Sometimes, despite the several security measures put in place by Mobile Money Operators in Nigeria, there is always a question of “How authentic is this mobile money platform?”. A simple answer to that is having an MMO that can be traced back to an existing company and that will be Firstmonie. Firstmonie wallet is an affiliate of the First Bank of Nigeria. Before we look deeper into what the Firstmonie wallet is all about, if you want to know what mobile money operators are and the top in Nigeria, you can take a quick look at that here. Now, let’s take the veil off the Firstmonie app, especially for those thinking of starting their journey with the brand. The Firstmonie Platform The Firstmonie platform is one of the bank-led mobile money operators owned by First Bank Nigeria Limited. Unlike other mobile money operators like Palmpay, Paga, Opay where there is no physical bank attached to it, with Firstmonie wallet you are sure that even if you don’t know any agent close by, you can always enter a First Bank branch to complain. FirstMonie provides financial services to small and medium enterprises that are in underbanked and unbanked areas using their registered agents and businesses. With the Firstmonie wallet, you can send and receive money. You can also pay bills like TV subscriptions, electricity, etc. Opening a Firstmonie Wallet Opening an account on Firstmonie is a bit different from other common platforms like PocketApp, KongaPay, etc, that could be, perhaps, because it’s a bank-led mobile money operator. Before walking you through the process of opening a Firstmonie account, you need to know the requirements to open an account. Requirements for Firstmonie Wallet To have a Firstmonie wallet, you will need a valid phone number and a Bank Verification Number (BVN) or your National Identification Number (NIN). The thing you provide when opening your account is your number. An OTP will be sent to your phone number from FirstBank which you will use for verification. You will be asked to enter your BVN or NIN. Immediately you do, the name linked to the number you provided will be displayed. You will enter your gender, DOB, and email. You will also be asked to create a PIN for transactions and set three security questions after which you will have access to your wallet. The phone you provided will be used as your account number. What Can Firstmonie be Used For? Just like other mobile payment platforms, you can use the Firstmonie wallet to send and receive money from the banks in Nigeria. You can use the Firstmonie app to send money to other Firstmonie wallets, FirstBank accounts, and other banks. Firstmonie wallet can be used to buy airtime and data subscriptions. You can also make bill payments such as electricity, internet services, etc. The Limitations of Firstmonie Mobile Banking One would have thought that Firstmonie, being a subsidiary of the popular FBN, would have some top tier services, but the reverse is the case. Aside from the design of the app that is not giving, below are some other things you may not like about the Firstmonie app: What People Are Saying About Firstmonie? There are 3.6 stars out of over 2700 Google Play Store Reviews for the Firstmonie app. I will personally give it a 2.5/5. Out of 60 ratings on the App Store, Firstmonie has a 3.1 out of 5. Up to half of the ratings given is a 1 star out of 5. Final Thoughts Firstmonie allows users to send and receive money, pay bills, and buy airtime. Though the app interface is basic, it is considered clunky and it has limitations compared to competitors, such as fees for transfers and limited top-up options. Ultimately, whether the Firstmonie wallet is a good fit for you depends on your priorities. If security and a traditional banking connection are most important, Firstmonie is a good choice. If a user-friendly interface and extensive features are higher priorities, you might consider exploring other mobile money options. You can download the app on Google Store or App Store. You can also read about other licensed mobile money operators in Nigeria like Kegow, NowNow, Parkway and Fortis Mobile Money. Frequently Asked Questions How does Firstmonie work? As mentioned in the article above, the Firstmonie wallet can be used to make payments to different places and organizations as it is seen on the app. Big payments like electricity bills and even the other ones like LindaIkejiTV payments. You can, of course, send and receive money from/to any bank account in Nigeria. You can also fund your bet9ja wallet from your Firstmonie wallet. Is Firstmonie the same as FirstBank? FirstBank owns Firstmonie but they are not the same thing. There is another banking app called the FirstMobile where you carry out all transactions on your FirstBank account. You can download FirstMobile for Android here. Is Firstmonie Wallet Safe? Firstmonie Wallet has a license from the Central Bank of Nigeria and also deposit insurance from Nigeria Deposit Insurance Corporation (NDIC). With this license and insurance, you are sure that your deposits and transactions are safe.

