Moving from Lagos to Westminster, you can pack your degrees, your experience, and your ambitions, but your financial life gets left behind at the airport. Despite years of responsible banking in Africa, the financial institutions treat you as if you’ve never seen money before. You need a credit score to get an apartment, but you need a credit card to build credit – and you need credit history to get that credit card. It’s a catch that millions of African immigrants know all too well.

This is the problem Kredete was built to solve. The fintech startup has found a clever way to help African immigrants build their credit scores. Kredete makes sure your money moves with you, and for you. Come see how.

The Double Problem for African Immigrants

The numbers show the scale of this challenge. African diaspora communities send over $95 billion home each year, making them one of Africa’s largest sources of foreign money. However, the same individuals sending this money often struggle to access basic financial services.

For African immigrants in the UK, the credit system creates almost impossible barriers. Your banking history from Nigeria or Ghana doesn’t count in Britain. A doctor who managed multiple accounts in Lagos suddenly becomes “credit invisible” in London. This invisibility has real costs:

- Housing becomes harder to get when rental applications are rejected

- Some jobs require credit checks, limiting career options

- Everything costs more – utilities need deposits, insurance costs more, and loans have worse terms

- No safety net during financial emergencies

The mental stress is often overlooked. Financial invisibility makes immigrants feel like they don’t belong, even when they pay taxes and contribute to the economy. This is a real pain that Kredete saw and wants to fix.

The Money Transfer Pain

It’s not like Africans in diaspora aren’t financially responsible. But even with consistent transfers back home, their credit doesn’t grow with them. Traditional services offer nothing to build financial credibility in their new countries. They spend safely and consistently, yet get zero credit for this financial discipline. These services offer poor experiences, too:

- Slow transfers, leaving families waiting during emergencies

- Few pickup locations in the recipient countries

- Hidden fees mask the real cost

- Zero connection to credit building

As Kredete puts it: “Send money to loved ones and watch your credit score grow.” Their platform recognizes what traditional services ignore: that every time you send money, you improve your records.

Instead of financial responsibility disappearing into the void, Kredete helps users “retain connections and build a strong credit history simultaneously.”

Kredete Approach to Increasing African Immigrant Credit Score

Kredete was founded with a simple but powerful idea: “money without borders.” Instead of treating money transfers and building immigrant credit scores as separate problems, the company saw them as connected.

The insight was brilliant: if someone can send money abroad every month, they clearly know how to handle money responsibly. Why not capture that responsibility and report it to credit agencies?

Since launching, Kredete has built strong momentum. They’ve received two different funding sources, one in 2024 and another in 2025. Their app has excellent ratings, 4.7 stars on Google Play and 4.4 stars on the App Store, showing they’re doing the right thing.

