliExpress, Prime, YouTube, and so many others. There are no restrictions when it comes to Changera virtual cards.