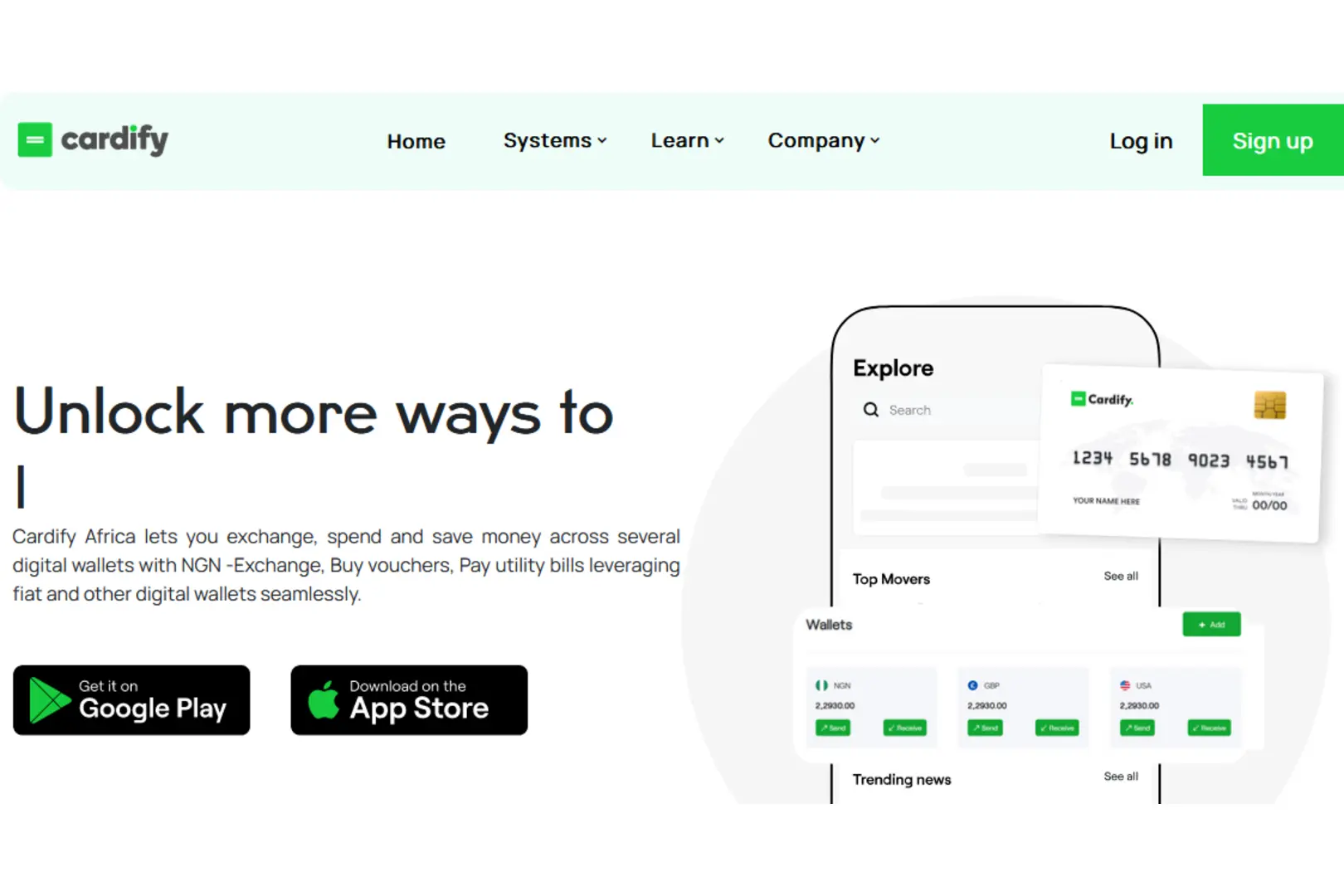

Getting Started With Cardify Virtual Dollar Card: How To Create and Fund Cardify Africa Virtual Dollar Card

Do you want to know more about Cardify Africa virtual dollar card? I’ve taken the time to share all we know in this detailed article. From how to create an account to how you can claim your Cardify Africa virtual dollar card, you’ll find that all here. Additionally, I’ll be letting you know our thoughts and what the audience has to say about the Cardify Africa virtual dollar card. But first.. What Is Cardify Africa? Cardify Africa is a virtual dollar card operator that issues users within Ghana and Nigeria a virtual dollar card to pay for goods and services online. It also lets you spend, exchange, buy and save money. To access Cardify, all you need to do is download the Cardify mobile app from the Google Play Store or App Store. How Does Cardify Africa Virtual Dollar Card Work? You’ll have to fund the Cardify Africa virtual dollar card before it works. However, it’s impossible to find your card if your registration process isn’t complete. To learn more on how to get your Cardify virtual dollar card working, keep reading. How To Open A Cardify Africa Account Before you can claim your Cardify Africa virtual dollar card, you’ll need to open an account with them. Cardify Africa allows you to own NGN/GH, USD, and GBP accounts. So, if it’s your first time learning about Cardify, you can follow the steps below to open an account: Note: Cardify Africa doesn’t allow signing up with your Google account. Also, signing up with your email address, you’ll need to put your phone number. Your Cardify account is ready. How To Fund A Cardify Account Below are the steps to follow if you’re trying to fund your Cardify Nigerian or Ghanian account: Note: If you haven’t verified for level 2, you’ll need to do that before you can proceed You’ll be taken to a page where you’ll see the requirements for level 2 verification If the number you used for your BVN is no longer in use, you can verify your account manually After you’ve selected bank transfer, the system will generate a dedicated account for you How To Fund Cardify Africa Dollar Account Note: You can only send USDT TRC20 How To Swap Your NGN To USD If you don’t have access to cryptocurrency, you can swap your Naira or Ghana cedis for USD all you need to do is follow the steps below: How Can I Create and Fund Cardify Africa Virtual Dollar Card Cardify Africa has various virtual dollar cards that users can choose from. The card fee for the basic dollar card and standard card are the same. To get the Deluxe dollar card, you’ll have to pay extra. Below are the steps to follow to create your Cardify Africa virtual dollar card: If you wish to get a Deluxe dollar card, you’ll have to verify your account by submitting your ID card; it can be your