How Kredete Works

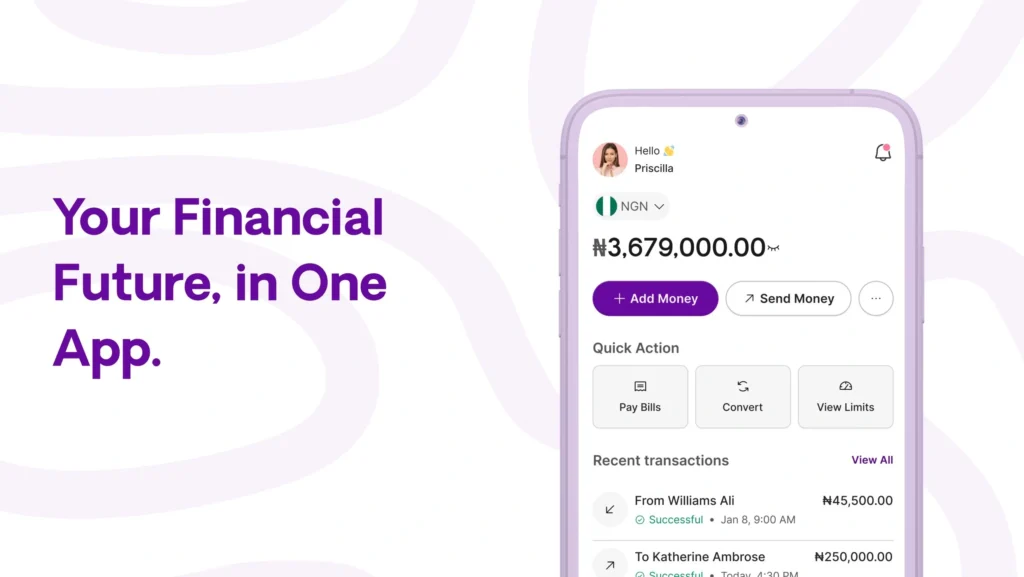

Kredete starts where traditional banks often stop: accepting international IDs. Users can open accounts using passports and other international documents, removing barriers that often keep new immigrants out of mainstream banking. Now, let’s take a look at those one by one.

Building Immigrant Credit Score Through Transfers

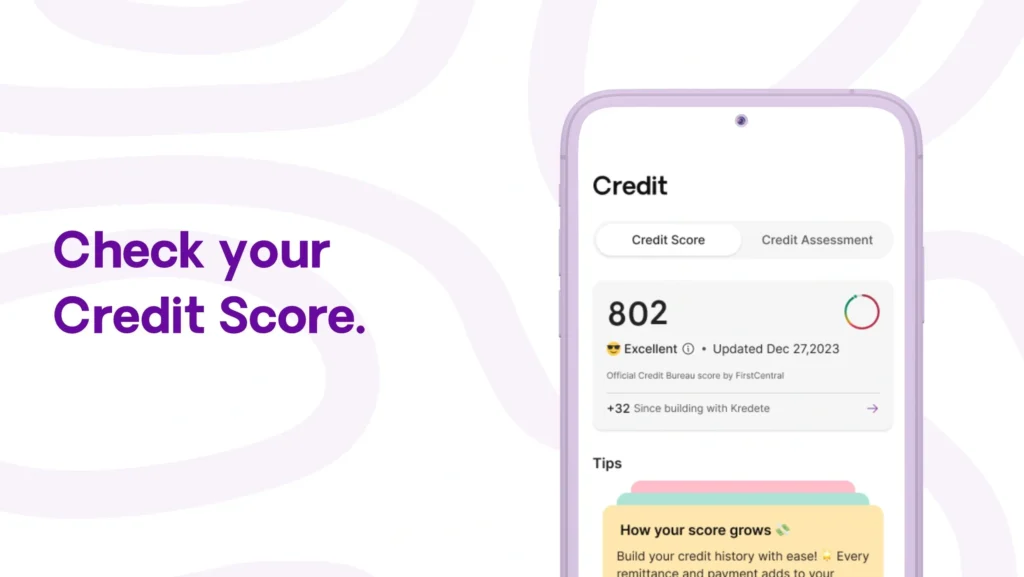

Here’s where Kredete’s innovation shines. Every money transfer made through their platform helps build the user’s credit history. The company ensures that responsible money transfer behavior translates into better credit scores.

The results are impressive: an average of 58+ credit score increase in 2024 (source: IG). That’s enough improvement to qualify for better apartments, lower insurance rates, and even some credit products.

As you make transfers to any country abroad, Kredete reports your transactions as on-time payments to the credit bureaus. This helps to positively update your credit history and build your score.

Low-Fee Money Transfers

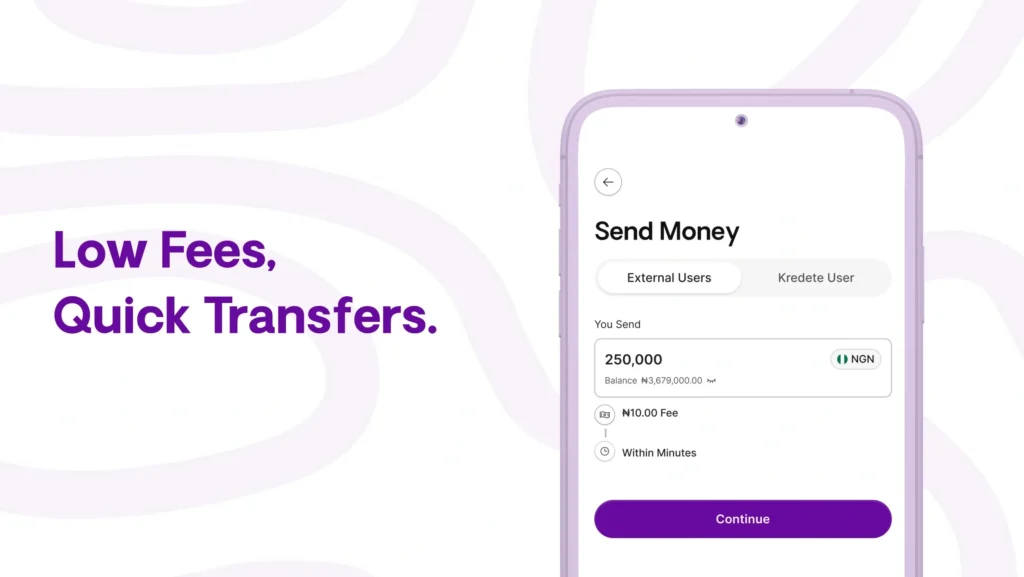

For transfers, Kredete uses stablecoin technology to offer something remarkable: low-fee transfers to over 20 African countries. This isn’t a temporary promotion; it’s their standard pricing, made possible by efficient blockchain settlements.

The platform supports transfers in over 15 different currencies, with competitive exchange rates and faster settlement than traditional services. Recipients can collect money through various methods, ensuring access even in areas with limited banking.

A Complete Banking Alternative

Another beautiful thing about Kredete is that it gives users an FDIC-insured account, completely replacing the traditional bank. The accounts have no overdraft fees or foreign transaction charges, a common problem with immigrant-focused financial services.

How Kredete Beats the Competition

When making my research for this review, I couldn’t help but smile at how Kredete is ticking all the boxes. Kredete isn’t just another fintech app that you use to send money. In three points, these are the areas Kredete is winning:

Against Traditional Money Transfer Services

Compared to Western Union or MoneyGram, Kredete’s zero-transfer fee model saves huge amounts. A user sending $6,000 annually could save $360-480 in fees alone while building credit, which is impossible with traditional services.

Against Credit Building Apps

Apps like Self or Credit Karma help build credit, but don’t help with money transfers. Some of these credit score builders usually require users to lock up money in savings accounts or pay monthly fees. Kredete builds credit through activities users already do. Cool, init?

Against Immigrant-Focused Banks

Some banks target immigrant communities, but they rarely offer innovative credit-building or competitive transfer pricing. Most still use traditional fee structures and don’t understand how immigrant financial needs connect. With Kredete, this isn’t the case.

Recent Success: $22M in Funding

The market has noticed Kredete’s approach. The company recently secured $22 million in Series A funding, led by AfricInvest, with other prominent investors. This funding validates both the business model and the market opportunity.

The investment will fuel several ambitious projects:

New Financial Products: The company is introducing rent reporting, credit-linked savings plans, and responsible goal-based loans, expanding beyond transfers into comprehensive financial services.

Currency Protection: Kredete is launching interest-bearing USD and EUR accounts, helping Africans globally preserve value, earn yield, and hedge against local currency volatility.

Infrastructure for Businesses: On the B2B side, Kredete is building Africa’s largest aggregation layer of banks and wallets, giving businesses a single API to enable secure, real-time, and affordable payouts across the continent.

What This Means for the Industry

Kredete’s model represents more than a business opportunity; it’s a blueprint for financial inclusion innovation. By recognizing that financial behaviors don’t exist separately, they’ve created a solution that addresses system-wide barriers.

Industry Influence

Other fintech companies serving immigrants are likely taking notes. The success of combining money transfers with building immigrant credit scores could inspire similar approaches for other underserved communities.

Technology Adoption

By successfully using stablecoin technology for mainstream financial services, Kredete is accelerating real-world adoption of blockchain-based financial infrastructure. Their approach shows how crypto technology can solve practical problems rather than just serving speculation.

Final Assessment

Kredete’s vision of “money without borders” goes beyond their current offerings. The company seems to be building toward a future where where you come from doesn’t determine your financial access.

Kredete deserves recognition not just for solving immediate problems, but for reimagining how financial services should work in a connected world. Their approach acknowledges that modern consumers, especially immigrants, need integrated solutions rather than separate products.