National ID, Voter’s card, International passport, or Driver’s license. Additionally, the amount you need to create your Cardify basic and standard virtual dollar card is a minimum of $8. $3 is for the card issuance fee and funding fee. The extra $5 is the least amount you can fund your card. Reviews On Google Play Store About Cardify Africa From a review on Google Play Store, a user complained that the card couldn’t be used to make payment for a purchase that cost $1. Another user complained that the card was rejected when they tried to make a purchase, and after 24 hours, his money was deducted and hasn’t been refunded. Others complained that their help desk was poor and that sometimes their money was deducted without explanation(it’s important to note that Cardify Africa stated that they had no card maintenance fee). On the other hand, those who found this platform useful were those who used the account to send and receive money. Only a few people spoke about the swift payment they received when they used the card for online payment. My Thoughts When I made use of Cardify Africa, the onboarding process was easy and straightforward. However, I didn’t like the idea of being asked for my phone number when I was asked to sign up using my email address. Also, I didn’t like the fact that for every action I take on the app, messages are sent to my phone number. Furthermore, the steps needed to find my dollar and Naira account were quite stressful. The designated account number I was meant to transfer to didn’t show up. Well, if you still want to find your NGN account, you need to have a lot of patience in order to understand how it works. Personally, I didn’t have that much patience. Conclusion Cardify Africa virtual dollar card can help you with various payments online. If you need any help, you can reach out to their customer support on the mobile app. Additionally, endeavour to do proper research before deciding to settle for Cardify Africa virtual dollar card operator. If you’re a crypto trader, you can make use of this app to save your coins. Frequently Asked Questions 1. How Can I Fund My Cardify Africa Virtual Dollar Card With NGN Or USD? You can fund your Cardify Africa virtual dollar card using your NGN or USD wallet (Binance pay, BUSD, USDT, and any other option). This allows you to change and assign funds to your card. 2. Does Cardify Virtual Dollar Card Work On AliExpress? Yes it does, you can use the Cardify Africa virtual dollar card on any platform including AliExpress. All you need to do is fund your card, shop, and enjoy swift and secure transactions. 3. Who Is The Owner Of Cardify Africa? Cardify Africa was founded and owned by Tunde Ibrahim Aderemi who is widely known as Tunde Buremo. 4. How Do I Contact Cardify Africa? For any issues you might come across in the process of using the app or the virtual card,